Agency: Workforce Services Line Item: Operations and Policy Function Operations and Policy is the main line item for the Department. It houses the various programs that comprise much of the agency. These include the following:

- Child Care Assistance

- Nutrition Assistance

- Workforce Development

- Workforce Investment Act Assistance

- Eligibility Services

- Information Technology

- Workforce Research and Analysis

- Facilities and Pass-Through

- Refugee Assistance

- Temporary Assistance to Needy Families

- Trade Adjustment Act Assistance

- Other Assistance

- All Other Programs

Intent Language During the 2012 General Session, the Legislature approved the following intent language for the Operations and Policy line item: The Legislature intends that the Department of Health, in conjunction with the Department of Workforce Services and the Department of Human Services, use part of their appropriations to pursue obtaining CHIPRA Performance Bonuses if the Department of Health determines that it would be in the best financial interest of the state. It is the intent of the Legislature that the Reed Act funds appropriated for FY 2013 to the Department of Workforce Services be used for workforce development and labor exchange activities. The Legislature intends that the Department of Health, in conjunction with the Department of Workforce Services and the Department of Human Services, use part of their appropriations to pursue obtaining CHIPRA Performance Bonuses if the Department of Health determines that it would be in the best financial interest of the state. The Legislature intends that, under 63J-1-603 of the Utah Code appropriations provided for the Department of Workforce Services Operations and Policy line item in Item 19 of Chapter 4 Laws of Utah 2011 not lapse at the close of Fiscal Year 2012. The amount of any nonlapsing funds is limited to $3,100,000 from the General Fund, $3,900,000 from the Special Administrative Expense Account, and $3,300,000 from Reed Act Funds. The use of any nonlapsing funds is for Operations and Policy line item expenses. All General Funds appropriated to the Department of Workforce Services - DWS Operations & Policy and DWS Unemployment Insurance line items are contingent upon expenditures from Federal Funds - American Recovery and Reinvestment Act (H.R. 1, 111th United States Congress) not exceeding amounts appropriated from Federal Funds - American Recovery and Reinvestment Act in all appropriation bills passed for FY 2012. If expenditures in the DWS Operations & Policy and DWS Unemployment Insurance line items from Federal Funds - American Recovery and Reinvestment Act exceed amounts appropriated to the DWS Operations & Policy and DWS Unemployment Insurance line

items from Federal Funds - American Recovery and Reinvestment Act in FY 2012, the Division of Finance shall reduce the General Fund allocations to the DWS Operations & Policy and DWS Unemployment Insurance line items by one dollar for every one dollar in Federal Funds -- American Recovery and Reinvestment Act expenditures that exceed Federal Funds - American Recovery and Reinvestment Act appropriations. It is the intent of the Legislature that the Reed Act funds appropriated for FY 2012 to the Department of Workforce Services be used for workforce development and labor exchange activities. Funding Detail DWS assesses costs incurred to each program through a process called cost allocation. Certain costs of the department benefit specific funding programs. In these cases the costs are directly charged to the appropriate funding. In other situations, specific DWS expenditures benefit multiple funding programs. Many individual employees work with customers benefiting from various programs. Instead of each of these individuals keeping track of what programs they worked during what times, the department measures the work they do on each program using Random Moment Time Sampling (RMTS). The RMTS sample sizes provide a 95% confidence level. Direct charge data and RMTS data are both used to determine the cost allocation of administrative expenditures. The RMTS cost allocation system is intended to accomplish several goals, including: - Provide a means of tracking time and effort that is simple and efficient for employees

-

Improve the precision of time reporting

-

Obtain compliance with requirements of federal OMB Circular A-87

-

Appropriately allocate costs to programs/activities that are measured by the RMTS.

The RMTS system utilizes an electronic database to measure time and effort. As implied by the system name, a sample of employees is randomly asked to input details of the program on which they are working at any particular moment. These data are then utilized to more accurately allocate costs across programs. For analysis of current budget requests and discussion of issues related to this budget click here.here. Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $53,843,800 | $57,315,500 | $56,690,800 | $51,681,900 | $51,824,300 | | General Fund, One-time | ($8,942,700) | $0 | $0 | ($1,386,200) | $28,000 | | Federal Funds | $399,942,200 | $542,655,400 | $587,780,600 | $591,663,300 | $620,085,500 | | American Recovery and Reinvestment Act | $2,312,800 | $20,733,900 | $17,800,800 | $9,983,300 | $6,187,900 | | Dedicated Credits Revenue | $1,917,400 | $2,408,000 | $3,903,000 | $3,500,300 | $2,848,700 | | GFR - Special Administrative Expense | $0 | $4,003,600 | $226,500 | $3,766,000 | $7,980,000 | | Unemployment Compensation Fund | $15,800,000 | $0 | $1,230,600 | $6,567,000 | $7,713,100 | | Transfers - Medicaid | $28,923,600 | $25,316,000 | $20,847,700 | $19,824,300 | $23,128,800 | | Transfers - Other Agencies | $0 | $0 | $0 | $16,400 | $0 | | Beginning Nonlapsing | $0 | $2,596,600 | $46,500 | $4,093,000 | $0 | | Closing Nonlapsing | ($2,596,600) | ($46,500) | ($4,469,200) | ($6,555,600) | $0 | | Lapsing Balance | $0 | ($7,419,000) | ($1,336,100) | ($268,100) | $0 | | Total | $491,200,500 | $647,563,500 | $682,721,200 | $682,885,600 | $719,796,300 |

|---|

| | | | | | Programs:

(click linked program name to drill-down) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Facilities and Pass-Through | $11,636,100 | $11,028,200 | $9,176,400 | $9,923,000 | $11,933,000 | | Workforce Development | $76,997,600 | $62,462,000 | $64,063,400 | $63,431,600 | $88,908,500 | | Temporary Assistance to Needy Families | $32,802,100 | $49,324,400 | $48,177,900 | $45,475,600 | $61,542,600 | | Refugee Assistance | $5,113,800 | $6,216,900 | $6,477,000 | $6,822,600 | $5,942,600 | | Workforce Research and Analysis | $3,105,200 | $3,117,600 | $2,604,400 | $2,895,200 | $2,699,700 | | Trade Adjustment Act Assistance | $4,045,300 | $4,647,800 | $3,086,800 | $2,376,200 | $4,185,000 | | Eligibility Services | $52,134,500 | $69,942,200 | $69,504,100 | $61,606,300 | $62,681,000 | | Child Care Assistance | $39,334,900 | $44,503,000 | $46,603,400 | $43,542,100 | $43,731,400 | | Nutrition Assistance | $215,111,700 | $352,971,200 | $391,994,500 | $410,226,900 | $393,679,500 | | Workforce Investment Act Assistance | $8,461,400 | $11,791,500 | $8,221,300 | $7,570,500 | $12,591,200 | | Other Assistance | $8,509,900 | $533,500 | $4,537,000 | $3,134,300 | $3,189,800 | | Information Technology | $33,948,000 | $31,025,200 | $28,275,000 | $25,881,300 | $28,712,000 | | Total | $491,200,500 | $647,563,500 | $682,721,200 | $682,885,600 | $719,796,300 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Personnel Services | $113,328,900 | $110,546,400 | $108,140,300 | $102,449,100 | $115,865,100 | | In-state Travel | $366,700 | $361,600 | $311,200 | $291,500 | $428,800 | | Out-of-state Travel | $78,800 | $75,800 | $121,700 | $102,800 | $169,700 | | Current Expense | $31,485,700 | $42,076,800 | $43,716,400 | $39,851,500 | $53,813,500 | | DP Current Expense | $35,880,300 | $27,964,600 | $28,660,400 | $26,601,900 | $27,414,400 | | DP Capital Outlay | $688,900 | $7,000,100 | $5,021,600 | $3,200,500 | $6,805,000 | | Capital Outlay | $0 | $0 | $0 | $1,216,800 | $0 | | Other Charges/Pass Thru | $309,371,200 | $459,538,200 | $496,749,600 | $509,171,500 | $515,299,800 | | Total | $491,200,500 | $647,563,500 | $682,721,200 | $682,885,600 | $719,796,300 |

