Agency: Agriculture Line Item: Administration Function The DAF Administration line item contains most of the department's programs. Detail on each program can be found in the following sections.

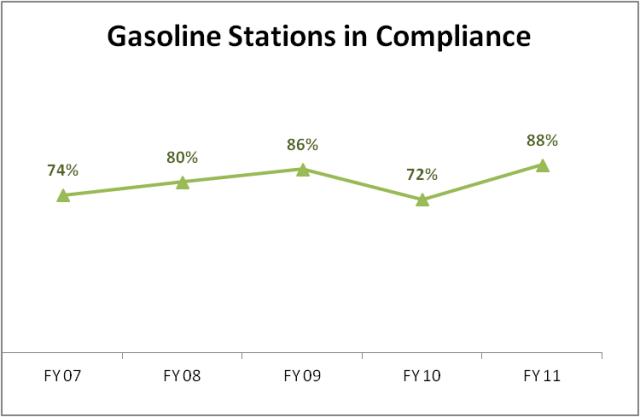

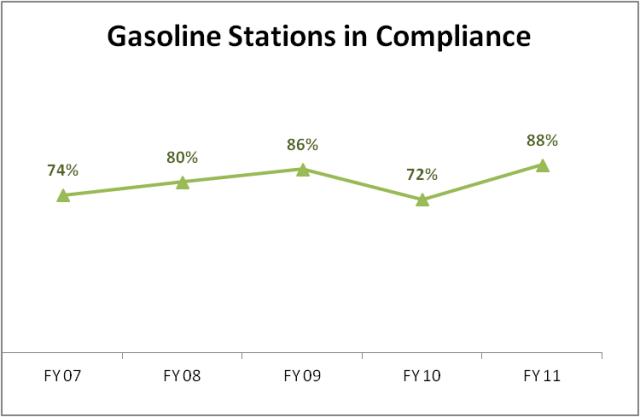

Intent Language Under the terms of 63J-1-603 of the Utah Code, the Legislature intends that appropriations provided for General Administration in Item 188, Chapter 2, Laws of Utah 2010, shall not lapse at the close of FY 2011. Expenditures of these funds are limited to: Capital Equipment or Improvements $118,000; Computer Equipment/Software $93,000; Employee Training/Incentives $179,000; Equipment/Supplies $95,500; Vehicles $20,000; Special Projects/Studies $1,213,000. Performance  Inspectors from the Weights and Measures program inspect all gasoline stations in the state. They test the gas pumps to insure that they are metering the gasoline dispensed properly, test the gasoline in the underground storage tanks to insure that the water content is below safe minimums, test the octane percentage of the gasoline dispensed, and inspect the cleanliness of the facility.

If the gasoline station does not meet the required standards in any one of these areas it is considered to be out of compliance. The goal is to have the highest number of stations meeting the standards as possible. Inspectors from the Weights and Measures program inspect all gasoline stations in the state. They test the gas pumps to insure that they are metering the gasoline dispensed properly, test the gasoline in the underground storage tanks to insure that the water content is below safe minimums, test the octane percentage of the gasoline dispensed, and inspect the cleanliness of the facility.

