Fiscal Highlights - June 2014

|

Revenue Surplus Anticipated -

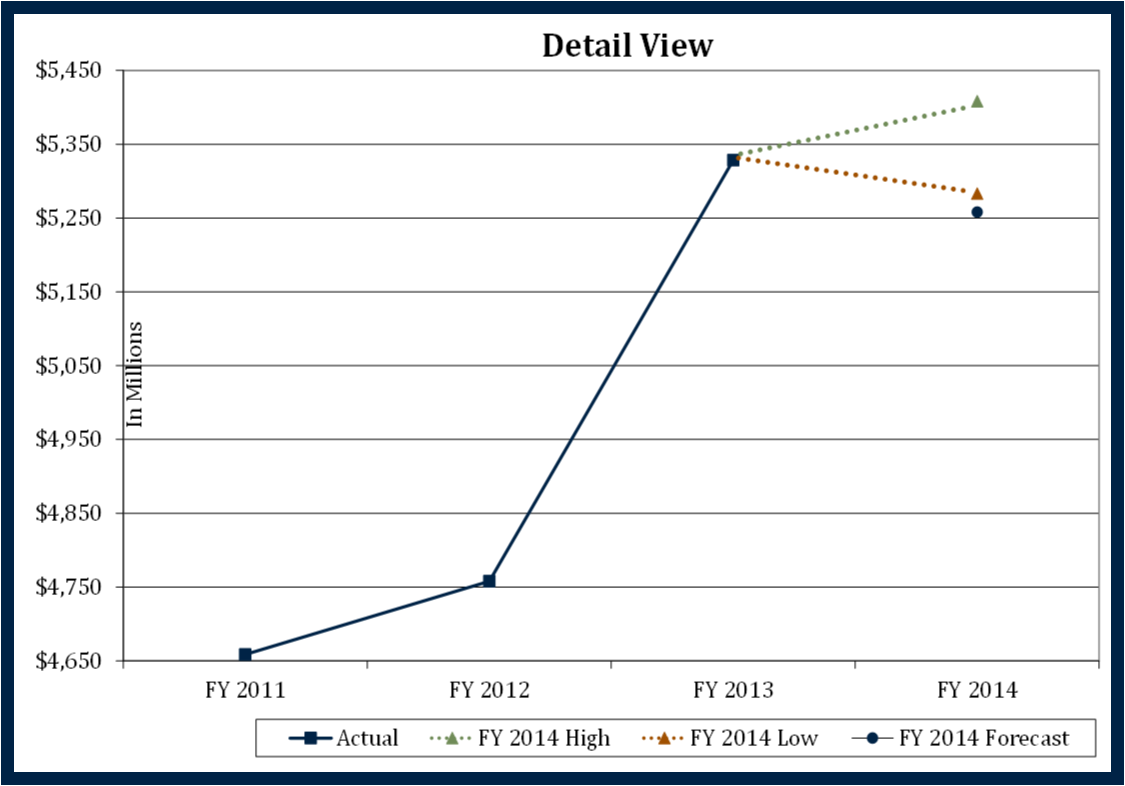

Andrea Wilko ( Consensus estimates indicate that General Fund/Education Fund collections will end FY 2014 between $25 million and $150 million above targets. We expect General Fund revenue at the end of FY 2014 to be from $25 million below to $25 million above the May FY 2014 target, and the Education Fund to end FY 2014 from $50 million to $125 million above the May target.