|---|

| | | | | | | Other Indicators | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Budgeted FTE | 0.0 | 0.0 | 0.0 | 0.0 | 1,616.3 | | Actual FTE | 0.0 | 0.0 | 0.0 | 1,553.5 | 0.0 | | Vehicles | 0 | 0 | 0 | 101 | 103 |

|

|

|

|

|

|

|---|

Subcommittee Table of ContentsProgram: Facilities and Pass-Through Function The Facilities and Pass-Through units are established to account for expenditures that are beyond the span of control of any specific program. The facilities units, for instance, capture the rents and lease expenditures for each Employment Service Area. The Pass-through units capture expenditures such as the EBT Card administrative fees, the Metlife Retirement charges, and travel and P-card clearing charges. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $3,174,600 | $3,385,500 | $3,181,500 | $2,522,300 | $3,291,400 | | Federal Funds | $7,130,300 | $6,455,300 | $5,339,400 | $6,592,500 | $5,984,100 | | Dedicated Credits Revenue | $92,900 | $60,600 | $83,000 | $19,900 | $16,900 | | GFR - Special Administrative Expense | $0 | $0 | $0 | $200 | $1,500,000 | | Transfers - Medicaid | $1,238,300 | $1,126,800 | $572,500 | $788,100 | $1,140,600 | | Total | $11,636,100 | $11,028,200 | $9,176,400 | $9,923,000 | $11,933,000 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Personnel Services | $2,566,300 | $1,852,000 | $979,300 | $2,144,700 | $1,122,600 | | Current Expense | $9,047,700 | $9,138,900 | $8,058,900 | $7,534,100 | $10,810,400 | | DP Current Expense | $22,100 | $37,300 | $23,700 | $20,100 | $0 | | Other Charges/Pass Thru | $0 | $0 | $114,500 | $224,100 | $0 | | Total | $11,636,100 | $11,028,200 | $9,176,400 | $9,923,000 | $11,933,000 |

