Agency: Health Line Item: Medicaid Optional Services Function The federal Centers for Medicare and Medicaid Services (CMS) designates which services in Medicaid are optional. An optional service means that a state does not have to provide the service for most Medicaid clients. These 38 optional services are eligible for the State's federal matching funds. These services include pharmacy, dental, ambulatory surgery, chiropractic, podiatry, physical therapy, vision care, substance abuse treatment, hearing, speech, dialysis clinics, surgical centers, alcohol and drug clinics, intermediate care facilities individuals with intellectual disabilities, personal care, hospice, and private duty nursing. As noted in the Medicaid Mandatory Services section, some of these services may be mandatory for certain populations or in certain settings. While the service as a whole may be optional, once the State elects to offer that service to a specific group, it must make it available to all qualified eligibles in that group. Alternatively, when the State decides to stop or start providing a particular service, it must submit a State Plan Amendment to CMS, notify clients thirty days in advance, and provide a public notice at least one day before the change.

There are 11 optional services that Utah does not provide in its Medicaid program: adult dental services, home health occupational therapy; home health speech and language; eyeglasses; home health audiology; speech, hearing and language; nurse anesthetist; chiropractor; Program of All-Inclusive Care for the Elderly; respiratory care; and qualified Religious Nonmedical Health Care Institutions. There are 13 programs within the Medicaid Optional Services line item: Capitated Mental Health Services, Pharmacy, Non-service Expenses, Home and Community Based Waivers Services, Dental Services, Intermediate Care Facilities for Individuals with Intellectual Disabilities, Buy-in/Buy-out, Mental Health Inpatient Hospital, Hospice Care Services, Vision Care, Disproportionate Share Hospital Payments, Clawback Payments, and Other Optional Services. Medicaid Optional Services also includes the Primary Care Network and Utah's Premium Partnership for Health Insurance. The Division of Aging and Adult Services has a Medicaid waiver to pay for some services in home and community-based settings. The waiver diverts some elderly people from nursing facility care. The waiver has an enrollment cap and maintains a waiting list for those seeking to receive services. Based on a needs assessment, an individual may receive some or all of the following services: adult companion, adult day health, case management, chores, emergency response systems, environmental accessibility adaptations, fiscal management, home delivered supplemental meals, homemaker, medication reminder systems, non-medical transportation, personal attendant program training, personal attendant, respite care, specialized medical equipment, and supportive maintenance home health aide. Historically, the Legislature has directed the Department of Human Services to maximize federal funds, often through accessing Medicaid for Human Services when possible. Certain services and clients of the Department of Human Services qualify for funding under the Medicaid Program. Some of the programs that receive Medicaid funding are: the Utah State Hospital, the Utah State Developmental Center, Home and Community Based Waivers in the Divisions of Aging and Adult Services, Services for People with Disabilities, Juvenile Justice Services, and Child and Family Services. Medicaid Work Incentive Program Utah has opted to cover individuals with disabilities who are working through the Medicaid program. The program is called the Medicaid Work Incentive Program. To qualify an individual with disabilities who is working can have countable income up to 250% of the Federal Poverty Level. Countable income generally is half of all earned income. Based on the individuals' income, they pay the following percentage of their countable income in exchange for Medicaid services:

Statutory Authority Medicaid Optional Services is governed by several chapters of the Utah Health Code in Title 26 of the Utah Code. - UCA 26-18 establishes the Medical Assistance Program, commonly referred to as Medicaid and its administrative arm, the Division of Medicaid and Health Financing.

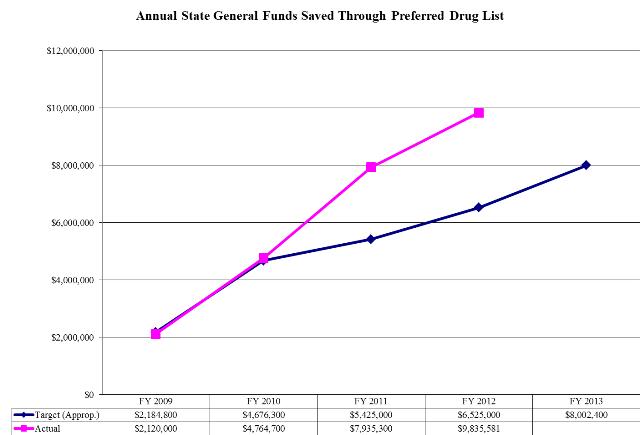

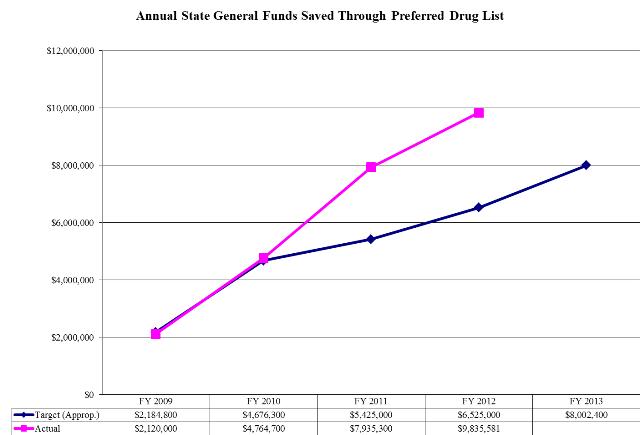

- UCA 26-18-2.4(1)(c) Preferred Drug List -- try preferred drugs first for certain drug classes unless the prescribing physician obtains prior approval.

