Agency: Natural Resources Line Item: Oil, Gas and Mining Function The mission of the Division of Oil, Gas and Mining (OGM) is to regulate and ensure industry compliance and site restoration while facilitating oil, gas and mining activities.

OGM is created under the authority of UCA 40-6-15. The division regulates exploration for and development of Utah's oil, gas, coal and other mineral resources. When exploration and developmental activities are completed, the division ensures that oil and gas wells are properly abandoned and mining sites are satisfactorily reclaimed. The division's staff strives to maintain a balance between environment and industrial development. OGM accounts for and protects the rights of all surface property and mineral owners in oil and gas operations. It also inspects each well site to assure that proper conservation practices are followed and that minimum ecological damage results from the location, operation, and reclamation of each site. Utah has primacy from the U.S. Department of the Interior for regulation of coal mining operations and reclamation of abandoned mine sites. The Coal Reclamation program is a reimbursable grant program with the Department of the Interior. Utah also has primacy from the U.S. Environmental Protection Agency (EPA) for regulation of Class II injection wells used for oilfield waste disposal and enhanced oil recovery projects. The Oil and Gas program receives this grant money for its Underground Injection Control (UIC) responsibilities, with the EPA providing the federal funds that amount to less than 3% of the program's budget. Some of the division's current focus is on the following issues: - Continuous process improvement

- Timeliness improvement

- Education and outreach

- Collaboration and coordinanation improvemets.

Statutory Authority The following laws govern operation of the division: - UCA 40-6-4 creates the Board of Oil, Gas and Mining.

- UCA 40-6-10 requires the board and division to comply with the Administrative Procedures Act in their adjudicative proceedings.

- UCA 40-6-14 levies a fee of .002 of the value of oil and gas produced and sold. Proceeds are deposited in the restricted Oil and Gas Conservation Account created in UCA 40-6-14.5. The balance at the end of the fiscal year is capped at $750,000.

- UCA 40-6-16 enumerates the division's duties, which include:

- Develop and implement an inspection program

- Publish a monthly production report

- Publish a monthly gas processing plant report

- Review evidence submitted to the board

- Require adequate assurance of approved water rights

- Notify the county executive where drilling will take place

- UCA 40-6-19 creates the Bond and Surety Forfeiture Trust Fund and requires monies collected by the division as a result of bond or surety failures to be deposited in the fund. The division must use the fund to accomplish the purposes for which the surety was established.

- UCA 40-8-7 gives the board and division broad authority to regulate all non-coal mining operations in the state.

- UCA 40-8-14 requires the division to determine a surety amount and receive the surety payment prior to allowing mining operations.

- UCA 40-10-6 establishes the authority for the board and division to specifically regulate coal mining and reclamation.

- UCA 40-10-25.1 creates the restricted special revenue fund known as the 'Abandoned Mine Reclamation Fund' and allows the division to expend monies from the fund to accomplish the purposes of the program. Funds must be appropriated except in emergency situations.