|---|

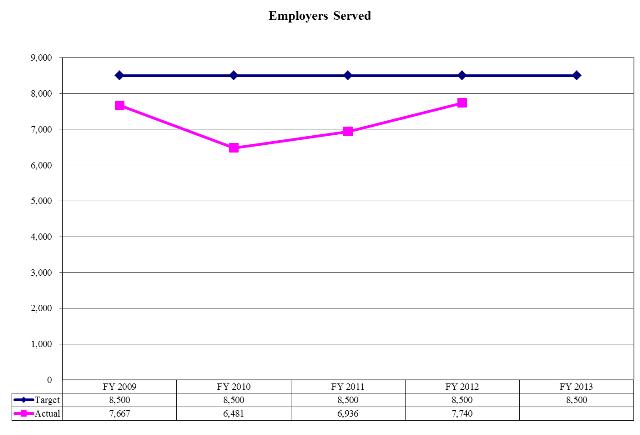

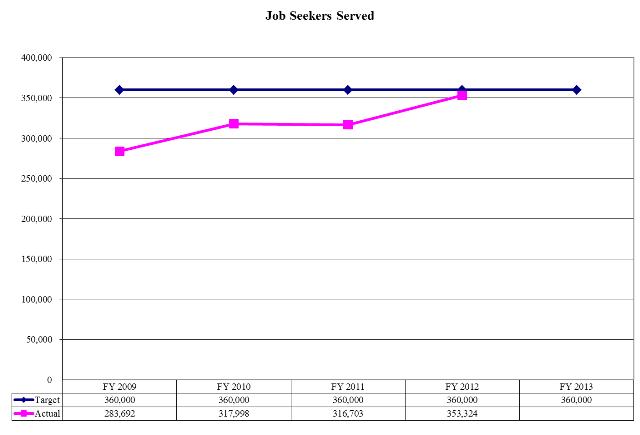

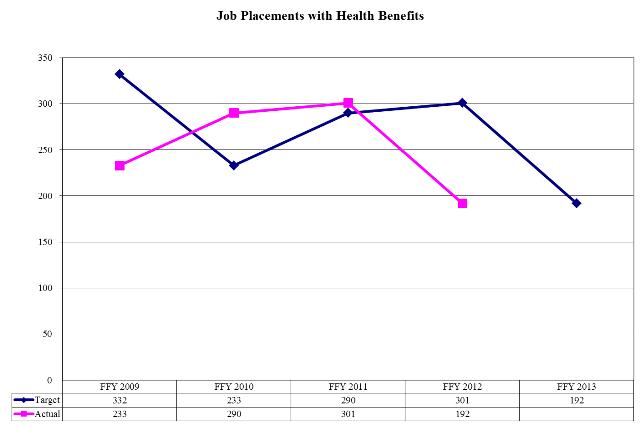

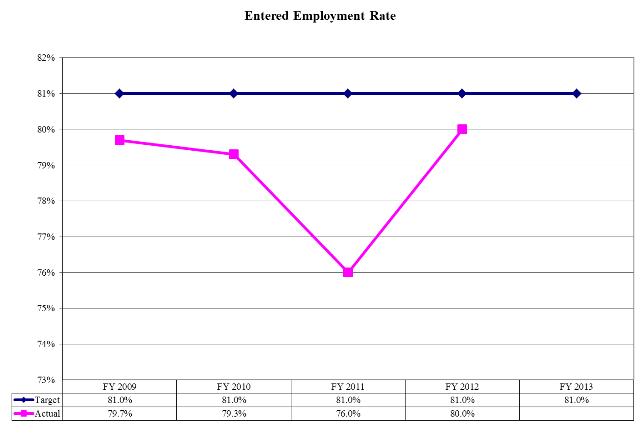

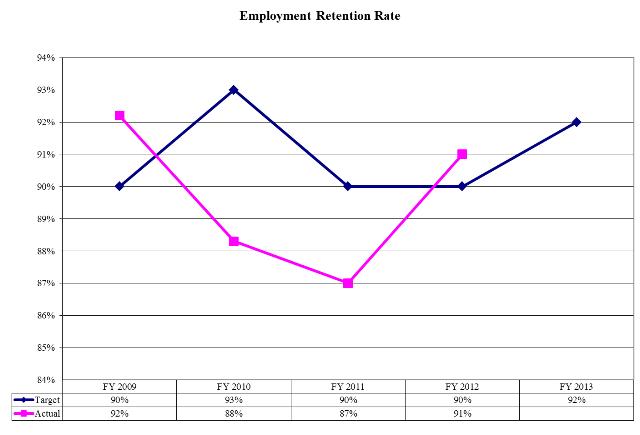

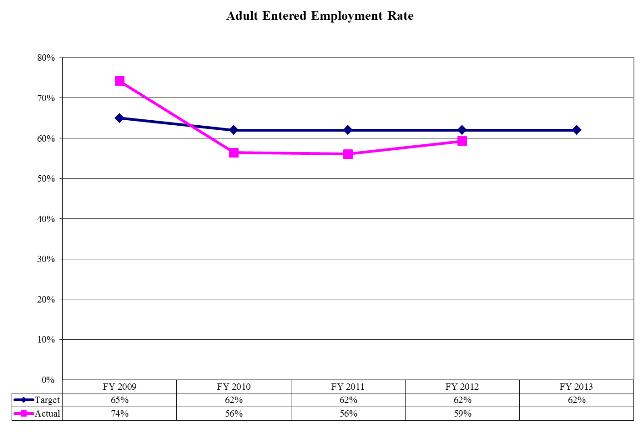

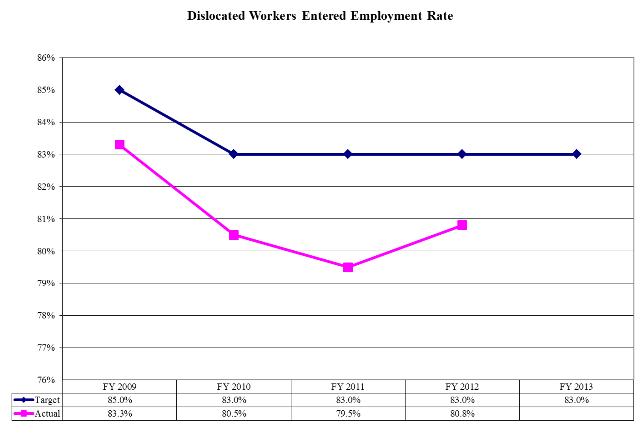

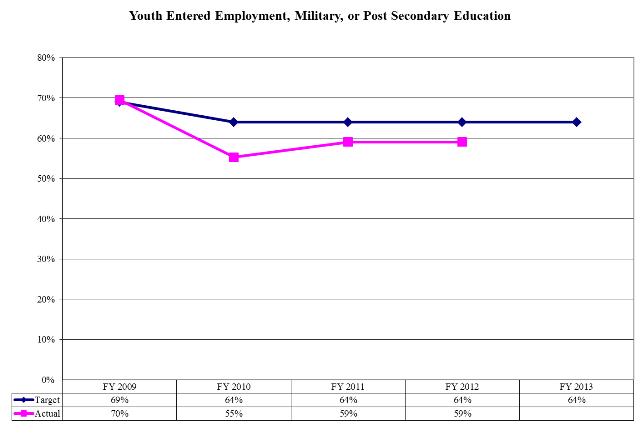

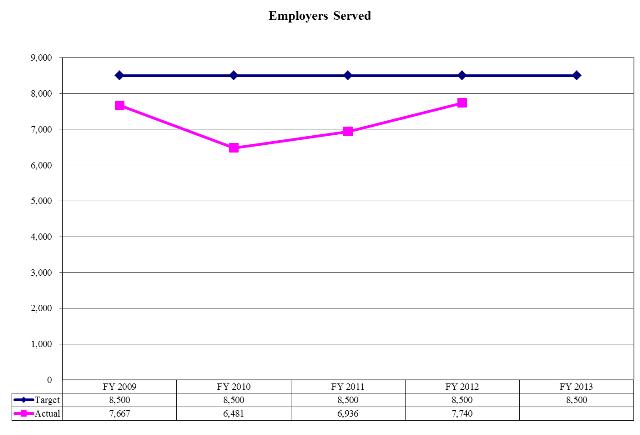

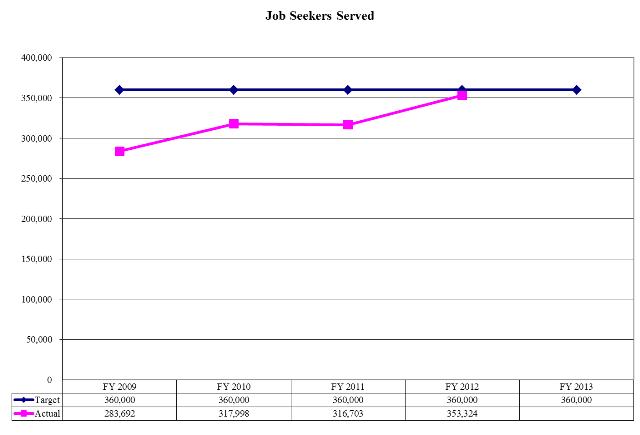

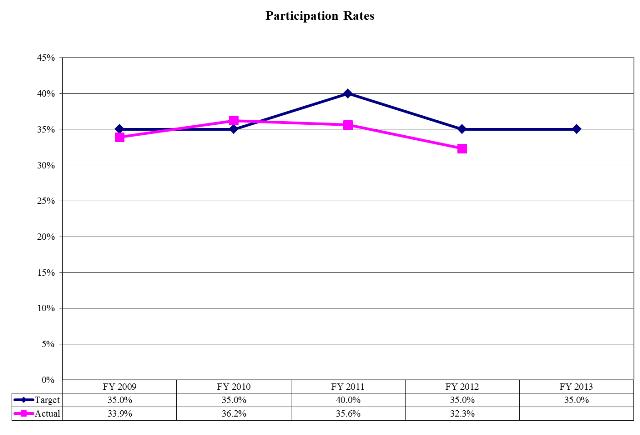

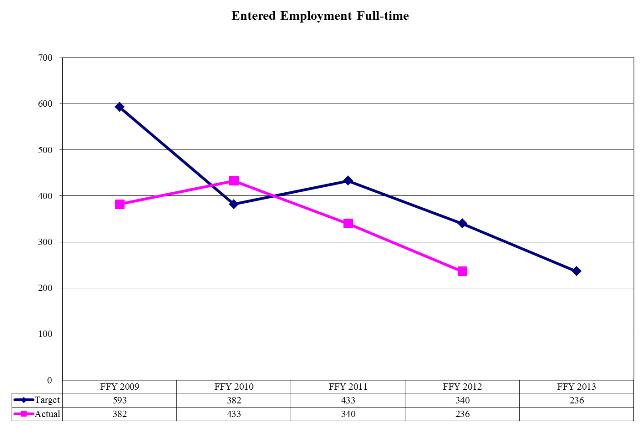

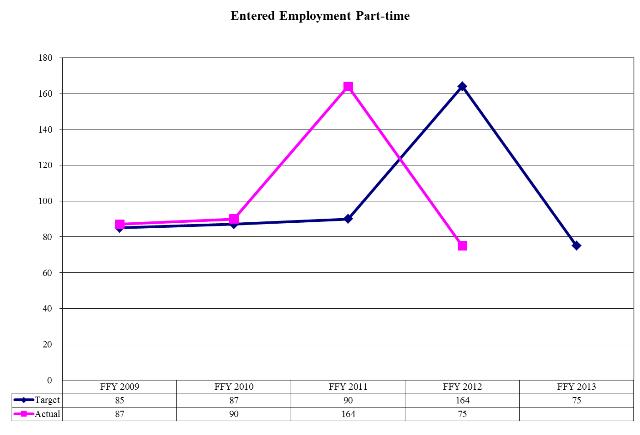

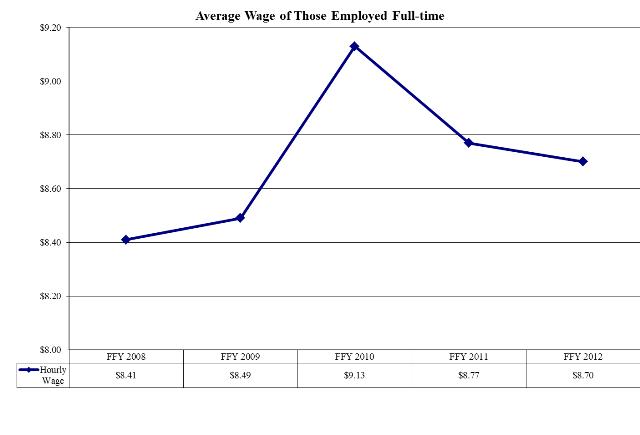

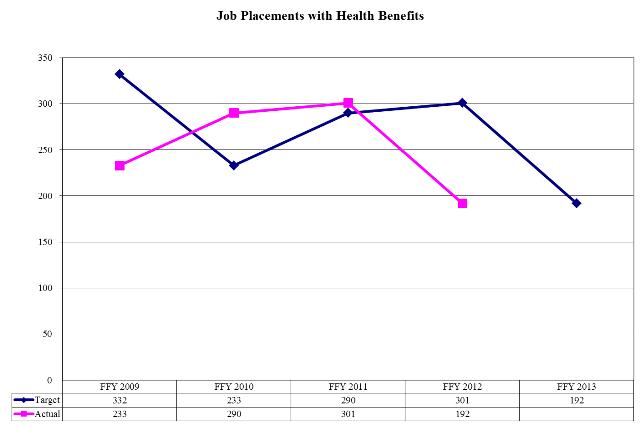

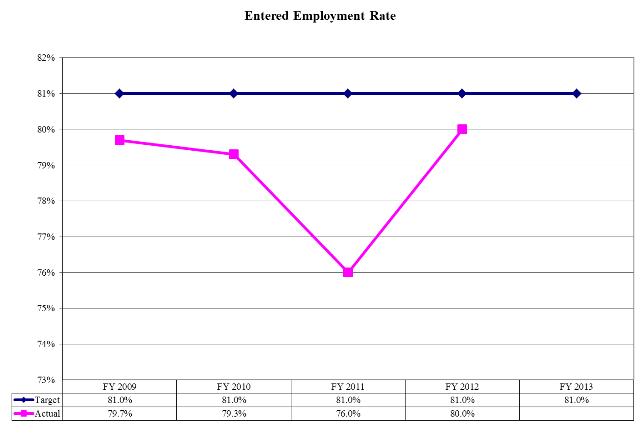

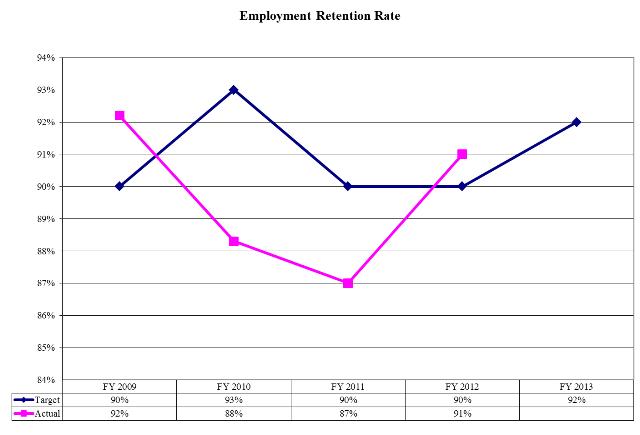

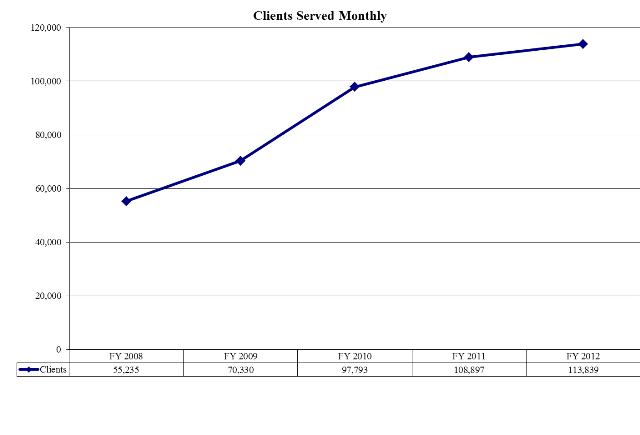

Subcommittee Table of ContentsProgram: Workforce Development Function The Workforce Development Division (WDD) consists of nine Economic Service Areas (ESAs), 34 statewide One-Stop Employment Centers, and a state division of Program and Training. The overall objective of this division is to strengthen Utah's economy by supporting the quality of our state's workforce, which is achieved by providing services to employers and job seekers so they can prosper now and as the workforce of the future. The role of WDD is a demand-driven approach to make a "product" (a skilled workforce) so industries grow, economies remain strong, and job seekers at all levels have the opportunity to be successful. Employment Centers serve as the anchor for a statewide workforce development system that responds to the needs of employers, job seekers, and the community. Employment Centers support workforce development by focusing on providing a qualified and skilled workforce that meets the needs of employers and by helping job seekers find good jobs quickly. This requires Service Area Directors to develop and maintain strong relationships with employers, the educational community, and partner agencies. These workforce development services include the following: - Employment and training services; - Connecting job seekers to open jobs; - Resume and interviewing assistance; - Providing job counseling and labor market information; - Providing information on targeted occupations for their local area, information on schools and in-demand careers, internships, apprenticeships, and on the-job training; -Connection to other