- UCA 26-18-2.6 requires the Department to bid out dental services via 100% risk-based contracts at least once every five years.

- UCA 26-18-3.5 describes the functions of the Primary Care Network and Utah's Premium Partnership for Health Insurance.

- UCA 26-18-105 authorizes the Drug Utilization Review Board which reviews prescription drugs for creating a prior approval requirement.

- UCA 26-18-604 requires the Department of Health to keep pharmacy costs as low as possible through an annual review of all drug prices as well as checking the availability of generics.

- UCA 26-19 authorizes the Department of Health to recover Medicaid benefits paid by the Division from third parties, including estates and trusts.

- UCA 58-17b-606(4) requires pharmacists to use generic drugs, when available, for clients served by the Department of Health in most cases unless the prescribing physician obtains prior approval for a brand name drug or the name brand drug costs less.

Intent Language The Legislature intends that the Department of Health fund the cost of covering emergency dental services for adults on Medicaid within existing appropriations up to $250,000 General Fund for FY 2013 as an offset for current emergency room expenditures. If existing appropriations prove to be insufficient, the Legislature intends that the Department of Health request funding in future years to cover the costs of providing these services. The Department shall report to the Office of the Legislative Fiscal Analyst by January 1, 2013 on the net cost of providing these services. The report shall include recommendations if the services should be continued. The Legislature intends that the Department of Health use the appropriations of $3,000,000 to provide services and treatment for children with autism spectrum disorder between the age of two to six years within Medicaid. Under Section 63J-1-603 of the Utah Code, the Legislature intends that up to $4,500,000 of appropriations provided for the Department of Health - Medicaid Optional Services line item not lapse at the close of Fiscal Year 2012. The use of any nonlapsing funds is limited to the autism waiver program to provide services and treatment for children with autism spectrum disorder between the age of two to six years. Under Section 63J-1-603 of the Utah Code, the Legislature intends that up to $4,500,000 of appropriations provided for the Department of Health - Medicaid Optional Services line item not lapse at the close of Fiscal Year 2013. The use of any nonlapsing funds is limited to the autism waiver program to provide services and treatment for children with autism spectrum disorder between the age of two to six years. Funding Detail For analysis of current budget requests and discussion of issues related to this budget click here. Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $107,538,200 | $95,207,800 | $112,580,100 | $111,104,000 | $129,720,800 | | General Fund, One-time | ($22,098,200) | ($28,024,800) | ($36,192,900) | $10,584,500 | $0 | | Federal Funds | $508,908,200 | $527,259,200 | $534,111,300 | $541,513,900 | $524,057,100 | | American Recovery and Reinvestment Act | $18,802,400 | $30,414,900 | $29,401,600 | $12,191,000 | $74,000,000 | | Dedicated Credits Revenue | $84,101,900 | $90,835,100 | $119,140,600 | $165,865,700 | $119,140,600 | | GFR - Medicaid Restricted | $4,962,500 | $76,000 | $0 | $0 | $0 | | GFR - Nursing Care Facilities Account | $1,454,300 | $1,654,300 | $1,589,000 | $2,741,100 | $2,851,300 | | Transfers | $1,233,100 | $0 | $0 | $0 | $0 | | Transfers - Fed Pass-thru | $0 | $0 | $3,330,100 | $0 | $3,330,100 | | Transfers - Intergovernmental | $54,922,700 | $35,846,200 | $3,790,700 | $0 | $16,315,500 | | Transfers - Medicaid - DHS | $57,005,400 | $65,258,500 | $64,528,900 | $70,205,000 | $75,258,400 | | Transfers - Medicaid - DWS | $558,900 | $150,100 | $0 | $0 | $0 | | Transfers - Medicaid - Internal DOH | $0 | $0 | $1,024,700 | $0 | $2,260,000 | | Transfers - Medicaid - USDB | $0 | $0 | $540,200 | $334,200 | $277,600 | | Transfers - Other Agencies | $0 | $654,000 | $0 | $131,100 | $0 | | Transfers - Within Agency | $2,719,900 | $1,034,100 | $549,600 | $1,583,000 | $423,900 | | Transfers - Workforce Services | $0 | $0 | $0 | $741,200 | $0 | | Transfers - Youth Corrections | $5,397,500 | $0 | $0 | $1,636,000 | $0 | | Pass-through | $38,000 | $0 | $0 | $0 | $0 | | Beginning Nonlapsing | $0 | $984,700 | $13,989,300 | $7,010,200 | $0 | | Closing Nonlapsing | ($984,700) | ($13,989,300) | ($7,010,200) | ($12,146,000) | $0 | | Lapsing Balance | $0 | ($124,000) | $0 | $0 | $0 | | Total | $824,560,100 | $807,236,800 | $841,373,000 | $913,494,900 | $947,635,300 |

|---|

| | | | | | Programs:

