Compendium of Budget Information for the 2011 General Session

| Social Services Appropriations Subcommittee | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Subcommittee Table of Contents | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Group: Social Services - Department of Health Line Item: Medicaid Mandatory Services Function Medicaid is a joint federal/state entitlement service consisting of three programs that provide health care to selected low-income populations: (1) a health insurance program for low-income parents (mostly mothers) and children; (2) a long-term care program for the elderly; and (3) services program to people with disabilities. Overall, Medicaid is an "optional" program, one that a state can elect to offer. However, if a state offers the program, it must abide by strict federal regulations. It also becomes an entitlement program for qualified individuals; that is, anyone who meets specific eligibility criteria is "entitled" to Medicaid services. The federal government establishes and monitors certain requirements concerning funding, and establishes standards for quality and scope of medical services. Requirements include services that must be provided and specific populations that must be served. States may expand their program to cover additional 'optional' services and/or 'optional' populations. In addition, states have some flexibility in determining certain aspects of their own programs in the areas of eligibility, reimbursement rates, benefits, and service delivery. As long as services meet State and federal standards, the federal government will provide a match for all State money spent on Medicaid. The match is known as the Federal Matching Assistance Percentage (FMAP). The entire Medicaid program is based upon an approved contract with the federal government, known as a State Plan. While this plan can be changed and/or amended the federal government must approve all changes. If the State were to provide a service without federal approval, the cost would be 100% paid for by the State rather than the usual federal match. Most providers for Medicaid must meet Medicare provider requirements to receive reimbursement for serving Medicaid clients. Additionally, they must accept Medicaid reimbursement as payment in full. The provider may charge the patient for services that are not covered by Medicaid only when the provider has advised the patient in advance that the services are not covered and the patient has agreed in writing to pay for the services. Medicaid does not pay for any services not considered medically necessary. The client's Medicaid Identification Card will state when a co-pay is required and for what type of services. Pregnant women and children are not subject to the co-pay requirement. The provider is responsible to collect the co-pay at the time of service or bill the client. The amount of the client's co-pay is deducted from the total amount paid to the provider. There are currently 53 services included in the entire Medicaid Program. Of these, inpatient hospital, outpatient hospital, intermediate care facilities for the mentally retarded, long-term care, physician, dental, pharmacy, and health maintenance organizations make up approximately 60 percent of all Medicaid expenditures. Medicaid services in Utah are accounted for in two budgetary line items: Medicaid Mandatory Services and Medicaid Optional Services. The line dividing mandatory and optional services is occasionally blurred by the fact that some optional services are mandatory for specific populations or in specific settings. For example, the federal government requires more services be provided to children and pregnant women. Additionally, clients in institutionalized settings must be provided a wider range of services. The State has some flexibility and has been granted waivers that allow some latitude in program implementation, as well as to offer some additional optional services. A brief description of each service is found in a list of defined terms. Mandatory services in the Medicaid Program are those that the federal government requires to be offered if a state has a Medicaid program. These include: inpatient and outpatient hospital, physician services, skilled and intermediate care nursing facilities, medical transportation, home health, nurse midwife, pregnancy-related services, lab and radiology, kidney dialysis, Early Periodic Screening Diagnosis and Treatment, and special reimbursement to community and rural health centers. The State is also required to pay Medicare premiums and co-insurance deductibles for aged, blind, and disabled persons with incomes up to 100 percent of the Federal Poverty Level. Additionally, the State pays for Medicare premiums for qualifying individuals with incomes up to 120 percent of the Federal Poverty Level. There are nine budget programs within the Medicaid Mandatory Services line item, which include: Inpatient Hospital, Contracted Health Plans, Nursing Home, Outpatient Hospital, Physician Services, Other Mandatory Services, Crossover Services, Medical Supplies, and State-run Primary Care Case Management. The Early Periodic Screening Diagnosis and Treatment Program, called Child Health Evaluation and Care in Utah, is a mandatory federal program which requires the State to screen all Medicaid children up to age 21 at scheduled intervals. The mandate includes providing all medically necessary services, such as organ transplants or any other service needed, regardless of cost or if it is normally covered by Medicaid. Utah's 12 local health departments provide the federally-required education and outreach for this program. The State has designated five major population groupings that may receive health care from the Medicaid Program. These include: (1) the elderly or disabled who receive federal Supplemental Security Income (SSI) and persons in nursing facilities (grouped together as aged), (2) disabled individuals, (3) children who receive Temporary Assistance for Needy Families (TANF) benefits, or are in the Foster Care program, (4) TANF adults, with dependent children, and (5) pregnant women. Each of these groups is discussed in more detail later in this section. Aged Individuals aged 65 and over qualify for Medicaid if they qualify for SSI, which provides an income of approximately 77.6 percent of the Federal Poverty Level (FPL). They also qualify for food stamps. Many of the elderly also qualify for Medicare coverage. The Medicaid Program pays for the premiums and deductibles for those eligible under both programs. Medicare pays the actual medical cost for most of these people. Medicaid is