Getting Closer on PED Property Tax Estimates - Thomas E. Young Last Updated: June 20, 2014

Every year leading

up to the General Session staff presents you with public education estimates that are based upon

projected property values and student enrollment. You then include those estimates in

appropriations bills. Two of these are

the Basic Rate estimate and the Voted & Board leeways

estimates.

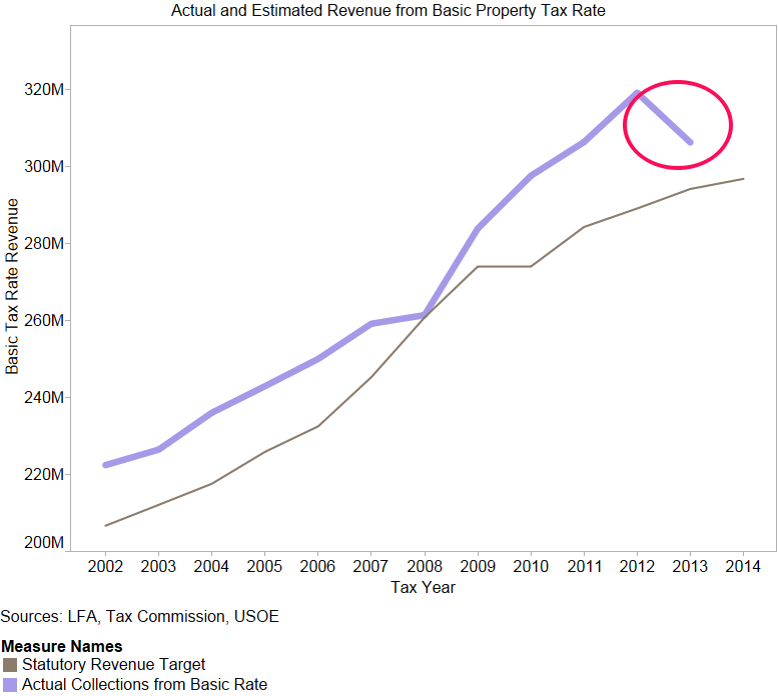

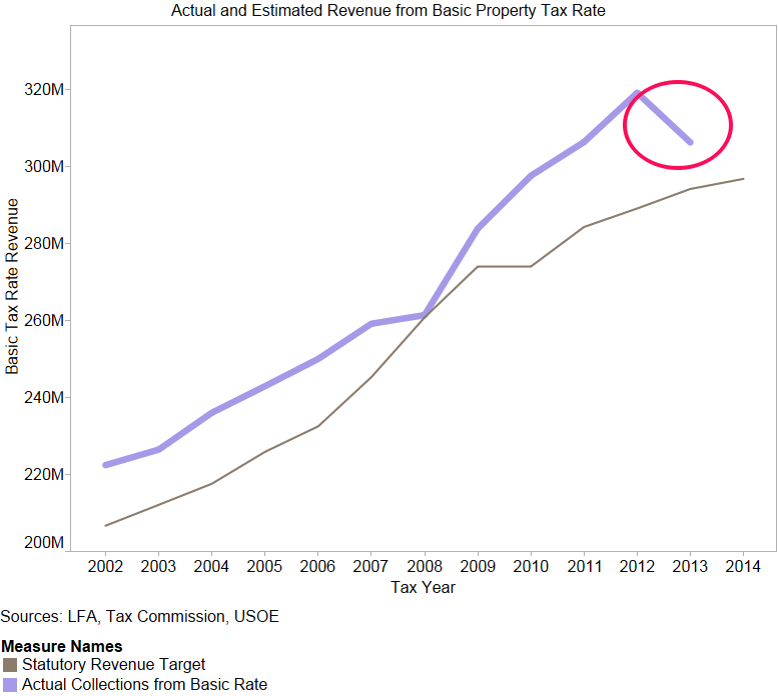

The Basic Rate and the revenue associated therewith showed up in H.B. 1 this year, with an estimated rate of 0.001477 and a revenue target of $296.7 million. Each year, after Session ends, the Tax Commission and State Office of Education (USOE) set a certified tax rate that often differs from our estimate. In the past 12 years, the basic rate has always been set too high, collecting more property tax revenue than was budgeted. Last year, we convinced Tax and USOE to change their process for certifying the tax rate so that it was more accurate. As a result, as shown in the figure below, collections are closer to our estimate for FY 2014.

