Agency: Human Resource Management Line Item: Human Resource Management Function The mission of DHRM is to develop, implement, and administer a statewide human resource management system that will:

- Promote quality government that aids in the effective execution of public policy

- Attract and retain quality employees and foster productive and meaningful careers in public service

- Develop effective relationships that aid in rendering assistance to agencies in performing their missions and working with customers and stakeholders.

Statutory Authority The powers and duties of DHRM are established in UCA 67-19-5. The director is given full responsibility and accountability for administration of statewide human resource management. Responsibilities for the department are identified in UCA 67-19-6, some of which include: - Administer a statewide personnel management program that aids efficient execution of public policy, fosters careers, and assists state agencies in performing their missions

- Design and administer the state pay plan, classification system, and recruitment and selection system

- Ensure human resource practices comply with federal law, state law, and state rules

- Adopt rules for personnel management

- Maintain a management information system that will provide current information on authorized positions, payroll, and related matters

- Help eliminate discrimination in state employment

- Advise local governments on effective personnel management when requested

- Establish compensation policies and procedures for early voluntary retirement

- Conduct research and planning activities to prepare for future human resource needs, improve human resource management, and submit needed policy changes to the governor

- Establish statewide training programs

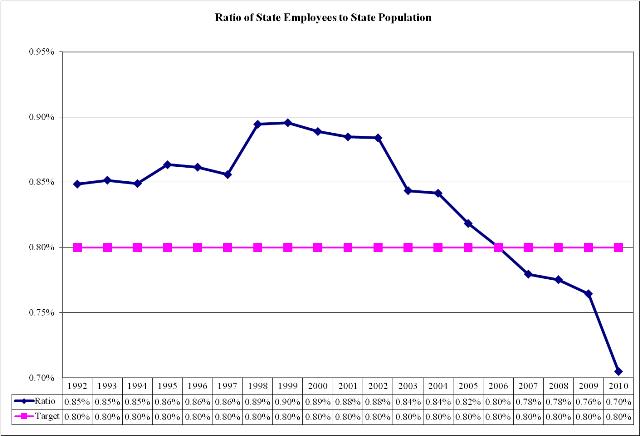

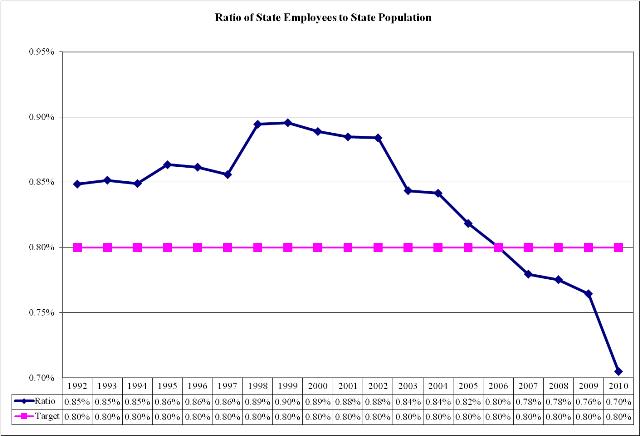

UCA 67-19-5 allows DHRM to operate an internal service fund and UCA 67-19-6.1 allows the director to establish field offices at state executive branch agencies in consultation and agreement with the agency head. Intent Language Under Section 63J-1-603 of the Utah Code the Legislature intends that appropriations provided for the Department of Human Resource Management in Item 45 of Chapter 396 Laws of Utah 2009 not lapse at the close of Fiscal Year 2010. The use of any nonlapsing funds is limited to the following: Information Technology Projects and Consulting Services - $262,200. Notwithstanding the intent language included in Item 38 of 'Fiscal Year 2010 and Fiscal Year 2011 Supplemental Appropriations' (House Bill 2, 2010 General Session), under Section 63J-1-603 of the Utah Code, the Legislature intends that appropriations provided for the Department of Human Resource Management in Item 45 of Chapter 396, Laws of Utah 2009, not lapse at the close of Fiscal Year 2010. The use of any nonlapsing funds is limited to the following: Information Technology Projects and Consulting Services - $262,200; Employee Training and Development Programs - $243,900. Performance An important component of the overall state human resource management is the ratio of state employees to state population. As the state's population has grown rapidly over the past decade, the number of state employees has grown more slowly.  Measure: Ratio of State Population to State Employees. Goal: Limit the growth of the State workforce to less than 0.8% of the state population. Methodology: Divide the number of state Full-Time Equivalent (FTE)