(click linked program name to drill-down) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Pharmacy | $160,825,500 | $170,059,100 | $166,316,100 | $182,403,600 | $132,159,300 | | Home and Community Based Waiver Services | $159,617,300 | $157,740,600 | $157,761,200 | $164,165,500 | $117,213,800 | | Capitated Mental Health Services | $175,485,000 | $161,948,500 | $143,517,800 | $138,909,500 | $144,111,300 | | Intermediate Care Facilities for Intellectually Disabled | $75,516,500 | $84,331,100 | $82,712,900 | $77,677,900 | $82,489,300 | | Non-service Expenses | $0 | $0 | $100,512,200 | $109,096,500 | $89,827,000 | | Buy-in/Buy-out | $39,434,300 | $36,273,700 | $32,717,900 | $41,196,000 | $39,240,100 | | Dental Services | $38,175,800 | $31,401,000 | $35,658,400 | $38,838,000 | $35,658,400 | | Clawback Payments | $0 | $0 | $0 | $28,713,700 | $32,800,000 | | Disproportionate Hospital Payments | $0 | $0 | $0 | $34,060,700 | $26,000,000 | | Mental Health Inpatient Hospital | $0 | $0 | $0 | $0 | $20,685,400 | | Hospice Care Services | $0 | $0 | $14,197,400 | $13,948,700 | $15,394,400 | | Vision Care | $2,108,900 | $2,081,700 | $2,289,500 | $2,265,700 | $2,289,500 | | Other Optional Services | $173,396,800 | $163,401,100 | $105,689,600 | $82,219,100 | $209,766,800 | | Total | $824,560,100 | $807,236,800 | $841,373,000 | $913,494,900 | $947,635,300 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Personnel Services | $103,800 | $3,400 | $382,400 | $119,500 | $297,900 | | Out-of-state Travel | $300 | $0 | $0 | $17,200 | $0 | | Current Expense | $70,000 | $16,941,700 | $25,600 | $1,678,900 | $25,200 | | DP Current Expense | $600 | $0 | $900 | $20,300 | $0 | | Other Charges/Pass Thru | $824,385,400 | $790,291,700 | $840,964,100 | $911,659,000 | $947,312,200 | | Total | $824,560,100 | $807,236,800 | $841,373,000 | $913,494,900 | $947,635,300 |

|---|

| | | | | | | Other Indicators | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Budgeted FTE | 0.1 | 0.0 | 0.6 | 0.0 | 3.0 | | Actual FTE | 49.1 | 33.1 | 2.3 | 1.2 | 0.0 |

|

|

|

|

|

|

|---|

Subcommittee Table of ContentsProgram: Pharmacy Function The Pharmacy Program manages prescription drugs for all Medicaid members. For prescriptions issued by a doctor to Medicaid clients, Utah Medicaid will pay for covered medications. There are no known Utah pharmacies that do not accept Medicaid reimbursement for prescription drugs. Most non-pregnant adults pay a $3 co-pay per prescription with some limits on total out of pocket costs. The lowest price of four different calculations for each drug determines reimbursement. Below is a list of each calculation:

- Estimated Acquisition Cost -- Average Wholesale Price (this is the pharmaceutical industry's equivalent of a catalog price for all of its drugs) minus 17.4%.

- Federal Maximum Allowable Cost -- Federal law establishes maximum price.

- Utah Maximum Allowable Cost -- Utah has the option to set maximum prices for its drug reimbursements.

- Usual and Customary Charges -- This is the amount the provider typically charges private pay patients.

The following drugs traditionally have been dispensed in the largest volume within Medicaid: depression, schizophrenia, bipolar disorders, attention deficit-hyperactivity disorder, and pain management.Obtaining prescription drugs in Medicaid is influenced by the following laws and cost saving efforts: Federal Law: - Medicaid must provide access to all prescribed drugs for drugs that provide rebates (few drugs are excluded).

State Law: - Generic drugs, when available, must be used in most cases unless prior approval for a brand name drug is obtained or the brand name drug costs less.

- Preferred Drug List -- try preferred drugs first for certain drug classes unless prior approval is obtained. The Pharmacy and Therapeutics Committee, which is composed of pharmacists and physicians, recommended which drugs are preferred. The committee recommends which drugs are preferred based on equivalency in efficacy and safety. Utah participates in the Sovereign States Drug Consortium, which negotiates with drug manufacturers to obtain supplemental rebates in exchange for having their drugs be the preferred drug for certain medical conditions.

- Drug Utilization Review Board -- determines if drugs subject to misuse need a prior approval, reviews drugs for acceptable off-label uses, and in recommending prior authorization for some drugs can consider costs.

Department-initiated Effort: - Contract with a drug regimen review center - review some Medicaid cases monthly for potential adverse drug reactions and/or duplicate prescriptions.

- Hemophilia disease management program -- products supplied to patients through a sole source contract.

- Abuse potential/drug over utilization -- clients considered for the Restriction Program when they take several drugs with high potential for addiction and/or are receiving similar prescriptions from two or more providers for potentially addictive drugs. The Restriction Program limits clients to a single pharmacy from which they can receive their prescriptions.

The Medicaid Program requires tamper-resistant pads for written prescriptions. Such pads have three characteristics: - One or more industry-recognized features designed to prevent unauthorized copying of a completed or blank prescription form.

- One or more industry-recognized features designed to prevent the erasure or modification of information written on the prescription by the prescriber.

- One or more industry-recognized features designed to prevent the use of counterfeit prescription forms.