As shown in the figure below, the average over-collection amount since 2002 has been about $17 million per year. In FY 2013, collections exceeded our estimate by more than $30 million. For FY 2014, as a result of more accurate methodologies, collections exceeded our estimate by only $12 million. Thus, the Basic School Program will still have a closing nonlapsing balance this year, but it will not be as big as it has been in the past.

Switching

to Voted & Board leeways, the state guarantees that participating districts will collect a certain amount per WPU from these local property taxes. If a district's property values are insufficient to collect a capped amount per WPU, the state fills-in the difference with income tax appropriations.

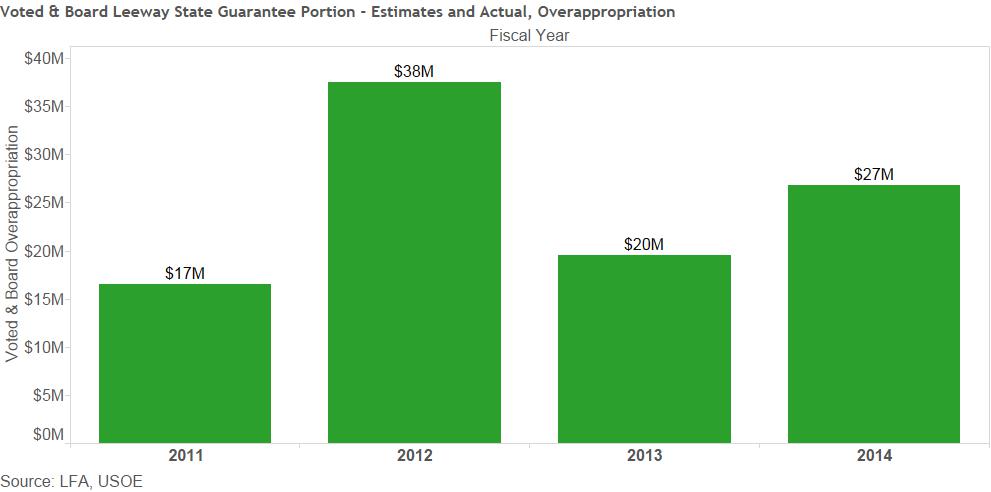

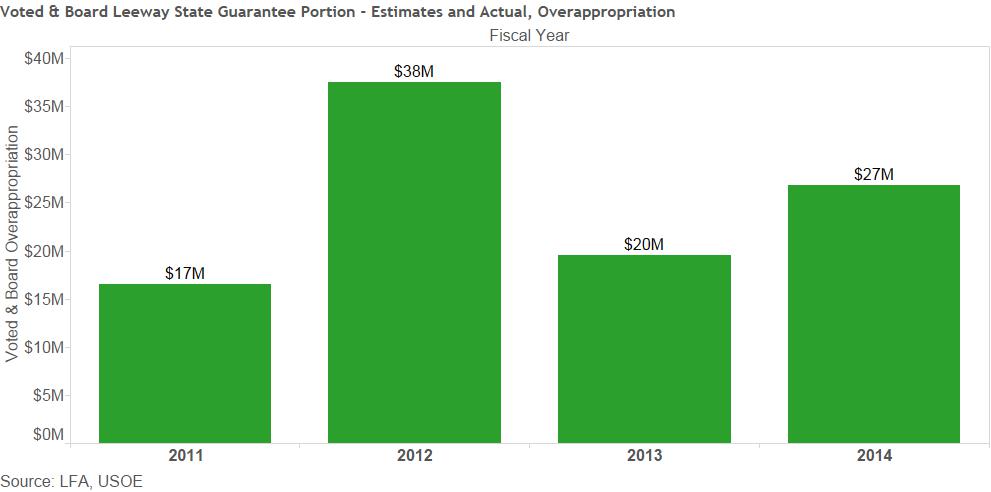

As

with the Basic Rate, staff provides you with estimates of property values and

enrollment for the purpose of estimating property tax collections and, therefore, income tax appropriations. The estimated property values have been low, resulting in over-appropriation of income taxes ranging from $17 million to $38 million over

the past four years (see below).

