Compendium of Budget Information for the 2013 General Session

| Infrastructure & General Government Appropriations Subcommittee | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <-Previous Page | Subcommittee Table of Contents | Next Page-> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Function The Capital Budget funds new construction, major remodeling, alterations, repairs, improvements, real estate, roofing, and paving projects. The Capital Budget is divided into five line items:

Statutory Authority UCA 63A-5-104 defines "Capital Developments" as one of the following:

The same statute defines "Capital Improvements" as one of the following:

UCA 63A-5-103 requires the State Building Board to develop and maintain a Five-Year Building Program for submission to the governor and Legislature that includes:

UCA 63A-5-104(2) requires the State Building Board to submit its capital development recommendations and priorities to the Legislature for approval and prioritization. The Board makes recommendations on behalf of all state agencies, commissions, departments, and institutions. UCA 63A-5-104(3) states that a capital development project may not be constructed without legislative approval unless:

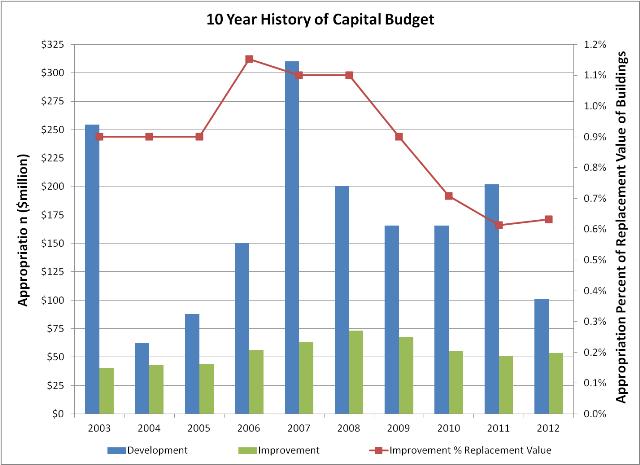

UCA 63A-5-104(4) requires the State Building Board, on behalf of all state agencies and institutions, to submit by January 15 of each year a list of anticipated capital improvement requirements to the Legislature. Unless otherwise directed by the Legislature, the Building Board must prioritize capital improvements from the list submitted to the Legislature up to the level of money appropriated. In an emergency situation the Building Board may reallocate capital improvement funds. The State Building Board may provide capital improvement funding to a single project, or to multiple projects within a single building, even if the total cost of the project(s) is more than $2,500,000, if the project(s) will take more than one year to complete and the Legislature has affirmatively authorized the project(s). UCA 63A-5-104(6) Prohibits the Legislature from funding the design or construction of any new capital development projects, except to complete projects already begun, until the Legislature has appropriated 1.1 percent of the replacement cost of existing state facilities to capital improvements. However, during a time of budget deficit, the Legislature may reduce the appropriation to 0.9 percent of the replacement cost of existing state facilities. The 1.1 percent and 0.9 percent requirements do not apply to fiscal years 2009 through 2012. "Replacement cost" is determined by the Division of Risk Management, except for auxiliary facilities as defined by the Building Board. The Building Board may make rules allocating to institutions and agencies their proportionate share of capital improvement funding. UCA 63A-5-104(9) declares the intention of the Legislature to fund at least half of the capital improvement requirement with the General Fund. UCA 63J-1-601(3)(d) prohibits transfers from a line item of any agency or institution into the Capital Projects Fund without the prior express approval of the Legislature. Special Funds The Project Reserve Fund is a subfund of the Capital Project Fund required by law to receive funds resulting from construction bids coming in under budget and any residual funds left over when a capital project is completed. The reserve fund may only be used by DFCM to award construction bids that exceed the amount budgeted. However, the Legislature retains the right to make appropriations from the fund for other building needs, including the cost of administration. The Project Reserve Fund ended FY 2012 with a balance of $6.7 million. The Contingency Reserve Fund receives funds based on a statutory percentage of construction cost which ranges from 4.5 percent to 6.5 percent for new construction, and from 6 percent to 9.5 percent for remodeling projects, depending on the size and complexity of the project. The Contingency Reserve Fund is used for unforeseen project costs, the majority of which are construction change orders. The Legislature may re-appropriate these funds to other building needs, including administrative costs, in any amount that is determined to be in excess of the reserve required to meet future contingency needs. The Contingency Reserve Fund had a balance of $7.8 million at the end of FY 2012. Funding Detail The following chart shows a ten year history of capital improvement and capital development funding (state funds and general obligation bonds).  The table shown below includes all appropriations in the capital budget. It does not show bond proceeds or other non-appropriated (for example, donated) funds. In FY 2010 and FY 2012 the Legislature funded a portion of the Capital Improvement budget from the Project Reserve Fund. The Fund had significant balances in those years as a result of favorable construction bids and sizable residuals on major construction projects. In FY 2008 and FY 2009 the Legislature appropriated excess funds from the Contingency Reserve Fund to the Property Acquistion and Land Banking line items. Table 1: Operating and Capital Budget Including Expendable Funds and Accounts

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <-Previous Page | Next Page-> |

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.