The State Auditor Program has five main functions: Administration, Financial Audit, Performance Audit, Special Projects, and Local Government.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $6,309,500 from all sources for State Auditor. This is a 17.9 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $3,212,300 from the General/Education Funds, a reduction of 9.1 percent from revised Fiscal Year 2015 estimates.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

As a measure of quality control and adherence to auditing standards, the Office undergoes an external peer review every three years. In the most recent peer review, performed in April 2014 by the National State Auditors Association, the Office received a clean or unmodified opinion. The Office has received clean opinions in each peer review for over 30 years.

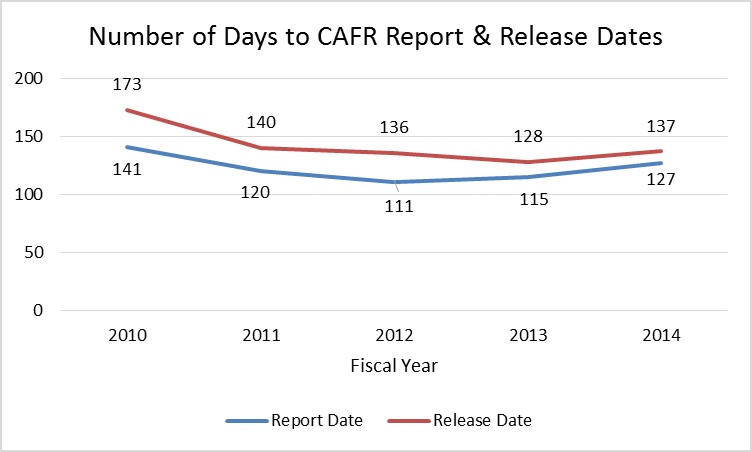

Number of Days to CAFR Report and Release Dates

Financial reports are most useful when issued in a timely manner. It is the goal of the Office of the State Auditor to maintain high quality in audit performance while also working with the State Division of Finance to issue the State of Utah's Comprehensive Annual Financial Report (CAFR) as quickly as possible. Utah currently is among the fastest states in the nation to issue a CAFR. This table represents the timeliness of completing the CAFR audit procedures (Report Date) and also the issuance of the CAFR (Release Date).

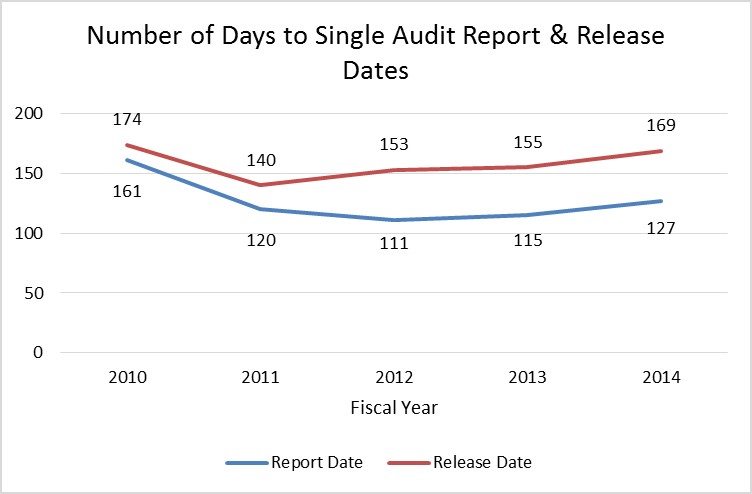

Number of Days to Single Audit Report & Release Dates

The Single Audit Report addresses the State's expenditure of federal funds and reports on the compliance and internal controls over compliance related to the State's administration of federal programs. It is the goal of the Office of the State Auditor to maintain high quality in audit performance while issuing the Single Audit Report as quickly as possible. Utah is currently among the fastest states in the nation to issue a Single Audit Report. This table represents the timeliness of completing Utah's Single Audit procedures (Report Date) and also the issuance of the Single Audit Report (Release Date).

