Agency: Insurance Line Item: Insurance Department Administration Function Administration manages other programs within the Department and is responsible for budgeting, financial tracking, personnel, actuarial services, and managerial statistics.

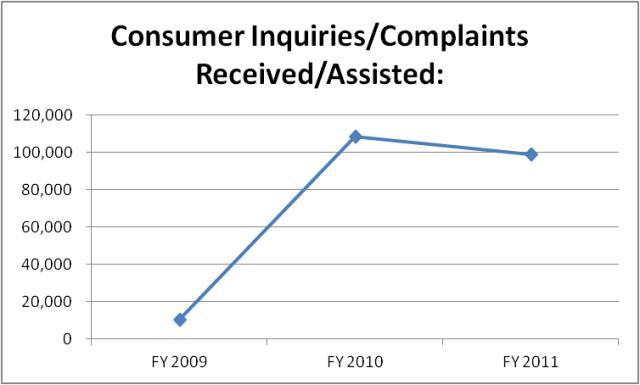

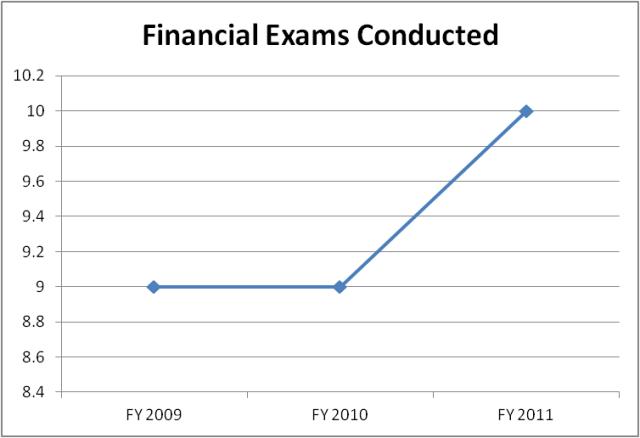

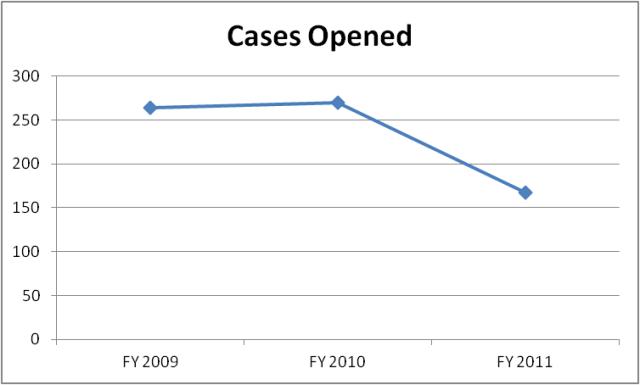

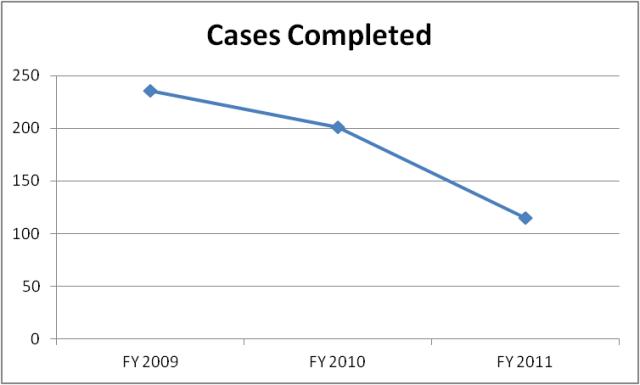

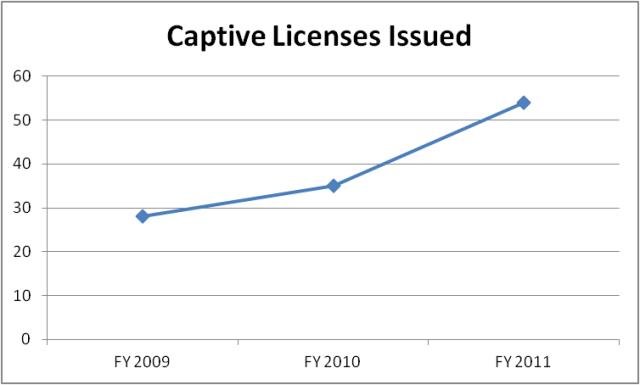

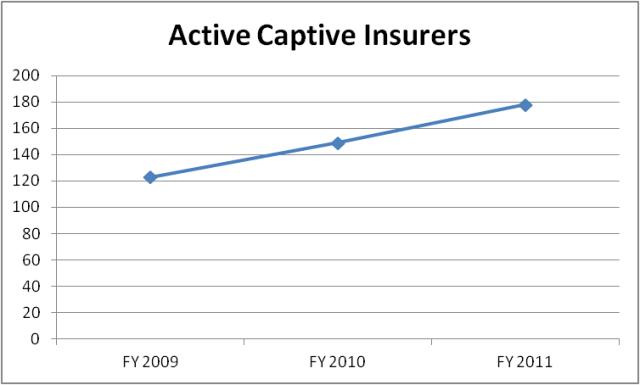

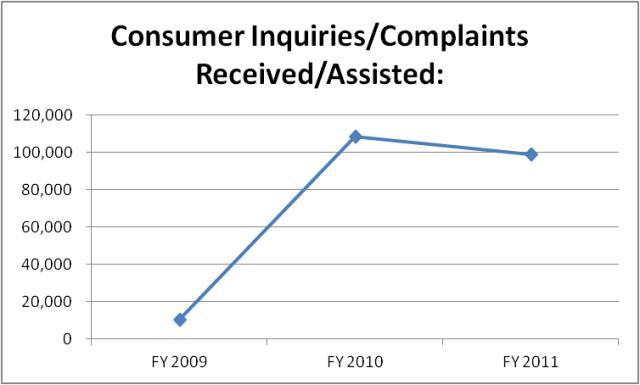

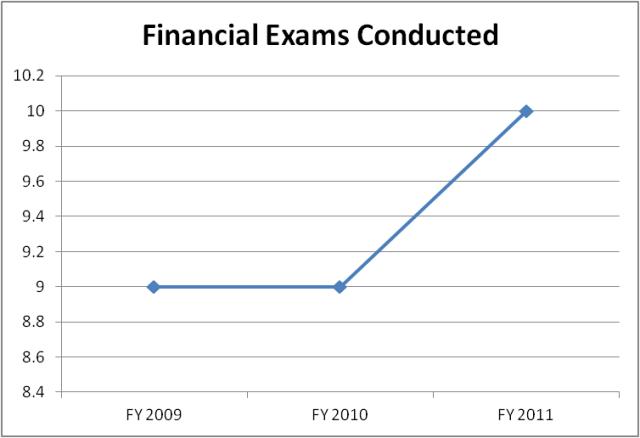

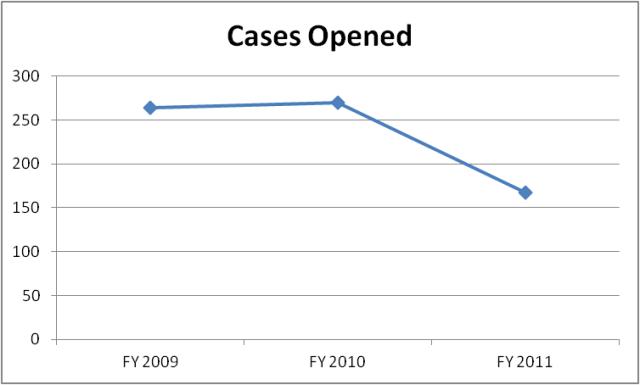

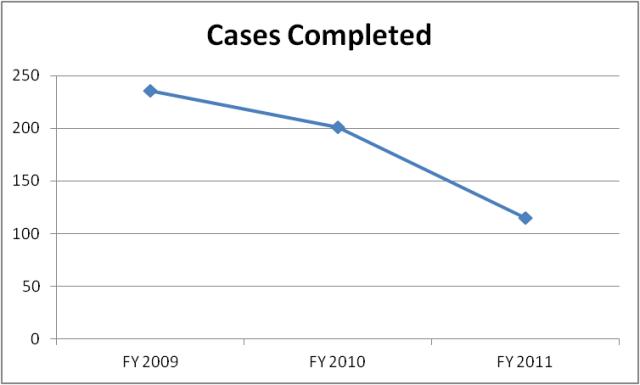

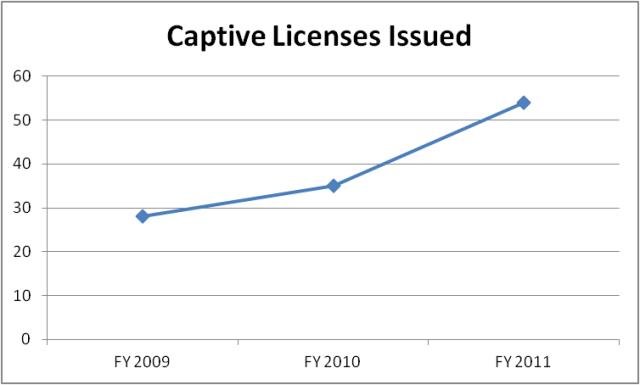

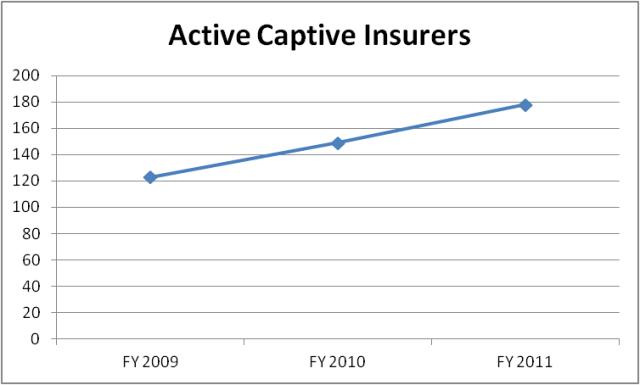

Producer Licensing is responsible for the issuance and renewal of licenses to all Utah insurance agents and agencies. Licensees qualify through examination. Financial Examination Division licenses approximately 1,600 insurance companies in Utah. It also monitors financial strength and solvency. The division is responsible for the financial examination of insurers according to statute. Because not all of the companies are headquartered