Compendium of Budget Information for the 2011 General Session

| Business, Economic Development, & Labor Appropriations Subcommittee | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Subcommittee Table of Contents | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Function The primary function of the State Tax Commission is collection of revenue for state and local governments and administering tax and motor vehicle laws. The Tax Commission handles revenue from about 40 taxes, surcharges, and fees; registers automobiles, and regulates the automobile dealer industry. In FY 2010, the Commission had 757 full-time equivalent employees and operated 12 offices across the state. Mission Statement The mission of the Tax Commission is to collect revenue for the state and local governments and to equitably administer tax and assigned motor vehicle laws. Statutory Authority The Utah Constitution, Article XIII, Section 6, Paragraph 3 details that the State Tax Commission shall administer and supervise the State's tax laws, ensure that properties are assessed and valued equally across county lines, review proposed bond issues, revise local tax levies, and have other powers as provided by statute. Most of the broad authority granted the Tax Commission in the Constitution is detailed in Utah Annotated Code Title 59, Chapters 1 through 27, and Utah Annotated Code Title 41. Utah Annotated Code Title 59-1-210 lists the general powers and duties of the State Tax Commission. All of Title 59 is the State's Revenue and Taxation section of statute. The Title includes:

Funding Detail Major sources of finance for the Tax Commission are the General Fund and Education Fund, which together account for 59 percent of the Department's total operating funding in FY 2011. Proceeds from dedicated credits and restricted revenue also represent large financing sources, accounting for approximately 33 percent of the Commission's total operating funding in FY 2011. The Commission also draws funding from the Transportation Fund. The Tax Commission is authorized funding from the Education Fund due to the function the Commision has in collecting income and corporate taxes. The Commission is also authorized funding from the Transportation Fund due to the function the Commission has in collecting motor fuel, special fuel, and other revenue sources to the Transportation Fund. In addition, the Commission draws funding from three restricted fund accounts, which are:

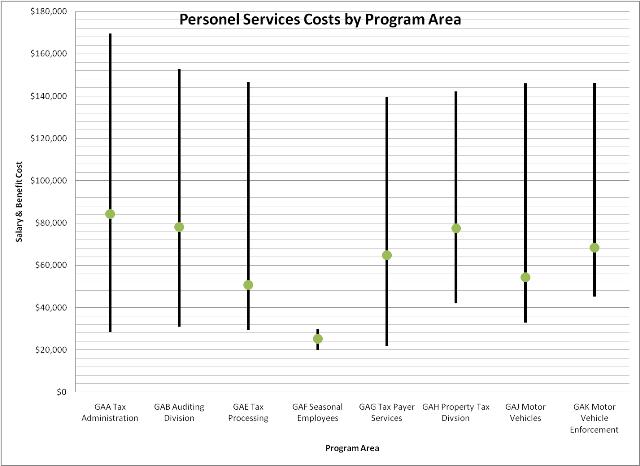

Expenditures at the agency level comprise largely personnel and current expenses. Of the personnel, the average salary and benefit cost is $64,725, with the lowest paid employees, on average, being those in the Seasonal Employees program area and the highest paid employees, on average, being those employed in the Tax Administration program area. The average hourly salary rate is $19.08 per hour.  Major categories making up current expenses are human resource management, payroll services, data processing, tax systems maintenance, software, building and grounds, postage, printing, electronic payments, and communication devices.

|