Agency: State Auditor Line Item: State Auditor Function The State Auditor consists of only one line item. The line item has three programs: Administration, Auditing, and State and Local Government.

Intent Language Under section 63J-1-603 of the Utah Code, the Legislature intends that appropriations provided for the State Auditor in Item 6 of Chapter2 Laws of Utah 2010 not lapse at the close of Fiscal Year 2011. The Legislature intends that agencies maximize budgets by examining expiring leases and contracts and explore all possibilities in doing so including re-negotiating for lower lease and contract rates, planning and allowing leases to expire and moving to locations with lower costs, purchasing instead of leasing a facility, and more. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $3,680,100 | $3,468,800 | $3,234,000 | $3,473,600 | $3,217,700 | | General Fund, One-time | $0 | $133,000 | $267,300 | $0 | $0 | | Dedicated Credits Revenue | $1,248,600 | $1,339,200 | $1,527,100 | $1,646,300 | $1,513,900 | | Beginning Nonlapsing | $197,200 | $250,600 | $95,800 | $228,800 | $222,400 | | Closing Nonlapsing | ($250,500) | ($95,800) | ($228,800) | ($459,700) | ($100,700) | | Total | $4,875,400 | $5,095,800 | $4,895,400 | $4,889,000 | $4,853,300 |

|---|

| | Programs: | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Administration | $380,400 | $415,000 | $342,000 | $343,600 | $344,200 | | Auditing | $3,964,600 | $4,097,000 | $4,092,000 | $4,127,000 | $4,329,700 | | State and Local Government | $530,400 | $583,800 | $461,400 | $418,400 | $179,400 | | Total | $4,875,400 | $5,095,800 | $4,895,400 | $4,889,000 | $4,853,300 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $4,490,000 | $4,836,800 | $4,555,800 | $4,595,900 | $4,481,800 | | In-state Travel | $27,900 | $13,200 | $3,800 | $6,100 | $4,800 | | Out-of-state Travel | $24,800 | $20,100 | $15,900 | $16,800 | $24,400 | | Current Expense | $201,100 | $181,100 | $219,400 | $183,600 | $223,500 | | DP Current Expense | $118,200 | $44,600 | $100,500 | $86,600 | $118,800 | | DP Capital Outlay | $13,400 | $0 | $0 | $0 | $0 | | Total | $4,875,400 | $5,095,800 | $4,895,400 | $4,889,000 | $4,853,300 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 47.0 | 45.0 | 45.0 | 43.2 | 44.4 | | Actual FTE | 41.4 | 41.3 | 40.0 | 41.0 | 0.0 | | Vehicles | 3 | 3 | 3 | 3 | 3 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Administration Function The Administration program consists of funding for the personnel services and other costs of the State Auditor, an administrative assistant, and other office administrative staff. General costs not attributable to other specific programs are also charged to the Administration program. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $354,500 | $387,600 | $344,400 | $343,600 | $344,200 | | General Fund, One-time | $0 | $0 | ($2,400) | $0 | $0 | | Beginning Nonlapsing | $25,900 | $27,400 | $0 | $0 | $0 | | Total | $380,400 | $415,000 | $342,000 | $343,600 | $344,200 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $369,500 | $406,900 | $332,800 | $336,700 | $334,900 | | In-state Travel | $500 | $100 | $100 | $700 | $200 | | Out-of-state Travel | $5,400 | $4,900 | $4,300 | $2,000 | $4,300 | | Current Expense | $5,000 | $3,100 | $4,800 | $4,200 | $4,800 | | Total | $380,400 | $415,000 | $342,000 | $343,600 | $344,200 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 4.0 | 4.0 | 3.8 | 3.0 | 3.0 | | Actual FTE | 2.9 | 3.0 | 2.0 | 2.0 | 0.0 |