employer resources offered through the Department. These Labor Exchange (job connecting) activities are available to employers and job seekers in every center. Most of these services are provided by federally funded programs which require specific reporting and outcomes based on the purpose of that federal program. Service Area Directors are accountable to achieve the mandatory outcomes of the programs delivered and for understanding and meeting the employer demands and job seeker needs of the area. The State Program and Training Division under WDD is responsible to ensure compliance, quality, and consistent delivery of services is provided in every One-Stop Employment Center. Program Managers and Program Specialists develop policy and procedures based on federally funded programs and develop training for staff. The Department is subject to state and federal audits, and feel it is critical to have the data necessary to monitor and measure outcomes. Performance   Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $16,542,800 | $11,337,000 | $8,863,600 | $8,900,600 | $10,529,100 | | General Fund, One-time | ($8,942,700) | $0 | $0 | $0 | $28,000 | | Federal Funds | $39,628,300 | $45,119,900 | $48,179,300 | $42,693,300 | $58,331,000 | | American Recovery and Reinvestment Act | $760,000 | $4,230,600 | $3,683,100 | $0 | $3,404,300 | | Dedicated Credits Revenue | $965,400 | $0 | $597,100 | $55,600 | $310,000 | | GFR - Special Administrative Expense | $0 | $0 | $0 | $3,399,200 | $6,480,000 | | Unemployment Compensation Fund | $15,800,000 | $0 | $1,230,600 | $6,567,000 | $7,713,100 | | Transfers - Medicaid | $12,243,800 | $1,774,500 | $1,509,700 | $1,815,900 | $2,113,000 | | Total | $76,997,600 | $62,462,000 | $64,063,400 | $63,431,600 | $88,908,500 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Personnel Services | $63,605,300 | $43,669,500 | $44,585,400 | $44,296,300 | $57,377,400 | | In-state Travel | $206,800 | $172,200 | $181,300 | $212,000 | $286,300 | | Out-of-state Travel | $31,100 | $23,500 | $27,800 | $32,300 | $82,300 | | Current Expense | $10,378,400 | $14,827,000 | $15,437,500 | $15,219,900 | $26,604,500 | | DP Current Expense | $2,776,000 | $3,769,800 | $3,831,400 | $3,669,400 | $4,558,000 | | Other Charges/Pass Thru | $0 | $0 | $0 | $1,700 | $0 | | Total | $76,997,600 | $62,462,000 | $64,063,400 | $63,431,600 | $88,908,500 |