If a pharmacy fills a prescription that does not comply with the requirements above, then Medicaid will recover the funds paid by Medicaid. Prescribers have to ensure that pads used to write Medicaid prescriptions meet the "tamper-resistant" requirements. If not, the patient will likely be required to get another prescription written on an approved prescription form. Performance  Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $38,876,700 | $44,342,600 | $20,254,700 | $29,168,800 | $15,997,600 | | General Fund, One-time | $1,741,200 | ($10,330,400) | ($8,980,800) | ($773,100) | $0 | | Federal Funds | $58,567,600 | $78,654,200 | $61,494,900 | $68,881,600 | $39,724,900 | | American Recovery and Reinvestment Act | $8,176,300 | $6,573,500 | $10,131,400 | $0 | $0 | | Dedicated Credits Revenue | $54,461,500 | $63,918,900 | $76,331,700 | $90,008,000 | $76,331,700 | | GFR - Medicaid Restricted | $0 | $76,000 | $0 | $0 | $0 | | Transfers - Medicaid - DHS | ($71,100) | $7,400 | $105,100 | $0 | $105,100 | | Transfers - Medicaid - DWS | $40,300 | $146,300 | $0 | $0 | $0 | | Transfers - Within Agency | $600 | $0 | $0 | $254,100 | $0 | | Beginning Nonlapsing | $0 | $984,700 | $13,989,300 | $7,010,200 | $0 | | Closing Nonlapsing | ($967,600) | ($14,314,100) | ($7,010,200) | ($12,146,000) | $0 | | Total | $160,825,500 | $170,059,100 | $166,316,100 | $182,403,600 | $132,159,300 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Personnel Services | $103,800 | $3,400 | $382,400 | $84,900 | $297,900 | | Out-of-state Travel | $300 | $0 | $0 | $0 | $0 | | Current Expense | $29,900 | $16,941,700 | $25,600 | $17,700 | $25,200 | | DP Current Expense | $600 | $0 | $900 | $200 | $0 | | Other Charges/Pass Thru | $160,690,900 | $153,114,000 | $165,907,200 | $182,300,800 | $131,836,200 | | Total | $160,825,500 | $170,059,100 | $166,316,100 | $182,403,600 | $132,159,300 |

|---|

| | | | | | | Other Indicators | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Budgeted FTE | 0.1 | 0.0 | 0.6 | 0.0 | 3.0 | | Actual FTE | 0.1 | 0.1 | 1.8 | 0.4 | 0.0 |

|

|

|

|

|

|

|---|

Subcommittee Table of ContentsProgram: Home and Community Based Waiver Services Function Medicaid clients must meet nursing facility level of care as described in Administrative Rule R414.502 in order to be eligible for the Home and Community Based Waiver Services. Clients must meet two of the following three conditions: (1) require substantial physical assistance for activities of daily living, (2) certain level of dysfunction in cognition, and (3) a less structured setting cannot meet the level of care needed. The State has six home and community based waiver programs. Two are administered directly by the Utah Department of Health (Waiver for Children who are Technology Dependent and the New Choices Waiver). Three are administered by the Division of Services for People with Disabilities in the Department of Human Services (Acquired Brain Injury Waiver, Community Supports Waiver for Individuals with Intellectual Disabilities and Other Related Conditions, and the Waiver for Individuals with Physical Disabilities). One is administered by the Division of Aging and Adult Services in the Department of Human Services (Waiver for Individuals Aged 65 and Older). The Department of Health is appropriated State General Funds for the two waivers it oversees directly. The Department of Human Services is appropriated State General Funds for the four waivers that it oversees. The federal government must specifically approve all waiver programs. One criteria for approval requires that waiver services cost less than or equal to the cost of services in an institutional setting. The waivers can offer new or expanded benefits to specific groups of individuals in exchange for reducing or maintaining overall costs to the program. New Choices Waiver The goal of the New Choices Waiver is to move clients out of nursing homes into home and community based services. In addition to the normal Medicaid requirements to receive nursing home services, a client must have been living in a nursing home a minimum of 90 days to qualify for this waiver. The waiver serves up to 1,200 clients. Autism Waiver The Autism Waiver is a pilot project to provide proven effective services for children between the ages of two to six with autism spectrum disorder. The waiver serves up to 300 children. The Department of Human Services administers the waiver. Waiver for Children who are Technology Dependent The Waiver for Children who are Technology Dependent serves medically fragile children, who are technology dependent. Without this waiver nursing homes would serve these children. The waiver serves up to 120 clients. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $0 | $0 | $2,232,600 | $1,042,900 | $0 | | General Fund, One-time | $0 | $0 | ($2,084,700) | $0 | $0 | | Federal Funds | $122,646,800 | $112,971,500 | $121,852,000 | $115,527,400 | $79,146,600 | | American Recovery and Reinvestment Act | $2,500 | $0 | ($2,800) | $0 | $0 | | Transfers - Medicaid - DHS | $36,971,600 | $44,769,100 | $35,764,100 | $47,595,200 | $38,067,200 | | Pass-through | $9,600 | $0 | $0 | $0 | $0 | | Closing Nonlapsing | ($13,200) | $0 | $0 | $0 | $0 | | Total | $159,617,300 | $157,740,600 | $157,761,200 | $164,165,500 | $117,213,800 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Personnel Services | $0 | $0 | $0 | $11,400 | $0 | | Other Charges/Pass Thru | $159,617,300 | $157,740,600 | $157,761,200 | $164,154,100 | $117,213,800 | | Total | $159,617,300 | $157,740,600 | $157,761,200 | $164,165,500 | $117,213,800 |

