Compendium of Budget Information for the 2011 General Session

| Social Services Appropriations Subcommittee | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Subcommittee Table of Contents | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

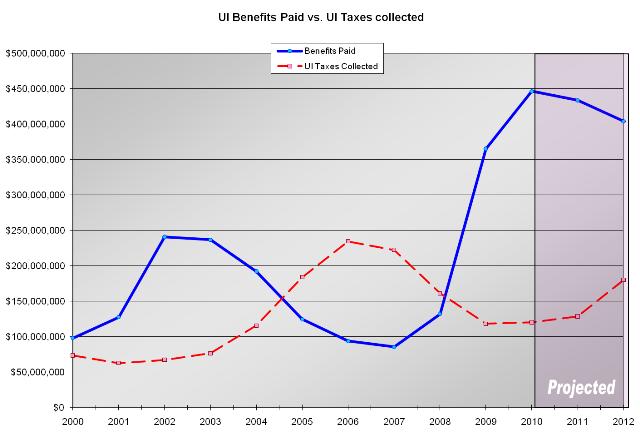

Group: Social Services - Workforce Services & Rehab Line Item: Unemployment Compensation Fund Function The Unemployment Compensation Fund is the funding mechanism that employers pay into and unemployed workers who are eligible receive their benefits. Benefits paid through the Utah UI program are funded entirely through a dedicated tax paid by employers into the trust fund. This arrangement means that workers do not pay any portion of benefit costs or UI taxes. Employers contribute to the fund according to tax rates that are set in statute and adjusted according to statutory formula. Background Historically, the UI Compensation Fund was part of the main DWS line item. However, during the 2010 General Session, the fund was separated from the main DWS line item, as well as from the administration costs of the program itself, which are contained in the Unemployment Insurance line item. Statutory Authority Language regarding the fund is contained in Utah Code 35A-4-107. Performance The following graph shows taxes collected and benefits paid out over 2000-2010, with projections for the current year and FY 2012.  Funding Detail

|