|---|

| | | | | | | Other Indicators | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Budgeted FTE | 0.0 | 0.0 | 0.0 | 0.0 | 728.0 | | Actual FTE | 0.0 | 0.0 | 0.0 | 679.9 | 0.0 | | Vehicles | 0 | 0 | 0 | 76 | 79 |

|

|

|

|

|

|

|---|

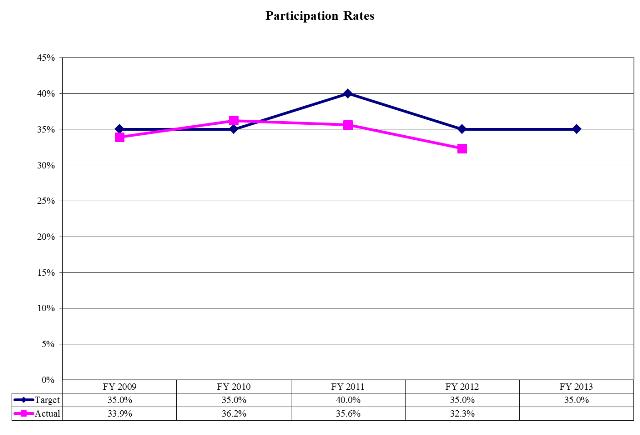

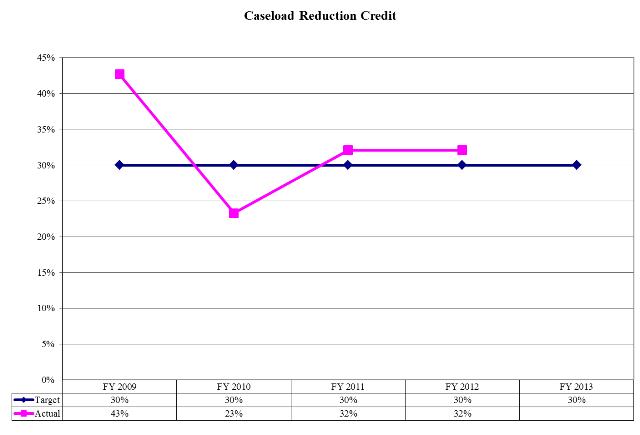

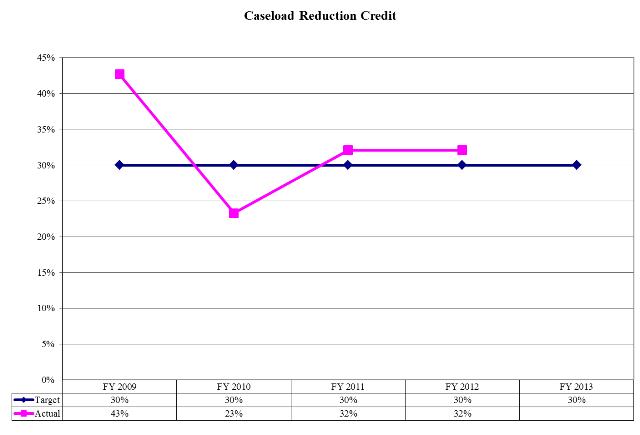

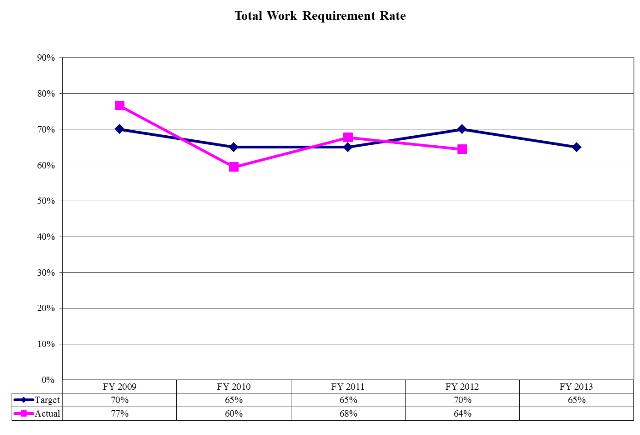

Subcommittee Table of ContentsProgram: Temporary Assistance to Needy Families Function Temporary Assistance for Needy Families (TANF) is a yearly federal grant that provides multiple services to unemployed and underemployed families with dependent children. The federal grant must be spent within the TANF purposes. They are 1) assisting needy families so that children can be cared for in their own homes, 2) reducing the dependency of needy parents by promoting job preparation, work and marriage, 3) preventing out-of-wedlock pregnancies, and 4) encouraging the formation and maintenance of two-parent families. Authority is derived from the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) Public Law 104-193 and 45 CFR 260 et al. TANF provides cash assistance (Family Employment Program - FEP) to work eligible single parent and two parent families that is time limited to 3 years in a life time. Cash assistance has very strict participation requirements for work eligible parents. Lack of participation is cause for denying services. The primary mission for FEP is employment with efforts for wage progression and retention. FEP has recently undergone some redesign which includes an intensive job club model called Work Success for all work ready parents. Customers must participate for up to four weeks for 40 hours per week in job search and work readiness activities. Other related TANF funded services that are not considered cash assistance are TANF - Non FEP training assistance for eligible parents to assist in tuition help for training in occupations in demand, after school programs for children designed to enhance learning and stability in school, support of the Marriage Commission to encourage stronger marriages in Utah, various contracted services that support the Economic Service Areas (local offices) to enhance services in local areas to support work and wage progression for both FEP families and other poor families needing employment assistance. In general, to receive services the recipient must be a citizen or eligible alien such as refugees, live in Utah, have dependent children or be a dependent child and meet low income criteria. Performance    Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $0 | $0 | $0 | $4,282,700 | $6,126,400 | | Federal Funds | $32,802,100 | $49,324,400 | $46,755,400 | $33,154,400 | $55,416,200 | | American Recovery and Reinvestment Act | $0 | $0 | $1,422,500 | $8,038,500 | $0 | | Total | $32,802,100 | $49,324,400 | $48,177,900 | $45,475,600 | $61,542,600 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Current Expense | $2,237,800 | $7,950,000 | $7,839,200 | $10,202,000 | $7,778,000 | | Other Charges/Pass Thru | $30,564,300 | $41,374,400 | $40,338,700 | $35,273,600 | $53,764,600 | | Total | $32,802,100 | $49,324,400 | $48,177,900 | $45,475,600 | $61,542,600 |