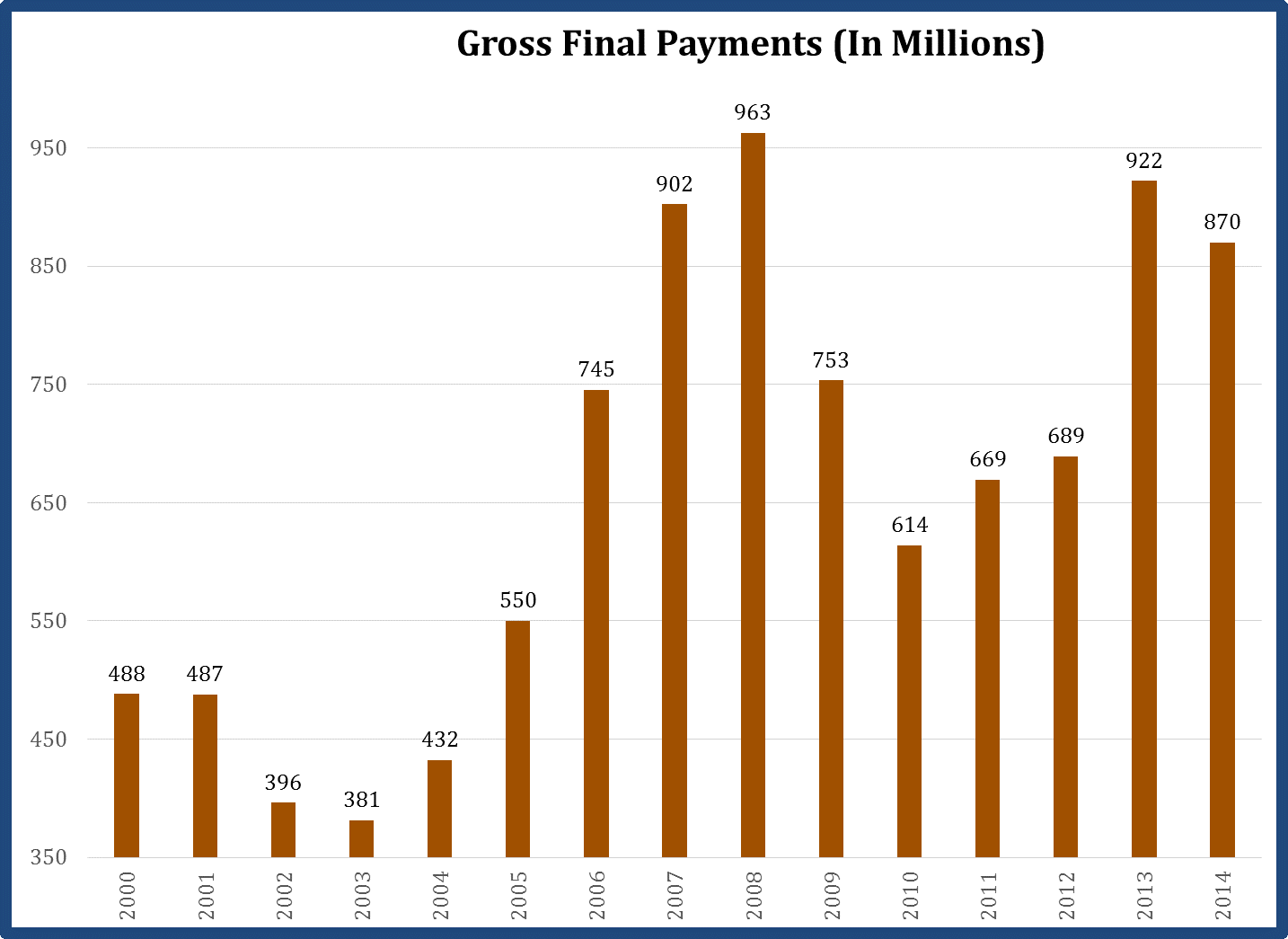

The largest portion of the potential GF/EF revenue surplus is due to above-target growth in the income tax. Within the income tax, the strength is largely due to higher-than-anticipated gross final payments, coming in at around $870 million, or a decline of around 6% over FY 2013 final payments. We had anticipated a decline of approximately 17%.

Overall, the economic outlook for Utah remains strong. Employment in the western states is doing particularly well: Arizona, Colorado, Oregon, Idaho and Utah are five of the 10 states forecasters expect to have the highest growth rates through 2014. Utah is also ranked number one for economic outlook in the report Rich States, Poor States, 2014 (American Legislative Exchange Council, 2014). The methodology used indicates that the state is poised for growth and prosperity going forward. Utah has received this ranking for the past seven years. In the same report, Utah is ranked second for economic performance. The diverse economy of the state has allowed it to weather some of the potential uncertainty and continue the trend of economic growth. Steady home construction, robust investment in high tech and the aerospace industry, and trade with Asia are a few of the reasons why businesses in Utah are doing comparatively so well. |

A New Era Begins At USTAR - Zackery N. King On May 21, 2014, during Extraordinary Session #6, the Senate confirmed Governor Herbert's appointme...Autism Pilot in the Department of Health: Past and Future - Russell T. Frandsen After two years of two pilot programs providing autism services, the Department of Health received ...Capital Improvement Funding - Mark Bleazard The Legislature annually appropriates funds to the capital improvements line item in the capital bu...Drug Courts - Stephen C. Jardine Total FY 2015 state funding for drug courts is $4,972,900. Drug court funding is distributed by a m...FY 2015 Custom Fit Allocations - Angela J. Oh The Custom Fit program administered by the Utah College of Applied Technology (UCAT) supports econo...Getting Closer on PED Property Tax Estimates - Thomas E. Young Every year leading up to the General Session staff presents you with public education estimates tha...Leasing of SAGE Online Adaptive Test Questions - Ben Leishman The State of Florida has requested to use Utah's SAGE (Student Assessment of Growth and Excellence)...PEHP Autism Treatment Pilot - Brian D. Fay In the 2012 General Session, the Legislature passed H.B. 272, Pilot Program for Autism Spectrum Dis...Pew Findings - Utah Prison Cost Drivers - Gary R. Syphus In February of 2014, state leaders requested that the Pew Charitable Trusts' Public Safety Performa...Revenue Surplus Anticipated - Andrea Wilko Consensus estimates indicate that General Fund/Education Fund collections will end FY 2014 between ...This Is The Place Heritage Park - Ivan D. Djambov This Is The Place Heritage Park was established in 1957, and it was managed by the Division of Park...USHE Joins Multi-State Collaboration to Improve Education - Spencer C. Pratt The Utah System of Higher Education (USHE) is joining 12 other higher education systems from across...What is the Judicial Conduct Commission and Where Can I Find Its Budget? - Gary K. Ricks The Judicial Conduct Commission is established by the State Constitution, Article VIII, Section 13.... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692