Agency: State Treasurer Line Item: State Treasurer Function The State Treasurer budget consists of only one line item. The line item has four programs: Treasury and Investment, Unclaimed Property, Money Management Council, and Financial Assistance.

Intent Language Under Section 63J-1-603 of the Utah Code, the Legislature intends that appropriations provided for the State Treasurer in Item 6 of Chapter 396 Laws of Utah 2009 not lapse at the close of fiscal year 2010. Funding Detail | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | General Fund | $938,900 | $1,010,900 | $938,400 | $875,300 | $940,200 | | General Fund, One-time | ($6,300) | $0 | $14,300 | $91,100 | $0 | | Dedicated Credits Revenue | $237,200 | $271,300 | $364,600 | $363,300 | $528,400 | | Unclaimed Property Trust | $1,309,500 | $1,365,700 | $1,465,300 | $1,399,500 | $1,412,300 | | Beginning Nonlapsing | $405,000 | $466,700 | $520,000 | $475,000 | $344,600 | | Closing Nonlapsing | ($466,700) | ($520,000) | ($475,000) | ($445,000) | $0 | | Lapsing Balance | ($91,900) | ($244,800) | ($301,200) | ($396,100) | $0 | | Total | $2,325,700 | $2,349,800 | $2,526,400 | $2,363,100 | $3,225,500 |

|---|

| | Programs: | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Treasury and Investment | $1,049,100 | $1,135,300 | $1,246,000 | $1,103,400 | $1,305,100 | | Unclaimed Property | $1,214,200 | $1,150,100 | $1,203,000 | $1,180,000 | $1,756,900 | | Money Management Council | $62,400 | $64,400 | $77,400 | $79,700 | $86,400 | | Financial Assistance | $0 | $0 | $0 | $0 | $77,100 | | Total | $2,325,700 | $2,349,800 | $2,526,400 | $2,363,100 | $3,225,500 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $1,628,100 | $1,709,400 | $1,841,700 | $1,802,700 | $2,192,500 | | In-state Travel | $9,400 | $2,600 | $1,300 | $1,600 | $3,800 | | Out-of-state Travel | $7,200 | $13,800 | $11,200 | $1,600 | $12,500 | | Current Expense | $555,300 | $533,100 | $566,200 | $481,100 | $570,100 | | DP Current Expense | $93,800 | $82,300 | $106,000 | $76,100 | $95,300 | | DP Capital Outlay | $31,900 | $8,600 | $0 | $0 | $156,300 | | Capital Outlay | $0 | $0 | $0 | $0 | $195,000 | | Total | $2,325,700 | $2,349,800 | $2,526,400 | $2,363,100 | $3,225,500 |

|---|

| | Other Indicators | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Budgeted FTE | 27.3 | 27.3 | 27.3 | 25.5 | 25.0 | | Vehicles | 1 | 1 | 1 | 1 | 1 |

