Foreword Welcome to the 2011 edition of the Utah Legislature's Compendium of Budget Information (COBI). COBI is one part of a three-pronged approach to staff budget analysis. It is designed as a reference document in which you will find detail on Utah state government activities. It includes program descriptions, references to statutory authority, and, of course, budget data. COBI sets a baseline against which you can evaluate budgets proposed during the 2011 General Session.

Parts two and three of the Legislature's budget analysis - Budget Briefs and Issue Briefs - will be available throughout the 2011 General Session beginning in January. Both are succinct, decision oriented papers that build on COBI, presenting future budget options rather than COBI's status quo. Budget Briefs follow the structure of state appropriations, documenting proposals for current year supplemental and future year budget action. Issue Briefs cut across 'silos' to discuss subjects that impact state appropriations independent of program structure.

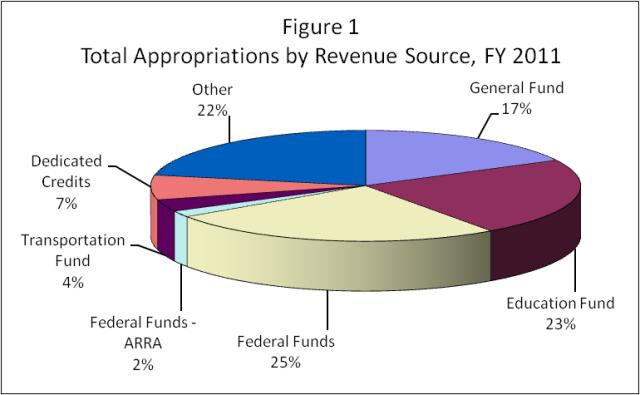

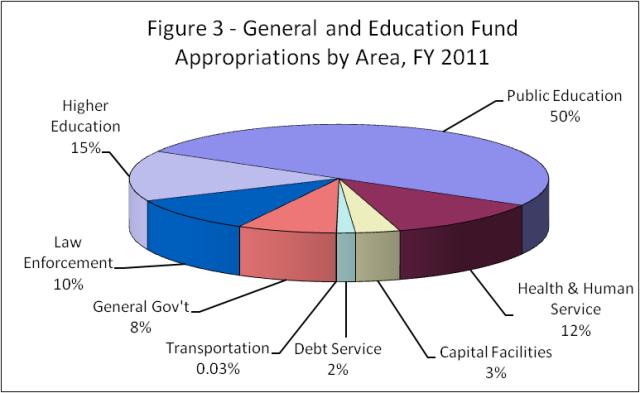

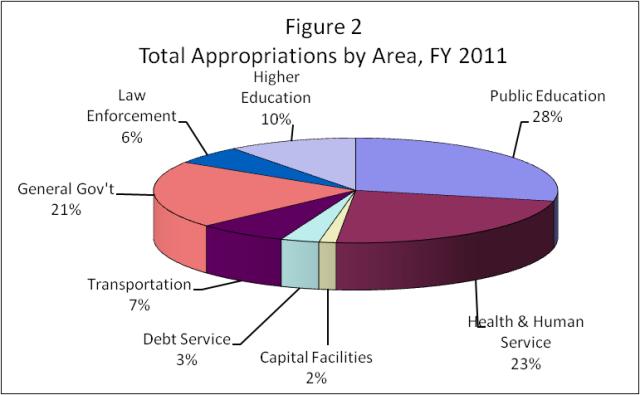

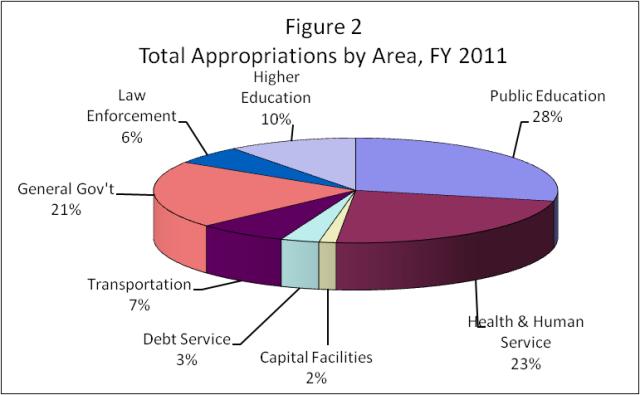

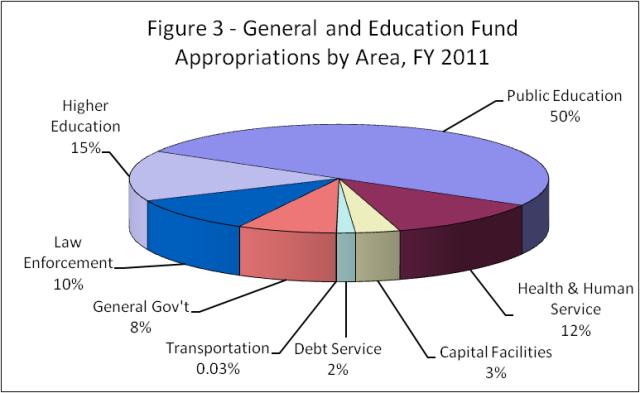

Detail on current state appropriations is included in the '2011 Approp' column of the budget tables herein. Figures 1 and 2 above reflect total appropriations first by source of finance and then by area of spending. General and Education Fund appropriations by area of spending are shown in figure 3 below. Utah's total budget, by funding source, committee, and category of expenditure, is summarized in the tables that follow.

