Compendium of Budget Information for the 2013 General Session

| Business, Economic Development, & Labor Appropriations Subcommittee | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <-Previous Page | Subcommittee Table of Contents | Next Page-> | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

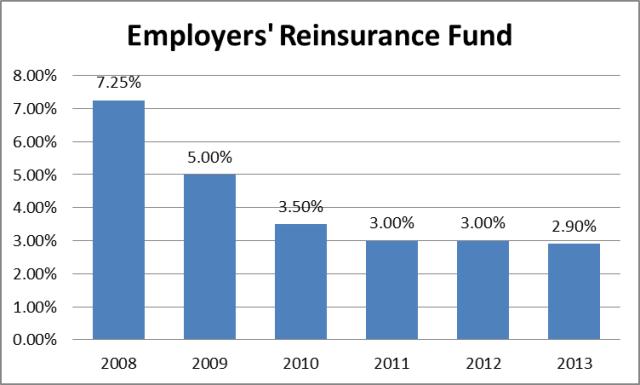

Line Item: Employers Reinsurance Fund Function The Employers Reinsurance fund (ERF) pays certain workers compensation benefits to eligible workers (and their dependents) as a result of work accidents that occurred prior to July 1994. Administrative costs may be paid from the fund, but unrelated expenses are not allowed. Statutory Authority UCA 34A-2-702 creates and authorizes ERF. UCA 34A-2-703 outlines liability and payments from ERF in the event an employee incurs an additional impairment that is completely disabling. Funding Detail Revenues come from a surcharge on employers' Workers' Compensation premiums collected by the State Tax Commission (currently 3%), plus an assessment to self-insured employers. Money that is collected is invested with the State Treasurer where interest is earned. The Labor Commission works closely with actuaries and the Workers Compensation Advisory Council each year to set the premium rates for the ERF. Based on input from the actuary, this Council has recommended a .1 percent decrease in the rate, from 3 percent to 2.9 percent for CY 2013.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| <-Previous Page | Next Page-> |

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.