Compendium of Budget Information for the 2012 General Session

| Business, Economic Development, & Labor Appropriations Subcommittee | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Subcommittee Table of Contents | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Line Item: Housing and Community Development Function The Division of Housing and Community Development enhances quality of life for Utah citizens through community infrastructure, affordable housing and development programs. The Division manages a capital budget and provides administrative support and programmatic oversight to many boards and committees. Statutory Authority Statutory authority for the Division of Housing and Community Development is provided in UCA 9-4. The Division's responsibilities are to:

Intent Language Under Section 63J-1-603 of the Utah Code, the Legislature intends that up to $24,500 of any remaining amount of the $289,800 ongoing General Funds provided by the Laws of Utah 2010 Chapter 2, State Agency and Higher Education Base Budget, Item 82, for the Department of Community and Culture -Housing and Community Development (Emergency Food Network) line item not lapse at the close of Fiscal Year 2011. This funding would be used specifically for food bank capital improvements. All General Funds appropriated to the Division of Housing and Community Development line item are contingent upon expenditures from Federal Funds -American Recovery and Reinvestment Act (H.R. 1, 111th United States Congress) not exceeding amounts appropriated from Federal Funds - American Recovery and Reinvestment Act in all appropriations bills passed for FY 2012. If expenditures in the Division of Housing and Community Development line item exceed amounts appropriated to the Division of Housing and Community Development line item from Federal Funds - American Recovery and Reinvestment Act in FY 2012, the Division of Finance shall reduce the General Fund allocations to the Division of Housing and Community Development line item by one dollar for every one dollar in Federal Funds -American Recovery and Reinvestment Act expenditures that exceed Federal Funds - American Recovery and Reinvestment Act appropriations. Special Funds The Division of Housing and Community Development Administers the following special revenue funds: The Pamela Atkinson Homeless Trust Fund (PAHTF) is funded by an appropriation from the General Fund and by contributions made by individuals on their Utah Individual Income Tax Form. The PAHTF is a competitive grant program to supplement various agencies statewide in moving people out of homelessness. The Methamphetamine Housing Reconstruction and Rehabilitation Account is funded through contributions made by individuals on their Utah Individual Income Tax Form. Funds are used to rehabilitate home that have been impacted by methamphetamine production. Funding Detail Most of the funding for Housing and Community Development is from federal funds. The General Fund is the second largest funding source. A history of the program is presented below.

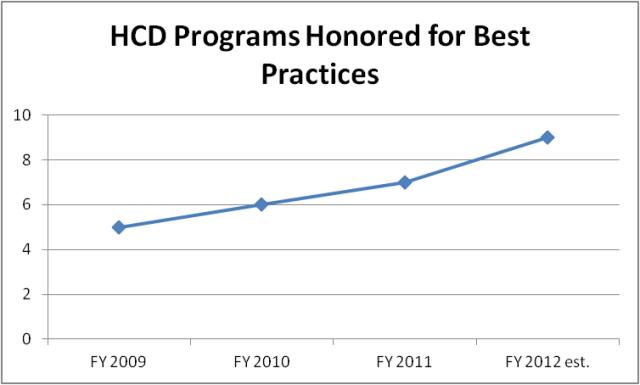

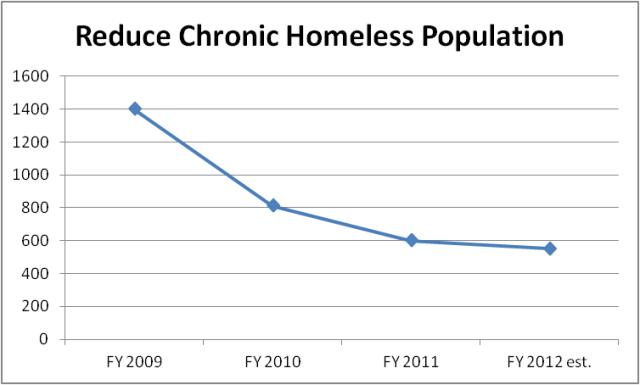

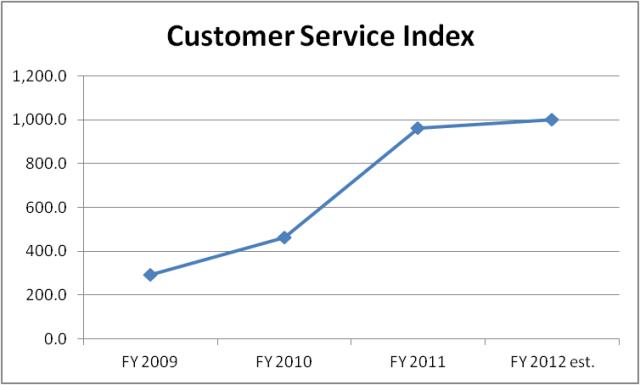

Program: Community Development Administration Function Administration provides leadership, financial management, and data management to Division programs. Performance The Division of Housing and community development uses as a performance measure the number of division programs that are honored for best practices. Results are shown below.  A key division goal is to eliminate chronic homelessness throughout the state. The chart below shows the progress they have made towards this goal.  The Division measures success through a customer service index. The results of this index are shown below.  Funding Detail Funding for the Administration Program is mainly from General Fund and the Permanent Community Impact Fund.