in Utah, the examiners may spend their time out of state. The Insurance Department is reimbursed by the insurer being examined for all costs incurred during the examination, which includes examiners salaries, benefits and travel expenses. These reimbursements are deposited into the Insurance Department Restricted Account. Property and Casualty and Health, and Life Divisions function by line of insurance. These divisions handle telephone and walk-in complaints and inquiries from the public. They review and analyze policy forms and rates filed by insurance companies and assist consumers with complaints about insurance products and companies. The Health and Life Division also operates a federal grant "Grants to Support States in Health Insurance Rate Review Grant Cycle II". Market Conduct Division investigates and enforces the insurance code violations referred from the insurance industry and other divisions of the department. Performance The Insurance Department uses the following performance measures: consumer inquiries/complaints received, financial exams conducted, fraud cases opened, fraud cases completed, captive insurers licenses issued, and the number of active captive insurers. Data is shown below.       Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $5,919,900 | $5,689,700 | $5,118,500 | $5,357,800 | $0 | | General Fund, One-time | $0 | $278,100 | $72,500 | ($25,000) | $0 | | Federal Funds | $0 | $0 | $0 | $171,800 | $1,049,900 | | Dedicated Credits Revenue | $3,695,800 | $2,718,400 | $2,830,500 | $1,967,500 | ($5,400) | | GFR - Guaranteed Asset Protection Waiver | $0 | $0 | $11,800 | $89,000 | $89,000 | | GFR - Insurance Department Account | $0 | $0 | $0 | $0 | $5,894,900 | | GFR - Insurance Fraud Investigation | $0 | $0 | $0 | $0 | $1,984,500 | | GFR - Relative Value Study | $0 | $0 | $0 | $0 | $90,000 | | GFR - Technology Development | $0 | $0 | $0 | $784,900 | $645,700 | | GFR - Criminal Background Check | $0 | $0 | $0 | $162,500 | $165,000 | | GFR - Captive Insurance | $0 | $0 | $0 | $664,400 | $688,900 | | Beginning Nonlapsing | $1,695,200 | $1,859,700 | $1,399,300 | $282,600 | $15,100 | | Closing Nonlapsing | ($1,861,400) | ($1,399,300) | ($282,600) | ($366,200) | $0 | | Lapsing Balance | ($52,400) | ($34,400) | ($593,800) | ($731,700) | $0 | | Total | $9,397,100 | $9,112,200 | $8,556,200 | $8,357,600 | $10,617,600 |