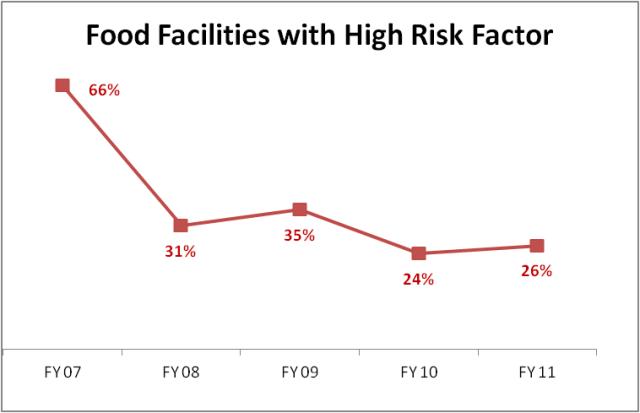

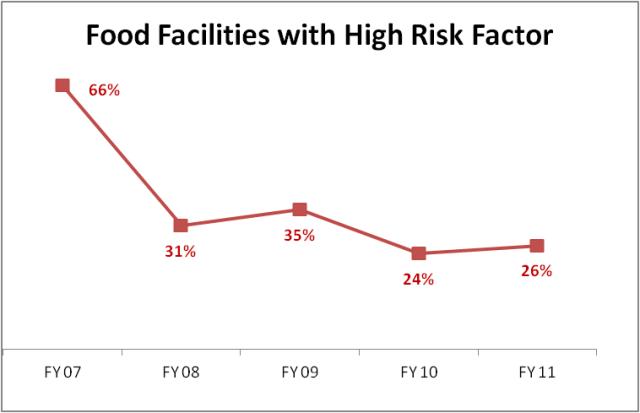

If the gasoline station does not meet the required standards in any one of these areas it is considered to be out of compliance. The goal is to have the highest number of stations meeting the standards as possible. The graph above represents the percentage of facilities processing food that are identified as 'High Risk' facilities. High Risk facilities are those that, for any reason, do not meeting minimum industry standards as required by law. Such facilities could pose a high risk for contamination if the items are not processed properly. The preference on this measure is that the percentage be as low as possible. It should be noted that a target of 0% would be ideal, but since we don't live in an ideal world, it is reasonable to expect that this measure will always be something greater than 0%. The graph above represents the percentage of facilities processing food that are identified as 'High Risk' facilities. High Risk facilities are those that, for any reason, do not meeting minimum industry standards as required by law. Such facilities could pose a high risk for contamination if the items are not processed properly. The preference on this measure is that the percentage be as low as possible. It should be noted that a target of 0% would be ideal, but since we don't live in an ideal world, it is reasonable to expect that this measure will always be something greater than 0%.Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $10,732,400 | $10,036,200 | $8,998,400 | $8,582,700 | $8,497,000 | | General Fund, One-time | $2,912,400 | $617,500 | ($467,900) | $15,000 | $0 | | Federal Funds | $5,124,300 | $7,332,400 | $5,757,600 | $5,349,300 | $6,304,900 | | Dedicated Credits Revenue | $2,457,300 | $2,952,700 | $3,521,400 | $3,796,900 | $3,375,700 | | GFR - Cat & Dog Spay & Neuter | $0 | $0 | $0 | $0 | $80,000 | | GFR - Horse Racing | $50,000 | $50,000 | $50,000 | $30,000 | $20,000 | | GFR - Livestock Brand | $877,000 | $935,700 | $925,100 | $932,500 | $931,400 | | GFR - Wildlife Damage Prev | $66,600 | $66,600 | $66,500 | $69,500 | $54,500 | | Agri Resource Development | $0 | $175,000 | $175,000 | $175,000 | $175,100 | | Utah Rural Rehab Loan | $0 | ($200) | $0 | $0 | $0 | | Transfers | $1,421,300 | $1,093,300 | $1,140,200 | $862,500 | $553,800 | | Pass-through | $170,800 | $156,400 | $191,500 | $192,300 | $56,900 | | Beginning Nonlapsing | $2,716,200 | $2,454,200 | $1,679,100 | $1,596,500 | $0 | | Closing Nonlapsing | ($2,454,200) | ($1,679,100) | ($1,596,500) | ($1,458,200) | $0 | | Lapsing Balance | ($296,900) | ($223,700) | ($537,100) | ($102,600) | $0 | | Total | $23,777,200 | $23,967,000 | $19,903,300 | $20,041,400 | $20,049,300 |

|---|

| | Programs: | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Administration | $6,102,600 | $3,537,200 | $3,131,800 | $3,432,200 | $2,669,000 | | Meat Inspection | $2,034,000 | $2,144,900 | $2,020,800 | $2,035,400 | $2,052,300 | | Chemistry Laboratory | $940,800 | $925,000 | $799,900 | $779,900 | $778,500 | | Animal Health | $1,808,400 | $1,764,900 | $1,535,600 | $1,476,100 | $1,348,200 | | Plant Industry | $2,406,100 | $1,937,900 | $2,073,000 | $2,040,700 | $2,816,400 | | Regulatory Services | $3,359,800 | $3,239,200 | $3,082,100 | $3,200,400 | $3,093,300 | | Sheep Promotion | $32,100 | $24,300 | $24,200 | $30,600 | $35,000 | | Auction Market Veterinarians | $63,800 | $60,900 | $61,400 | $61,900 | $72,000 | | Brand Inspection | $1,414,500 | $1,377,000 | $1,390,500 | $1,303,900 | $1,219,400 | | Utah Horse Commission | $31,100 | $22,300 | $19,700 | $24,900 | $29,800 | | Environmental Quality | $2,545,800 | $4,938,600 | $2,914,400 | $3,208,300 | $2,905,200 | | Grain Inspection | $315,800 | $286,100 | $222,800 | $237,000 | $224,100 | | Insect Infestation | $1,653,900 | $2,136,500 | $1,582,700 | $1,123,100 | $1,528,500 | | Marketing and Development | $1,068,500 | $993,500 | $547,600 | $539,000 | $506,700 | | Grazing Improvement | $0 | $578,700 | $496,800 | $548,000 | $770,900 | | Total | $23,777,200 | $23,967,000 | $19,903,300 | $20,041,400 | $20,049,300 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $12,434,300 | $12,847,500 | $12,030,400 | $12,246,300 | $12,125,900 | | In-state Travel | $295,200 | $213,900 | $185,100 | $197,800 | $205,700 | | Out-of-state Travel | $143,200 | $120,400 | $87,500 | $80,300 | $113,600 | | Current Expense | $2,056,300 | $2,367,600 | $1,963,100 | $1,756,400 | $2,026,700 | | DP Current Expense | $671,300 | $885,400 | $581,400 | $718,000 | $612,400 | | DP Capital Outlay | $0 | $5,700 | $8,400 | $0 | $0 | | Capital Outlay | $303,800 | $101,900 | $179,200 | $279,800 | $20,000 | | Other Charges/Pass Thru | $7,844,200 | $7,424,600 | $4,868,200 | $4,762,800 | $4,945,000 | | Transfers | $28,900 | $0 | $0 | $0 | $0 | | Total | $23,777,200 | $23,967,000 | $19,903,300 | $20,041,400 | $20,049,300 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 189.6 | 184.1 | 202.0 | 177.0 | 180.5 | | Actual FTE | 0.0 | 0.0 | 177.1 | 176.5 | 0.0 | | Vehicles | 114 | 120 | 101 | 101 | 96 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: General Administration Function The DAF General Administration program ensures that all financial transactions are performed according to state laws and procedures. Other responsibilities include budgeting, human resource management, information technology services, establishment of department policies, federal grant administration, and other accounting functions. Statutory Authority The following laws govern operation of this program: - UCA 4-2-1 creates the Utah Department of Agriculture and Food (UDAF), making it responsible for administration of all laws, services, and consumer programs related to agriculture.

