Compendium of Budget Information for the 2012 General Session

| Public Education Appropriations Subcommittee | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Subcommittee Table of Contents | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Agency: MSP - Voted and Board Leeways Line Item: Voted and Board Leeway Programs Function The Voted Leeway and Board Leeway are state-supported programs in which school districts levy a property tax and the state guarantees a certain amount of revenue generated per Weighted Pupil Unit. As guarantee programs, state funding supplements school districts with lower property values. Only school districts that don't meet the minimum revenue per WPU receive an allocation of state funding. Included in this section is a third property tax levied by school districts: the Board Leeway - Reading Improvement Program. This program is more of a matching program. School districts receive state funding for the K-3 Reading Improvement Program if they match the state allocation with property tax revenue (or some other local revenue source). House Bill 301 of the 2011 General Session created two new levies based upon certain existing levies. The first new levy is the Capital Local Levy, which is a combination of the previous:

The second new levy is the Board Local Levy, which is a combination of the previous:

The bill imposed new maximum caps for the new rates. Funding Detail In FY 2011, local school districts generated approximately $310.5 million in local revenues to support the Voted and Board Leeway programs. The Legislature provided approximately $57.9 million ongoing to fund the Voted and Board state guarantee in the same year. Increased state costs are due to an overall decrease in the taxable value of properties within qualifying school districts. Local school districts generated $15 million to support the K-3 Reading Improvement program. Similarly, the Legislature appropriated $15 million to support the program. Please see the K-3 Reading Improvement Program above for more information

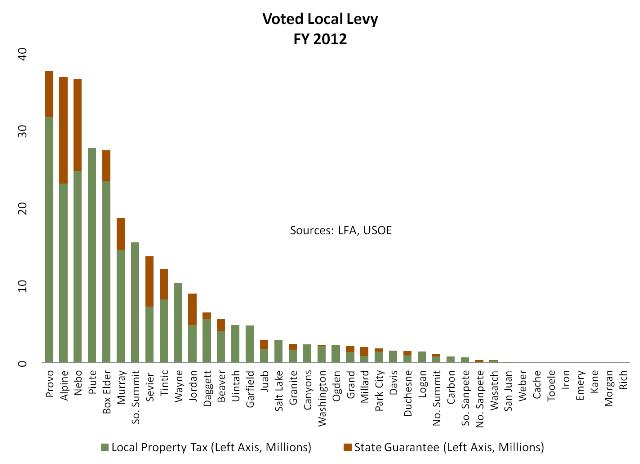

Function First authorized by the Legislature in 1954, the Voted Leeway Program is a property tax levy authorized to cover a portion of the costs of operation and maintenance of the state supported Minimum School Program in a school district. In order to impose the property tax levy, the Voted Leeway must receive a majority vote by the school district electorate. Revenue generated through a district's Voted Leeway may be budgeted and expended under general fund (GASB replaced the previously used "maintenance and operation" with general fund) as authorized by the local school board. Formula - When including the Board Leeway levy, a district may impose a Voted Leeway rate of up to 0.002 to generate property tax and state aid revenue to supplement the district's general fund costs. In addition to the property tax, the State provides a "state guarantee" for each school district levying the Voted Leeway levy. The guarantee is a statutorily set dollar amount of 0.0001 of tax rate per Weighted Pupil Unit (WPU). House Bill 38 'School District Voted Leeway Amendments' of the 2001 General Session provided for a state guarantee up to a combined tax rate between the Voted and the Board Leeway of .002000. It also indexed the amount of the guarantee to the value of the WPU. During the economic downturn of the early 2000s, the increased guarantee amount was postponed to reduce program costs. In FY 2012, the Legislature authorized an increase in the state guarantee contribution from $25.25 to $27.17 per weighted pupil unit. Statute provides that the state guarantee will increase by increments of .0005 until the guarantee is equal to .010544 times the value of the prior year weighted pupil unit. However, during the 2009 and 2010 General Sessions, the Legislature delayed the statutory increase, keeping the contribution rate at $25.25 and delaying increased program costs. Statutory Authority UCA 53A-17a-133 - authorizes the Voted Leeway Program, establishes the state funded guarantee thresholds, and outlines election procedures for school districts implementing a Voted Leeway. The State Board of Education's Administrative Rule R277-422-3 provides administrative procedures associated with the governance of the Voted Leeway Program. Funding Detail Funding for the Voted Leeway Progam has grown from $227.7 million in FY 2008 to $297.3 million in FY 2011, with the State's portion increasing from 14% in FY 2008 to 21% in FY 2011. School districts receiving the largest amount of revenue from the Voted Leeway include Provo ($37.6 million), Alpine ($36.9 million), Nebo ($36.7 million), Piute ($27.7 million), and Box Elder ($27.4 million).