|---|

| | | | | | | Other Indicators | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Actual FTE | 0.0 | 0.0 | 0.0 | 0.2 | 0.0 |

|

|

|

|

|

|

|---|

Subcommittee Table of ContentsProgram: Capitated Mental Health Services Function In order to qualify for managed care Capitated Mental Health Services, a Medicaid client must live in a county covered by a Prepaid Mental Health Plan (PMHP) 1915(b) Freedom of Choice waiver. PMHPs cover 27 of Utah's 29 counties and provide inpatient hospital and outpatient mental health services through at-risk, capitated contracts. Local mental health authorities must provide the services or contract for them. In Wasatch and San Juan Counties, the two counties without a PMHP, mental health services are provided on a fee-for-service basis. A licensed mental health therapist must provide or supervise these services. A potential mental health client must receive a psychiatric diagnostic interview examination to assess the existence, nature, or extent of illness, injury or other health deviation for the purpose of determining the client's need for mental health services. Qualifying patients must have a written individual treatment plan. The treatment plan must contain measurable treatment goals related to problems identified in the psychiatric diagnostic interview examination. The treatment plan must focus on improving and/or stabilizing the client's condition. The provider must review treatment plans at least once every 6 months. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $1,667,700 | $15,253,400 | $5,053,500 | $508,700 | $0 | | General Fund, One-time | $700,000 | $0 | ($2,048,900) | $0 | $0 | | Federal Funds | $134,343,500 | $115,659,000 | $113,547,900 | $97,561,800 | $102,304,600 | | American Recovery and Reinvestment Act | $356,300 | $0 | $99,800 | $0 | $0 | | Dedicated Credits Revenue | $25,070,200 | $18,341,700 | $22,177,800 | $31,024,900 | $22,177,800 | | Transfers - Intergovernmental | $0 | $9,830,500 | $0 | $0 | $1,870,700 | | Transfers - Medicaid - DHS | $7,522,900 | $2,539,100 | $4,687,700 | $9,527,800 | $17,758,200 | | Transfers - Medicaid - DWS | $398,300 | $0 | $0 | $0 | $0 | | Transfers - Within Agency | $0 | $0 | $0 | $286,300 | $0 | | Transfers - Youth Corrections | $5,397,500 | $0 | $0 | $0 | $0 | | Pass-through | $28,400 | $0 | $0 | $0 | $0 | | Closing Nonlapsing | $200 | $324,800 | $0 | $0 | $0 | | Total | $175,485,000 | $161,948,500 | $143,517,800 | $138,909,500 | $144,111,300 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $175,485,000 | $161,948,500 | $143,517,800 | $138,909,500 | $144,111,300 | | Total | $175,485,000 | $161,948,500 | $143,517,800 | $138,909,500 | $144,111,300 |

|---|

Subcommittee Table of ContentsProgram: Intermediate Care Facilities for Intellectually Disabled Function A special group of nursing facilities is Intermediate Care Facilities for Individuals with Intellectual Disabilities (ICFs/ID). These facilities specialize in the care of people with disabilities. The individuals served by ICFs/ID are in need of more continuous supervision and structure, but are not significantly different from those served in other systems serving people with disabilities. ICFs/ID are long-term care programs certified to receive Medicaid reimbursement for habilitative and rehabilitative services and must provide for the active treatment needs. Nursing services are available for those requiring nursing and medical services. There are specific federal regulations requiring active treatment programs and other treatment options. Current State law limits the size of new ICF/ID facilities to 16 beds or less. There are currently 15 privately-owned facilities with populations ranging from 12 to 82 and one State ICF/ID facility (the Utah State Developmental Center) licensed for 260. Only four of the facilities have 16-or-fewer beds. ICFs/ID are an optional service in the Medicaid Program but are part of the basis for the federal government allowing a Home and Community Based Waiver. Reimbursement rates for Intermediate Care Facilities for Individuals with Intellectual Disabilities as well as how those rates are calculated are online at http://health.utah.gov/medicaid/stplan/longtermcare.htm. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $6,498,400 | $4,745,800 | $8,514,200 | $12,154,400 | $7,902,300 | | General Fund, One-time | $250,000 | $0 | ($811,900) | ($85,200) | $0 | | Federal Funds | $54,997,300 | $59,603,800 | $59,584,500 | $51,024,500 | $55,093,100 | | American Recovery and Reinvestment Act | $1,876,300 | $6,002,900 | $2,854,500 | $0 | $0 | | GFR - Nursing Care Facilities Account | $1,454,300 | $1,654,300 | $1,589,000 | $1,654,300 | $1,654,300 | | Transfers - Medicaid - DHS | $10,440,200 | $12,448,300 | $10,982,600 | $12,929,900 | $17,839,600 | | Lapsing Balance | $0 | ($124,000) | $0 | $0 | $0 | | Total | $75,516,500 | $84,331,100 | $82,712,900 | $77,677,900 | $82,489,300 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $75,516,500 | $84,331,100 | $82,712,900 | $77,677,900 | $82,489,300 | | Total | $75,516,500 | $84,331,100 | $82,712,900 | $77,677,900 | $82,489,300 |

|---|

Subcommittee Table of ContentsProgram: Non-service Expenses Function The funding in this program goes for three different purposes, each of which is discussed below:

- Direct Graduate Medical Education -- these funds represent payments up to the Medicare Upper Payment Limit. About 75% of the available funding goes to the University of Utah. The other 25% goes to other non-university hospitals with residency programs. The State provides the match money for these payments.