This year's COBI reflects the appropriations committee structure enacted during the November 2010 Special Session. Joint Rules Resolution - Appropriations Subcommittee Amendments (S.J.R. 201, 2010 2nd Special Session) consolidates the previous ten appropriations subcommittees into eight. Some agencies will also now report directly to the Executive Appropriations Committee (EAC). To get information about EAC or a particular subcommittee, you may follow committee links in the table below, or go to our Statewide Table of Contents . Utah State Budget Summary | Sources of Finance | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | General Fund | $1,781,898,100 | $2,087,626,350 | $1,962,627,250 | $1,838,669,250 | $2,005,558,050 | | General Fund, One-time | $454,595,540 | $349,708,320 | $219,114,600 | ($6,673,300) | $66,217,100 | | Uniform School Fund | $2,115,252,445 | $2,413,266,208 | $2,332,619,286 | $2,178,256,186 | $19,000,000 | | Uniform School Fund, One-time | $74,357,300 | $296,803,500 | $176,204,600 | $181,836,700 | $0 | | Education Fund | $548,663,800 | $463,136,000 | $384,367,200 | $350,937,400 | $2,675,594,686 | | Education Fund, One-time | $62,412,200 | $433,064,400 | ($74,259,100) | ($80,684,300) | $16,592,800 | | Transportation Fund | $422,737,800 | $440,434,900 | $434,697,300 | $554,239,000 | $419,331,600 | | Transportation Fund, One-time | $1,200,000 | $2,000,000 | $0 | $0 | $0 | | Transportation Investment Fund of 2005 | $55,000,000 | $105,000,000 | $132,742,800 | $434,325,900 | $104,758,500 | | TIF of 2005, One-time | $0 | $0 | $32,569,400 | ($63,000,000) | $0 | | Centennial Highway Fund | $127,976,800 | $127,976,800 | $313,832,000 | $137,022,500 | $137,915,300 | | Centennial Highway Fund Restricted Account | $223,297,100 | $200,277,000 | $0 | $179,954,000 | $64,305,300 | | Centennial Highway Fund, One-time | $0 | $3,650,000 | $0 | $0 | $0 | | Federal Funds | $2,386,197,852 | $2,825,333,000 | $2,702,587,800 | $3,269,485,300 | $3,029,938,500 | | American Recovery and Reinvestment Act | $0 | $0 | $313,321,000 | $699,154,500 | $218,454,800 | | Dedicated Credits Revenue | $702,603,540 | $882,879,900 | $984,094,400 | $972,921,500 | $852,165,300 | | Dedicated Credits - Land Grant | $1,943,425 | $1,702,100 | $1,303,100 | $1,386,400 | $1,108,500 | | Dedicated Credits - GO Bonds | $15,200 | $3,261,900 | $5,492,000 | $5,867,600 | $0 | | Federal Mineral Lease | $170,055,653 | $190,833,600 | $122,085,200 | $122,694,600 | $137,049,100 | | Restricted Revenue | $19,200,600 | $18,760,500 | $1,206,600 | $311,600 | $0 | | GFR - Alc Bev Enf & Treatment | $4,350,000 | $4,984,800 | $5,425,600 | $5,622,600 | $5,597,200 | | GFR - Alternative Dispute Resolution | $162,000 | $310,700 | $317,500 | $590,000 | $415,300 | | GFR - Autism Treatment Account | $0 | $0 | $0 | $0 | $50,000 | | GFR - Bail Bond Surety Admin | $22,100 | $22,100 | $23,500 | $23,500 | $23,500 | | GFR - Boating | $4,730,300 | $4,340,600 | $4,374,900 | $4,340,700 | $5,325,800 | | GFR - Cancer Research Restricted Account | $0 | $0 | $0 | $0 | $20,000 | | GFR - Law Enforcement Services | $0 | $0 | $0 | $0 | $619,000 | | GFR - Cat & Dog Spay & Neuter | $0 | $50,000 | $66,200 | $80,000 | $80,000 | | GFR - Children's Legal Defense | $646,900 | $667,500 | $810,600 | $1,010,800 | $812,800 | | GFR - Children's Trust | $400,000 | $400,000 | $400,000 | $900,000 | $400,000 | | GFR - Cigarette Tax Rest | $7,416,200 | $7,416,200 | $6,699,100 | $7,416,200 | $7,416,200 | | GFR - Commerce Service | $17,174,500 | $18,495,400 | $18,549,400 | $22,391,200 | $18,249,000 | | GFR - Commerce Service, One-time | $0 | $0 | $0 | $0 | ($27,600) | | GFR - CSF - PURF | $6,333,700 | $6,696,500 | $6,926,500 | $1,982,200 | $7,056,300 | | GFR - Guaranteed Asset Protection Waiver | $0 | $0 | $0 | $11,800 | $89,000 | | GFR - Constitutional Defense | $2,030,500 | $2,037,100 | $2,368,900 | $2,366,100 | $2,366,000 | | GFR - Court Reporter Technology | $0 | $0 | $250,000 | $250,000 | $250,000 | | GFR - Court Security Account | $4,170,000 | $4,756,400 | $5,106,400 | $7,556,400 | $7,556,400 | | GFR - Court Trust Interest | $250,000 | $250,000 | $775,000 | $775,000 | $795,000 | | GFR - Criminal Forfeiture Restricted Account | $300,000 | $500,000 | $500,000 | $500,000 | $500,000 | | GFR - Disaster Recovery Fund | $0 | $0 | $0 | $24,000 | $3,000,000 | | GFR - Domestic Violence | $813,100 | $832,400 | $919,000 | $2,019,000 | $919,000 | | GFR - DNA Specimen | $1,436,600 | $1,447,400 | $1,455,900 | $1,451,000 | $1,698,200 | | GFR - E-911 Emergency Services | $4,190,000 | $4,200,000 | $4,200,000 | $4,195,600 | $4,191,300 | | GFR - Economic Incentive Restricted Account | $1,528,000 | $5,928,000 | $15,480,000 | $3,514,100 | $4,540,000 | | GFR - Environmental Quality | $6,333,800 | $6,940,500 | $6,715,300 | $6,475,800 | $6,521,400 | | GFR - Factory Built Housing Fees | $104,700 | $104,700 | $104,700 | $104,700 | $104,700 | | GFR - Financial Institutions | $5,789,900 | $5,989,500 | $6,592,300 | $5,874,900 | $5,969,000 | | GFR - Fire Academy Support | $4,732,600 | $5,398,500 | $5,348,800 | $5,522,100 | $5,524,900 | | GFR - Firefighter Support Account | $0 | $0 | $0 | $0 | $132,000 | | GFR - Geologist Ed. & Enf. | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | | GFR - Guardian Ad Litem Services | $348,700 | $355,300 | $360,900 | $355,700 | $365,300 | | GFR - Homeless Trust | $850,000 | $1,350,000 | $1,350,000 | $849,500 | $732,000 | | GFR - Horse Racing | $50,000 | $50,000 | $50,000 | $50,000 | $30,000 | | GFR - Industrial Assistance | $1,736,500 | $223,500 | $223,500 | $223,500 | $223,500 | | GFR - Interstate Cmpct for Adult Offender Sup. | $29,000 | $29,000 | $29,000 | $29,000 | $29,000 | | GFR - Intoxicated Driver Rehab | $1,500,000 | $1,500,000 | $1,500,000 | $1,500,000 | $1,500,000 | | GFR - Invasive Species Mitigation | $0 | $0 | $0 | $1,100,000 | $0 | | GFR - ISF Overhead | $1,296,500 | $1,299,600 | $1,299,600 | $1,299,600 | $1,299,600 | | GFR - Justice Court Tech, Sec,& Training | $899,300 | $899,400 | $1,299,300 | $1,299,300 | $1,105,700 | | GFR - Children's Organ Transplant Trust | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 | | GFR - Land Exchange Distribution Account | $0 | $21,691,400 | $16,326,000 | $19,464,000 | $19,383,300 | | GFR - Law Enforcement Operations | $0 | $2,370,000 | $2,370,000 | $2,365,200 | $1,800,000 | | GFR - Livestock Brand | $916,200 | $877,000 | $935,700 | $925,100 | $932,500 | | GFR - Medicaid Restricted | $1,995,900 | $4,065,000 | $8,790,900 | $8,396,500 | $1,847,600 | | GFR - Meth House Reconstruction | $0 | $0 | $0 | $0 | $8,600 | | GFR - Mineral Bonus | $0 | $19,447,000 | $0 | $5,406,000 | $20,900,000 | | GFR - Motion Picture Incentive Fund | $1,000,000 | $4,000,000 | $3,831,300 | $2,206,300 | $2,206,300 | | GFR - Non-Judicial Assessment | $684,400 | $721,700 | $1,445,300 | $1,154,100 | $936,200 | | GFR - Nuclear Oversight | $1,793,300 | $1,793,300 | $1,793,300 | $1,793,300 | $1,793,300 | | GFR - Nursing Facility | $11,698,600 | $0 | $0 | $0 | $0 | | GFR - Nurses Ed & Enf Fund | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | | GFR - Nursing Care Facilities Account | $0 | $15,716,200 | $15,716,200 | $18,240,300 | $19,506,300 | | GFR - Off-highway Vehicle | $3,466,800 | $4,307,500 | $5,383,700 | $3,749,400 | $4,984,300 | | GFR - Oil & Gas Conservation Account | $3,240,400 | $3,382,200 | $3,508,500 | $3,497,600 | $3,526,200 | | GFR - Online Court Assistance | $75,000 | $74,400 | $75,000 | $251,000 | $201,000 | | GFR - Pawnbroker Operations | $45,000 | $45,000 | $129,000 | $129,000 | $129,000 | | GFR - Petroleum Storage Tank | $0 | $50,000 | $0 | $0 | $0 | | GFR - Prison Telephone Surcharge Account | $819,436 | $886,600 | $935,900 | $1,500,000 | $1,500,000 | | GFR - Public Safety Honoring Heroes Account | $0 | $0 | $0 | $0 | $15,500 | | GFR - Public Safety Support | $3,680,700 | $4,245,100 | $4,409,900 | $4,125,500 | $4,111,900 | | GFR - Rangeland Improvement | $0 | $0 | $0 | $4,046,300 | $1,241,700 | | GFR - Reduced Cigarette Ignition Propensity & Firefighter Protection Account | $0 | $0 | $0 | $0 | $75,000 | | GFR - Off-highway Access & Education | $0 | $0 | $0 | $0 | $17,500 | | GFR - Zion National Park Support Programs | $0 | $0 | $0 | $0 | $4,000 | | GFR - Rural Health Care Facilities | $0 | $0 | $0 | $555,000 | $555,000 | | GFR - Sales and Use Tax Admin Fees | $7,944,000 | $12,319,300 | $14,670,900 | $9,106,000 | $8,590,900 | | GFR - Industrial Accident Restricted Account | $0 | $0 | $0 | $566,600 | $1,921,500 | | GFR - Sovereign Land Mgt | $4,866,600 | $3,482,900 | $4,348,200 | $6,484,200 | $5,163,000 | | GFR - Special Administrative Expense | $0 | $0 | $4,057,300 | $3,000,000 | $2,000,000 | | GFR - Species Protection | $983,000 | $584,600 | $1,199,400 | $1,063,400 | $601,800 | | GFR - State Court Complex | $4,700,000 | $4,700,000 | $4,700,000 | $4,700,000 | $4,700,000 | | GFR - State Fish Hatch Maint | $1,205,000 | $1,205,000 | $1,205,000 | $1,205,000 | $1,205,000 | | GFR - State Lab Drug Testing Account | $293,500 | $407,100 | $418,000 | $417,300 | $420,300 | | GFR - State Law Enforcement Forfeiture Account | $7,500 | $20,000 | $0 | $25,000 | $25,000 | | GFR - State Park Fees | $10,455,100 | $11,309,200 | $12,223,900 | $11,967,300 | $11,821,600 | | GFR - Statewide Warrant Ops | $506,600 | $531,000 | $644,000 | $612,500 | $568,200 | | GFR - Substance Abuse Prevention | $936,100 | $943,600 | $502,400 | $993,000 | $1,010,700 | | GFR - Tobacco Settlement | $22,899,800 | $24,985,900 | $23,120,000 | $27,393,600 | $31,309,200 | | GFR - Tourism Marketing Performance | $11,000,000 | $11,000,000 | $10,888,000 | $7,000,000 | $6,950,000 | | GFR - Transcriptions | $249,400 | $250,000 | $0 | $0 | $0 | | GFR - Trust for People with Disabilities | $100,000 | $100,000 | $100,000 | $481,900 | $100,000 | | GFR - Underground Wastewater System | $76,000 | $76,000 | $75,700 | $76,000 | $76,000 | | GFR - Used Oil Administration | $727,600 | $737,000 | $744,300 | $742,300 | $747,000 | | GFR - Utah Housing Opportunity Restricted Account | $0 | $0 | $0 | $20,000 | $20,000 | | GFR - Voluntary Cleanup | $611,500 | $614,700 | $622,000 | $619,400 | $624,000 | | WDSF - Drinking Water | $129,300 | $159,400 | $0 | $0 | $138,700 | | WDSF - Drinking Water Loan Program | $0 | $0 | $138,700 | $138,700 | $3,500 | | WDSF - Drinking Water Origination Fee | $0 | $0 | $77,200 | $76,200 | $74,900 | | WDSF - Water Quality | $904,400 | $1,066,600 | $0 | $0 | $0 | | WDSF - Utah Wastewater Loan Program | $0 | $0 | $1,003,200 | $976,500 | $995,800 | | WDSF - Water Quality Origination Fee | $0 | $0 | $66,300 | $85,700 | $79,300 | | GFR - Wildlife Damage Prev | $611,800 | $634,000 | $608,800 | $600,900 | $641,600 | | GFR - Wildlife Habitat | $1,652,600 | $2,006,200 | $2,758,900 | $2,706,400 | $2,900,000 | | GFR - Wildlife Resources | $26,449,800 | $29,277,900 | $26,925,700 | $28,290,100 | $29,538,900 | | GFR - Workplace Safety | $1,572,300 | $1,588,400 | $1,580,300 | $1,719,200 | $1,713,200 | | USFR - Interest and Dividends Account | $15,081,900 | $25,808,900 | $26,499,500 | $24,754,400 | $20,410,400 | | USFR - Professional Practices | $86,100 | $1,434,800 | $1,465,900 | $1,460,600 | $1,469,900 | | TFR - Aeronautics Fund | $9,107,600 | $7,460,300 | $7,071,600 | $7,282,300 | $6,904,800 | | TFR - Motorcycle Education | $216,100 | $369,900 | $372,300 | $323,000 | $323,200 | | TFR - County of First Class State Highway Fund | $7,204,400 | $6,950,000 | $14,462,000 | $19,307,500 | $20,988,300 | | TFR - Dept. of Public Safety Rest. Acct. | $22,808,900 | $24,479,800 | $26,465,600 | $27,484,000 | $29,226,400 | | TFR - Uninsured Motorist I.D. | $1,993,900 | $1,993,900 | $2,493,900 | $2,493,900 | $2,493,900 | | Trust and Agency Funds | $14,132,900 | $55,086,100 | $219,228,000 | $32,759,200 | $0 | | ET - Petroleum Storage Tank | $1,246,600 | $1,255,100 | $1,306,800 | $1,298,000 | $1,310,800 | | ET - Waste Tire Recycling | $118,900 | $125,000 | $129,800 | $129,200 | $130,700 | | Agri Resource Development | $629,400 | $804,400 | $812,000 | $812,000 | $812,100 | | Agri Rural Dev Loan Fund | $0 | $0 | $0 | $0 | $2,000,000 | | Attorney General Litigation Fund | $279,800 | $321,700 | $335,400 | $332,900 | $336,500 | | Clean Fuel Vehicle Loan | $101,300 | $106,000 | $109,400 | $108,800 | $110,000 | | Crime Victims Reparation Trust | $3,629,300 | $4,329,200 | $4,472,000 | $3,716,200 | $3,560,600 | | Critical Highway Needs Fund | $0 | $90,000,000 | $65,351,800 | $377,385,800 | $160,578,500 | | Debt Service | $0 | ($131,626,800) | ($133,826,800) | ($137,022,500) | ($137,915,300) | | Designated Sales Tax | $227,822,300 | $37,822,900 | $8,317,200 | $7,175,000 | $33,409,200 | | Employers' Reinsurance Fund | $0 | $0 | $73,000 | $50,985,100 | $2,573,000 | | Hospital Provider Assessment Special Revenue Fund | $0 | $0 | $0 | $0 | $2,000,000 | | Land Grant Mgt Fund | $17,586,800 | $20,269,200 | $26,471,900 | $22,348,600 | $18,262,400 | | Land Grant Mgt Fund, One-time | $0 | $0 | $0 | $0 | $4,376,300 | | Liquor Control Fund | $23,396,400 | $27,066,000 | $28,704,500 | $28,878,300 | $31,017,700 | | Local Property Tax | $470,804,680 | $0 | $0 | $0 | $0 | | Local Revenue | $0 | $508,148,621 | $592,118,974 | $602,671,370 | $584,414,678 | | DHS DP ISF | $0 | $0 | $119,900 | $0 | $0 | | Oil Overchg - Exxon | $763,500 | $771,500 | $0 | $0 | $0 | | Oil Overchg - Stripper Well | $431,900 | $436,500 | $0 | $0 | $0 | | Organ Donation Contribution Fund | $113,000 | $113,000 | $113,000 | $113,000 | $113,000 | | Permanent Community Impact | $903,000 | $1,023,600 | $35,684,300 | $49,108,200 | $95,913,000 | | Petroleum Storage Tank Account | $50,000 | $0 | $19,100 | $50,000 | $50,000 | | Petroleum Storage Tank Loan | $149,000 | $155,600 | $146,800 | $160,500 | $163,300 | | Premium Tax Collections | $0 | $0 | $0 | $3,139,000 | $46,574,000 | | Unclaimed Property Trust | $1,309,500 | $1,365,700 | $1,465,300 | $1,399,500 | $1,412,300 | | Unemployment Compensation Trust | $0 | $0 | $499,666,600 | $626,197,000 | $466,550,000 | | Uninsured Employers' Fund | $1,165,300 | $1,227,400 | $1,517,100 | $1,014,300 | $1,018,000 | | Universal Public Telecom Service Fund | $0 | $6,418,400 | $6,493,100 | $0 | $5,693,400 | | Utah Rural Rehab Loan | $18,000 | $63,000 | $62,800 | $63,000 | $63,000 | | Water Resources C&D | $6,281,100 | $6,479,400 | $6,608,100 | $6,593,400 | $6,618,600 | | Water Res Construction | $150,000 | $150,000 | $150,000 | $150,000 | $150,000 | | Transfers | $53,034,859 | $71,549,600 | $36,033,800 | $39,751,000 | $17,427,500 | | Transfers - Child Nutrition | $855,400 | $931,300 | $827,000 | $907,500 | $1,033,700 | | Transfers - Commission on Criminal and Juvenile Justice | $1,744,800 | $1,902,600 | $3,016,500 | $3,639,100 | $4,029,700 | | Transfers - Environmental Quality | $11,000 | $19,900 | $6,500 | $0 | $0 | | Transfers - Fed Pass-thru | $71,800 | $116,000 | $158,500 | $96,800 | $97,400 | | Transfers - Federal | $0 | $395,000 | $322,300 | $314,600 | $337,500 | | Transfers - Governor's Office Administration | $0 | $245,600 | $214,700 | $16,800 | $0 | | Transfers - H - Medical Assistance | $142,847,800 | $160,303,000 | $171,974,800 | $186,174,300 | $164,505,500 | | Transfers - Health | $40,000 | $0 | $11,700 | $1,035,800 | $0 | | Transfers - Human Services | $78,474,100 | $57,284,600 | $70,268,700 | $75,065,700 | $67,213,000 | | Transfers - Interagency | $725,500 | $5,100 | $0 | $5,256,600 | $0 | | Transfers - Intergovernmental | $34,272,000 | ($215,400) | $70,320,700 | $37,504,300 | $27,255,000 | | Transfers - Medicaid | $15,853,500 | $15,704,700 | $14,119,200 | $26,735,200 | $31,991,400 | | Transfers - Other Agencies | $5,974,600 | $12,926,500 | $1,420,000 | $508,200 | $2,075,900 | | Transfers - Public Safety | $269,500 | $433,800 | $545,900 | $516,900 | $354,800 | | Transfers - State Office of Education | $0 | $15,200 | $0 | $16,800 | $0 | | Transfers - Within Agency | $25,809,900 | $52,141,400 | $18,213,400 | $78,922,400 | $22,926,800 | | Transfers - Workforce Services | $1,041,000 | $3,110,200 | $28,325,700 | $29,539,900 | $27,334,600 | | Transfers - Youth Corrections | $0 | $0 | $6,074,700 | $0 | $3,552,900 | | Rural Health Care Facilities Fund | $0 | $277,500 | $277,500 | $0 | $0 | | State Debt Collection Fund | $0 | $500,000 | $233,000 | $0 | $0 | | UDC Data Processing ISF | $0 | $368,300 | $0 | $0 | $0 | | Capital Projects Fund | $1,801,800 | $3,109,000 | $1,945,200 | $1,950,500 | $1,942,900 | | Project Reserve Fund | $200,000 | $200,000 | $200,000 | $5,200,000 | $200,000 | | Contingency Reserve Fund | $82,300 | $2,082,300 | $2,082,300 | $82,300 | $82,300 | | Other Financing Sources | $871,096 | $172,000 | $988,700 | $2,379,300 | $613,000 | | Pass-through | $1,276,400 | $3,617,300 | $6,937,800 | $4,434,300 | $2,862,300 | | Repayments | $11,816,900 | $15,182,200 | $19,589,700 | $51,319,700 | $44,337,500 | | Beginning Nonlapsing | $432,599,349 | $522,764,700 | $462,237,000 | $279,698,100 | $169,254,800 | | Beginning Fund Balances - CSF | $100,000 | $843,900 | $0 | $0 | $0 | | Beginning Nonlapsing - DHRM Flex Benefits | $0 | $10,200 | $0 | $0 | $0 | | Beginning Nonlapsing - Retirement | $71,500 | $178,500 | $0 | $0 | $0 | | Closing Nonlapsing | ($539,534,343) | ($552,608,900) | ($245,599,200) | ($366,447,000) | ($123,289,600) | | Closing Nonlapsing - Highway Safety | $0 | $0 | $100,000 | $0 | $0 | | Lapsing Balance | ($98,931,600) | ($158,343,000) | ($33,954,500) | ($63,316,300) | ($3,755,600) | | Total | $10,354,410,632 | $12,040,612,999 | $12,403,948,710 | $13,221,375,306 | $11,918,700,314 |