|---|

| | Programs: | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Administration | $6,088,000 | $6,111,700 | $5,324,000 | $5,416,200 | $6,944,800 | | Relative Value Study | $33,000 | $69,200 | $192,100 | $6,200 | $90,600 | | Insurance Fraud Program | $2,662,300 | $2,144,200 | $2,086,100 | $1,685,200 | $1,993,700 | | Captive Insurers | $243,200 | $346,400 | $362,500 | $510,800 | $688,800 | | Electronic Commerce Fee | $370,600 | $440,700 | $586,900 | $587,800 | $645,700 | | GAP Waiver Program | $0 | $0 | $0 | $4,400 | $89,000 | | Office of Consumer Health Assistance | $0 | $0 | $4,600 | $0 | $0 | | Criminal Background Checks | $0 | $0 | $0 | $147,000 | $165,000 | | Total | $9,397,100 | $9,112,200 | $8,556,200 | $8,357,600 | $10,617,600 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $5,676,000 | $6,172,700 | $5,793,200 | $5,640,900 | $6,543,300 | | In-state Travel | $34,900 | $36,000 | $27,700 | $6,000 | $41,400 | | Out-of-state Travel | $149,200 | $102,800 | $36,300 | $52,500 | $111,000 | | Current Expense | $2,265,200 | $1,481,500 | $1,437,600 | $1,331,400 | $1,766,200 | | DP Current Expense | $1,239,300 | $1,310,400 | $1,261,400 | $1,318,500 | $1,360,000 | | DP Capital Outlay | $32,500 | $8,800 | $0 | $0 | $3,000 | | Capital Outlay | $0 | $0 | $0 | $8,300 | $0 | | Other Charges/Pass Thru | $0 | $0 | $0 | $0 | $792,700 | | Total | $9,397,100 | $9,112,200 | $8,556,200 | $8,357,600 | $10,617,600 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 95.0 | 91.0 | 91.0 | 84.0 | 82.0 | | Actual FTE | 0.0 | 0.0 | 75.4 | 84.0 | 0.0 | | Vehicles | 10 | 10 | 11 | 10 | 10 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Relative Value Study Function Under UCA 31A-22-307, the Relative Value Study is to determine the reasonable value of medical expenses. It is funded by a 0.01 percent tax on motor vehicle liability, uninsured motorist, and personal injury protection insurance premiums. Funds are collected by the Tax Commission as restricted funds in the Relative Value Study Restricted Account. The study is produced by the All-Payer Claims Data Base in the Office of Health Care Statistics in the Department of Health. The contract to produce the study is re-bid every three years. The department charges $10 per copy. Funding Detail | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Dedicated Credits Revenue | $93,500 | $100,200 | $100,100 | $95,500 | $600 | | GFR - Relative Value Study | $0 | $0 | $0 | $0 | $90,000 | | Beginning Nonlapsing | $210,900 | $269,700 | $300,700 | $208,700 | $0 | | Closing Nonlapsing | ($271,400) | ($300,700) | ($208,700) | $0 | $0 | | Lapsing Balance | $0 | $0 | $0 | ($298,000) | $0 | | Total | $33,000 | $69,200 | $192,100 | $6,200 | $90,600 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $0 | $0 | $145,900 | $0 | $0 | | Current Expense | $23,500 | $63,200 | $39,600 | $200 | $82,600 | | DP Current Expense | $9,500 | $6,000 | $6,600 | $6,000 | $8,000 | | Total | $33,000 | $69,200 | $192,100 | $6,200 | $90,600 |