|---|

Subcommittee Table of ContentsProgram: Refugee Assistance Function Refugee Resettlement Program - Immigration and Nationality Act: Chapter 2 - Refugee Assistance, as amended. Refugees enter the United States with just the belongings they can carry and any employable education and skills they may possess. The Refugee Resettlement Program is for the effective resettlement of refugees and to assist them in achieving economic self-sufficiency within the shortest possible time after entrance to the State through employment and acculturation by use of coordinated support services and cash/medical assistance. CFDA 93.566 Refugee and Entrant Assistance - State Administered Programs: Funds are used for the provision of time limited financial assistance (Refugee Cash Assistance), time limited medical assistance (Refugee Medical Assistance), initial health screening, foster care for unaccompanied refugee minors, case management and employment support services (Social Services). Social Service funds are distributed nationally on a formula basis based on the number of recent refugee and entrant arrivals, nationally and to each state. CFDA 93.584 Refugee and Entrant Assistance - Targeted Assistance: Funds are used for case management and employment support services for refugees in the Salt Lake and Davis County areas due to the high refugee concentration and the high utilization of federal assistance by refugees in these counties. Counties across the nation are evaluated periodically to establish counties with high concentrations of refugees and determine the top 50 counties in need of additional assistance. Funds are distributed on a formula basis based on the number of recent refugee and entrant arrivals, nationally and to each county or statistical area being considered. CFDA 93.576 Refugee and Entrant Assistance - Discretionary Grants: Funds are awarded to States through a competitive evaluation of projects submitted for specific grant purposes identified by the Office of Refugee Resettlement. Performance     Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $0 | $0 | $0 | $46,600 | $0 | | Federal Funds | $5,113,800 | $6,216,900 | $6,430,500 | $6,776,000 | $5,942,600 | | Beginning Nonlapsing | $0 | $0 | $46,500 | $0 | $0 | | Total | $5,113,800 | $6,216,900 | $6,477,000 | $6,822,600 | $5,942,600 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Current Expense | $0 | $0 | $212,900 | $0 | $0 | | Other Charges/Pass Thru | $5,113,800 | $6,216,900 | $6,264,100 | $6,822,600 | $5,942,600 | | Total | $5,113,800 | $6,216,900 | $6,477,000 | $6,822,600 | $5,942,600 |

|---|

Subcommittee Table of ContentsProgram: Workforce Research and Analysis Function The Workforce Research & Analysis Division (WRA) is a decision-support unit of economists and analysts dedicated to providing accurate and timely labor market, economic, and program information. WRA products and services provide the workforce system (internal and external) with the information needed to make business decisions, evaluate programs, allocate resources, distribute workload, and develop service delivery strategies. Labor market information provided by WRA is a mandate of the Wagner-Peyser Act, the Workforce Investment Act, and the Trade Act. Data gathered by WRA are contracted by and submitted to the US Bureau of Labor Statistics. WRA also fulfills reporting requirements for all Department of Workforce Services programs including Unemployment Insurance, the public labor exchange, job training services, and public assistance such as Temporary Assistance to Needy Families (TANF), Food Stamps (SNAP), and Medicaid. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $330,100 | $325,600 | $152,800 | $202,900 | $176,400 | | Federal Funds | $2,590,300 | $2,550,500 | $1,989,700 | $2,524,300 | $2,344,900 | | Dedicated Credits Revenue | $18,000 | $93,600 | $403,100 | $96,700 | $118,100 | | Transfers - Medicaid | $166,800 | $147,900 | $58,800 | $71,300 | $60,300 | | Total | $3,105,200 | $3,117,600 | $2,604,400 | $2,895,200 | $2,699,700 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Personnel Services | $2,858,800 | $2,869,900 | $2,312,600 | $2,668,800 | $2,494,800 | | In-state Travel | $4,400 | $4,000 | $1,600 | $2,100 | $2,500 | | Out-of-state Travel | $25,400 | $24,700 | $50,900 | $34,700 | $36,400 | | Current Expense | $154,800 | $161,200 | $155,600 | $85,500 | $114,000 | | DP Current Expense | $61,800 | $57,800 | $83,700 | $104,100 | $52,000 | | Total | $3,105,200 | $3,117,600 | $2,604,400 | $2,895,200 | $2,699,700 |

|---|

| | | | | | | Other Indicators | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Budgeted FTE | 0.0 | 0.0 | 0.0 | 0.0 | 31.8 | | Actual FTE | 0.0 | 0.0 | 0.0 | 27.5 | 0.0 |

|

|

|

|

|

|

|---|

Subcommittee Table of ContentsProgram: Trade Adjustment Act Assistance Function The Trade Act (Trade Adjustment Assistance, TAA) is a U.S. Department of Labor program. The program provides services to eligible individuals who have lost their job due to trade. The program is designed to provide training and other services that will assist individuals who have lost their employment due to foreign trade in reattaching to the workforce at a level of suitable employment. Suitable employment is defined as at least 80% of their layoff wage. Eligibility for the trade act is determined by the department of labor. A petition requesting Trade Adjustment Assistance for impacted workers must be filed. A petition can be filed by the company, a state one-stop center, or a group of three employees. The Department of Labor conducts an investigation, and if eligibility is met, they issue a Trade certification. Services provided under Trade Adjustment Assistance include: - Training Services - This can include training in basic skills and occupational skills as well as on-the-job training. Participants use an "individual training account" to select an appropriate training program from a qualified training provider

- Trade Readjustment Allowances (TRA) - cash payments administered by the Unemployment Division

- Wage subsidy for workers age 50 or older who obtain employment at a wage that is lower paying than the Trade affected employment (ATAA/TAA)

- Out of area job search allowance

- Relocation Assistance

Performance   Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | Federal Funds | $4,045,300 | $4,647,800 | $3,086,800 | $2,376,200 | $4,185,000 | | Total | $4,045,300 | $4,647,800 | $3,086,800 | $2,376,200 | $4,185,000 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $4,045,300 | $4,647,800 | $3,086,800 | $2,376,200 | $4,185,000 | | Total | $4,045,300 | $4,647,800 | $3,086,800 | $2,376,200 | $4,185,000 |