positions by the total state population. Measure Type: Outcome. Note: The chart shows a declining ratio of state employees to state population, thus suggesting increased efficiency of the state workforce. Funding Detail The department utilizes funding from the General Fund and Dedicated Credits. Dedicated Credits are collected from training fees. Most of the department funding is used for staff support and IT costs. | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | General Fund | $3,196,500 | $3,317,300 | $3,395,800 | $3,073,600 | $2,963,500 | | General Fund, One-time | $12,500 | $50,000 | $207,100 | ($54,300) | $450,000 | | Dedicated Credits Revenue | $295,600 | $343,200 | $263,400 | $143,300 | $400,000 | | Beginning Nonlapsing | $631,900 | $686,300 | $512,800 | $506,100 | $0 | | Closing Nonlapsing | ($686,300) | ($512,800) | ($506,100) | ($460,200) | $0 | | Lapsing Balance | ($57,000) | ($176,500) | ($243,500) | ($299,600) | $0 | | Total | $3,393,200 | $3,707,500 | $3,629,500 | $2,908,900 | $3,813,500 |

|---|

| | Programs: | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Administration | $807,300 | $853,400 | $822,200 | $779,800 | $1,370,500 | | Policy | $1,222,800 | $1,270,000 | $1,188,400 | $751,200 | $811,200 | | Classification and Employee Relations | $0 | $0 | $196,200 | $0 | $206,400 | | Teacher Salary Supplement | $0 | $12,700 | $0 | $104,500 | $0 | | Statewide Management Liability Training | $269,500 | $353,900 | $270,100 | $189,200 | $400,000 | | Information Technology | $1,093,600 | $1,217,500 | $1,152,600 | $1,084,200 | $1,025,400 | | Total | $3,393,200 | $3,707,500 | $3,629,500 | $2,908,900 | $3,813,500 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $1,805,900 | $1,965,700 | $1,977,000 | $1,527,600 | $1,458,000 | | In-state Travel | $1,300 | $3,500 | $1,800 | $11,700 | $8,700 | | Out-of-state Travel | $26,800 | $53,800 | $21,100 | $10,200 | $75,000 | | Current Expense | $471,300 | $482,400 | $399,500 | $269,900 | $1,122,400 | | DP Current Expense | $1,087,900 | $1,202,100 | $1,230,100 | $1,089,500 | $1,149,400 | | Total | $3,393,200 | $3,707,500 | $3,629,500 | $2,908,900 | $3,813,500 |

|---|

| | Other Indicators | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Budgeted FTE | 28.5 | 28.0 | 26.0 | 24.8 | 24.0 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Administration Function The Administration program oversees the goals, plans, and implementation of policy for the entire department as well as statewide issues. Functions include workforce planning for the department; coordination with the governor's office and Legislature on key issues; public information and dissemination; budget oversight and control; and oversight of classification, compensation, benefits, recruitment and selection, training and development, employee relations, and HR-related liability management, and statewide workforce planning. Funding Detail | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | General Fund | $702,500 | $980,900 | $740,500 | $981,800 | $920,500 | | General Fund, One-time | ($1,900) | $0 | $183,100 | ($127,900) | $450,000 | | Beginning Nonlapsing | $106,700 | $0 | $0 | $0 | $0 | | Lapsing Balance | $0 | ($127,500) | ($101,400) | ($74,100) | $0 | | Total | $807,300 | $853,400 | $822,200 | $779,800 | $1,370,500 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $605,500 | $680,000 | $680,200 | $666,800 | $565,400 | | In-state Travel | $400 | $1,000 | $400 | $200 | $2,200 | | Out-of-state Travel | $4,300 | $14,300 | $5,700 | $4,900 | $15,000 | | Current Expense | $197,100 | $157,500 | $134,500 | $104,300 | $787,900 | | DP Current Expense | $0 | $600 | $1,400 | $3,600 | $0 | | Total | $807,300 | $853,400 | $822,200 | $779,800 | $1,370,500 |