|

|

|

|

|

|

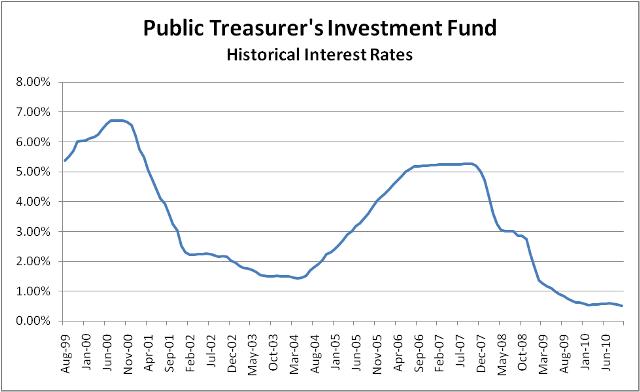

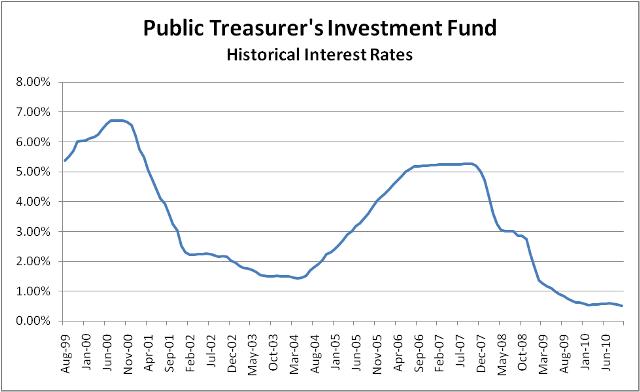

Subcommittee Table of ContentsProgram: Treasury and Investment Function This program adheres to the Money Management Act and Rules of the Money Management Council, and uses appropriate investment research tools to maximize the safety of state and local government funds invested and to earn competitive yields. The Treasurer also maintains a Public Treasurers' Investment Fund (PTIF) so that other governmental entities can pool their idle money together for professional management, high liquidity and the best possible return. All available funds are invested each day at the highest available interest rates. The primary investment instruments used are bank certificates of deposit, commercial paper, short-term corporate notes, and obligations of the U. S. Treasury and government agencies. The Treasurer is a member of the State Bonding Commission which issues debt for the state. He oversees the team of professionals who work together to issue debt including the financial advisor, bond counsel, disclosure counsel and underwriters. He coordinates all relations with bond rating agencies including formal presentations at least once a year. The Treasurer also manages the investments of the Permanent State School and Institutional Trust Land fund. The investment income from the public school's portion of this portfolio provides the income for the State Trust Lands Program which allocates funding directly to individual schools. Performance The following chart shows historical interest rates earned by the PTIF. Rates have been less than one percent since June of 2009. A review of records back to 1981 shows this is the first time interest rates have fallen below one percent in that time frame. Returns are directly correlated to the relative level of short-term interest rates.

- FY 2010 Spread between PTIF interest rate and benchmark interest rate: 0.43%

- FY 2010 Earnings to the Uniform School Fund Interest and Dividends Account: $23,075,600

Funding Detail | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | General Fund | $843,700 | $911,700 | $858,400 | $789,900 | $853,800 | | General Fund, One-time | ($6,100) | $0 | $8,900 | $91,600 | $0 | | Dedicated Credits Revenue | $237,200 | $271,300 | $364,600 | $363,300 | $451,300 | | Unclaimed Property Trust | $0 | $0 | $61,500 | $0 | $0 | | Beginning Nonlapsing | $168,600 | $130,000 | $145,000 | $100,000 | $0 | | Closing Nonlapsing | ($130,000) | ($145,000) | ($100,000) | ($50,000) | $0 | | Lapsing Balance | ($64,300) | ($32,700) | ($92,400) | ($191,400) | $0 | | Total | $1,049,100 | $1,135,300 | $1,246,000 | $1,103,400 | $1,305,100 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $808,500 | $957,000 | $979,100 | $922,900 | $1,068,500 | | In-state Travel | $6,200 | $1,800 | $500 | $900 | $2,300 | | Out-of-state Travel | $3,900 | $10,300 | $8,200 | $1,600 | $9,000 | | Current Expense | $181,700 | $137,500 | $227,400 | $162,900 | $169,400 | | DP Current Expense | $16,900 | $20,100 | $30,800 | $15,100 | $19,600 | | DP Capital Outlay | $31,900 | $8,600 | $0 | $0 | $36,300 | | Total | $1,049,100 | $1,135,300 | $1,246,000 | $1,103,400 | $1,305,100 |

|---|

| | Other Indicators | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Budgeted FTE | 9.5 | 9.5 | 9.5 | 9.5 | 8.8 | | Vehicles | 1 | 1 | 1 | 1 | 1 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Unclaimed Property Function The Unclaimed Property Program is responsible for reuniting lost or abandoned property with its rightful owners. Property types include savings accounts, life insurance policies, payroll checks, safe deposit box contents, stocks and mutual funds, and other types of property. Any amount not returned to rightful owners is deposited in the Uniform School Fund. By law, the division is required to publish notice of property received during the year in a newspaper having general circulation in Utah. This publication generally is published and distributed in late spring. Additional outreach programs include radio ads, a listing of all names and addresses on the Internet, and visits to senior centers and other businesses to allow patrons the opportunity to lookup their names in the database. One employee is dedicated to locating names and businesses in the database. The Unclaimed Property Division will continue to maximize returns of abandoned property to owners by increasing claims processed by three percent annually. This will be achieved by examining current business processes and implementing improvements where needed, resulting in more efficient management of current resources. In addition, the Division will increase productivity through the continued adoption of new IT enabled processes. Statutory Authority Statutory authority is provided within UCA 67-4a, "Unclaimed Property Act." Performance - FY 2010 Number of unclaimed property claims paid: 8,378