- UCA 4-2-2 lists powers and duties

- UCA 4-2-3 sets administration of the department under the control of a commissioner appointed by the governor with the consent of the Senate.

- UCA 4-2-4 allows the commissioner to organize the department into divisions as necessary for efficient administration.

- UCA 4-2-5 requires the commissioner to prepare and submit an itemized budget each year.

- UCA 4-2-7 creates the Agricultural Advisory Board.

Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $2,171,400 | $1,024,500 | $2,185,800 | $1,781,500 | $2,015,700 | | General Fund, One-time | $2,695,900 | $437,500 | ($465,600) | $15,000 | $0 | | Federal Funds | $772,200 | $458,400 | $704,500 | $611,700 | $548,000 | | Dedicated Credits Revenue | $0 | $0 | $0 | $6,900 | $5,800 | | GFR - Cat & Dog Spay & Neuter | $0 | $0 | $0 | $0 | $80,000 | | GFR - Livestock Brand | ($70,700) | $0 | $12,700 | $0 | $0 | | GFR - Wildlife Damage Prev | $16,600 | $16,600 | $16,500 | $19,500 | $19,500 | | Transfers | $70,400 | $0 | $7,400 | $7,000 | $0 | | Pass-through | $10,500 | $7,600 | $36,000 | $6,000 | $0 | | Beginning Nonlapsing | $652,300 | $2,394,300 | $1,679,100 | $1,596,500 | $0 | | Closing Nonlapsing | ($216,000) | ($801,700) | ($573,400) | ($611,900) | $0 | | Lapsing Balance | $0 | $0 | ($471,200) | $0 | $0 | | Total | $6,102,600 | $3,537,200 | $3,131,800 | $3,432,200 | $2,669,000 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $1,753,800 | $1,643,900 | $1,653,800 | $1,574,200 | $1,423,800 | | In-state Travel | $19,700 | $8,600 | $12,200 | $8,800 | $11,700 | | Out-of-state Travel | $24,200 | $12,200 | $9,500 | $11,700 | $9,600 | | Current Expense | $355,100 | $790,500 | $409,700 | $362,400 | $247,800 | | DP Current Expense | $522,800 | $709,300 | $357,500 | $516,700 | $384,300 | | DP Capital Outlay | $0 | $5,700 | $8,400 | $0 | $0 | | Capital Outlay | $10,500 | $0 | $128,400 | $257,000 | $0 | | Other Charges/Pass Thru | $3,416,500 | $367,000 | $552,300 | $701,400 | $591,800 | | Total | $6,102,600 | $3,537,200 | $3,131,800 | $3,432,200 | $2,669,000 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 21.0 | 18.2 | 20.0 | 14.0 | 17.0 | | Actual FTE | 0.0 | 0.0 | 17.7 | 16.9 | 0.0 | | Vehicles | 114 | 120 | 1 | 3 | 1 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Meat Inspection Function Utah's meat inspection system ensures that meat and poultry coming from state-inspected facilities is safe, wholesome, and correctly labeled and packaged as required by state law (UCA 4-32) and federal law. The program inspects and regulates raw beef, pork, lamb, chicken, and turkey, as well as ready-to-eat and other processed products. Inspectors test for the presence of pathogens, toxins, drugs and chemical residues. Inspections are done before and after slaughter. Facilities are inspected for cleanliness and sanitation. According to the USDA, consumers spend one third of their annual food dollars on meat and poultry products. Statutory Authority UCA 4-32 'Utah Meat and Poultry Products Inspection and Licensing Act' governs operation of this program. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $1,079,600 | $1,114,900 | $972,500 | $972,500 | $810,900 | | Federal Funds | $1,036,500 | $1,074,400 | $1,083,900 | $1,092,200 | $1,241,400 | | Dedicated Credits Revenue | $300 | $400 | $200 | $1,400 | $0 | | Beginning Nonlapsing | $11,500 | $0 | $0 | $0 | $0 | | Closing Nonlapsing | ($93,900) | ($44,800) | ($35,800) | ($30,700) | $0 | | Total | $2,034,000 | $2,144,900 | $2,020,800 | $2,035,400 | $2,052,300 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $1,852,800 | $1,948,300 | $1,851,100 | $1,874,500 | $1,766,000 | | In-state Travel | $24,600 | $7,500 | $2,700 | $2,200 | $3,000 | | Out-of-state Travel | $6,800 | $6,200 | $1,900 | ($3,000) | $3,700 | | Current Expense | $141,500 | $159,900 | $163,500 | $160,300 | $279,300 | | DP Current Expense | $8,300 | $15,800 | $1,600 | $1,400 | $300 | | Other Charges/Pass Thru | $0 | $7,200 | $0 | $0 | $0 | | Total | $2,034,000 | $2,144,900 | $2,020,800 | $2,035,400 | $2,052,300 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 29.3 | 28.9 | 30.0 | 28.0 | 27.0 | | Actual FTE | 0.0 | 0.0 | 28.4 | 28.5 | 0.0 | | Vehicles | 0 | 0 | 20 | 20 | 20 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Chemistry Laboratory Function The Chemistry Laboratory provides analytical support and services for the various divisions of the department. Analysis may be performed for other agencies as long as it does not interfere with work required by the department. In all cases, the purpose of the work is to ensure that products comply with label guarantees, are free of pathogens and toxins, and to protect the consumer, farmer, and industry. Some of the products tested are feed, fertilizer, pesticides, meat and meat products, dairy products, food, groundwater, and other items as needed. Statutory Authority UCA 4-2-2 requires the state chemist to be appointed by the commissioner and lists the chemist's responsibilities. The state chemist performs all analytical tests required by the Agricultural Code. The lab may perform tests for other agencies or anybody else if the tests don't interfere with work required by UDAF, and if a fee is charged. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $846,600 | $877,500 | $755,300 | $755,400 | $769,800 | | General Fund, One-time | $2,300 | $0 | $0 | $0 | $0 | | Federal Funds | $76,900 | $21,000 | $24,600 | $10,500 | $8,700 | | Dedicated Credits Revenue | $1,400 | $5,400 | $9,000 | $14,000 | $0 | | Beginning Nonlapsing | $22,800 | $0 | $0 | $0 | $0 | | Closing Nonlapsing | ($9,200) | $21,100 | $11,000 | $0 | $0 | | Total | $940,800 | $925,000 | $799,900 | $779,900 | $778,500 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $796,900 | $785,900 | $697,700 | $714,400 | $725,100 | | In-state Travel | $1,100 | $500 | $600 | $200 | $1,200 | | Out-of-state Travel | $2,100 | $2,700 | $1,800 | $2,400 | $2,400 | | Current Expense | $129,900 | $101,500 | $92,000 | $61,100 | $45,200 | | DP Current Expense | $0 | $400 | $7,800 | $1,800 | $4,600 | | Capital Outlay | $10,800 | $34,000 | $0 | $0 | $0 | | Total | $940,800 | $925,000 | $799,900 | $779,900 | $778,500 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 10.0 | 9.3 | 12.0 | 9.0 | 8.5 | | Actual FTE | 0.0 | 0.0 | 8.0 | 8.4 | 0.0 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Animal Health Function The aim of the Animal Health program is to maintain the disease free status and promote the marketability of Utah animals and to protect public health. This benefits the animals, the livestock industry, and the public. The program administers various state and federal cooperative disease control programs. It monitors animal imports to the state, reviews all Certificates of Veterinary Inspection, contracts with local veterinarians for inspections, and inspects aquaculture facilities, slaughter plants, brine shrimp plants, dog food plants, etc. A staff of veterinarians and professionally-trained inspectors carries out most of the work. Homeland security is a significant aspect of the program. The law further provides quarantine powers to the Commissioner to prevent the spread of contagious or infections deceases. Statutory Authority The following chapters of UCA 4 govern operation of this program: Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $1,470,000 | $1,509,500 | $1,401,100 | $1,401,200 | $1,143,500 | | General Fund, One-time | $22,500 | $0 | $0 | $0 | $0 | | Federal Funds | $267,500 | $254,500 | $349,500 | $169,400 | $154,500 | | Dedicated Credits Revenue | $12,700 | $10,100 | $52,000 | $50,800 | $46,300 | | Transfers | $53,200 | $21,700 | $10,000 | $3,600 | $3,900 | | Beginning Nonlapsing | $33,400 | $0 | $0 | $0 | $0 | | Closing Nonlapsing | ($50,900) | ($30,900) | ($277,000) | ($148,900) | $0 | | Total | $1,808,400 | $1,764,900 | $1,535,600 | $1,476,100 | $1,348,200 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $764,900 | $793,500 | $649,200 | $706,500 | $729,100 | | In-state Travel | $8,200 | $5,800 | $13,500 | $5,600 | $12,800 | | Out-of-state Travel | $17,300 | $10,900 | $10,000 | $9,500 | $4,000 | | Current Expense | $248,200 | $225,600 | $214,800 | $229,600 | $92,200 | | DP Current Expense | $29,300 | $29,900 | $3,300 | $11,500 | $1,100 | | Capital Outlay | $18,900 | $0 | $0 | $12,400 | $0 | | Other Charges/Pass Thru | $692,700 | $699,200 | $644,800 | $501,000 | $509,000 | | Transfers | $28,900 | $0 | $0 | $0 | $0 | | Total | $1,808,400 | $1,764,900 | $1,535,600 | $1,476,100 | $1,348,200 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 9.5 | 9.2 | 9.0 | 8.0 | 8.0 | | Actual FTE | 0.0 | 0.0 | 8.0 | 6.6 | 0.0 | | Vehicles | 0 | 0 | 3 | 3 | 3 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Plant Industry Function The Plant Industry program performs a wide scope of inspection, regulatory and enforcement activities, including: pesticide product registration; fertilizer product registration and sampling; nursery licensing and inspection; Inspection and grading of fresh fruits and vegetables; USDA Restricted Use pesticide record auditing; Utah Noxious Weed Act enforcement; Animal feed product registration and sampling; and Seed inspection and sampling. District compliance specialists perform inspections and regulatory functions throughout the state. Seasonal personnel are employed as needed. Office personnel are utilized to handle the registrations and licensing for the division. The pesticide program includes applicator certification, pesticide enforcement, worker protection standards, endangered species protection, and groundwater protection. Statutory Authority The following chapters of UCA 4 govern operation of this program: Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $763,600 | $768,100 | $0 | $0 | $456,100 | | Federal Funds | $412,200 | $235,900 | $489,400 | $511,400 | $486,900 | | Dedicated Credits Revenue | $1,134,400 | $1,647,800 | $1,897,200 | $2,014,400 | $1,870,300 | | Pass-through | $6,500 | $2,800 | $3,100 | $5,100 | $3,100 | | Beginning Nonlapsing | $988,400 | $0 | $0 | $0 | $0 | | Closing Nonlapsing | ($899,000) | ($716,700) | ($316,700) | ($490,200) | $0 | | Total | $2,406,100 | $1,937,900 | $2,073,000 | $2,040,700 | $2,816,400 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $1,626,700 | $1,600,700 | $1,569,400 | $1,649,700 | $1,866,700 | | In-state Travel | $34,800 | $24,800 | $26,500 | $30,700 | $26,300 | | Out-of-state Travel | $29,500 | $15,300 | $19,800 | $20,200 | $14,100 | | Current Expense | $212,700 | $150,500 | $256,700 | $185,000 | $736,900 | | DP Current Expense | $7,300 | $8,300 | $94,600 | $55,700 | $92,300 | | Capital Outlay | $0 | $0 | $0 | $10,400 | $0 | | Other Charges/Pass Thru | $495,100 | $138,300 | $106,000 | $89,000 | $80,100 | | Total | $2,406,100 | $1,937,900 | $2,073,000 | $2,040,700 | $2,816,400 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 25.0 | 23.0 | 26.0 | 26.0 | 28.0 | | Actual FTE | 0.0 | 0.0 | 24.0 | 24.4 | 0.0 | | Vehicles | 0 | 0 | 16 | 15 | 16 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Regulatory Services Function The Regulatory Services program can be broken down into seven areas: food compliance, dairy compliance, retail meat compliance, egg and poultry grading, product labeling, upholstery and bedding inspection, and weights and measures. The prime responsibility is to ensure that Utah consumers receive a safe, wholesome, and properly labeled supply of agricultural products. The program also plays an active role in Homeland Security for food protection. Statutory Authority The following chapters of UCA 4 govern operation of this program: Funding Detail Federal dollars are used for inspecting egg producers/retailers, inspecting meat handlers, grading dairy products, and inspecting school lunches. Dedicated credits come from fees charged for inspections of certain operations where food or dairy products are handled, and registration of food and weight and measures establishments. | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $2,060,600 | $2,094,100 | $1,508,500 | $1,514,400 | $1,528,900 | | Federal Funds | $185,500 | $196,200 | $232,800 | $172,500 | $352,200 | | Dedicated Credits Revenue | $1,027,200 | $1,018,100 | $1,254,300 | $1,400,800 | $1,158,400 | | Transfers | $0 | $1,600 | $0 | $0 | $0 | | Pass-through | $145,200 | $127,400 | $143,800 | $181,200 | $53,800 | | Beginning Nonlapsing | $121,100 | $0 | $0 | $0 | $0 | | Closing Nonlapsing | ($179,800) | ($198,200) | ($57,300) | ($68,500) | $0 | | Total | $3,359,800 | $3,239,200 | $3,082,100 | $3,200,400 | $3,093,300 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $2,622,700 | $2,709,400 | $2,586,900 | $2,649,700 | $2,618,800 | | In-state Travel | $46,500 | $42,800 | $29,200 | $42,800 | $28,500 | | Out-of-state Travel | $28,700 | $20,800 | $19,800 | $18,000 | $33,900 | | Current Expense | $292,300 | $270,500 | $266,900 | $277,600 | $260,400 | | DP Current Expense | $40,200 | $61,800 | $34,900 | $28,700 | $46,300 | | Capital Outlay | $183,500 | $6,500 | $0 | $0 | $0 | | Other Charges/Pass Thru | $145,900 | $127,400 | $144,400 | $183,600 | $105,400 | | Total | $3,359,800 | $3,239,200 | $3,082,100 | $3,200,400 | $3,093,300 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 43.0 | 42.2 | 48.0 | 46.0 | 44.5 | | Actual FTE | 0.0 | 0.0 | 41.0 | 41.3 | 0.0 | | Vehicles | 0 | 0 | 29 | 29 | 24 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Sheep Promotion Function The department contracts with the Utah Woolgrowers Association to conduct promotional and educational programs. Statistical data and market information are presented to all woolgrowers comparing market price of lambs in Utah with other areas of the country so that the best market decisions might be made. Department representatives meet with woolgrowers at regular meetings to help stimulate and strengthen sheep and wool producer programs by discussing problems facing the industry and the alternatives necessary to solve them. Statutory Authority UCA 4-23-8 authorizes the department to spend up to $0.18 per head each year from the proceeds collected from the 'head tax' on sheep for the promotion, advancement, and protection of the sheep interests of the state. Funding Detail This program is funded entirely from the General Fund Restricted - Agricultural and Wildlife Damage Prevention Account. | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | GFR - Wildlife Damage Prev | $50,000 | $50,000 | $50,000 | $50,000 | $35,000 | | Lapsing Balance | ($17,900) | ($25,700) | ($25,800) | ($19,400) | $0 | | Total | $32,100 | $24,300 | $24,200 | $30,600 | $35,000 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Other Charges/Pass Thru | $32,100 | $24,300 | $24,200 | $30,600 | $35,000 | | Total | $32,100 | $24,300 | $24,200 | $30,600 | $35,000 |