|---|

| | Other Indicators | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Budgeted FTE | 9.0 | 12.0 | 10.0 | 8.5 | 8.5 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Policy Function In FY 2007 the Department transferred the functions and personnel of the Central Operations program to the Policy program. The Policy program provides oversight and development of the following functions: recruiting; selection; employee development; employee relations, fair employment practices, compensation and benefits, classification, diversity and liability prevention. The functions performed by this program affect the working life of all state employees in terms of salaries and working conditions. Funding Detail | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | General Fund | $1,235,400 | $1,281,700 | $1,246,200 | $709,000 | $811,200 | | General Fund, One-time | ($3,900) | $0 | $12,000 | $74,400 | $0 | | Beginning Nonlapsing | $400 | $0 | $0 | $0 | $0 | | Lapsing Balance | ($9,100) | ($11,700) | ($69,800) | ($32,200) | $0 | | Total | $1,222,800 | $1,270,000 | $1,188,400 | $751,200 | $811,200 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $1,198,100 | $1,275,000 | $1,185,400 | $759,500 | $773,800 | | In-state Travel | $800 | $2,500 | $1,000 | $1,400 | $1,000 | | Out-of-state Travel | $0 | $2,100 | $5,300 | $1,500 | $10,000 | | Current Expense | $23,500 | $22,900 | $26,700 | $18,800 | $56,400 | | DP Current Expense | $400 | $0 | $0 | $0 | $0 | | Other Charges/Pass Thru | $0 | ($32,500) | ($30,000) | ($30,000) | ($30,000) | | Total | $1,222,800 | $1,270,000 | $1,188,400 | $751,200 | $811,200 |

|---|

| | Other Indicators | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Budgeted FTE | 16.0 | 16.0 | 16.0 | 14.5 | 13.5 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Classification and Employee Relations Function In FY 2010, funding and operations activities were transferred to the Teacher Salary Supplement program going forward. The appropriation that shows in the funding table below for FY 2011 will ultimately be transferred. Funding Detail | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | General Fund | $900 | $0 | $235,200 | $800 | $206,400 | | General Fund, One-time | ($900) | $0 | $0 | ($800) | $0 | | Lapsing Balance | $0 | $0 | ($39,000) | $0 | $0 | | Total | $0 | $0 | $196,200 | $0 | $206,400 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $0 | $0 | $111,400 | $0 | $118,800 | | In-state Travel | $0 | $0 | $100 | $0 | $500 | | Current Expense | $0 | $0 | $1,000 | $0 | $34,700 | | DP Current Expense | $0 | $0 | $83,700 | $0 | $52,400 | | Total | $0 | $0 | $196,200 | $0 | $206,400 |

|---|

| | Other Indicators | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Budgeted FTE | 3.5 | 0.0 | 0.0 | 0.0 | 2.0 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Teacher Salary Supplement Function The Teacher Salary Supplement program was created in the 2008 General Session (SB 2) to provide bonuses to math and science teachers in the public education system who meet certain criteria specified in the bill. DHRM's role is to administer the program by creating an online application system, verifying teacher eligibility, determining the amount of the bonues to be received, and then working with State Finance to have funding dispersed to applicable local education agencies for disbursement to qualifying teachers. DHRM is allocated funding to provide for staff time and IT resources. The funding for the bonuses themselves is given to the Division of Finance. Funding Detail Dedicated Credits have not been collected since FY 2004. | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | General Fund | $0 | $0 | $0 | $205,000 | $0 | | General Fund, One-time | $0 | $50,000 | $0 | $0 | $0 | | Lapsing Balance | $0 | ($37,300) | $0 | ($100,500) | $0 | | Total | $0 | $12,700 | $0 | $104,500 | $0 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $0 | $10,700 | $0 | $101,300 | $0 | | In-state Travel | $0 | $0 | $0 | $100 | $0 | | Current Expense | $0 | $2,000 | $0 | $1,100 | $0 | | DP Current Expense | $0 | $0 | $0 | $2,000 | $0 | | Total | $0 | $12,700 | $0 | $104,500 | $0 |

|---|

| | Other Indicators | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Budgeted FTE | 0.0 | 0.0 | 0.0 | 1.8 | 0.0 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Statewide Management Liability Training Function Statewide Management Liability Training provides opportunities and resources available to agencies across the state to meet workforce needs including: - Courses and workshops for supervisors and managers to sharpen knowledge and implement skills in liability reduction, leadership, communication, and workplace processes