- Inpatient State Teaching Hospital Payments -- these funds help offset some of the costs of residency programs that serve Medicaid clients as well as other uncompensated care costs. The University of Utah Hospital receives 100% of the total available funding. The University of Utah provides the match money for these payments.

- Physician Enhanced Payments -- two types: (1) payments to the University of Utah Medical Group (UUMG) for the difference between the average commercial rate, which is seeded by UUMG, and the Medicaid fee schedule as well as (2) a 12% enhancement for payments to rural physicians.

Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $0 | $0 | $15,140,700 | $158,400 | $7,549,900 | | General Fund, One-time | $0 | $0 | ($1,508,200) | ($158,300) | $0 | | Federal Funds | $0 | $0 | $63,814,600 | $66,725,300 | $70,027,700 | | American Recovery and Reinvestment Act | $0 | $0 | $7,102,000 | $12,191,000 | $0 | | Dedicated Credits Revenue | $0 | $0 | $11,157,300 | $34,357,000 | $7,443,600 | | Transfers - Fed Pass-thru | $0 | $0 | $3,330,100 | $0 | $3,330,100 | | Transfers - Medicaid - DHS | $0 | $0 | $1,475,700 | $0 | $1,475,700 | | Transfers - Within Agency | $0 | $0 | $0 | ($4,176,900) | $0 | | Total | $0 | $0 | $100,512,200 | $109,096,500 | $89,827,000 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $0 | $0 | $100,512,200 | $109,096,500 | $89,827,000 | | Total | $0 | $0 | $100,512,200 | $109,096,500 | $89,827,000 |

|---|

Subcommittee Table of ContentsProgram: Buy-in/Buy-out Function For Buy-out Services, Utah Medicaid determines if new clients have both a high medical need and other options for health insurance. When it is less expensive to help the client purchase their private health plan than pay the full amount of medical claims, Utah Medicaid opts to pay for the qualifying individual's health insurance premiums. Other plan options may include the client's current health insurance plan or a COBRA (Consolidated Omnibus Budget Reconciliation Act of 1986) plan for a client who recently left employment. Buy-in refers to Medicare Part B premiums paid by the State on behalf of Medicare-eligible Medicaid clients. The federal government requires the State to pay Medicare premiums. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $13,025,300 | $11,571,200 | $13,612,500 | $15,897,900 | $16,010,000 | | General Fund, One-time | $1,600,000 | $0 | ($788,900) | $0 | $0 | | Federal Funds | $22,848,600 | $21,795,300 | $17,917,600 | $22,298,100 | $23,230,100 | | American Recovery and Reinvestment Act | $1,960,300 | $2,907,200 | $1,976,700 | $0 | $0 | | Transfers - Within Agency | $0 | $0 | $0 | $3,000,000 | $0 | | Closing Nonlapsing | $100 | $0 | $0 | $0 | $0 | | Total | $39,434,300 | $36,273,700 | $32,717,900 | $41,196,000 | $39,240,100 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $39,434,300 | $36,273,700 | $32,717,900 | $41,196,000 | $39,240,100 | | Total | $39,434,300 | $36,273,700 | $32,717,900 | $41,196,000 | $39,240,100 |

|---|

Subcommittee Table of ContentsProgram: Dental Services Function Utah Medicaid pays for dental services for children up to age 21 as per federal law. Additionally, the State has opted to pay for dental services to pregnant women. Any licensed dentist can be a Medicaid provider. There are some limits to the number of specific services a client can receive per year and what services are covered. The Department has a program that intends to "increase access to dental service and reward dentists who treat a significant number of Medicaid clients" (Utah Medicaid Provider Manual). Dentists in urban areas who see an average of two clients per week receive a 20% increase in their Medicaid reimbursement. Dentists in rural areas automatically receive the 20% increase. Oral surgeons can receive the 20% increase by agreeing to be on a Medicaid-provider referral list for dentists. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $8,537,100 | $6,041,900 | $8,180,100 | $10,535,400 | $10,327,500 | | General Fund, One-time | $137,500 | $0 | ($517,700) | $0 | $0 | | Federal Funds | $24,256,800 | $22,376,700 | $25,398,400 | $27,394,600 | $25,324,600 | | American Recovery and Reinvestment Act | $1,987,000 | $2,952,100 | $2,591,300 | $0 | $0 | | Dedicated Credits Revenue | $452,600 | $0 | $0 | $0 | $0 | | Transfers - Medicaid - DHS | ($13,500) | $30,300 | $6,300 | $0 | $6,300 | | Transfers - Medicaid - DWS | $100,600 | $0 | $0 | $0 | $0 | | Transfers - Within Agency | $2,719,300 | $0 | $0 | $908,000 | $0 | | Closing Nonlapsing | ($1,600) | $0 | $0 | $0 | $0 | | Total | $38,175,800 | $31,401,000 | $35,658,400 | $38,838,000 | $35,658,400 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $38,175,800 | $31,401,000 | $35,658,400 | $38,838,000 | $35,658,400 | | Total | $38,175,800 | $31,401,000 | $35,658,400 | $38,838,000 | $35,658,400 |