|---|

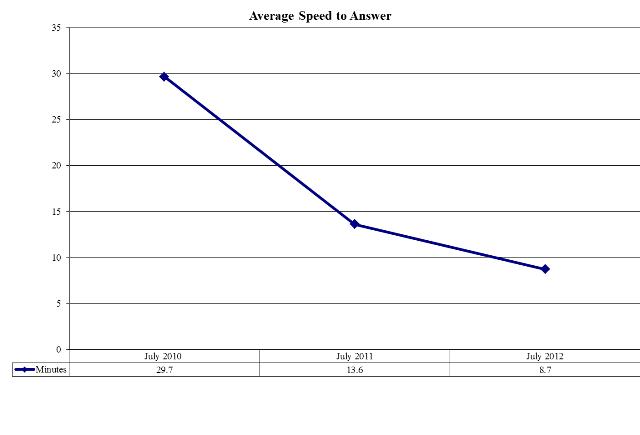

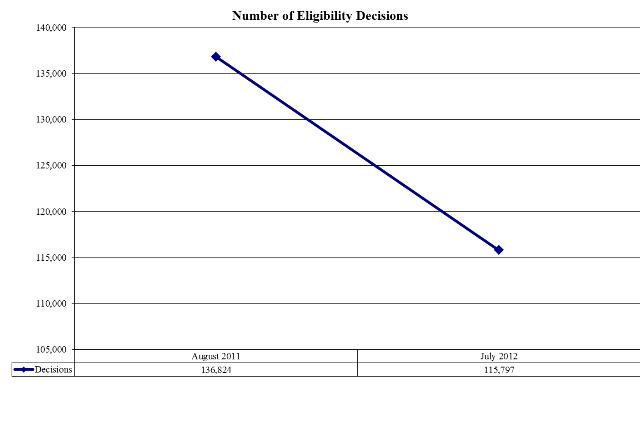

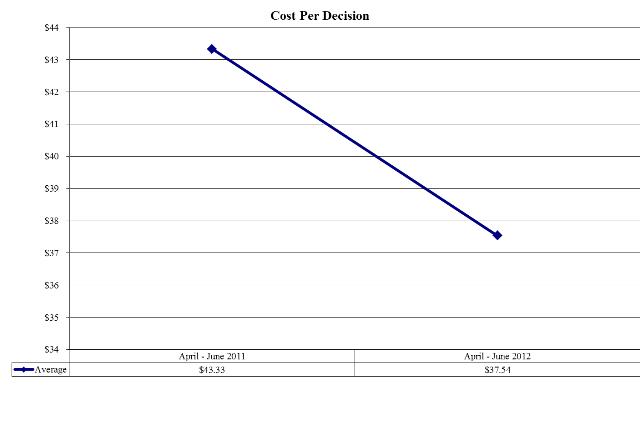

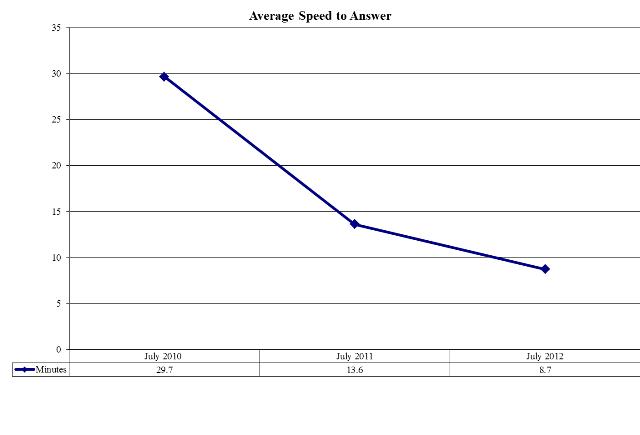

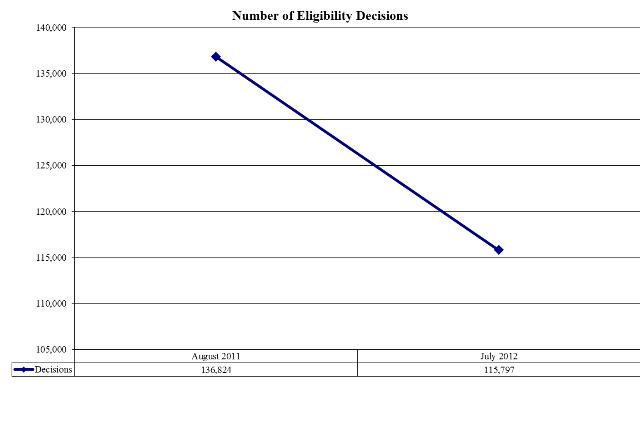

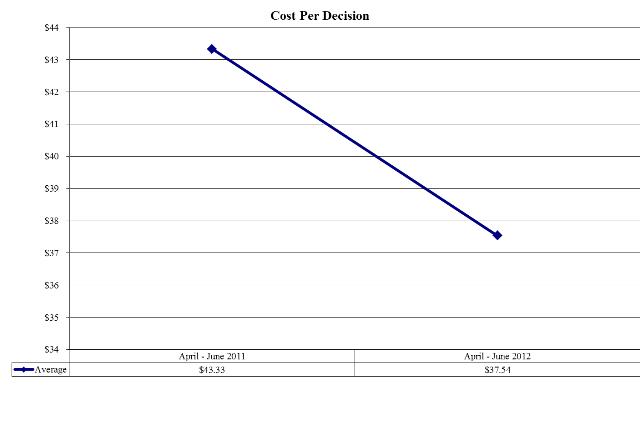

Subcommittee Table of ContentsProgram: Eligibility Services Function The Eligibility Services Division specializes in determining eligibility for a variety of DWS programs. Each program--TANF, Child Care, Medicaid, CHIP, Food Stamps, General Assistance and Refugee Relocation--requires that eligibility be determined in a timely and accurate manner. The department believes that, by consolidating all eligibility functions and systems into one unit, the eligibility determination process can be streamlined with increased accuracy. Performance    Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $16,402,900 | $30,635,900 | $35,583,800 | $21,075,300 | $16,077,900 | | General Fund, One-time | $0 | $0 | $0 | ($1,386,200) | $0 | | Federal Funds | $26,239,400 | $19,787,900 | $21,621,500 | $26,197,100 | $29,228,500 | | American Recovery and Reinvestment Act | $686,100 | $693,200 | $1,017,000 | $0 | $0 | | Dedicated Credits Revenue | $643,500 | $1,698,600 | $972,200 | $2,014,200 | $1,382,500 | | Transfers - Medicaid | $8,162,600 | $17,126,600 | $14,695,700 | $14,115,700 | $15,992,100 | | Transfers - Other Agencies | $0 | $0 | $0 | $16,400 | $0 | | Beginning Nonlapsing | $0 | $0 | $0 | $2,673,800 | $0 | | Closing Nonlapsing | $0 | $0 | ($3,050,000) | ($3,100,000) | $0 | | Lapsing Balance | $0 | $0 | ($1,336,100) | $0 | $0 | | Total | $52,134,500 | $69,942,200 | $69,504,100 | $61,606,300 | $62,681,000 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Personnel Services | $43,127,600 | $62,155,000 | $60,263,000 | $53,339,300 | $54,870,300 | | In-state Travel | $137,800 | $185,400 | $128,300 | $77,400 | $140,000 | | Out-of-state Travel | $20,700 | $13,900 | $14,400 | $11,000 | $15,000 | | Current Expense | $6,997,800 | $6,868,800 | $7,316,500 | $6,497,000 | $6,273,100 | | DP Current Expense | $1,850,600 | $678,100 | $1,781,900 | $1,670,700 | $1,382,600 | | DP Capital Outlay | $0 | $41,000 | $0 | $0 | $0 | | Capital Outlay | $0 | $0 | $0 | $10,900 | $0 | | Total | $52,134,500 | $69,942,200 | $69,504,100 | $61,606,300 | $62,681,000 |

|---|

| | | | | | | Other Indicators | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Budgeted FTE | 0.0 | 0.0 | 0.0 | 0.0 | 856.5 | | Actual FTE | 0.0 | 0.0 | 0.0 | 846.2 | 0.0 | | Vehicles | 0 | 0 | 0 | 25 | 24 |

