Compendium of Budget Information for the 2010 General Session

| Capital Facilities & Government Operations Appropriations Subcommittee | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Subcommittee Table of Contents | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

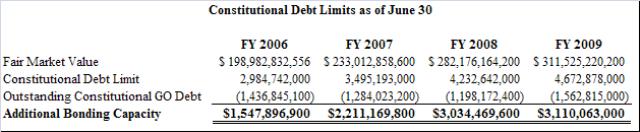

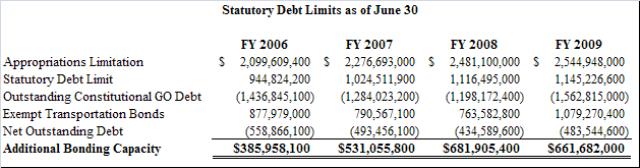

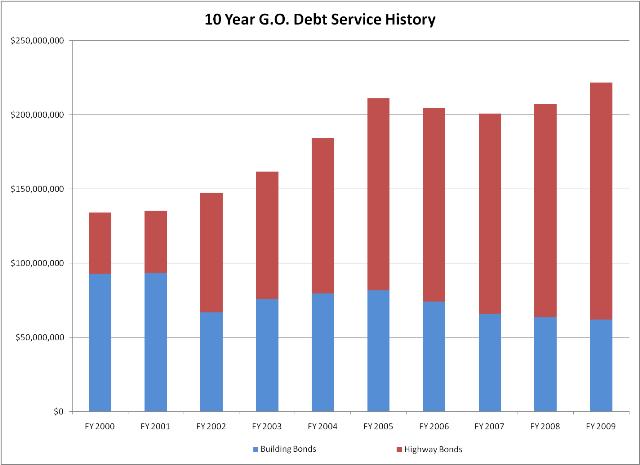

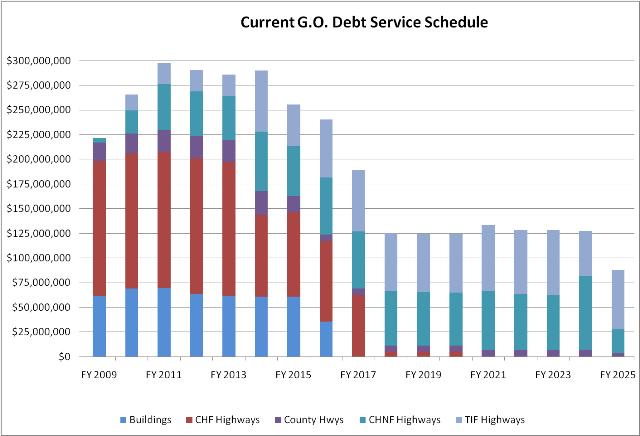

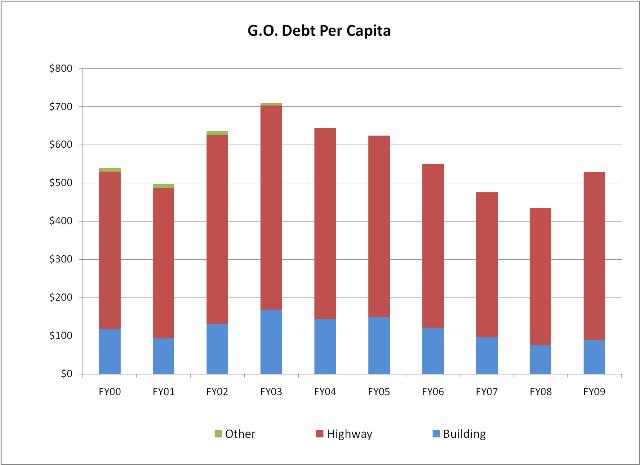

Function The Debt Service line item contains the appropriations necessary to pay off interest, principal, and fees due on the state's bonded indebtedness. The state uses long-term debt to finance large capital expenditures including new buildings, major remodeling, and highway projects. The state issues general obligation bonds backed by the full faith and credit of the state and revenue bonds secured by dedicated revenue streams such as enterprise fund revenue or dedicated lease payments. Both general obligation and revenue bond debt, issued by the state, are included in this line item. Bonds issued by entities besides the State of Utah, such as institutions of higher education or loan funds, are not included in this line item. Statutory Authority Article XIV, Section 1 of the State Constitution, the "Constitutional Debt Limit," limits the total general obligation indebtedness of the state to an amount equal to 1.5 percent of the value of the total taxable property of the state. UCA 63J-3-402, the "Statutory Debt Limit," limits the maximum general obligation borrowing ability of the state at any given time to no more than forty five percent of the maximum allowable state budget appropriations limit set in UCA 63J-3-201 (a formula that reflects changes in population and inflation). Some highway bonds are exempt from this debt limitation. UCA 63B-1-201 creates the State Bonding Commission composed of the governor, state treasurer, and a third person appointed by the governor. UCA 63B-1-202 requires that all legislation authorizing the State Bonding Commission to issue bonds contain an estimate of the annual amount of funds necessary for operation and maintenance of each project. UCA 63B-1-304 creates the State Building Ownership Authority composed of the governor, state treasurer, and the chair of the State Building Board. The authority may, among other things, borrow money and issue obligations (including refunding obligations); pledge revenues from any facility to secure the payment of obligations relating to that facility; cause to be executed mortgages, trust deeds, and other documents; own, lease, operate and encumber facilities; and rent or lease any facility to any state body. Any obligations issued by the authority may not constitute general obligation debt of the state and must be legislatively authorized. UCA 63B-1-307 requires the State Building Ownership Authority to lease space back to the agency for which obligations were issued. Rent amounts must be sufficient to pay off the principal and interest as they come due. UCA 63B-1a, known as the 'Master General Obligation Bond Act,' authorizes the State Bonding Commission to issue bonds only if the Legislature has affirmatively authorized the issuance of the bonds, the capital projects to be funded, and the maximum amount of the bonds. Article XIII Section 5(3) of