|---|

| | | | | | | Other Indicators | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Actual FTE | 32.8 | 21.0 | 0.2 | 0.5 | 0.0 |

|

|

|

|

|

|

|---|

Subcommittee Table of ContentsProgram: Clawback Payments Function As part of the federal Medicare Modernization Act, effective January 1, 2006, Utah Medicaid no longer provides prescription drugs for Medicaid members who are also eligible for Medicare. Instead, Utah Medicaid is required to make "Clawback" payments to Medicare. This contribution is adjusted annually and has increased every year since the program started. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $0 | $0 | $0 | $27,000,000 | $32,800,000 | | General Fund, One-time | $0 | $0 | $0 | $1,713,700 | $0 | | Total | $0 | $0 | $0 | $28,713,700 | $32,800,000 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $0 | $0 | $0 | $28,713,700 | $32,800,000 | | Total | $0 | $0 | $0 | $28,713,700 | $32,800,000 |

|---|

Subcommittee Table of ContentsProgram: Disproportionate Hospital Payments Function Disproportionate Hospital Payments are used to pay hospitals that serve a disproportionate share of Medicaid and uninsured patients. The funds are intended to offset some of the hospitals' uncompensated costs in serving these individuals. The majority of the seed money comes from hospitals. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $0 | $0 | $0 | $3,815,900 | $0 | | General Fund, One-time | $0 | $0 | $0 | $5,009,600 | $0 | | Federal Funds | $0 | $0 | $0 | $22,945,000 | $26,000,000 | | Dedicated Credits Revenue | $0 | $0 | $0 | $2,290,200 | $0 | | Total | $0 | $0 | $0 | $34,060,700 | $26,000,000 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $0 | $0 | $0 | $34,060,700 | $26,000,000 | | Total | $0 | $0 | $0 | $34,060,700 | $26,000,000 |

|---|

Subcommittee Table of ContentsProgram: Mental Health Inpatient Hospital Function To obtain mental health inpatient hospital services, the provider must obtain authorization within 24 hours of hospital admission. Providers must demonstrate that any alternate setting cannot provide the needed care. The Prepaid Mental Health Plan becomes responsible for payment of services once the hospital notifies the plan of its client's admission. Payment for these services is included in the per-member-per-month rate paid to Prepaid Mental Health Plans. Expenses include fee-for-service mental health inpatient hospital services to those clients living in the two counties without Prepaid Mental Health Plans. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $0 | $0 | $352,500 | $0 | $0 | | General Fund, One-time | $0 | $0 | ($352,500) | $0 | $0 | | Federal Funds | $0 | $0 | $0 | $0 | $16,971,700 | | Dedicated Credits Revenue | $0 | $0 | $0 | $0 | $3,713,700 | | Total | $0 | $0 | $0 | $0 | $20,685,400 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $0 | $0 | $0 | $0 | $20,685,400 | | Total | $0 | $0 | $0 | $0 | $20,685,400 |

|---|

Subcommittee Table of ContentsProgram: Hospice Care Services Function Hospice services are an optional benefit under the Medicaid program. In order to qualify, a physician must certify that the eligible person is within the last 6 months of life. The State has no limits on the amount of hospice care a client may receive. Reimbursement rates for hospice services are online at http://health.utah.gov/medicaid/stplan/hospice.htm. For individuals residing in nursing facilities, Federal law requires that the hospice provider reimburse the nursing facility provider at 95% of the daily nursing home reimbursement rate. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $0 | $0 | $4,256,800 | $2,956,700 | $4,114,400 | | General Fund, One-time | $0 | $0 | ($188,600) | $0 | $0 | | Federal Funds | $0 | $0 | $10,114,600 | $9,905,200 | $10,083,000 | | American Recovery and Reinvestment Act | $0 | $0 | $14,600 | $0 | $0 | | GFR - Nursing Care Facilities Account | $0 | $0 | $0 | $1,086,800 | $1,197,000 | | Total | $0 | $0 | $14,197,400 | $13,948,700 | $15,394,400 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $0 | $0 | $14,197,400 | $13,948,700 | $15,394,400 | | Total | $0 | $0 | $14,197,400 | $13,948,700 | $15,394,400 |