|---|

| | Committees | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Executive Offices & Criminal Justice | $678,486,400 | $742,554,250 | $750,706,250 | $726,439,850 | $778,660,750 | | Infrastructure & General Government | $2,114,168,400 | $2,402,371,500 | $1,968,671,000 | $2,375,088,000 | $1,440,394,000 | | Business, Economic Development, & Labor | $435,525,600 | $549,650,900 | $506,407,100 | $578,353,000 | $694,957,200 | | Social Services | $2,677,497,700 | $3,177,042,700 | $3,780,963,700 | $4,368,889,900 | $3,972,520,400 | | Higher Education | $1,121,954,267 | $1,276,695,400 | $1,299,005,700 | $1,294,727,200 | $1,231,337,200 | | Natural Resources, Agriculture, & Environmental Quality | $315,684,600 | $323,834,100 | $356,693,800 | $352,728,900 | $361,503,000 | | Public Education | $2,954,099,125 | $3,496,434,729 | $3,663,970,560 | $3,457,622,456 | $3,374,075,664 | | Retirement & Independent Entities | $3,605,000 | $3,926,600 | $3,836,000 | $3,125,800 | $4,042,300 | | Executive Appropriations | $53,389,540 | $68,102,820 | $73,694,600 | $64,400,200 | $61,209,800 | | Total | $10,354,410,632 | $12,040,612,999 | $12,403,948,710 | $13,221,375,306 | $11,918,700,314 |

|---|

| | Categories of Expenditure | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Personnel Services | $2,101,694,274 | $2,184,034,530 | $2,302,075,950 | $2,322,666,100 | $2,281,741,350 | | In-state Travel | $18,013,806 | $20,265,100 | $16,728,300 | $15,972,800 | $13,161,000 | | Out-of-state Travel | $6,591,000 | $8,217,960 | $5,624,700 | $4,729,200 | $6,443,500 | | Current Expense | $1,023,054,981 | $1,232,594,700 | $1,155,374,400 | $1,433,000,000 | $1,257,228,600 | | DP Current Expense | $140,621,800 | $122,213,580 | $129,724,100 | $142,793,200 | $144,768,500 | | DP Capital Outlay | $22,973,900 | $16,295,900 | $11,974,600 | $70,975,300 | $5,452,400 | | Capital Outlay | $789,338,760 | $981,935,900 | $969,276,400 | $1,444,512,500 | $417,101,300 | | Other Charges/Pass Thru | $6,093,166,211 | $7,212,018,129 | $7,603,706,860 | $9,240,230,106 | $7,563,175,964 | | Cost of Goods Sold | ($227,600) | ($439,300) | $1,833,400 | $673,200 | $1,805,600 | | Cost Accounts | ($600) | ($61,900) | ($1,900) | ($700) | $0 | | Operating Transfers | $58,702,300 | $46,659,700 | $52,437,700 | ($221,011,000) | $66,375,100 | | Transfers | ($56,004,000) | $59,142,300 | $46,700 | $38,200 | $46,100 | | Trust & Agency Disbursements | $156,485,800 | $157,736,400 | $155,147,500 | ($1,233,203,600) | $161,401,000 | | Total | $10,354,410,632 | $12,040,612,999 | $12,403,948,710 | $13,221,375,306 | $11,918,700,414 |

|---|

| | Other Indicators | 2007

Actual | 2008

Actual | 2009

Actual | 2010

Actual | 2011

Approp | | Budgeted FTE | 33,060.1 | 33,570.0 | 33,940.9 | 34,036.1 | 33,499.7 | | Vehicles | 9,183 | 9,263 | 7,339 | 7,151 | 7,316 |

|

|

|

|

|

|

Statewide Table of Contents |