Budget Year Ends with $64 Million Remaining in the Minimum School Program - Ben Leishman Last Updated: September 27, 2013

What! Utah schools left $64 million unspent in the Minimum School Program (MSP) last year? No, in reality, several factors outside the control of the public schools can result in unspent funding at the end of each year. The interplay between various estimates used to develop the budget and the actual outcome of these estimates results in the nonlapsing balance.

The Legislature relies on estimates to build the budget for the MSP each year. These estimates are developed by the Common Data Committee (CDC), which includes representatives from the Legislative Fiscal Analyst, the Governor's Office of Management and Budget, and the Utah State Office of Education. Through a consensus process, the CDC develops estimates for the following factors:

- Weighted Pupil Units - The WPU estimate is largely based on the number of students expected to enroll in the public schools during the next budget year. Statutes detail how school districts and charter schools generate WPUs based on various student or program characteristics. When combined, these WPUs determine how much funding is required to support several programs in the MSP. If school districts and charter schools generate fewer WPUs than estimated, a balance will accrue in the MSP.

- Taxable Value of Property - WPUs are funded from two primary sources: state revenues (Education Fund/Uniform School Fund) and local property taxes. School districts must levy a property tax called the Basic Rate to participate in the MSP. The taxable value of property helps in determining how much local revenue will be generated to support the cost of the MSP. Local revenue generated from the Basic Rate is applied to the program cost first, then the balance is funded with state revenues. If local revenue is underestimated, less state revenue is required to support the cost of the program than anticipated, and a balance will accrue in the MSP.

- Basic Rate - The Legislature estimates the Basic Tax Rate in statute each year. The Tax Commission sets the actual rate later in the year to generate the amount revenue authorized by the Legislature in statute. School districts charge the same rate, however, the amount of revenue generated by each school district will vary. The value of property, collection rate, and other factors will alter how much the Basic Rate will generate in each taxing jurisdiction. The Tax Commission uses these factors in estimating the Basic Rate which contributes to the accrual of balances in the program.

Of the $64 million nonlapsing balance in FY 2013, approximately $50.6 million is attributed by the Utah State Office of Education to the estimates mentioned above. The remaining $13.4 million is made up of unspent balances in several programs. This amount may decrease as school districts and charter schools make final payments to teachers and programs for summer-related activities.

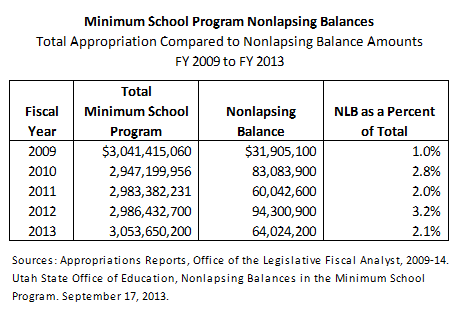

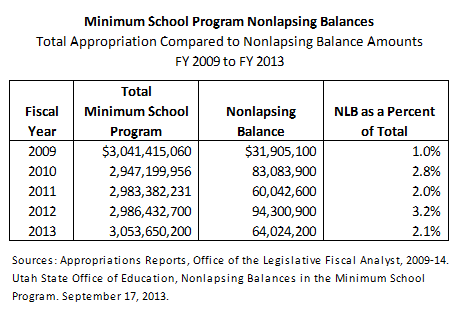

Over the past five years, the MSP nonlapsing balance has ranged from $31.9 million to $94.3 million, or between 1 percent and 3.2 percent of the total MSP appropriation. The following table details the total MSP appropriation and nonlapsing balance amounts for each of the past five fiscal years.

A variance of 1 to 3.2 percent of the total appropriation doesn't seem large, but the dollar value associated with that variance is substantial. For example, in FY 2012 nearly $95 million in appropriated funding was not distributed to the public schools, largely based on the outcome of the estimates mentioned above and other statutory provisions.

Looking closer at the factors used in estimating the cost of the MSP reveals that the CDC is good at estimating WPUs. In the past five years, the variance between the WPU estimate used in the budgeting process and the actual number of WPUs generated by the school districts and charter schools has ranged from -0.3 percent to 0.5 percent. However, the variance between the estimated local revenue collected by the Basic Rate and the actual local revenue collected has a much greater range of 0.2 percent to 11.6 percent.