also required to pay Medicare premiums, co-insurance, and deductibles for anyone qualifying for Medicare who has income up to 100 percent of FPL, but only has to pay Medicare premiums for those between 100 and 135 percent of FPL. Medicare has a 100 day limit for services in nursing care facilities. For eligible clients, Medicaid pays for the nursing care services after the expiration of Medicare benefits. Medicaid also covers non-SSI aged people whose income does not exceed 100 percent of FPL. Aged people with income over 100 percent of FPL can spend down to the Medically Needy Income Limit (100% of FPL) to receive Medicaid. Disabled Persons with disabilities are eligible for services under the Medicaid Program. The criteria for disability require that a person be unable to participate in gainful activity for at least a year, or have a medical condition that will result in death. Among the disabilities covered are mental retardation, blindness, mental health, spinal injury, and AIDS. Income is limited to 100 percent of the Federal Poverty Level. An asset test similar to that for TANF is required. Eligible individuals also qualify for food stamps. Temporary Assistance to Needy Families (TANF) and Foster Care Aid to Families with Dependent Children (AFDC) was a joint federal-state program which provided financial assistance to families with children deprived of the support of at least one parent. In 1996, AFDC was replaced with block grants to the states and the Temporary Assistance to Needy Families (TANF). In general, people who meet AFDC eligibility criteria that were in effect on July 16, 1996 are eligible for Medicaid. Also, those people who qualify for a TANF grant may be eligible for Medicaid. The Medically Needy Children program is for children who do not qualify for assistance under normal Family Medicaid because they are not deprived of the support of a parent. The asset test is the same as for TANF; the family is allowed to spend down to become eligible. This is an optional group, meaning it is not required by the federal government, and so coverage could be terminated. Many children who have been eligible for this group in the past have become eligible in the mandatory programs for children. In addition to the previously mentioned TANF children, there are four groups of children covered under the Medicaid Program. These are: (1) medically needy children, (2) children under age 6 with family income up to 133 percent of the Federal Poverty Level (FPL), (3) children and youth from age 6 through 18 years with income up to 100 percent of FPL, and (4) children in subsidized adoptions. The program for children under age six with family income up to 133 percent of FPL is a mandatory program. The program for children born after September 30, 1983 with family income up to 100 percent of the FPL is designed to provide coverage for children in poverty. There is an asset test required for children in this category of $3,000 for a family of two; one home (primary residency only) is exempted, and a car with an equity value of $1,500 is allowed. Children in Foster Care are eligible for Medicaid coverage if they meet Medicaid Program requirements. The State is responsible for their medical care. Most children placed in foster care have histories of abuse or neglect. This often means there are unresolved medical and mental health problems that must be dealt with. Each year, a number of children come into the custody of the State and are placed for adoption. Some of these children have serious medical problems which makes them hard to place. In some of these cases, the State subsidizes the adoption. Some families receive a small stipend to assist in the cost of care for these children, and the State covers the child's medical care under Medicaid until the child is 18 years old. Foster Care graduates, regardless of income and assets, receive Medicaid services until they turn 21 through the Independent Living Program, unless they are eligible for another Medicaid program. TANF Adults The group referred to as TANF Adults includes those adults with dependent children who are either categorically or medically needy and meet the basic program requirements. Some of the individuals may be required to "spend down" to obtain Medicaid services, which means that they must reduce their disposable income with payments to Medicaid or with medical bills which they have incurred. There are two groups of people who qualify for Medicaid under the TANF Program. These include: (1) those in the basic program where a child is deprived of the support of one parent, and (2) those in two-parent families that qualify under the unemployed parent program. The majority of eligible families are deprived because of divorce, desertion, or unwed mothers. TANF families may also qualify for food stamps. Depending on family size, the TANF grant and food stamps provide an income between 62 and 74 percent of the Federal Poverty Level. There is an asset limit of $3,000 for families in the TANF Program. The asset limit does not include a primary residence or a car with an equity value of less than $8,000. In addition to the basic Family Employment Program (FEP), there is also a program for unemployed two-parent families. This program provides cash assistance for seven months in any 13-month period. One parent in families in this program is required to work 32 hours a week (in an emergency work program) and spend at least 8 hours per week seeking regular employment. With the exception of the time limitation and work requirement, the criteria and benefits for the Family Employment Program - Two Parent are the same as those for the regular FEP. Federal law requires that the family be eligible for Medicaid for the full 12 months of the year. Besides those eligible through FEP cash assistance, there are several programs which provide transitional Medicaid coverage for periods of 4 months (for child support-related eligibles) or 24 months (for people who no longer receive cash assistance due to child support payments or earnings). Pregnant Women The prenatal/pregnancy program helps pregnant women receive prenatal care. The program covers the mother from the time of application to 60 days after the birth. A woman only needs to meet the eligibility requirements in any one month to be eligible for the balance of the pregnancy. Children born to women on this program can be covered on Medicaid (after the first 60 days) for the rest of the first year under the postnatal program. Statutory Authority Medicaid Mandatory Services is governed by several chapters of the Utah Health Code in Title 26 of the Utah Code.