|

|

|

|

|

|

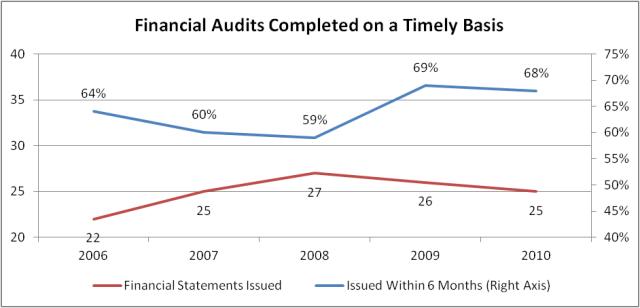

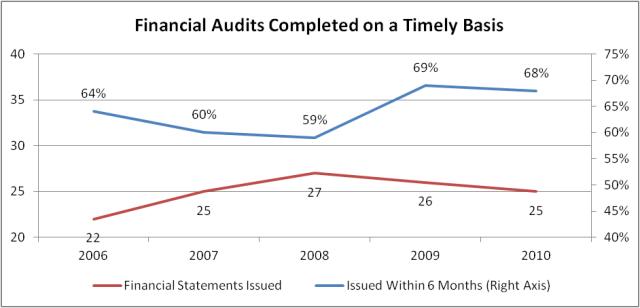

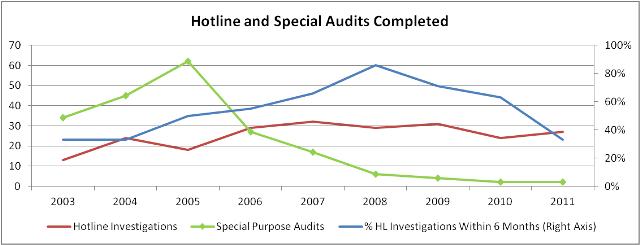

Subcommittee Table of ContentsProgram: Auditing Function The Auditing Program is primarily responsible for performing financial and compliance audits of state agencies, departments, colleges and universities, and quasi-state agencies on a regular basis. The program is responsible to audit the state's entity-wide Comprehensive Annual Financial Report. This includes financial auditing as well as testing for compliance with material state and other laws and regulations, and reviewing significant internal controls. Colleges and universities and some state agencies also issue separate annual financial statements, which the Auditing Division audits. The Auditing Program also performs the federally mandated "single audit." The single audit is an entity-wide audit of federal funds to determine whether the funds were spent in accordance with federal laws and regulations. The single audit also requires a review of internal controls used in administering federal assistance programs. The program uses a risk and materiality based audit approach to focus audit efforts on essential areas. Contracted CPA firms are also used in the program's audit plan where feasible and necessary. The program uses a risk-based approach to prioritize audits of areas that do not receive direct audit coverage in required audits. The program also investigates issues from Hotline calls and performs other auditing services as requested by the Legislature or State agencies. The required audits are performed in accordance with generally accepted auditing standards, Government Auditing Standards issued by the U.S. Government Accountability Office, and where applicable, the federal Single Audit Act and OMB Circular A-133. Costs of the single audit are charged back to the applicable programs. Costs of certain other audits are charged back to the agencies where allowed by statute or specially requested. Performance To track efficiency and productivity, the State Auditor records multiple performance measures, FY 2011 results are included below (Note: Due to the ongoing nature of certain audits at the release of this report, some measures for FY 2011 have not been obtained. As a result, the most up-to-date numbers for the respective measures for which this is the case will be reported, generally FY 2010 results): Timeliness of Financial Statements Audited (FY 2010): - Total financial statements issued - 25