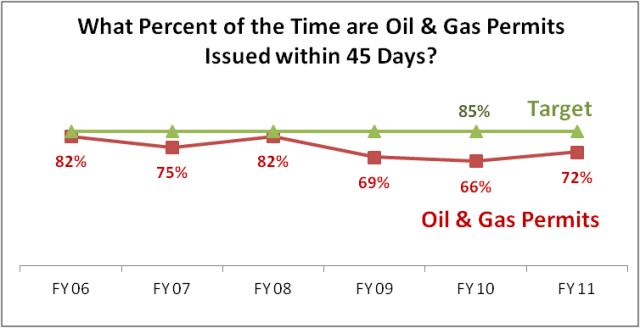

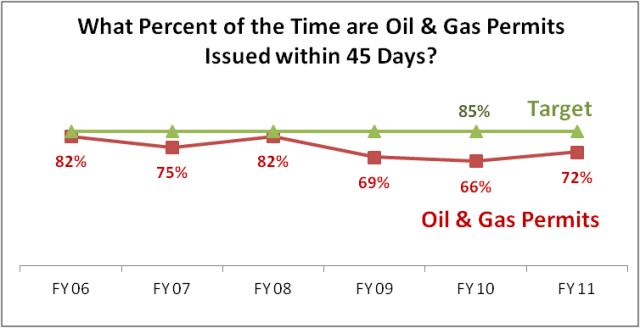

Intent Language Under the terms of 63J-1-603 of the Utah Code, the Legislature intends that appropriations provided for Oil, Gas, and Mining in Item 173, Chapter 2, Laws of Utah 2010, shall not lapse at the close of FY 2011. Expenditures of these funds are limited to: Mining Special Projects/Studies $250,000; Computer Equipment/Software $50,000; Employee Training/Incentives $50,000; Equipment/Supplies $50,000. Performance Continued increased emphasis by management on timeliness of permiting has improved results.  Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $1,800,400 | $1,480,000 | $1,480,100 | $1,411,200 | $1,400,900 | | General Fund, One-time | ($235,000) | $3,600 | ($15,200) | $0 | $0 | | Federal Funds | $4,431,600 | $4,252,300 | $4,308,000 | $5,472,200 | $7,100,900 | | Dedicated Credits Revenue | $155,200 | $168,900 | $156,000 | $161,800 | $206,500 | | GFR - Oil & Gas Conservation Account | $3,382,200 | $3,508,500 | $3,497,600 | $3,526,200 | $3,614,600 | | Beginning Nonlapsing | $548,900 | $658,000 | $1,193,600 | $1,293,600 | $0 | | Closing Nonlapsing | ($658,000) | ($1,193,600) | ($1,293,600) | ($1,493,600) | $0 | | Lapsing Balance | $0 | $0 | ($546,300) | ($445,700) | $0 | | Total | $9,425,300 | $8,877,700 | $8,780,200 | $9,925,700 | $12,322,900 |

