Fiscal Highlights - July 2016

|

Utah Compared to Other States with a Triple-Triple-A Credit Rating -

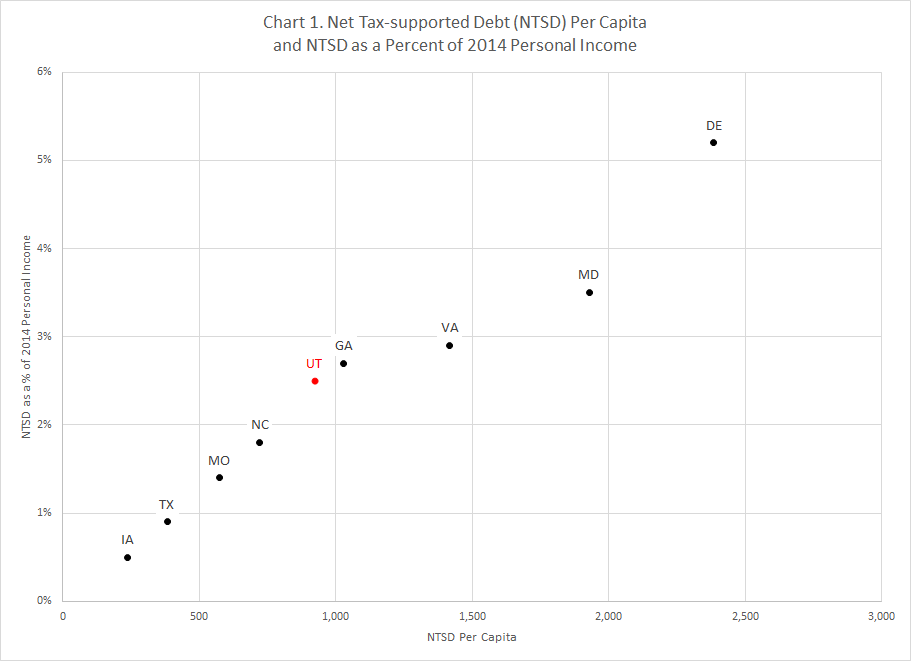

Brian Wikle ( Utah has earned a triple-A credit rating (the highest) from each of the three major credit rating agencies - sometimes referred to as a "Triple-Triple-A" - every year since 1992. The most recent ratings put Utah in the elite company of only eight other Triple-Triple-A states - Delaware, Georgia, Iowa, Maryland, Missouri, North Carolina, Texas, and Virginia. While each rating agency has a distinct methodology for assigning credit ratings to the states, attributes that contribute to receiving a AAA rating include keeping debt at a moderate level and aggressively paying down the debt, maintaining a balanced budget, and adequately funding liabilities such as pension and benefit plans. Rating agencies also look at a number of measures that put a state's debt in context of the populace's ability to afford the debt. The information that follows in this article is as reported by Moody's Investor Service, one of the major credit rating agencies. Chart 1 shows that Utah's net tax-supported debt (NTSD) per capita is currently $921. This means that a four-person household's share of the debt is almost $3,700. The state's NTSD as a percent of 2014 personal income is 2.5 percent.  Chart 2 shows that the ratio of net tax-supported debt to total economic output in Utah is about 2 percent (i.e. NTSD as a percent of state gross domestic product). The state's debt service ratio - the proportion of the budget used to pay principal and interest on the debt - is nearly 6 percent.  On all of these measures, Utah ranks in the middle of the Triple-Triple-A states. State officials should carefully monitor these measures and continue sound financial practices that will allow Utah to maintain its high credit rating, thereby qualifying for low costs of borrowing when issuing debt. |

Behavioral Health Needs of At-Risk and Juvenile Justice-Involved Youth - Clare Tobin Lence At the July interim meeting of the Executive Offices and Criminal Justice (EOCJ) Appropriations S...Catastrophic Fire Prevention Program - Ivan D. Djambov The Legislature passed the following pieces of legislation directing the Division of Forestry, Fire...Concurrent Enrollment a Benefit for Students - Spencer C. Pratt Concurrent enrollment proves to be a benefit for students financially and in preparing them for pos...EOCJ Interim Meeting Summary and Action - Gary R. Syphus The Executive Offices and Criminal Justice (EOCJ) Appropriations Subcommittee met on July 14th at t...Follow up on Building Blocks Within Social Services - Russell T. Frandsen The Fiscal Analyst's Office reports annually on the implementation of fiscal notes and budget actio...Following up on Past Budget Items and Fiscal Notes 2016 Interim - Stephen C. Jardine The Fiscal Analyst's Office reports annually on the implementation of fiscal notes and budget act...Looking at the Present Value of Bonding for Certain Projects - Thomas E. Young During the 2016 General Session, the Legislature gave the following direction to the Utah Departmen...Providing for the Mental Health Needs of the Utah National Guard - Steven M. Allred When a National Guard service member deploys for military service, training, or especially combat, ...Transportation and Water Infrastructure Funding - Angela J. Oh The Infrastructure and General Government Appropriations Subcommittee had their first 2016 interi...Utah Compared to Other States with a Triple-Triple-A Credit Rating - Brian Wikle Utah has earned a triple-A credit rating (the highest) from each of the three major credit rating a...Utah Department of Alcoholic Beverage Control Long Term Issues - Andrea Wilko The Business and Economic Development Appropriations Subcommittee held their June 22nd meeting at t...Utah Schools for the Deaf and the Blind Utah County Modular Classrooms - Jill L.Curry In an effort to better understand budget issues regarding Utah Schools for the Deaf and the Blind (... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692