Program: Ethnic Affairs Commission Function The Office of Ethnic Affairs was established by executive order of the Governor in 1996 and included four ethnic groups. In 2005, the four offices, along with the Martin Luther King Human Rights Commission were combined into one managerial entity, the Office of Ethnic Affairs. The office has currently been realigned into a Multicultural Affairs Office with two FTE's. The original executive order mandated the following:

There will also be an executive order that will define the role of the new Multicultural Commission. This Commission, will be appointed by the Governor, and will represent state agencies and ethnic community leaders who will collaborate in addressing the issues of the ethnic community and will make recommendations and find resolutions in response. Funding Detail Funding for the Office of Ethnic Affairs is appropriated from the General Fund and dedicated credit revenues. Dedicated credit revenues for this program are generated by outside donations.

Program: Community Development Function The Community Development program administers the federal Community Development Block Grant (CDBG) and the Neighborhood Stabilization Program (NSP). It also provides staff leadership for and financial management of the Permanent Community Impact Fund, the Navajo Revitalization Fund, and the Uintah Basin Revitalization Fund. The Community Development Block Grant The Community Development Block Grant program provides funds to cities or counties with populations of less than 50,000 or 200,000 people respectively. Funds are used for public facilities, infrastructure housing and economic development opportunities. Larger communities get CDBG funds directly from the U.S. Department of Housing and Urban Development. The Community Development Block Grant Policy Committee is made up of elected officials from each of the seven Association of Government offices and provides oversight of the program. The Community Development Block Grant program and Neighborhood Stabilization Programs are funded through the Department of Housing and Urban Development. The programs are primarily tools for community development to create and maintain a suitable living environment. The programs also have significant economic development components. CDBG has capitalized six regional revolving loan funds in the state and also offers interim loans to eligible businesses. NSP is a federal program designed for emergency assistance to purchase and/or redevelop abandoned, foreclosed, or residential properties. State grantees act directly to implement this program. The Permanent Community Impact Fund The Permanent Community Impact Fund is defined in the Community Development Capital Program. The program includes administrative funding and costs for staff support and board expenses as well as staff time spent on Federal Mineral Lease and Exchanged Land Mineral Lease receipt analysis. Navajo Revitalization Fund Board and the Uintah Basin Revitalization fund Board The Navajo Revitalization Fund Board and the Uintah Basin Revitalization Fund Board are authorized in statute to maximize the long-term benefit of state severance taxes paid on oil and natural gas production. Revenue from these taxes fund grants and loans to agencies of the state, county or tribal government in San Juan County for the benefit of the Navajo Nation members and for Ute Indian Tribe members of the Uintah and Ouray Reservation in Duchesne and Uintah counties. Administrative costs for staff support are included in the Community Assistance program. Funding Detail Most of the funding for the Community Assistance comes from the federal government. The resources are then used to pass on to local communities to support infrastructure type projects.

Function The Olene Walker Housing Loan Fund (OWHLF) provides funding for acquisition, rehabilitation, or new construction of the highest quality housing possible at a reasonable cost to insure that low and moderate income residents of the state have access to affordable, safe, decent and sanitary housing. Loans and other financial assistance are made for multiple family rental properties, single family rehabilitation and home ownership assistance and for special needs housing for the homeless. These and other activities assist in improving the availability and quality of housing for low income persons statewide. Statutory Authority Statutory Authority for the Olene Walker Housing Loan Fund (OWHLF) is found in UCA 9-4-701 to 708. The statute sets up the requirements for distribution of state and federal funds. Funding is utilized for loans, grants, and education as provided in statute. Funding Detail Funding for housing development is from the federal government and the General Fund.

Function The Special Housing program pays for utilities, building renovations and leased space for the homeless and those with low incomes. It also provides housing for the chronically mentally ill, disabled homeless and AIDS victims. All resources are federal funds but only one program, Housing Opportunities for Persons with AIDS (HOPWA), is a formula grant. All other funding, including the Shelter Plus Care Program and Rural Development, are competitive grants. Funding Detail Funding for Special Housing comes from federal funds and is passed through to eligible entities.