Intent Language

Funding Detail For analysis of current budget requests and discussion of issues related to this budget click here.

Function Inpatient Hospital means services provided by bed occupancy for 24 hours or more in an approved hospital. Medicaid covers inpatient visits at a hospital for most services without a prior authorization. Some services may require a prior authorization. Some imaging services require manual review for medical necessity after the service. A hospital which accepts a Medicaid patient for treatment accepts the responsibility to make sure that the patient receives all medically necessary services from Medicaid providers. Readmissions within 30 days for the same or similar principal diagnosis may be denied or, at the option of the State, be combined with the claim for the first admission. Non-pregnant Medicaid adult clients have a $220 co-insurance payment for inpatient hospital services. Reimbursement rates for inpatient hospital services are online at http://health.utah.gov/medicaid/stplan/inpatient.htm. Funding Detail

Function Over a third of Utah Medicaid clients are enrolled with one of two contracted health plans: Molina or Healthy U (University of Utah Hospitals and Clinics). The contracts with each provider are described below:

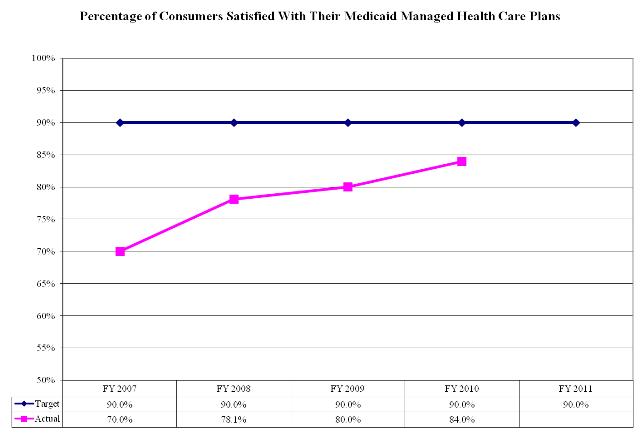

Performance  Funding Detail

Function Medicaid clients must meet nursing facility level of care as described in Administrative Rule R414.502 to receive this service. This rule requires two of the following three conditions to be met: (1) require substantial physical assistance for activities of daily living, (2) certain level of dysfunction in orientation, and (3) the level of care needed cannot be met in a less structured setting. Additionally, clients must pass a low asset test to qualify for this service. The asset test includes a 'look back period' of five years where asset transfers are examined to determine if an inappropriate transfer of assets took place. Any findings of improper transfers delay Medicaid qualification. Once a client qualifies for nursing home care, there is no limit on the time they receive that care for as long as they continue to qualify. Additionally, federal law mandates that clients receiving this service are entitled to whatever benefits are prescribed by their supervising physician. The Medicare program has a 100 day annual limit for nursing home services. Medicare clients who also qualify for Medicaid would have any nursing home service days above 100 paid for by Medicaid. The federal government's Centers for Medicare & Medicaid Services posts the results of nursing home inspections on their website. These surveys indicate the home's compliance with performance measure regulations. The restrictions on building new nursing facilities is described in UCA 26-18-502 and UCA 26-18-503. Any individual working in a nursing facility as a nurse aide for more than four months on a full-time basis must have successfully completed a nurse aide training and/or competency evaluation program approved by the State. Medicaid nursing home clients are permitted to retain a fixed monthly amount for personal needs. For most individuals expected to stay longer than six months in long-term care the permitted allowance is $45 monthly. In most cases, the client's account balance cannot exceed $2,000 without risking a loss of Medicaid eligibility due to asset level requirements. Medicaid determines the amount of income the Medicaid client must pay to the facility in order to be eligible for Medicaid. This income is reduced from the Medicaid reimbursement paid to the facility. Reimbursement rates for nursing home services are online at http://health.utah.gov/medicaid/stplan/longtermcare.htm. Funding Detail