the State Constitution requires a tax levy to pay off general obligation bonds within 20 years while UCA 63B-1a-101(4) limits maturity dates to 15 years unless otherwise directed by the Legislature. UCA 63B-1a-301 requires that a sinking fund be created to pay debt service on general obligation bonds. The State Treasurer administers the fund and deposits monies into the fund as necessary to pay debt service. Any bond monies remaining after a project is completed are to be deposited in the sinking fund. UCA 63B-1a-303 levies a direct property tax each year after bonds are issued until they are paid off, sufficient to pay principal, interest, and premiums on each bond. However, subsection (5) abates the tax to the extent money is available from other sources. UCA 63B-1a-601 allows the State Bonding Commission to issue bond anticipation notes that represent a general obligation of the state. Notes are payable from proceeds of the sale of bonds and/or other monies of the state. Further Information Constitutional Debt Limit: The state's constitutional debt limit caps total general obligation debt at 1.5 percent of the value of the state's taxable property. The following table shows the state's position as of June 30, 2009.  Statutory Debt Limit: The state's statutory debt limit further limits general obligation debt to 45 percent of the allowable appropriations limit unless approved by more than two-thirds of the Legislature. However, statute excludes most highway bonds from being subject to the statutory debt limitation. The following table shows the state's position as of June 30, 2009.  The state typically issues highway bonds with a fifteen year maturity and facilities bonds with a six year maturity. The following chart shows how the state's general obligation debt service payments have increased over the last ten years, particulary for highway bonds.  The following chart depicts the current debt service schedule as of October 2009 that requires payments through FY 2025. This chart does not reflect bonds authorized by the Legislature, but not yet issued.  To a large extent population growth drives state government expenditures including bonding. Utah's growth is primarily internal, meaning that the state must provide infrastructure for an expanding population while a younger portion of that population is not yet contributing to the tax base. Over the last ten years the state's population has grown by 25.8 percent while the state's per capita general obligation debt has actually decreased by 2.1 percent. This is a result of the State's policy of paying cash for buildings and highways when economically feasible.  Funding Detail The Legislature currently appropriates General Fund and Education Fund to pay general obligation debt service on buildings. The Legislature also currently appropriates Transportation Investment, Centennial Highway, Critical Highway Needs, and County of the First Class transportation restricted funds to pay general obligation debt service on highways. Agencies occupying buildings constructed with lease revenue bonds make lease payments, recorded as dedicated credits, to the debt service line item. In FY 2008 the University of Utah and the State of Utah defeased over $100 million of SBOA lease revenue bonds, which significantly increased the dedicated credits to this line item.

|