In setting the Basic Rate for FY 2014, the Tax Commission used a different methodology to reduce the anticipated variance between estimated and actual collections. The CDC is in the process of evaluating the estimating process used to determine the value of local property and the estimated local revenue in the FY 2015 budget. The combination of these efforts should result in a closer estimate and reduce the amount of nonlapsing balances remaining in the MSP at the end of the year. By the end of FY 2015, we will have a better understanding of the impact of these changes on MSP nonlapsing balances.

In the past, MSP nonlapsing balances have helped the Legislature solve some tricky budget problems. For example, the Legislature was able to fix a $25 million estimation error following the 2012 General Session largely with MSP nonlapsing balances. However, tightening the variance between these estimates and actual experience will ensure appropriated funding is distributed to school districts and charter schools in the fiscal year intended by the Legislature.

What! Utah schools left $64 million unspent in the Minimum School Program (MSP) last year? No, in reality, several factors outside the control of the public schools can result in unspent funding at the end of each year. The interplay between various estimates used to develop the budget and the actual outcome of these estimates results in the nonlapsing balance.

The Legislature relies on estimates to build the budget for the MSP each year. These estimates are developed by the Common Data Committee (CDC), which includes representatives from the Legislative Fiscal Analyst, the Governor's Office of Management and Budget, and the Utah State Office of Education. Through a consensus process, the CDC develops estimates for the following factors:

- Weighted Pupil Units - The WPU estimate is largely based on the number of students expected to enroll in the public schools during the next budget year. Statutes detail how school districts and charter schools generate WPUs based on various student or program characteristics. When combined, these WPUs determine how much funding is required to support several programs in the MSP. If school districts and charter schools generate fewer WPUs than estimated, a balance will accrue in the MSP.

- Taxable Value of Property - WPUs are funded from two primary sources: state revenues (Education Fund/Uniform School Fund) and local property taxes. School districts must levy a property tax called the Basic Rate to participate in the MSP. The taxable value of property helps in determining how much local revenue will be generated to support the cost of the MSP. Local revenue generated from the Basic Rate is applied to the program cost first, then the balance is funded with state revenues. If local revenue is underestimated, less state revenue is required to support the cost of the program than anticipated, and a balance will accrue in the MSP.

- Basic Rate - The Legislature estimates the Basic Tax Rate in statute each year. The Tax Commission sets the actual rate later in the year to generate the amount revenue authorized by the Legislature in statute. School districts charge the same rate, however, the amount of revenue generated by each school district will vary. The value of property, collection rate, and other factors will alter how much the Basic Rate will generate in each taxing jurisdiction. The Tax Commission uses these factors in estimating the Basic Rate which contributes to the accrual of balances in the program.

Of the $64 million nonlapsing balance in FY 2013, approximately $50.6 million is attributed by the Utah State Office of Education to the estimates mentioned above. The remaining $13.4 million is made up of unspent balances in several programs. This amount may decrease as school districts and charter schools make final payments to teachers and programs for summer-related activities.

Over the past five years, the MSP nonlapsing balance has ranged from $31.9 million to $94.3 million, or between 1 percent and 3.2 percent of the total MSP appropriation. The following table details the total MSP appropriation and nonlapsing balance amounts for each of the past five fiscal years.

A variance of 1 to 3.2 percent of the total appropriation doesn't seem large, but the dollar value associated with that variance is substantial. For example, in FY 2012 nearly $95 million in appropriated funding was not distributed to the public schools, largely based on the outcome of the estimates mentioned above and other statutory provisions.

Looking closer at the factors used in estimating the cost of the MSP reveals that the CDC is good at estimating WPUs. In the past five years, the variance between the WPU estimate used in the budgeting process and the actual number of WPUs generated by the school districts and charter schools has ranged from -0.3 percent to 0.5 percent. However, the variance between the estimated local revenue collected by the Basic Rate and the actual local revenue collected has a much greater range of 0.2 percent to 11.6 percent.

In setting the Basic Rate for FY 2014, the Tax Commission used a different methodology to reduce the anticipated variance between estimated and actual collections. The CDC is in the process of evaluating the estimating process used to determine the value of local property and the estimated local revenue in the FY 2015 budget. The combination of these efforts should result in a closer estimate and reduce the amount of nonlapsing balances remaining in the MSP at the end of the year. By the end of FY 2015, we will have a better understanding of the impact of these changes on MSP nonlapsing balances.

In the past, MSP nonlapsing balances have helped the Legislature solve some tricky budget problems. For example, the Legislature was able to fix a $25 million estimation error following the 2012 General Session largely with MSP nonlapsing balances. However, tightening the variance between these estimates and actual experience will ensure appropriated funding is distributed to school districts and charter schools in the fiscal year intended by the Legislature.