Function Outpatient hospital services are provided for less than 24 hours and must be medically necessary and appropriate to diagnose or treat illness, disability or pain. Medicaid covers outpatient visits at a hospital for most services without a prior authorization. Some surgeries may require a prior authorization. Medicaid clients have a $3 co-payment for outpatient hospital services. Medicaid clients have a $6 co-payment for non-emergency use of the emergency room. Reimbursement rates for outpatient hospital services are online at http://health.utah.gov/medicaid/stplan/physician.htm. Funding Detail

Function Medicaid clients may visit any willing physician provider to receive services. This includes any specialist physician. Medicaid clients must have a medical need for seeking physician services as Medicaid does not pay for annual wellness or preventive health visits. Most non-pregnant adults are charged a $3 copay for a doctor's visit. Funding Detail

Program: Other Mandatory Services Function Other Mandatory Services includes: Home Health Services, Rural Health Clinic, Federally Qualified Health Centers, Indian Health, Radiology, Laboratory, and Well Child Care (Early Periodic Screening, Diagnosis and Treatment Program). Detailed coverage information is contained in the Medicaid provider manuals. Federally Qualified Health Centers - For specifically designated medical clinics that qualify as federally qualified health centers, Utah Medicaid must pay these clinics their full cost of providing Medicaid services. This is done through an annual adjustment at the end of each fiscal year and usually results in a payment that is higher than what Medicaid would normally pay. Utah has 10 federally qualified health centers. The federal government pays 100% of the service costs for Indian Health Services. Utah has over 10 Indian Health/Tribal facilities. Medicaid pays these facilities an all inclusive rate for everything except for physician inpatient services, which use the fee-for-service reimbursement schedule. Funding Detail

Function By federal law, Medicaid must be the payer of last resort behind any other insurers, including Medicare, who may have responsibility for payment. Additionally, federal law mandates that Medicaid reimburse providers up to the Medicaid level of reimbursement for services to clients with other insurance, whose insurance did not fully cover a Medicaid-covered service. On average, around 5% of Medicaid fee-for-service claims require bills to be sent to other insurances. The Federal Deficit Reduction Act of 2005 required insurers to verify insurance eligibility information for Medicaid clients. The database with this information is maintained by the Office of Recovery Services in the Department of Human Services. Funding Detail

Function About half of all medical supplies require a prior authorization. In order to ensure medical appropriateness and/or unit limitations, some items require prior authorization. Medicaid maintains a specific list of supplies that may be used in an emergency, but later would have to be submitted to determine if the supply qualifies for reimbursement. Following are some items approved for possible reimbursement due to a medical emergency:

Funding Detail

Program: State-run Primary Care Case Management Function The State pays about $0.70 Total Funds per member per month access fee for each client being served in the Intermountain Health Care system. The Department of Health processes the claims for services and pays providers directly using the Medicaid fee-for-service reimbursement schedule. On average, about one third of all Medicaid clients are being served by the Intermountain Health Care system called Select Access. Once in the system, clients may only receive services at Intermountain Health Care facilities, but there is no active case management of the clients, except for four pediatric nurses that provide some basic case management for children. Funding Detail

|