|---|

| | Programs: | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Administration | $1,629,200 | $1,572,500 | $1,440,200 | $1,441,600 | $1,783,400 | | Board | $41,300 | $42,900 | $48,000 | $40,800 | $50,000 | | Oil and Gas Conservation | $2,705,800 | $2,773,300 | $2,755,800 | $2,633,200 | $3,038,200 | | Minerals Reclamation | $700,300 | $611,000 | $714,200 | $749,900 | $816,700 | | Coal Reclamation | $1,583,300 | $1,617,900 | $1,636,600 | $1,576,500 | $1,768,300 | | OGM Misc. Nonlapsing | $98,500 | $22,000 | $86,000 | $104,200 | $0 | | Abandoned Mine | $2,666,900 | $2,238,100 | $2,099,400 | $3,379,500 | $4,866,300 | | Total | $9,425,300 | $8,877,700 | $8,780,200 | $9,925,700 | $12,322,900 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $5,941,500 | $6,145,400 | $6,072,300 | $6,146,100 | $6,496,600 | | In-state Travel | $65,400 | $46,500 | $37,400 | $42,400 | $63,000 | | Out-of-state Travel | $35,900 | $14,900 | $12,000 | $30,800 | $40,900 | | Current Expense | $1,689,700 | $1,165,900 | $1,566,000 | $1,860,900 | $2,732,900 | | DP Current Expense | $369,900 | $574,300 | $578,200 | $572,200 | $589,500 | | Other Charges/Pass Thru | $1,322,900 | $930,700 | $514,300 | $1,273,300 | $2,400,000 | | Total | $9,425,300 | $8,877,700 | $8,780,200 | $9,925,700 | $12,322,900 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 72.2 | 73.7 | 84.0 | 83.0 | 82.0 | | Actual FTE | 0.0 | 0.0 | 74.0 | 75.2 | 0.0 | | Vehicles | 0 | 0 | 14 | 14 | 14 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Administration Function The OGM Administration program establishes policy, provides direction, and furnishes administrative support to the division's established work programs. This program is the principal point of contact between DNR and the division work programs. Sound mining and oil and gas industries are essential to an industrialized society and help meet a DNR goal of promoting appropriate energy development in Utah. Administration assures these activities are carried out in a technically sound manner and consistent with direction established by the board, DNR, and enabling statutes. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $814,700 | $618,100 | $423,600 | $448,800 | $372,200 | | General Fund, One-time | $0 | $3,600 | ($15,200) | $0 | $0 | | Federal Funds | $517,700 | $760,300 | $907,300 | $898,300 | $746,900 | | Dedicated Credits Revenue | $900 | $1,100 | $500 | $300 | $6,500 | | GFR - Oil & Gas Conservation Account | $780,000 | $591,400 | $686,800 | $558,200 | $657,800 | | Closing Nonlapsing | ($484,100) | ($402,000) | ($16,500) | ($373,500) | $0 | | Lapsing Balance | $0 | $0 | ($546,300) | ($90,500) | $0 | | Total | $1,629,200 | $1,572,500 | $1,440,200 | $1,441,600 | $1,783,400 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $1,100,100 | $1,202,600 | $1,051,500 | $1,119,200 | $1,353,600 | | In-state Travel | $7,400 | $3,700 | $6,000 | $3,900 | $8,000 | | Out-of-state Travel | $7,400 | $2,200 | $3,900 | $6,000 | $7,500 | | Current Expense | $221,500 | $182,300 | $124,400 | $138,500 | $132,800 | | DP Current Expense | $292,300 | $181,700 | $180,700 | $174,000 | $181,500 | | Other Charges/Pass Thru | $500 | $0 | $73,700 | $0 | $100,000 | | Total | $1,629,200 | $1,572,500 | $1,440,200 | $1,441,600 | $1,783,400 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 14.6 | 14.9 | 18.0 | 18.0 | 18.0 | | Actual FTE | 0.0 | 0.0 | 14.0 | 14.6 | 0.0 | | Vehicles | 0 | 0 | 14 | 14 | 14 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Board Function The Board of Oil, Gas and Mining conducts administrative hearings in a quasi-judicial forum to provide direction on the development of energy and mineral resources in Utah. It assures appropriate resource conservation, waste minimization, and environmental mitigation. The board also provides policy advice and promulgates rules for the division. The make-up of the board is: - Two members knowledgeable in mining matters

- Two members knowledgeable in oil and gas matters

- One member knowledgeable in ecological and environmental matters

- One member who is a private landowner and owns a mineral or royalty interest

- One member who is knowledgeable in geological matters

Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $24,100 | $34,000 | $40,000 | $45,000 | $50,000 | | Closing Nonlapsing | $17,200 | $8,900 | $8,000 | ($4,200) | $0 | | Total | $41,300 | $42,900 | $48,000 | $40,800 | $50,000 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $7,100 | $7,200 | $8,800 | $6,700 | $8,800 | | In-state Travel | $9,500 | $7,800 | $5,800 | $4,300 | $8,500 | | Out-of-state Travel | $1,700 | $1,100 | $0 | $3,400 | $1,600 | | Current Expense | $23,000 | $26,800 | $33,400 | $24,800 | $31,100 | | DP Current Expense | $0 | $0 | $0 | $1,600 | $0 | | Total | $41,300 | $42,900 | $48,000 | $40,800 | $50,000 |