|---|

Subcommittee Table of ContentsProgram: Vision Care Function Federal law requires that Medicaid pays for vision care for children up to age 21. Additionally, the State has opted to pay for vision care services to pregnant women. The Utah Medicaid Provider Manual explains: "Optometry care services covered by the Utah Medicaid Program include the examination, evaluation, diagnosis and treatment of visual deficiency; removal of a foreign body; and prescription and provision of corrective lenses by providers qualified to perform the service(s)." Clients may receive one routine eye exam per year unless there is a documented medical necessity for more. Medicaid expects frames for glasses to last two years. A client would receive contact lenses only if eye glasses cannot serve the medical necessity. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $240,500 | $517,000 | $521,700 | $655,900 | $657,200 | | General Fund, One-time | $250,000 | $0 | ($34,600) | $0 | $0 | | Federal Funds | $1,493,600 | $1,365,600 | $1,625,200 | $1,605,200 | $1,626,000 | | American Recovery and Reinvestment Act | $123,300 | $195,300 | $170,900 | $0 | $0 | | Transfers - Medicaid - DHS | $0 | $0 | $6,300 | $0 | $6,300 | | Transfers - Medicaid - DWS | $1,800 | $3,800 | $0 | $0 | $0 | | Transfers - Within Agency | $0 | $0 | $0 | $4,600 | $0 | | Closing Nonlapsing | ($300) | $0 | $0 | $0 | $0 | | Total | $2,108,900 | $2,081,700 | $2,289,500 | $2,265,700 | $2,289,500 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $2,108,900 | $2,081,700 | $2,289,500 | $2,265,700 | $2,289,500 | | Total | $2,108,900 | $2,081,700 | $2,289,500 | $2,265,700 | $2,289,500 |

|---|

Subcommittee Table of ContentsProgram: Other Optional Services Function Other Optional Services, depending on a client's eligibility, may include: Personal Care Services, Alcohol and Drugs, Ambulatory Surgical Services, Kidney Dialysis, Private Duty Nursing, Psychologist Services, Podiatrist Services, Enhanced Pregnancy, Skills Development, Medical Supplies, Durable Medical Equipment, Medical Transportation, and Early Intervention. Medicaid also operates the Primary Care Network, which provides a limited array of health services to legal residents or U.S. citizens with incomes up to 150% of the Federal Poverty Level, who do not qualify for regular Medicaid benefits. Covered services include: visits to a primary care provider, up to four prescriptions monthly, routine dental cleaning and examination, family planning services, immunizations, and routine lab services and x-rays. The program maintains a cap on enrollment and has limited periods for accepting new applicants. Medicaid additionally operates the Utah's Premium Partnership for Health Insurance for adults, which pays monthly up to $150 per adult to pay the premiums of qualifying employee-sponsored health insurance. Adults who qualify can make up to 150% of the Federal Poverty Level. Since 1977 the State has run some Medical/Dental Clinics to provide access to medical and dental services to Medicaid, Primary Care Network (PCN), and Children's Health Insurance Program (CHIP) clients. There are three medical clinics supported by the Department of Health. They are in Provo, Salt Lake City and Ogden. The State-run medical clinics provide general primary care medical services. These clinics utilize paid staff as well as volunteers to provide regular office visits as well as after-hour visits. The three dental clinics supported by this program are located in Salt Lake City, Ogden, and St. George. The State also operates a mobile dental clinic which serves underinsured clients and provides about 800 services at over 10 rural locations annually. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $38,692,500 | $12,735,900 | $34,460,800 | $7,209,000 | $34,361,900 | | General Fund, One-time | ($26,776,900) | ($17,694,400) | ($18,876,100) | $4,877,800 | $0 | | Federal Funds | $89,754,000 | $114,833,100 | $58,761,600 | $57,645,200 | $74,524,800 | | American Recovery and Reinvestment Act | $4,320,400 | $11,783,900 | $4,463,200 | $0 | $74,000,000 | | Dedicated Credits Revenue | $4,117,600 | $8,574,500 | $9,473,800 | $8,185,600 | $9,473,800 | | GFR - Medicaid Restricted | $4,962,500 | $0 | $0 | $0 | $0 | | Transfers | $1,233,100 | $0 | $0 | $0 | $0 | | Transfers - Intergovernmental | $54,922,700 | $26,015,700 | $3,790,700 | $0 | $14,444,800 | | Transfers - Medicaid - DHS | $2,155,300 | $5,464,300 | $11,501,100 | $152,100 | $0 | | Transfers - Medicaid - DWS | $17,900 | $0 | $0 | $0 | $0 | | Transfers - Medicaid - Internal DOH | $0 | $0 | $1,024,700 | $0 | $2,260,000 | | Transfers - Medicaid - USDB | $0 | $0 | $540,200 | $334,200 | $277,600 | | Transfers - Other Agencies | $0 | $654,000 | $0 | $131,100 | $0 | | Transfers - Within Agency | $0 | $1,034,100 | $549,600 | $1,306,900 | $423,900 | | Transfers - Workforce Services | $0 | $0 | $0 | $741,200 | $0 | | Transfers - Youth Corrections | $0 | $0 | $0 | $1,636,000 | $0 | | Closing Nonlapsing | ($2,300) | $0 | $0 | $0 | $0 | | Total | $173,396,800 | $163,401,100 | $105,689,600 | $82,219,100 | $209,766,800 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Personnel Services | $0 | $0 | $0 | $23,200 | $0 | | Out-of-state Travel | $0 | $0 | $0 | $17,200 | $0 | | Current Expense | $40,100 | $0 | $0 | $1,661,200 | $0 | | DP Current Expense | $0 | $0 | $0 | $20,100 | $0 | | Other Charges/Pass Thru | $173,356,700 | $163,401,100 | $105,689,600 | $80,497,400 | $209,766,800 | | Total | $173,396,800 | $163,401,100 | $105,689,600 | $82,219,100 | $209,766,800 |

|---|

| | | | | | | Other Indicators | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Actual FTE | 16.2 | 12.0 | 0.3 | 0.1 | 0.0 |

|

|

|

|

|

|

|---|

Subcommittee Table of Contents |