- Conferences and symposia for managers and human resource professionals to receive current information and data on workplace liability, leadership, and management practices

- Customized training at the request of any work unit to build business and management skills in the organization

- Business consultation for work unit leaders to advance strategic solutions or examine work unit processes for improvement

- Professional coaching for managers and leadership teams to improve operational and behavioral effectiveness

- Work units to access speakers or facilitators for leadership, management and liability reduction related topics or processes

Funding Detail The program is funded through Dedicated Credit revenue generated by fees for services provided. | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Dedicated Credits Revenue | $295,600 | $343,200 | $263,400 | $143,300 | $400,000 | | Beginning Nonlapsing | $235,200 | $261,300 | $250,600 | $243,900 | $0 | | Closing Nonlapsing | ($261,300) | ($250,600) | ($243,900) | ($198,000) | $0 | | Total | $269,500 | $353,900 | $270,100 | $189,200 | $400,000 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | In-state Travel | $0 | $0 | $300 | $10,000 | $5,000 | | Out-of-state Travel | $22,500 | $37,400 | $4,000 | $3,800 | $50,000 | | Current Expense | $247,000 | $284,000 | $235,800 | $145,400 | $315,000 | | Other Charges/Pass Thru | $0 | $32,500 | $30,000 | $30,000 | $30,000 | | Total | $269,500 | $353,900 | $270,100 | $189,200 | $400,000 |

|---|

Subcommittee Table of ContentsProgram: Information Technology Function Information Technology is used to provide the automated systems that comprise the enterprise Human Resource Management Information system. This system provides support to all agencies relative to employee recruitment, employment, pay, and all other employee related functions. Statewide systems supported by DHRM include: - HRE (Human Resource Enterprise)

- TRM (Training Records Management)

- Employee Gateway

- HR Data Warehouse

- UJM (Utah Job Match)

- UJM Job & Position Analysis

- Lifestyle Benefits

- UMD (Utah Master Directory)

- HREventure Events Management System

- Teacher Salary Supplement Program Website

- Utah Performance Management

The Information Technology program provides the technology support for the department. It provides support for internal DHRM needs as well as other state agencies in processing HR business. This includes processing from recruitment through termination. The program provides direct access to human resource information to employees. It also provides information to the public and employees through the Web. Funding Detail In FY 2007 all FTE in this program transferred to the new Department of Technology Services; which bill for the services previously performed by this division to DHRM as current expenses. | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | General Fund | $1,257,700 | $1,054,700 | $1,173,900 | $1,177,000 | $1,025,400 | | General Fund, One-time | $19,200 | $0 | $12,000 | $0 | $0 | | Beginning Nonlapsing | $289,600 | $425,000 | $262,200 | $262,200 | $0 | | Closing Nonlapsing | ($425,000) | ($262,200) | ($262,200) | ($262,200) | $0 | | Lapsing Balance | ($47,900) | $0 | ($33,300) | ($92,800) | $0 | | Total | $1,093,600 | $1,217,500 | $1,152,600 | $1,084,200 | $1,025,400 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $2,300 | $0 | $0 | $0 | $0 | | In-state Travel | $100 | $0 | $0 | $0 | $0 | | Out-of-state Travel | $0 | $0 | $6,100 | $0 | $0 | | Current Expense | $3,700 | $16,000 | $1,500 | $300 | ($71,600) | | DP Current Expense | $1,087,500 | $1,201,500 | $1,145,000 | $1,083,900 | $1,097,000 | | Total | $1,093,600 | $1,217,500 | $1,152,600 | $1,084,200 | $1,025,400 |

|---|

Subcommittee Table of Contents |