|---|

Subcommittee Table of ContentsProgram: Oil and Gas Conservation Function The mission of the Oil and Gas Conservation program is to encourage development of Utah's crude oil and natural gas resources in a manner that obtains the greatest possible recovery while preventing waste and protecting the environment. This program includes the Underground Injection Control (UIC) Program, which is an EPA program that has been assigned to the division. The intent of the UIC program is to prevent water pollution that could result from injecting produced oil field waters into underground reservoirs with water quality equivalent to or lower than that of the produced water. The program provides technical assurance that injected waters will not impact underground sources of drinking water. The EPA provides partial funding, but the majority is funded by the Oil and Gas Conservation fee. Statutory Authority The Oil and Gas Conservation program is created under the authority of UCA 40-6-16. Statute requires an inspection program, issuance of monthly production reports, and provision of technical support to the board by reviewing and evaluating evidence that accompanies petitions to the board. Performance Timely permitting is a major focus of the division. Staff is striving to issue new drilling permits for oil and gas within 45 days.  Timeliness of oil and gas permitting of 72% in FY 2011 equals the average of the prior three years. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Federal Funds | $33,500 | $20,600 | $23,900 | $16,800 | $64,900 | | Dedicated Credits Revenue | $11,500 | $8,800 | $4,800 | $3,600 | $16,500 | | GFR - Oil & Gas Conservation Account | $2,602,200 | $2,917,100 | $2,810,800 | $2,968,000 | $2,956,800 | | Closing Nonlapsing | $58,600 | ($173,200) | ($83,700) | $0 | $0 | | Lapsing Balance | $0 | $0 | $0 | ($355,200) | $0 | | Total | $2,705,800 | $2,773,300 | $2,755,800 | $2,633,200 | $3,038,200 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $1,991,600 | $2,096,000 | $2,058,700 | $2,070,800 | $2,020,700 | | In-state Travel | $10,700 | $8,300 | $6,300 | $12,300 | $12,000 | | Out-of-state Travel | $16,000 | $1,000 | $1,400 | $12,000 | $15,000 | | Current Expense | $422,100 | $393,000 | $491,200 | $311,600 | $625,000 | | DP Current Expense | $21,200 | $274,400 | $198,200 | $226,500 | $265,500 | | Other Charges/Pass Thru | $244,200 | $600 | $0 | $0 | $100,000 | | Total | $2,705,800 | $2,773,300 | $2,755,800 | $2,633,200 | $3,038,200 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 24.7 | 25.2 | 28.0 | 28.0 | 26.0 | | Actual FTE | 0.0 | 0.0 | 25.0 | 25.2 | 0.0 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Minerals Reclamation Function The Minerals Reclamation program requires that every exploration or mining operation for non-coal commodities have a valid notice of intent or an approved mining and reclamation plan before surface disturbing operations are commenced. The program ensures that non-coal mining operations will be reclaimed at the conclusion of the mining cycle, and affected lands returned to viable use. Statutory Authority Authority for this program is found at UCA 40-8. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $584,000 | $553,100 | $614,100 | $558,800 | $638,700 | | Dedicated Credits Revenue | $142,700 | $158,700 | $150,700 | $157,900 | $178,000 | | Closing Nonlapsing | ($26,400) | ($100,800) | ($50,600) | $33,200 | $0 | | Total | $700,300 | $611,000 | $714,200 | $749,900 | $816,700 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $660,200 | $577,700 | $647,800 | $667,000 | $736,200 | | In-state Travel | $6,800 | $6,800 | $5,100 | $8,200 | $10,000 | | Out-of-state Travel | $1,800 | $300 | $700 | $2,600 | $3,000 | | Current Expense | $31,500 | $16,200 | $15,700 | $20,500 | $17,500 | | DP Current Expense | $0 | $10,000 | $44,900 | $51,600 | $50,000 | | Total | $700,300 | $611,000 | $714,200 | $749,900 | $816,700 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 8.2 | 7.5 | 10.0 | 9.0 | 10.0 | | Actual FTE | 0.0 | 0.0 | 8.0 | 8.7 | 0.0 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Coal Reclamation Function The Coal program reviews applications for mining and reclamation plans for all coal mines and coal exploration activities in Utah. Upon approval of a permit application a reclamation bond is posted to assure final reclamation is conducted under terms of the permit. When mining begins, operations are inspected for compliance with the permit. The reclamation process can take several years after the mining ends, depending on the size of the mine. Statutory Authority Activities in this regulatory program have been delegated to the division under a cooperative agreement with the Secretary of the Interior. Provisions for the program are found in UCA 40-10. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $274,600 | $209,300 | $337,400 | $293,600 | $275,000 | | General Fund, One-time | ($235,000) | $0 | $0 | $0 | $0 | | Federal Funds | $1,343,900 | $1,357,900 | $1,380,000 | $1,342,800 | $1,492,800 | | Dedicated Credits Revenue | $0 | $0 | $0 | $0 | $500 | | Closing Nonlapsing | $199,800 | $50,700 | ($80,800) | ($59,900) | $0 | | Total | $1,583,300 | $1,617,900 | $1,636,600 | $1,576,500 | $1,768,300 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $1,404,900 | $1,351,200 | $1,395,000 | $1,351,700 | $1,505,000 | | In-state Travel | $4,800 | $4,800 | $5,000 | $5,800 | $6,500 | | Out-of-state Travel | $2,300 | $2,000 | $2,300 | $1,400 | $5,000 | | Current Expense | $148,700 | $155,200 | $145,200 | $143,300 | $159,300 | | DP Current Expense | $22,600 | $104,700 | $89,100 | $74,300 | $92,500 | | Total | $1,583,300 | $1,617,900 | $1,636,600 | $1,576,500 | $1,768,300 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 15.8 | 15.9 | 18.0 | 18.0 | 18.0 | | Actual FTE | 0.0 | 0.0 | 17.0 | 16.2 | 0.0 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: OGM Misc. Nonlapsing Function This program accounts for nonlapsing balances rolled forward from previous fiscal years. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Beginning Nonlapsing | $548,900 | $658,000 | $1,193,600 | $1,293,600 | $0 | | Closing Nonlapsing | ($450,400) | ($636,000) | ($1,107,600) | ($1,189,400) | $0 | | Total | $98,500 | $22,000 | $86,000 | $104,200 | $0 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $30,100 | $5,000 | $3,800 | $1,100 | $0 | | Current Expense | $34,600 | $14,300 | $16,900 | $59,600 | $0 | | DP Current Expense | $33,800 | $2,700 | $65,300 | $43,500 | $0 | | Total | $98,500 | $22,000 | $86,000 | $104,200 | $0 |