|---|

Subcommittee Table of ContentsProgram: Auction Market Veterinarians Function There are six auction markets held throughout the state. A veterinarian inspects all animals that pass through the market. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Dedicated Credits Revenue | $63,800 | $60,900 | $61,400 | $61,900 | $72,000 | | Total | $63,800 | $60,900 | $61,400 | $61,900 | $72,000 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Current Expense | $63,800 | $60,900 | $61,400 | $61,900 | $72,000 | | Total | $63,800 | $60,900 | $61,400 | $61,900 | $72,000 |

|---|

Subcommittee Table of ContentsProgram: Brand Inspection Function The Brand Inspection program was established to keep to a minimum the loss of livestock through theft and stray. Loss prevention is accomplished through enforcement of the brand and estray laws (UCA 4-24 and 4-25) by field and auction inspectors who check all cattle and horses prior to sale, slaughter, or movement across state lines. The program also maintains a brand recording system so that ownership of animals can be readily determined through a master brand identification book. The brand book is published every five years. This program is actively involved in tying the existing brand program to the new Animal Disease Traceability (ADT), where each livestock owner will be issued a premises I.D. number. This number was added to the brand card for easy reference as the system develops. ADT is a modern, streamlined information system that helps producers and animal health officials respond quickly and effectively to animal health events in the United States. The ADT program-a voluntary State-Federal-Industry partnership-is designed to: - Protect agriculture premises and producers livelihoods;

- Reduce hardships caused by an animal disease outbreak or other animal health events in the community; and

- Protect access to agriculture markets.

In 1997 the Legislature gave this program responsibility of monitoring and regulating elk farming, and in 1999, private elk hunting. Livestock inspectors ensure animal identification, theft protection, genetic purity, and disease control. Domestic elk are now included in the department's definition of livestock. Statutory Authority The following chapters of UCA 4 govern operation of this program: Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $587,800 | $601,600 | $475,900 | $459,700 | $288,800 | | Federal Funds | $128,200 | $0 | $0 | $0 | ($800) | | GFR - Livestock Brand | $947,700 | $935,700 | $912,400 | $932,500 | $931,400 | | Beginning Nonlapsing | $10,400 | $0 | $0 | $0 | $0 | | Closing Nonlapsing | ($9,500) | $0 | $2,200 | ($20,000) | $0 | | Lapsing Balance | ($250,100) | ($160,300) | $0 | ($68,300) | $0 | | Total | $1,414,500 | $1,377,000 | $1,390,500 | $1,303,900 | $1,219,400 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $1,097,400 | $1,089,700 | $1,080,600 | $1,052,600 | $1,014,500 | | In-state Travel | $49,400 | $52,400 | $57,000 | $56,000 | $57,500 | | Out-of-state Travel | $3,800 | $1,700 | $2,700 | $4,100 | $5,500 | | Current Expense | $208,200 | $198,000 | $194,800 | $180,000 | $101,900 | | DP Current Expense | $36,800 | $25,300 | $49,700 | $11,200 | $40,000 | | Other Charges/Pass Thru | $18,900 | $9,900 | $5,700 | $0 | $0 | | Total | $1,414,500 | $1,377,000 | $1,390,500 | $1,303,900 | $1,219,400 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 22.6 | 22.3 | 24.0 | 22.0 | 21.5 | | Actual FTE | 0.0 | 0.0 | 23.0 | 22.4 | 0.0 | | Vehicles | 0 | 0 | 17 | 17 | 17 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Utah Horse Commission Function The Utah Horse Commission provides a regulatory structure for horse racing, administers rules and regulations, issues licenses, collects license fees, sanctions tracks and pays for approved expenses such as: - Stewards (Commission may designate three Stewards at each race meet to enforce rules)

- Veterinarians

- Blood and urine testing

- Assistance with insurance and other items mandated by the Act

Statutory Authority The five-member Utah Horse Racing Commission was created under the Utah Horse Regulation Act (UCA 4-38). Funding Detail The funding for the General Fund Restricted - Horse Racing Account comes from license fees paid by participants in racing and other racetrack activities. | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $10,000 | $10,000 | $9,800 | $9,800 | $9,800 | | GFR - Horse Racing | $50,000 | $50,000 | $50,000 | $30,000 | $20,000 | | Lapsing Balance | ($28,900) | ($37,700) | ($40,100) | ($14,900) | $0 | | Total | $31,100 | $22,300 | $19,700 | $24,900 | $29,800 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $600 | $300 | $300 | $0 | $1,400 | | In-state Travel | $2,100 | $1,900 | $2,000 | $400 | $2,000 | | Current Expense | $0 | $100 | $0 | $0 | $6,400 | | DP Current Expense | $0 | $0 | $0 | $0 | $20,000 | | Other Charges/Pass Thru | $28,400 | $20,000 | $17,400 | $24,500 | $0 | | Total | $31,100 | $22,300 | $19,700 | $24,900 | $29,800 |

|---|

Subcommittee Table of ContentsProgram: Environmental Quality Function This program provides incentive funding assistance to farmers and ranchers to voluntarily implement structural and management practices which help prevent animal waste and soil sediment from entering the state's water in priority watersheds. Funds are also used in conjunction with private and other government resources. This program is divided into three areas: Watershed Management, Groundwater Management, and Information and Education. Assistance is given to farmers and ranchers to meet the mandates of the federal Clean Water Act and the water quality rules of the State of Utah. The conservation arm of this program helps farmers and ranchers protect the state's soil and water resources through soil conservation and water quality programs, coordination of the ARDL (Agriculture Resource Development