During the 2014 General Session, we improved the method by which we estimate property values and thereby reduced FY 2015 income tax appropriations by $23 million. The Legislature also retroactively corrected that same $23 million over-appropriation for FY 2014. Thus, while property taxes will yield $27 million more than we originally estimated for FY 2014, only $4 million will remain as a non-lapsing balance in the Voted and Board Leeway State Guarantee at the end of FY 2014.

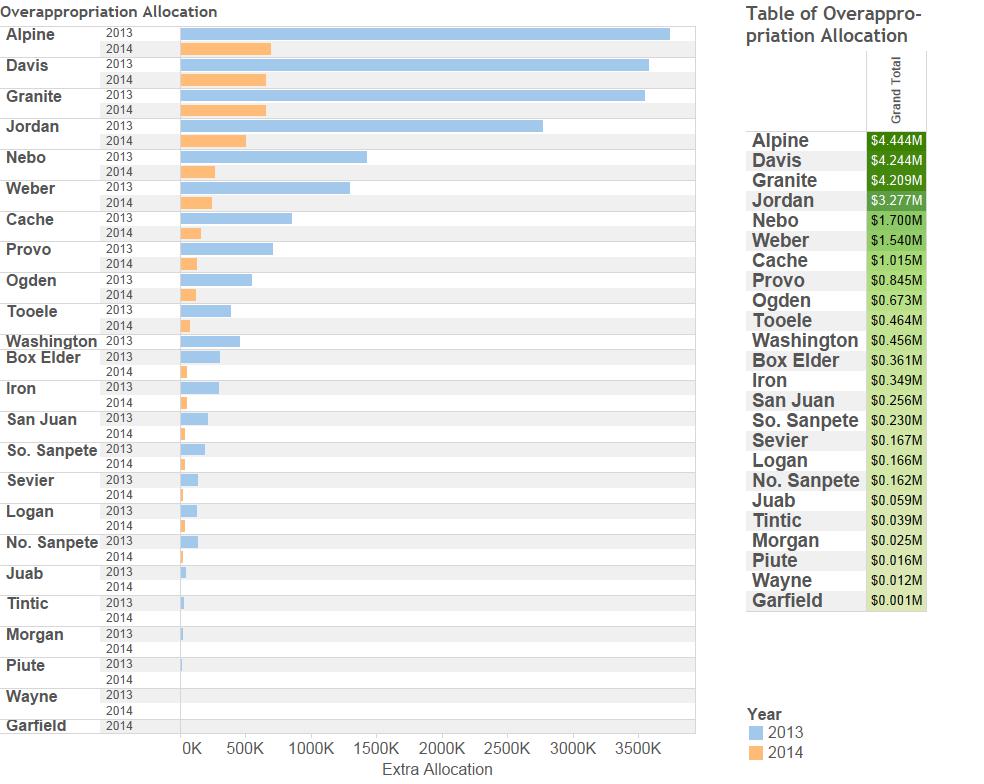

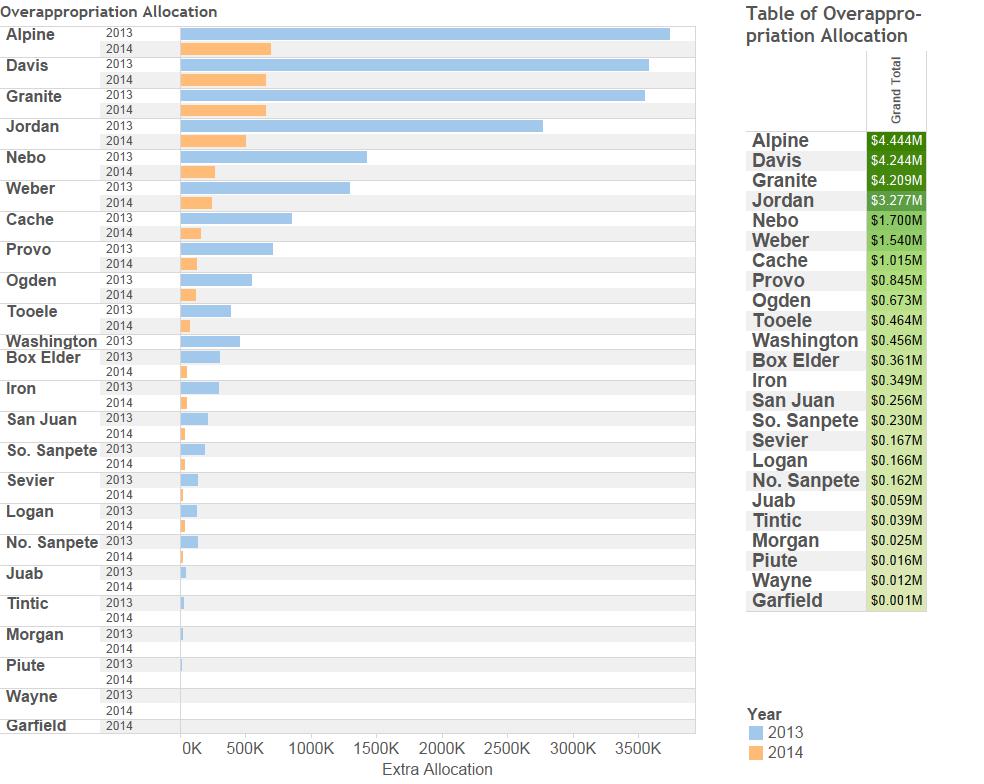

H.B. 49 of the 2013 General Session (Handy) directed that any non-lapsing balance remaining in the guarantee program shall go directly to school

districts as a windfall. The following is a look at where the 2013 balance went and where early estimates indicate the 2014 balance will go.

In summary, our estimates for property values and tax collections are getting more accurate, thus unspent balances in the Basic School Program, and windfall allocations under the Voted and Board Leeway State Guarantee, will both be lower at the end of FY 2014.

Every year leading up to the General Session staff presents you with public education estimates that are based upon projected property values and student enrollment. You then include those estimates in appropriations bills. Two of these are the Basic Rate estimate and the Voted & Board leeways estimates.

The Basic Rate and the revenue associated therewith showed up in H.B. 1 this year, with an estimated rate of 0.001477 and a revenue target of $296.7 million. Each year, after Session ends, the Tax Commission and State Office of Education (USOE) set a certified tax rate that often differs from our estimate. In the past 12 years, the basic rate has always been set too high, collecting more property tax revenue than was budgeted. Last year, we convinced Tax and USOE to change their process for certifying the tax rate so that it was more accurate. As a result, as shown in the figure below, collections are closer to our estimate for FY 2014.

