Agency: Tax Commission Line Item: Liquor Profit Distribution Function This line item accounts for a portion of revenue generated by the beer tax, collected by the Tax Commission and distributed to local governments. The Alcoholic Beverage Enforcement and Treatment Restricted Account houses the funds collected.

Statutory Authority Utah Code 32B-2-404 specifies the distribution formula for municipalities and counties as follows: - 25 percent based on population;

- 30 percent based on alcohol related convictions;

- 20 percent based on the number state liquor stores, package agencies, retail licensees, and off-premise beer retailers; and

- 25 percent for confinement and treatment purposes, and authorized on the basis of population

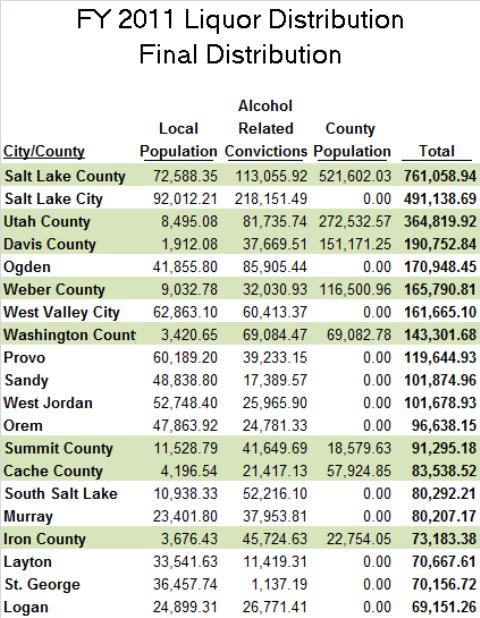

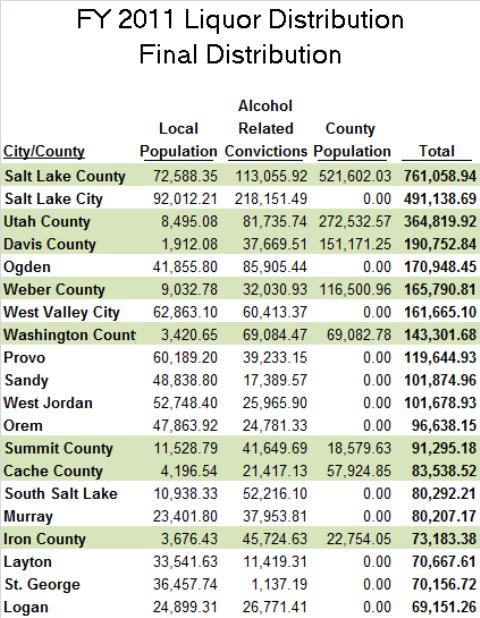

Performance The following table shows the top 20 twenty municipalities and counties for funds received from the Alcoholic Beverage Enforcement and Treatment Restricted Account in FY 2011:  Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | GFR - Alc Bev Enf & Treatment | $4,984,800 | $5,425,600 | $5,622,600 | $5,597,200 | $5,308,900 | | Total | $4,984,800 | $5,425,600 | $5,622,600 | $5,597,200 | $5,308,900 |

|---|

| | Programs: | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Liquor Profit Distribution | $4,984,800 | $5,425,600 | $5,622,600 | $5,597,200 | $5,308,900 | | Total | $4,984,800 | $5,425,600 | $5,622,600 | $5,597,200 | $5,308,900 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Other Charges/Pass Thru | $4,984,800 | $5,425,600 | $5,622,600 | $5,597,200 | $5,308,900 | | Total | $4,984,800 | $5,425,600 | $5,622,600 | $5,597,200 | $5,308,900 |

|---|

Subcommittee Table of Contents |