Loan) program, the EPA 319 Water Quality program, rangeland monitoring, and a groundwater monitoring program. Funding Detail Federal funds are granted to assist irrigators in improving irrigation efficiency. The funding is also for protecting water quality and for promoting specialty crops relating to groundwater salinity. The improved irrigation reduces saline waters from entering the Colorado River System. | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $334,600 | $351,600 | $361,100 | $361,100 | $357,600 | | General Fund, One-time | $18,900 | $0 | $0 | $0 | $0 | | Federal Funds | $1,008,800 | $3,531,500 | $1,509,900 | $2,023,800 | $1,997,700 | | Utah Rural Rehab Loan | $0 | ($200) | $0 | $0 | $0 | | Transfers | $1,297,700 | $1,070,000 | $1,122,800 | $843,900 | $549,900 | | Pass-through | $8,600 | $8,600 | $8,600 | $0 | $0 | | Beginning Nonlapsing | $4,800 | $0 | $0 | $0 | $0 | | Closing Nonlapsing | ($127,600) | ($22,900) | ($88,000) | ($20,500) | $0 | | Total | $2,545,800 | $4,938,600 | $2,914,400 | $3,208,300 | $2,905,200 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $542,100 | $645,300 | $662,700 | $689,500 | $695,400 | | In-state Travel | $8,100 | $5,900 | $8,000 | $6,600 | $12,900 | | Out-of-state Travel | $5,400 | $5,400 | $8,600 | $8,100 | $17,700 | | Current Expense | $27,200 | $31,800 | $40,800 | $34,300 | $21,500 | | DP Current Expense | $3,500 | $2,100 | $800 | $63,400 | $2,800 | | Capital Outlay | $0 | $0 | $50,800 | $0 | $20,000 | | Other Charges/Pass Thru | $1,959,500 | $4,248,100 | $2,142,700 | $2,406,400 | $2,134,900 | | Total | $2,545,800 | $4,938,600 | $2,914,400 | $3,208,300 | $2,905,200 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 6.6 | 7.5 | 7.0 | 8.0 | 8.0 | | Actual FTE | 0.0 | 0.0 | 8.0 | 7.8 | 0.0 | | Vehicles | 0 | 0 | 2 | 2 | 2 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Grain Inspection Function All grain may be officially inspected and graded to U.S. standards. These services are provided on a fee basis to grain elevators, flour mills, farmers, and others. Being funded entirely by Dedicated Credits, the program has some flexibility to adjust its size to meet the demands of the industry. Statutory Authority Grain inspection services are provided under authority of UCA 4-2 and under the authority of the Federal Grain Inspection Service. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $0 | $0 | $0 | $0 | $34,700 | | Dedicated Credits Revenue | $179,800 | $168,100 | $209,900 | $210,400 | $189,400 | | Beginning Nonlapsing | $136,000 | $0 | $0 | $0 | $0 | | Closing Nonlapsing | $0 | $118,000 | $12,900 | $26,600 | $0 | | Total | $315,800 | $286,100 | $222,800 | $237,000 | $224,100 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $280,600 | $241,000 | $191,800 | $195,700 | $197,200 | | In-state Travel | $0 | $100 | $0 | $100 | $0 | | Out-of-state Travel | $1,500 | $33,000 | $600 | $500 | $1,800 | | Current Expense | $30,900 | $0 | $26,700 | $30,400 | $24,400 | | DP Current Expense | $0 | $9,000 | $300 | $7,000 | $700 | | Other Charges/Pass Thru | $2,800 | $3,000 | $3,400 | $3,300 | $0 | | Total | $315,800 | $286,100 | $222,800 | $237,000 | $224,100 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 4.4 | 3.5 | 7.0 | 2.0 | 3.0 | | Actual FTE | 0.0 | 0.0 | 3.0 | 3.6 | 0.0 | | Vehicles | 0 | 0 | 1 | 1 | 1 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Insect Infestation Function State law mandates an effective control of insects that are harmful to agricultural production in Utah. The law further provides quarantine powers to the Commissioner to prevent the spread or invasion of plant pests and disease. Program employees perform insect and invasive species surveys. Statutory Authority The following chapters of UCA 4 govern operation of this program: Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $690,500 | $696,200 | $375,100 | $375,100 | $219,300 | | General Fund, One-time | $17,400 | $0 | $0 | $0 | $0 | | Federal Funds | $1,134,500 | $1,338,700 | $1,329,400 | $704,900 | $1,275,700 | | Dedicated Credits Revenue | $35,600 | $41,700 | $36,400 | $36,200 | $33,500 | | Beginning Nonlapsing | $572,700 | $59,900 | $0 | $0 | $0 | | Closing Nonlapsing | ($796,800) | $0 | ($158,200) | $6,900 | $0 | | Total | $1,653,900 | $2,136,500 | $1,582,700 | $1,123,100 | $1,528,500 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $681,100 | $637,600 | $447,000 | $370,100 | $311,200 | | In-state Travel | $96,100 | $50,900 | $23,300 | $15,100 | $22,200 | | Out-of-state Travel | $15,300 | $7,900 | $6,200 | $6,800 | $8,700 | | Current Expense | $95,800 | $128,100 | $149,000 | $53,600 | $67,800 | | DP Current Expense | $21,900 | $10,500 | $5,200 | $1,000 | $5,300 | | Capital Outlay | $80,100 | $61,400 | $0 | $0 | $0 | | Other Charges/Pass Thru | $663,600 | $1,240,100 | $952,000 | $676,500 | $1,113,300 | | Total | $1,653,900 | $2,136,500 | $1,582,700 | $1,123,100 | $1,528,500 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 13.0 | 11.5 | 10.0 | 6.0 | 6.0 | | Actual FTE | 0.0 | 0.0 | 9.0 | 8.1 | 0.0 | | Vehicles | 0 | 0 | 8 | 8 | 8 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Marketing and Development Function The Marketing and Development program helps by expanding markets, adding value to locally-produced agricultural commodities, developing new products and promoting further in-state processing for state, national, and international markets. Part of this program is Utah's Own, which was created for consumers to look for and purchase Utah products. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $717,700 | $684,100 | $649,200 | $647,900 | $506,100 | | General Fund, One-time | $155,400 | $100,000 | $0 | $0 | $0 | | Federal Funds | $102,000 | $220,300 | $24,200 | $0 | $600 | | Dedicated Credits Revenue | $2,100 | $200 | $1,000 | $100 | $0 | | Pass-through | $0 | $10,000 | $0 | $0 | $0 | | Beginning Nonlapsing | $162,800 | $0 | $0 | $0 | $0 | | Closing Nonlapsing | ($71,500) | ($21,100) | ($126,800) | ($109,000) | $0 | | Total | $1,068,500 | $993,500 | $547,600 | $539,000 | $506,700 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $414,700 | $416,600 | $366,200 | $367,200 | $370,800 | | In-state Travel | $4,600 | $3,000 | $2,600 | $1,800 | $0 | | Out-of-state Travel | $8,600 | $3,700 | $2,000 | $700 | $7,600 | | Current Expense | $250,700 | $222,400 | $58,600 | $81,500 | $54,100 | | DP Current Expense | $1,200 | $12,700 | $24,000 | $17,800 | $14,200 | | Other Charges/Pass Thru | $388,700 | $335,100 | $94,200 | $70,000 | $60,000 | | Total | $1,068,500 | $993,500 | $547,600 | $539,000 | $506,700 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 5.2 | 4.8 | 5.0 | 4.0 | 4.0 | | Actual FTE | 0.0 | 0.0 | 4.0 | 3.9 | 0.0 | | Vehicles | 0 | 0 | 1 | 1 | 1 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Grazing Improvement Function The goal of the Grazing Improvement Program (GIP) is to incorporate the most effective use of federal, state, and private land. Staff works with landowners to identify what activities would allow the land to be profitable and still remain environmentally strong. Statutory Authority UCA 4-20 creates the Grazing Improvement Program. Funding Detail The Grazing Improvement Program budget, as found in the General Administration line item, represents the administrative costs of the program's operation, covering personnel, travel, current expense, and other general operating expenditures. In a separate line item, the Rangeland Improvement line item, the Legislature has appropriated the funding for the GIP projects. That funding is not used for administrative costs related to the creation of the projects. | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $0 | $304,100 | $304,100 | $304,100 | $355,800 | | General Fund, One-time | $0 | $80,000 | ($2,300) | $0 | $0 | | Federal Funds | $0 | $1,500 | $9,400 | $52,900 | $240,000 | | Agri Resource Development | $0 | $175,000 | $175,000 | $175,000 | $175,100 | | Transfers | $0 | $0 | $0 | $8,000 | $0 | | Closing Nonlapsing | $0 | $18,100 | $10,600 | $8,000 | $0 | | Total | $0 | $578,700 | $496,800 | $548,000 | $770,900 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $0 | $335,300 | $273,700 | $402,200 | $405,900 | | In-state Travel | $0 | $9,700 | $7,500 | $27,500 | $27,600 | | Out-of-state Travel | $0 | $600 | $4,600 | $1,300 | $4,600 | | Current Expense | $0 | $27,800 | $28,200 | $38,700 | $16,800 | | DP Current Expense | $0 | $300 | $1,700 | $1,800 | $500 | | Other Charges/Pass Thru | $0 | $205,000 | $181,100 | $76,500 | $315,500 | | Total | $0 | $578,700 | $496,800 | $548,000 | $770,900 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 0.0 | 4.0 | 4.0 | 4.0 | 5.0 | | Actual FTE | 0.0 | 0.0 | 3.0 | 4.6 | 0.0 | | Vehicles | 0 | 0 | 3 | 2 | 3 |

|

|

|

|

|

|

Subcommittee Table of Contents |