As shown in the figure below, the average over-collection amount since 2002 has been about $17 million per year. In FY 2013, collections exceeded our estimate by more than $30 million. For FY 2014, as a result of more accurate methodologies, collections exceeded our estimate by only $12 million. Thus, the Basic School Program will still have a closing nonlapsing balance this year, but it will not be as big as it has been in the past.

Switching to Voted & Board leeways, the state guarantees that participating districts will collect a certain amount per WPU from these local property taxes. If a district's property values are insufficient to collect a capped amount per WPU, the state fills-in the difference with income tax appropriations.

As with the Basic Rate, staff provides you with estimates of property values and enrollment for the purpose of estimating property tax collections and, therefore, income tax appropriations. The estimated property values have been low, resulting in over-appropriation of income taxes ranging from $17 million to $38 million over the past four years (see below).

During the 2014 General Session, we improved the method by which we estimate property values and thereby reduced FY 2015 income tax appropriations by $23 million. The Legislature also retroactively corrected that same $23 million over-appropriation for FY 2014. Thus, while property taxes will yield $27 million more than we originally estimated for FY 2014, only $4 million will remain as a non-lapsing balance in the Voted and Board Leeway State Guarantee at the end of FY 2014.

H.B. 49 of the 2013 General Session (Handy) directed that any non-lapsing balance remaining in the guarantee program shall go directly to school districts as a windfall. The following is a look at where the 2013 balance went and where early estimates indicate the 2014 balance will go.

In summary, our estimates for property values and tax collections are getting more accurate, thus unspent balances in the Basic School Program, and windfall allocations under the Voted and Board Leeway State Guarantee, will both be lower at the end of FY 2014.