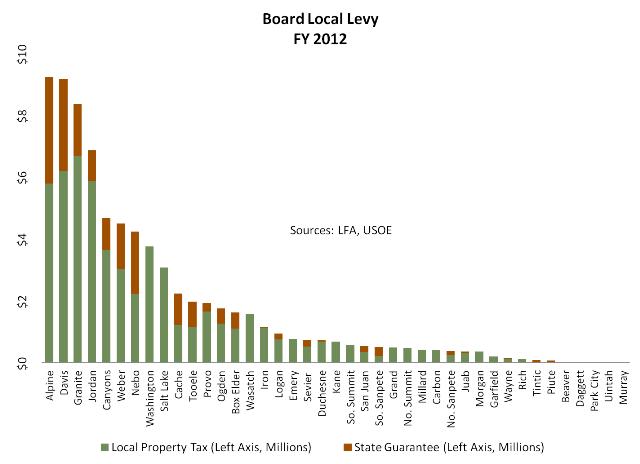

Function The Board Leeway Program allows a local school board to levy a property tax rate of up to 0.0004 to maintain a school program above the cost of the basic program. Statute limits the use of revenue generated by the Board Leeway Program to class size reduction. However, if a local school board determines that district class sizes are not excessive, it may seek authorization to use program revenue to support other district functions. 'If a local school board determines that the average class size in the school district is not excessive, it may use the monies for other school purposes but only if the board has declared the use for other school purposes in a public meeting prior to levying the tax rate' (USOE Finance and Statistics, School District Tax Levies Descriptions, March 2006). Statute also requires school district to certify to the State Board of Education that class size needs are being met and identify the other school purposes for which Board Leeway revenues will be used before they can use any generated revenue. Formula - Similar to the Voted Leeway, the Board Leeway contains a state guarantee component. The state guarantee component is a statutorily set dollar amount per 0.0001 of tax rate per WPU, with a cap at 0.0004. Please refer to the Voted Leeway formula section for more information on the state guarantee rate. Statutory Authority UCA 53A-17a-134 - provides statutory authorization for the Board Leeway and restricts the use of generated revenue to class size reduction efforts. The statute outlines the required procedure districts must follow in order to use generated revenue on other district programs (other than class size reduction efforts) and establishes the state funded guarantee amount. The State Board of Education's Administrative Rule R277-422-3 provides administrative procedures associated with the governance of the Board Leeway Program. Funding Detail Funding for the Board Leeway Program has increased from $62.1 million in FY 2008 to $75.1 million in FY 2011, with the State's portion increasing from 16% to 24%. Local school districts receiving the largest amount of revenue from the Board Leeway are Alpine ($9.2 million), Davis ($9.2 million), Granite ($8.4 million), Jordan ($6.9 million), and Canyons ($4.7 million).

Program: Board Leeway - Reading Improvement Function The Reading Improvement Program discussed in Chapter 8 includes a local property tax component. A local school board may levy a tax rate of up to 0.000121 per dollar of taxable value for funding the school district's K-3 Reading Improvement Program. The reading levy is in addition to the other tax levies imposed by the school district and does not require the approval of the district electorate. Generated revenue supports a school district's reading improvement plan, which is mainly to have students reading at grade level by the end of the third grade. Statute requires that a local school board repeal the reading levy if the district's goals are not achieved within 36 months of program operation. Following one year, the school district may revise its plan for reading achievement, obtain approval from the State Board of Education and reinstate the reading levy. The Legislature addressed the K-3 Reading Improvement Program in the 2011 General Session by issuing a request for proposals for computer-assisted instructional learning and assessments for the K-3 Reading Improvement Program. The total amount is not to exceed $7,500,000 (see H.B. 2 of the 2011 General Session). Please refer to the K-3 Reading Improvement Program in Chapter 8 for more information. Statutory Authority Please refer to the statutory guidelines detailed in the K-3 Reading Improvement Program section in the Minimum School Program. Intent Language The Legislature intends that the State Board of Education issue a request for proposals for computer-assisted instructional learning and assessments for the K-3 Reading Improvement Program and that the State Board of Education may use no more than $7,500,000 from the appropriation for the K-3 Reading Improvement for computer-assisted instructional learning and assessment programs. The Legislature intends that the State Board of Education provide copies of all requests for proposals submitted for a computer-assisted instructional learning assessment program for the K-3 Reading Improvement Program to the Governor's Office of Planning and Budget (H.B. 2 of the 2011 General Session). Funding Detail Since FY 2008, funding has been constant at $15 million per year.

|