- Percent of reports issued within 6 months - 68%

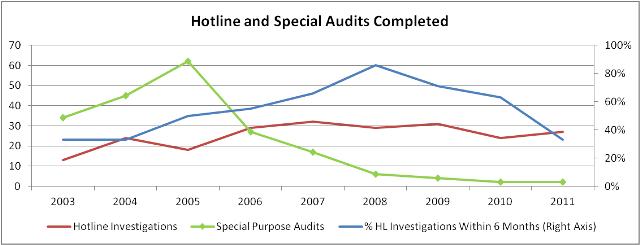

Hotline and Special Audits Completed: - Hotline Investigations - 27

- Percent of Hotline Investigations Completed Within 6 Months - 33%

- Special Purpose Audits - 2

Funding Detail During the 2010 General Session, the Legislature appropriated an additional $265,000 from Dedicated Credits for costs of auditing federal stimulus funds in state agencies. The Auditor bills the costs to agencies, who in turn bill the costs to the federal grants. | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $2,840,100 | $2,547,000 | $2,320,700 | $2,732,800 | $2,706,700 | | General Fund, One-time | $0 | $133,000 | $398,300 | $0 | $0 | | Dedicated Credits Revenue | $1,236,300 | $1,326,500 | $1,506,000 | $1,625,100 | $1,501,300 | | Beginning Nonlapsing | $138,700 | $186,300 | $95,800 | $228,800 | $222,400 | | Closing Nonlapsing | ($250,500) | ($95,800) | ($228,800) | ($459,700) | ($100,700) | | Total | $3,964,600 | $4,097,000 | $4,092,000 | $4,127,000 | $4,329,700 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $3,612,400 | $3,864,500 | $3,784,100 | $3,865,000 | $3,990,000 | | In-state Travel | $25,200 | $11,700 | $2,800 | $3,400 | $3,700 | | Out-of-state Travel | $15,100 | $14,100 | $8,900 | $10,600 | $17,400 | | Current Expense | $180,300 | $162,100 | $195,700 | $161,400 | $199,800 | | DP Current Expense | $118,200 | $44,600 | $100,500 | $86,600 | $118,800 | | DP Capital Outlay | $13,400 | $0 | $0 | $0 | $0 | | Total | $3,964,600 | $4,097,000 | $4,092,000 | $4,127,000 | $4,329,700 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 39.0 | 37.0 | 37.3 | 38.7 | 38.4 | | Actual FTE | 34.5 | 34.7 | 34.6 | 36.0 | 0.0 | | Vehicles | 3 | 3 | 3 | 3 | 3 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: State and Local Government Function The Local Government Program has the responsibility to ensure uniform accounting, budgeting, and financial reporting of the state's local governments. To that end, the program provides consultation, training, budget and financial reporting forms, and uniform accounting services to local governments. The program publishes a Uniform Accounting Manual, which gives guidance to local governments in budgeting, accounting, financial reporting, auditing and complying with state legal requirements. The program prescribes the budget forms used by all units of local governments. The program also publishes the State Legal Compliance Audit Guide, which is used by CPA firms for testing compliance with state laws. All local governments as well as certain nonprofit organizations are required by law to file annual financial reports with the State Auditor's Office. The program reviews the reports (over 900) to determine if applicable standards are met. The program has been scanning all budgets and financial reports received from local governments into electronic form. This provides citizens, research groups, and financial advisors greater accessibility to these documents. Funding Detail In order to comply with statutory mandates during lean budget times, the Auditor has discussed the possibility of moving personnel resources from this program to the Auditing program. Although the table below shows FY 2011 appropriated FTE at 1.5 (an estimate made during the 2010 General Session), actual FTE were 3.0. | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $485,500 | $534,200 | $568,900 | $397,200 | $166,800 | | General Fund, One-time | $0 | $0 | ($128,600) | $0 | $0 | | Dedicated Credits Revenue | $12,300 | $12,700 | $21,100 | $21,200 | $12,600 | | Beginning Nonlapsing | $32,600 | $36,900 | $0 | $0 | $0 | | Total | $530,400 | $583,800 | $461,400 | $418,400 | $179,400 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $508,100 | $565,400 | $438,900 | $394,200 | $156,900 | | In-state Travel | $2,200 | $1,400 | $900 | $2,000 | $900 | | Out-of-state Travel | $4,300 | $1,100 | $2,700 | $4,200 | $2,700 | | Current Expense | $15,800 | $15,900 | $18,900 | $18,000 | $18,900 | | Total | $530,400 | $583,800 | $461,400 | $418,400 | $179,400 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 4.0 | 4.0 | 4.0 | 1.5 | 3.0 | | Actual FTE | 4.0 | 3.7 | 3.3 | 3.0 | 0.0 |

|

|

|

|

|

|

Subcommittee Table of Contents |