Compendium of Budget Information for the 2012 General Session

| Business, Economic Development, & Labor Appropriations Subcommittee | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Subcommittee Table of Contents | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Agency: Financial Institutions Function The Department of Financial Institutions regulates state-chartered deposit taking institutions including banks, savings and loan associations, credit unions, and industrial banks. It also regulates third-party payment providers, independent escrow companies, check cashers, deferred deposit (payday) lenders, title lenders, mortgage loan servicers and consumer credit lenders operating in Utah. The Department of Financial Institutions promotes the availability of sound financial services through chartering, regulating, and supervising. The department is open to establishing new and enhancing existing financial products. Financial Institutions regulates 95 depository institutions including: 29 commercial banks, 46 credit unions, and 20 industrial banks. It also regulates 2 trust companies, 48 travelers check or money order issuers, 3 independent escrow companies, 64 check cashers, 180 deferred deposit lenders, 63 title lenders and 162 residential first mortgage loan servicers. The department employs 50 people. Two primary department goals are 1) to complete the number of examinations required to maintain the health of the State-chartered banking and credit union systems in Utah and 2) to remain accredited by its financial institution peers in an interstate banking environment. The department's primary activity is the examination of depository institutions for safety, soundness, and compliance with applicable state and federal laws and rules. In the case of depository institutions, its statutory charge is to charter, regulate, supervise and safeguard the interest of shareholders, members, depositors, and borrowers, through on site examinations and remedial action orders. Specialty examinations are performed at each depository institution and if the financial condition of a depository institution requires it, semi-annual or quarterly follow-up examinations are performed to review its current financial condition. The optimum number of examinations required each fiscal year is based upon the number of institutions under the department's jurisdiction. The financial condition of the institutions and the industry also influence the number of examinations. Each depository institution, deferred deposit lender, check cashers, and title lender is examined at least once every 12 to 15 months. Statutory Authority For persons or entities that provide financial services to the public, the Department's statutory requirement is that consumer credit terms be lawful, easily understood, and fully disclosed. The following statutory references govern Utah's financial institutions and can be found in the Utah Code Annotated in the following places:

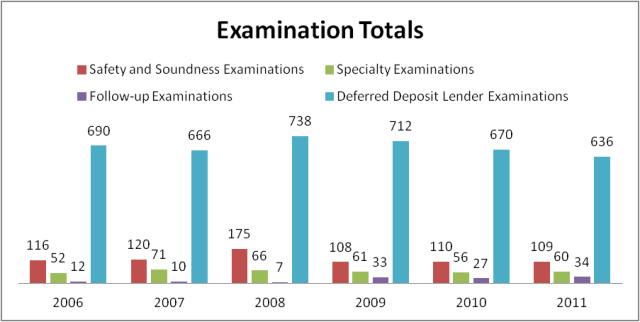

Performance The Department performed 839 total examinations in FY 2011. These examinations include: safety and soundness, specialty, follow-up, and deferred deposit lender. The following chart is a historical graph of the Department's examination performance.  The Conference of State Bank Supervisors (CSBS) and the National Association of State Credit Union Supervisors (NASCUS)are two organizations that oversee accreditation requirements and standards nationwide. In order to maintain their accreditation, departments must maintain a 75% rating. The Department most recently received a score of 86.2% from CSBS, and a 92.92% score from NASCUS. Funding Detail Financial Institutions is funded primarily through assessments on financial institutions it regulates.

|