|---|

Subcommittee Table of ContentsProgram: Abandoned Mine Function The purpose of this program is to mitigate adverse effects of past unregulated mining practices by identifying and prioritizing the health/safety aspects of abandoned mines and developing and executing closure and reclamation plans. Authority for this program is found in UCA 40-10-25. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $103,000 | $65,500 | $65,000 | $65,000 | $65,000 | | Federal Funds | $2,536,500 | $2,113,500 | $1,996,800 | $3,214,300 | $4,796,300 | | Dedicated Credits Revenue | $100 | $300 | $0 | $0 | $5,000 | | Closing Nonlapsing | $27,300 | $58,800 | $37,600 | $100,200 | $0 | | Total | $2,666,900 | $2,238,100 | $2,099,400 | $3,379,500 | $4,866,300 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $747,500 | $905,700 | $906,700 | $929,600 | $872,300 | | In-state Travel | $26,200 | $15,100 | $9,200 | $7,900 | $18,000 | | Out-of-state Travel | $6,700 | $8,300 | $3,700 | $5,400 | $8,800 | | Current Expense | $808,300 | $378,100 | $739,200 | $1,162,600 | $1,767,200 | | DP Current Expense | $0 | $800 | $0 | $700 | $0 | | Other Charges/Pass Thru | $1,078,200 | $930,100 | $440,600 | $1,273,300 | $2,200,000 | | Total | $2,666,900 | $2,238,100 | $2,099,400 | $3,379,500 | $4,866,300 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 8.9 | 10.2 | 10.0 | 10.0 | 10.0 | | Actual FTE | 0.0 | 0.0 | 10.0 | 10.5 | 0.0 |

|

|

|

|

|

|

Subcommittee Table of Contents |