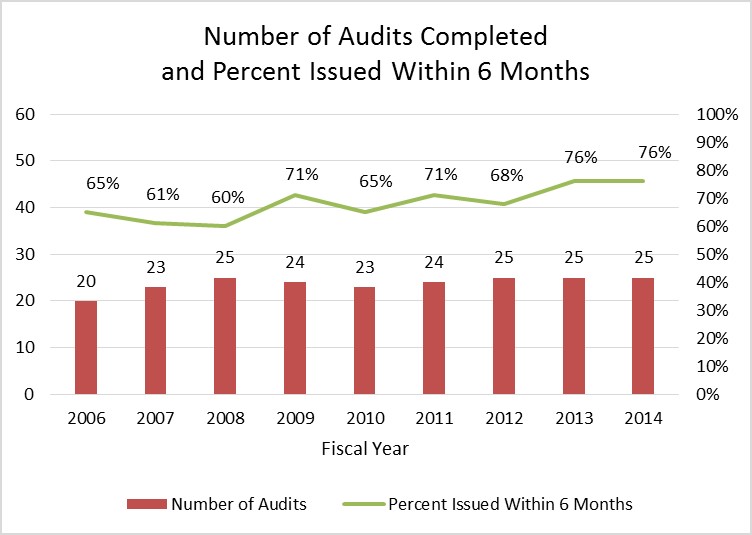

Number of Audits Completed and Percent Issued Within 6 Months

In addition to the CAFR, Single Audit, and other specialized audit reports, the Office of the State Auditor issues opinions on about 25 financial reports annually. Due to limited resources, not all financial audit reports can be issued within six months. This table presents the percent of audits that are completed within the six month timeframe. Typically, audits that are issued after six months are for smaller colleges and Applied Technology Colleges (ATCs). In FY 2014, two audits were contracted to CPA firms.

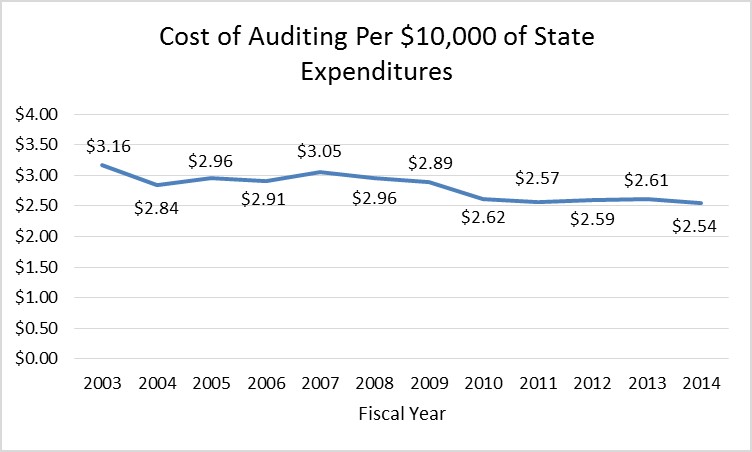

Cost of Auditing Per $10,000 of State Expenditures

This table shows the historical cost of the State Auditor function compared to total State expenditures (including the primary government, component units and trusts).

The five State Auditor units are:

Administration

The Administration unit consists of funding for the personnel services and other costs of the State Auditor, an administrative assistant, and other office administrative staff.

Financial Audit

Financial Audit is responsible for auditing all State departments, agencies and colleges and universities. Both State funds and federal grants are audited. These audits are conducted in accordance with generally accepted auditing standards, Government Auditing Standards, and the Single Audit Act to determine the reliability of financial statements, the effectiveness and adequacy of internal controls, and the degree of compliance with legal and contractual requirements.

Performance Audit

Performance Audit performs audits that evaluate the efficiency of operations and the effectiveness of programs, and can range from an audit of a specific case or individual to an audit of an entire agency. Performance audits can also measure operational compliance to given criteria such as state/federal law, administrative rule, or policy and the adequacy of such standards.

Special Projects

Special Projects are hotline calls, special request audits, reviews, or other engagements. The audits include internal control reviews, legal compliance and financial related audits, and other investigations, often referred to the Office by citizens, of potential waste, fraud and abuse in government organizations.

Local Government

Local Government ensures uniform accounting, budgeting, and financial reporting by Utah's local governments. This is done by providing consultation, budget forms, and uniform accounting guidelines and services for counties, municipalities, school districts, and local districts. Local Government reviews independent audits of all units of local government for compliance with reporting standards and conformity with generally accepted accounting principles and State law. The Division also presents training to local government officials and to CPAs conducting governmental audits.

During the 2013 General Session, all funding from the State Auditor, Auditing, and State and Local Planning programs was combined into the State Auditor Program. The FY 2014 Approp column reflects this change.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.