This program adheres to the Money Management Act and Rules of the Money Management Council, and uses appropriate investment research tools to maximize the safety of state and local government funds invested and to earn competitive yields. The Treasurer also maintains the Public Treasurers' Investment Fund (PTIF) so that other governmental entities can pool their idle money together for professional management, a high degree of liquidity and optimal return on funds.

All available funds are invested each day at competitive interest rates. The primary investment instruments used are bank certificates of deposit, commercial paper, short-term corporate notes, and obligations of the U. S. Treasury and government agencies.

The Treasurer is a member of the State Bonding Commission and the State Building Ownership Authority, which issues debt for the state. He oversees the team of professionals who work together to issue debt including the financial advisor, bond counsel, disclosure counsel and underwriters. He coordinates all relations with bond rating agencies including formal presentations at least once a year.

The Treasurer also manages the investments of the State School and Institutional Trust Funds. The dividend and interest earnings from the State School Fund provide income for the Permanent School Fund, which allocates funding directly to individual schools statewide.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $1,407,500 from all sources for Treasury and Investment. This is a 5.1 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $861,500 from the General/Education Funds, an increase of 3.1 percent from revised Fiscal Year 2015 estimates.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

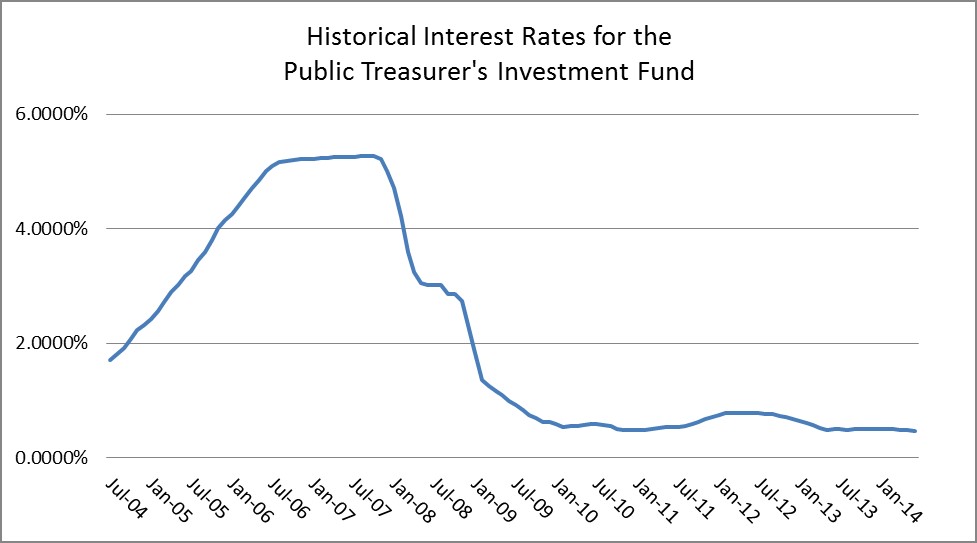

Historical Interest Rates for the PTIF

The chart shows historical interest rates earned by the Public Treasurer's Investment Fund (PTIF). Rates have been less than one percent since June of 2009. A review of records back to 1981 shows this is the first time interest rates have fallen below one percent in that time frame.

The PTIF invests only in securities authorized by the Money Management Act and while yield is important, the primary objective of the PTIF is safety of principal. Returns are directly correlated to the relative level of short-term interest rates. Considering that State and local government budgets are constrained, interest earned on PTIF investments is of critical importance. In FY 2014 the rate fluctuated between a low of .4733 percent (June 2014) and a high of .5080 percent (November 2013).

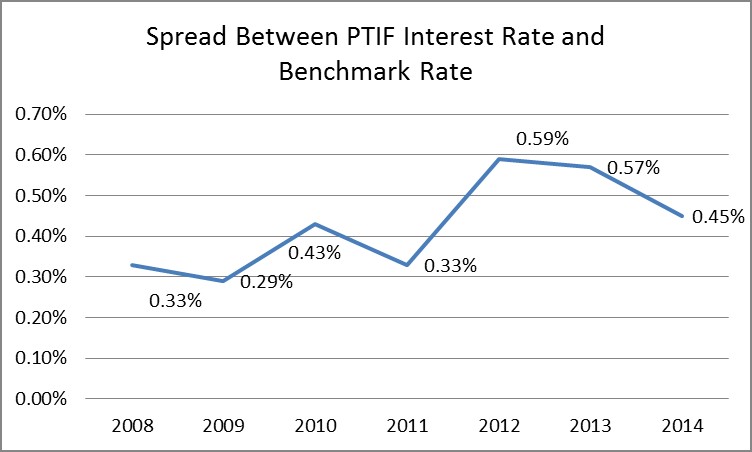

Spread Between PTIF Interest Rate and Benchmark Rate

The next measure provides a comparison between PTIF performance and that of a fund with similar characteristics, the Vanguard Prime Money Market Fund.

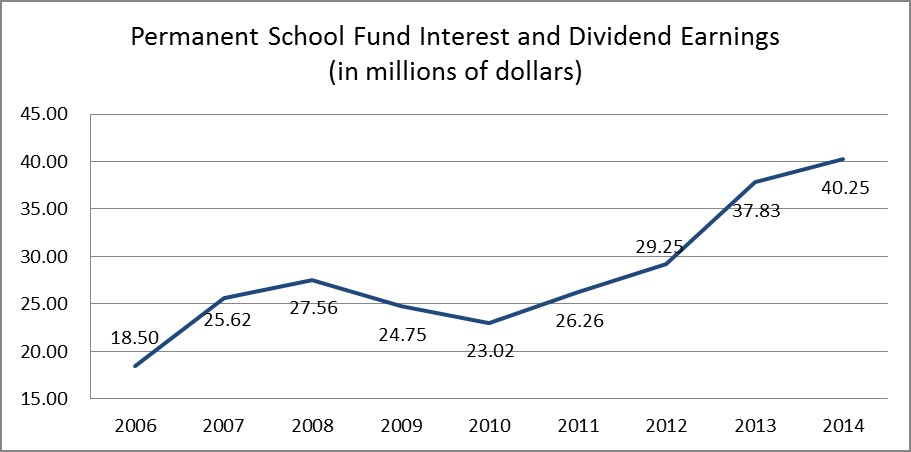

Permanent School Fund Interest and Dividend Earnings

The dividend and interest earnings from the State School Fund provide funding directly to schools statewide. The State School and Institutional Trust Fund portfolios hold a broadly diversified mix of investments, including domestic equities, domestic fixed income, international equities and real estate.

Given the substantial breadth of underlying investments held within the portfolio, the factors which impact the investments are numerous, but investments are impacted primarily by global economic conditions and the financial performance of the underlying diversified investments (stocks and bonds, mostly) that are maintained within the portfolio. The graph depicts historical dividend and interest income to the Permanent School Fund by fiscal year and provides a measure of its investment performance over time.

Interest and dividend earnings increased from FY 2013 to FY 2014 for two primary reasons:

- 1. Investments in higher-yielding real estate assets have increased steadily over the past five fiscal years.

- 2. Fixed income distributions increased slightly from the record low yields seen in FY 2013.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.