|---|

Subcommittee Table of ContentsProgram: Insurance Fraud Program Function The 1994 Legislature created the Insurance Fraud Act (UCA 31A-31-101 through 108) and the department created the Insurance Fraud Division. It conducts criminal investigations and prosecutes insurance fraud violators. Nationwide, insurance fraud is estimated at over $3 billion per year. The program is funded by the Insurance Fraud Investigation Restricted Account. Funding Detail Funding for the Insurance Fraud program is largely from the Insurance Fraud Investigation Restricted Account. Funds are used mainly for staff and corresponding current expense costs. | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | General Fund | $0 | $76,000 | $0 | $0 | $0 | | Federal Funds | $0 | $0 | $0 | $5,700 | $0 | | Dedicated Credits Revenue | $2,831,200 | $1,819,600 | $1,896,200 | $1,872,000 | ($5,900) | | GFR - Insurance Fraud Investigation | $0 | $0 | $0 | $0 | $1,984,500 | | Beginning Nonlapsing | $343,500 | $512,400 | $263,800 | $73,900 | $15,100 | | Closing Nonlapsing | ($512,400) | ($263,800) | ($73,900) | $0 | $0 | | Lapsing Balance | $0 | $0 | $0 | ($266,400) | $0 | | Total | $2,662,300 | $2,144,200 | $2,086,100 | $1,685,200 | $1,993,700 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Personnel Services | $911,200 | $1,107,400 | $1,041,400 | $790,000 | $1,006,000 | | In-state Travel | $29,200 | $30,000 | $25,700 | $4,300 | $27,000 | | Out-of-state Travel | $37,700 | $21,200 | $13,900 | $13,000 | $15,300 | | Current Expense | $1,636,500 | $917,500 | $920,100 | $827,500 | $889,900 | | DP Current Expense | $47,700 | $59,300 | $85,000 | $50,400 | $55,500 | | DP Capital Outlay | $0 | $8,800 | $0 | $0 | $0 | | Total | $2,662,300 | $2,144,200 | $2,086,100 | $1,685,200 | $1,993,700 |

|---|

| | Other Indicators | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Budgeted FTE | 21.0 | 21.0 | 21.0 | 13.0 | 13.0 | | Actual FTE | 0.0 | 0.0 | 12.0 | 13.0 | 0.0 | | Vehicles | 10 | 10 | 11 | 10 | 10 |

|

|

|

|

|

|

Subcommittee Table of ContentsProgram: Electronic Commerce Fee Function The Captive Insurance Division was created in 2003 when the Captive Insurance Companies Act (UCA 31A-37-101 through 604) was passed by the Legislature. The division licenses captive insurance companies formed by companies to manage their risk exposure. It licenses captive insurance companies, monitors their solvency and financial strength. The division is funded by the Captive Insurance Restricted Account. Currently, the division regulates 185 Utah domiciled companies. Funding Detail Funding for the Captive Insurers program is used to fund data processing current expense. | Sources of Finance | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Dedicated Credits Revenue | $479,700 | $415,000 | $448,300 | $0 | $0 | | GFR - Technology Development | $0 | $0 | $0 | $784,900 | $645,700 | | Beginning Nonlapsing | $522,500 | $631,600 | $605,900 | $0 | $0 | | Closing Nonlapsing | ($631,600) | ($605,900) | $0 | ($197,100) | $0 | | Lapsing Balance | $0 | $0 | ($467,300) | $0 | $0 | | Total | $370,600 | $440,700 | $586,900 | $587,800 | $645,700 |

|---|

| | Categories of Expenditure | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Approp | | Out-of-state Travel | $1,200 | $0 | $0 | $0 | $0 | | Current Expense | $47,900 | $0 | $0 | $0 | $0 | | DP Current Expense | $321,500 | $440,700 | $586,900 | $587,800 | $645,700 | | Total | $370,600 | $440,700 | $586,900 | $587,800 | $645,700 |

|---|

Subcommittee Table of Contents |