- FY 2010 Dollar amount of unclaimed property claims paid: $8,372,824

- FY 2010 Transfer from the Unclaimed Property Trust Fund to the Uniform School Fund: $22,000,000

Funding Detail The program's administrative costs are paid from the Unclaimed Property Trust Fund. As allowed in UCA 67-4a-405, the fund receives proceeds from the sale of abandoned property. | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Unclaimed Property Trust | $1,309,500 | $1,365,700 | $1,403,800 | $1,399,500 | $1,412,300 | | Beginning Nonlapsing | $236,400 | $331,700 | $375,000 | $375,000 | $344,600 | | Closing Nonlapsing | ($331,700) | ($375,000) | ($375,000) | ($395,000) | $0 | | Lapsing Balance | $0 | ($172,300) | ($200,800) | ($199,500) | $0 | | Total | $1,214,200 | $1,150,100 | $1,203,000 | $1,180,000 | $1,756,900 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $764,400 | $693,000 | $791,900 | $809,700 | $974,600 | | In-state Travel | $3,200 | $800 | $800 | $700 | $1,500 | | Out-of-state Travel | $3,300 | $3,500 | $3,000 | $0 | $3,500 | | Current Expense | $366,400 | $390,600 | $332,300 | $308,600 | $386,800 | | DP Current Expense | $76,900 | $62,200 | $75,000 | $61,000 | $75,500 | | DP Capital Outlay | $0 | $0 | $0 | $0 | $120,000 | | Capital Outlay | $0 | $0 | $0 | $0 | $195,000 | | Total | $1,214,200 | $1,150,100 | $1,203,000 | $1,180,000 | $1,756,900 |

|---|

| | Other Indicators | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Budgeted FTE | 15.8 | 15.8 | 15.8 | 14.0 | 14.3 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Money Management Council Function The Utah Money Management Council is responsible for the oversight of bank deposits and investments maintained by all Utah public treasurers. This involves overseeing and supporting over 500 public treasurers from municipalities of all types, large and small, urban and rural. Additionally, the council must oversee and monitor the degree to which over 60 financial institutions which hold public funds comply with the Money Management Act and Rules of the Money Management Council. The State Treasurer's Office provides staff to the council. The council is comprised of five members appointed by the Governor with the advice and consent of the Senate. At least one member must be from banking, one must be an elected treasurer, one must be an appointed treasurer and one must be experienced in the field of investments. No more than three members of the council may be from the same political party. Statutory Authority Statutory authority for this program is provided within UCA 51 Chapter 7, "Money Management Act." Funding Detail | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | General Fund | $95,200 | $99,200 | $80,000 | $85,400 | $86,400 | | General Fund, One-time | ($200) | $0 | $5,400 | ($500) | $0 | | Beginning Nonlapsing | $0 | $5,000 | $0 | $0 | $0 | | Closing Nonlapsing | ($5,000) | $0 | $0 | $0 | $0 | | Lapsing Balance | ($27,600) | ($39,800) | ($8,000) | ($5,200) | $0 | | Total | $62,400 | $64,400 | $77,400 | $79,700 | $86,400 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $55,200 | $59,400 | $70,700 | $70,100 | $77,200 | | Current Expense | $7,200 | $5,000 | $6,500 | $9,600 | $9,000 | | DP Current Expense | $0 | $0 | $200 | $0 | $200 | | Total | $62,400 | $64,400 | $77,400 | $79,700 | $86,400 |

|---|

| | Other Indicators | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Budgeted FTE | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Financial Assistance Function Although this program received an appropriation from dedicated credits for FY 2010, it is not currently in use by the Treasurer. When operational, the program evaluates proposals for water and other infrastructure development submitted to the Community Impact Board, the Board of Water Resources, the Water Pollution Control Committee and the Safe Drinking Water Committee. It prioritizes and makes standardized responses. The FTE is funded by the boards which utilize its service. Funding Detail | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Dedicated Credits Revenue | $0 | $0 | $0 | $0 | $77,100 | | Total | $0 | $0 | $0 | $0 | $77,100 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $0 | $0 | $0 | $0 | $72,200 | | Current Expense | $0 | $0 | $0 | $0 | $4,900 | | Total | $0 | $0 | $0 | $0 | $77,100 |

|---|

| | Other Indicators | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Budgeted FTE | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 |

|

|

|

|

|

|

Subcommittee Table of Contents |