Function The Pamela Atkinson Homeless Trust Fund was created in 1983. It is administered by the State Community Services Office under the direction of the State Homeless Coordinating Committee (SHCC). Programs include Critical Needs Housing, Emergency Shelter Grants, the Pamela Atkinson Homeless Trust Fund, the Homeless Management Information System (HMIS), Temporary Assistance for Needy Families (TANF), and the Homeless Prevention and Rapid Re-housing Program (HPRP), an ARRA funded program. Programs provide statewide funding to social service agencies for homeless services. The SHCC was established to facilitate a better understanding of the concept of homelessness in the community and to assist in the allocation of homeless funds received from the state and federal government. Funds are disbursed in a competitive and/or formula-driven process to private and public non-profit providers of homeless services, local housing authorities, and associations of governments to support efforts to create affordable housing, shelter and support services for homeless individuals and families and victims of domestic violence. In addition, the SHCC is responsible for compiling data and reporting on homeless and poverty trends in Utah, as required by the federal government. The SHCC provides funds through the Pamela Atkinson Homeless Trust Fund and other programs to public and non-profit entities that provide services to the homeless, poor, and victims of domestic violence across the state. More than 80 agencies provide services that assist these families and individuals to become self-sufficient. Methods used include, but are not limited to, rental assistance, temporary shelter, transitional housing, case management and mental health services. The SHCC also coordinates the State's 10-Year Plan to end chronic homelessness. In concert with the Housing First model, the program coordinates permanent supportive housing with comprehensive integrated services such as mental health counseling, substance abuse counseling, social security issues, veteran's issues etc. The 10-Year Plan was drafted in 2004 and local implementation continues. Funding Detail Funding from the Homeless Committee comes from the General Fund, federal funds, donations from the Utah State Individual Income Tax Form and other revenues. Most of the funding is passed through to homeless providers in the state to provide services.

Function The federal Low-Income Home Energy Assistance Program (LIHEAP), which also operates under the state title of Home Energy Assistance Target (HEAT) Program, is a 100 percent federally-funded block grant program used to provide utility assistance to low-income households during the winter months. This program is administered in partnership with local agencies such as the Associations of Government (AOGs) and non-profit agencies. The Home Energy Assistance Target (HEAT) program provides the following services:

Benefit funds that are unused at the end of the heat season (typically, November through March), can be sub-awarded for home weatherization activity (between 15-25 percent of the total original award). The Utah Telephone Assistance Program (UTAP) provides low-income families at 150 percent below the poverty level and/or families receiving public assistance with a discount on their monthly telephone bill and/or and installation rebate. Funding Detail Funding for the HEAT program is federal funds; funding for UTAP and HELP are provided through dedicated credit revenues.

Program: Weatherization Assistance Function The Weatherization Assistance program helps reduce energy consumption and utility bills for low-income households. Priority is given to the elderly, disabled, families with pre-school age children, those with very high heating bills, and other at-risk households. Utah residents who are below 150 percent of the federal poverty guidelines are eligible for a one-time non-cash grant to make energy efficient improvements to their homes. In addition to energy efficiency, the program seeks to increase health and safety through heating system improvements and to increase the overall comfort of the occupants. The Division administers the program through local government and non-profit agencies. Primary funding is made available through the U.S. Department of Energy (DOE). Local agencies conduct a computerized energy audit on each home to identify the most cost effective improvements to make. They then implement a wide variety of improvements including: insulation air leakage testing and sealing, comprehensive heating system evaluations and tune-ups, client education, and electrical base load reduction measures. As a result of weatherization, participating households realize an average annual savings in excess of 30 percent. The Utah Weatherization Program has been very successful in leveraging its appropriation of State funding to gain large amounts of federal, private and utility funding. Utah Power, Questar Gas and the Utah Public Service Commission are contributing financial partners in the funding of the Weatherization Program. The Weatherization Program received a substantial increase in one-time funding through the American Recovery and Reinvestment Act (ARRA), which will be spent by the end of FY 2012. To meet the demand for energy auditors and weatherization contractors, the program has developed a permanent training center in Clearfield, Utah, and has expanded its role as a trainer in weatherization activity. Funding Detail Most of the funding for Weatherization is allocated from federal funds and dedicated credit revenues, including significant funding from local utilities. The appropriation is passed through to eligible entities.

Function The Community Services Block Grant (CSBG) is a federal formula-based appropriations administered by the State Community Services Office for community action programs (CAPs) across the state. The community action programs provide local leadership and support to combat the causes, as well as the effects, of poverty. Statutory authority for the program is provided in UCA 9-4-1403 to 1408. There are nine community action programs serving all 29 counties in Utah. Community action programs implement a self-help philosophy through a process of innovative, practical and timely programs and services that emphasize self-sufficiency while addressing the immediate financial crisis needs of low-income people. Community action programs serve as a catalyst to coordinate efforts, to mobilize resources and to encourage other organizations to deliver needed services. Funding Detail Community Services primarily uses federal funds and some state revenues to provide services to eligible populations.

Program: Commission on Volunteers Function The mission of the Utah Commission on Volunteers is to improve communities through service and volunteering in Utah. Statutory Authority Statutory authority for the Utah Commission on Volunteers is provided in UCA 9-1-803. The Commission is charged with finding innovative and creative ways to increase volunteerism in the state. Funding Detail Funding for the Commission on Volunteers is mainly federal funds with a small portion attributable to the General Fund and dedicated credits revenue for the required federal match. Dedicated credits from this program come from outside contracts and donations.

Program: Emergency Food Network Function Funding provided to the Emergency Food Network (EFN) is administered by the State Community Services Office for distribution to emergency food pantries statewide. The funds assist local food banks and other providers with the storage and distribution of emergency and supplemental nutrition to households in poverty. Emergency food pantries utilize a variety of resources. These are mostly state and local funds leveraged with in-kind resources that include food and volunteer support. Funding Detail Funding for the program is from the General Fund with resources being passed through to eligible entities.

|