Compendium of Budget Information for the 2013 General Session

| Social Services Appropriations Subcommittee | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <-Previous Page | Subcommittee Table of Contents | Next Page-> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

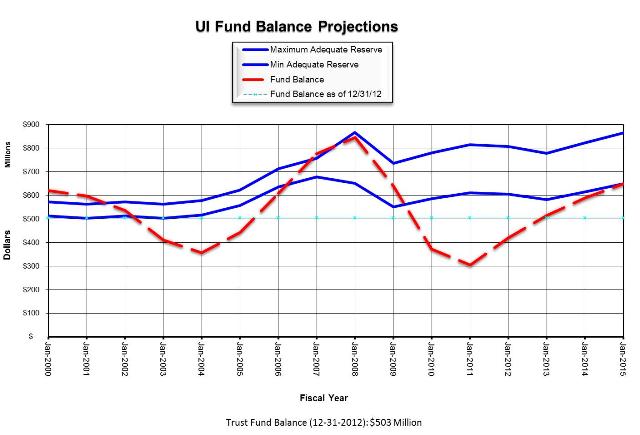

Line Item: Unemployment Compensation Fund Function The Unemployment Compensation Fund provides cash benefits to certain unemployed individuals. Such benefits are funded almost exclusively through a dedicated tax paid by employers. Additional benefits may be paid by the federal government. Background Participating UI employers contribute taxes to that portion of the Unemployment Compensation Fund commonly known as the Unemployment Insurance Trust Fund. Tax rates are unique to individual employers and are set according to statutory formula. That formula considers an employer's unemployment benefits payment history, the health of the Unemployment Insurance Trust Fund, and the default rate of other employers along with other socialized costs. The rate is calculated as follows: The reserve factor is a multiplier that is adjusted up or down depending upon the health of the Unemployment Insurance Trust Fund. In bad economic times, the fund is drawn down and the reserve factor goes up. In a good economy, the fund may thrive, in which case the reserve goes down. When the UI Trust Fund has a balance that is sufficient to pay between 18 and 24 months of benefits, the reserve factor is 1. The social cost factor is added to all participants rates as a means to cover costs that cannot be charged to any one employer. An example of such as cost is benefits paid to former employees or a business that has closed. This factor is determined using the experienced social cost for the past four years. DWS pays up to $479 per week in benefits to unemployed individuals. The benefit amount depends upon a person's earnings history. Benefits are paid for between ten and twenty-six weeks, not including any federally funded extension. Beneficiaries are required to seek work in every week for which they receive benefits, and must document and report their job-search activity. Failure to do so may result in benefit denial, reduction, or even repayment requirements. Statutory Authority Language regarding the fund is contained in Utah Code UCA 35A-4-201 and UCA 35A-4-501. Performance The Department of Workforce Services measures the performance and health of the Unemployment Compensation Fund by monitoring its Trust Fund portion. Figure 1 below shows the counter-cyclical nature of benefits paid and revenue received by the Trust Fund. Source: Department of Workforce Services DWS attempts to keep Trust Fund balances in a range such that they are sufficient to pay between 18 months and 24 months in benefits. Figure 2 tracks balances in relation to that range. Figure 2  Source: Department of Workforce Services Funding Detail For analysis of current budget requests and discussion of issues related to this budget click here.here.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <-Previous Page | Next Page-> |

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.