|

|

|

|

|

|

|---|

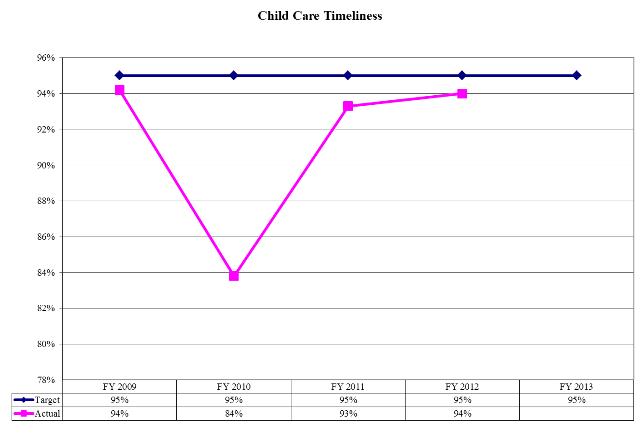

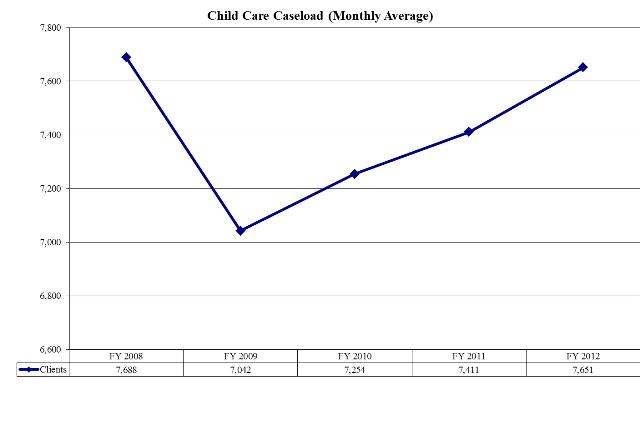

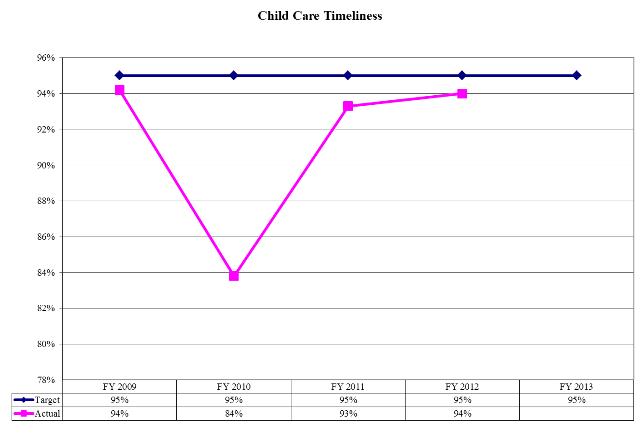

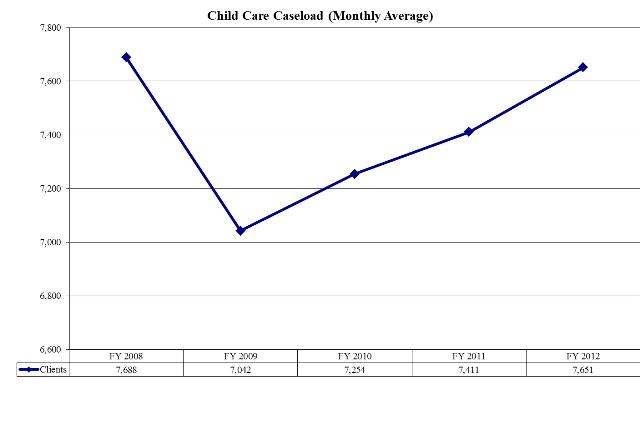

Subcommittee Table of ContentsProgram: Child Care Assistance Function The Child Care program operates to help "provide low-income families with the financial resources to find and afford quality child care for their children." Additionally, the program operates to enhance the quality and increase the supply of child care; increase the availability of early childhood development; and ensure the provision of before-and-after school care services. In FY 2009, clients, on average, spent 21 of the last 60 months on this program. Within the Child Care Program there are at least five major service and benefit areas including: Child Care Subsidy; Child Care Resource and Referral; Child Care Professional Development and Training;

Child Care Quality Grants to Providers; and After School Programs. These federal program funds are used for such benefits and services as supplementing parents' child care costs, operating Utah's six child care resource and referral agencies, funding the Child Care Professional Development Institute at Salt Lake Community College, funding quality improvement and training grants to providers, and supporting After School programs (approximately 250 programs statewide). Performance   Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $250,000 | $500,000 | $0 | $7,837,600 | $7,180,900 | | Federal Funds | $39,084,900 | $34,953,300 | $37,091,700 | $35,303,100 | $36,550,500 | | American Recovery and Reinvestment Act | $0 | $9,049,700 | $9,511,700 | $401,400 | $0 | | Total | $39,334,900 | $44,503,000 | $46,603,400 | $43,542,100 | $43,731,400 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $39,334,900 | $44,503,000 | $46,603,400 | $43,542,100 | $43,731,400 | | Total | $39,334,900 | $44,503,000 | $46,603,400 | $43,542,100 | $43,731,400 |

|---|

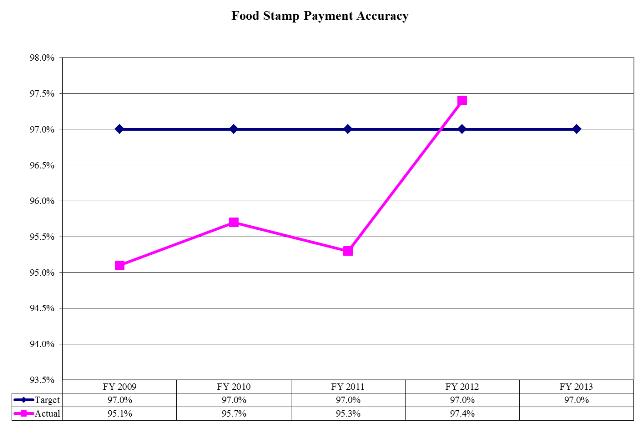

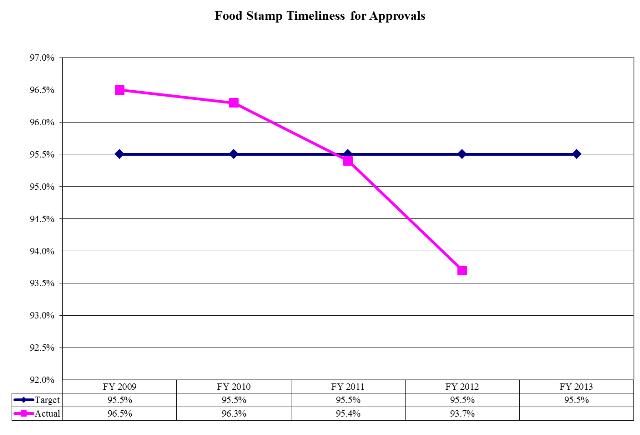

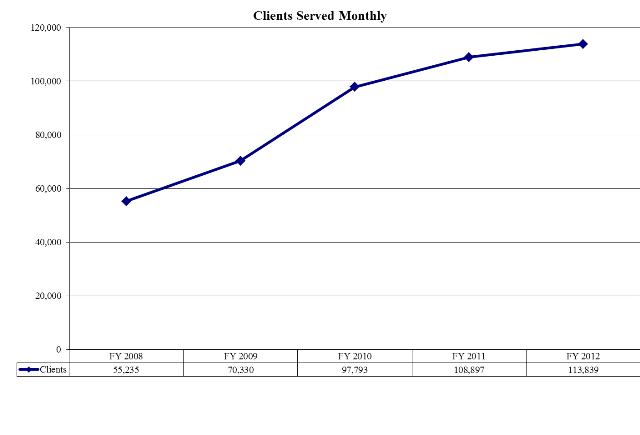

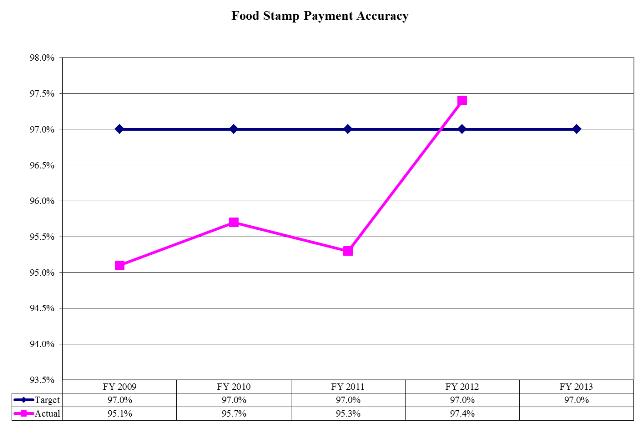

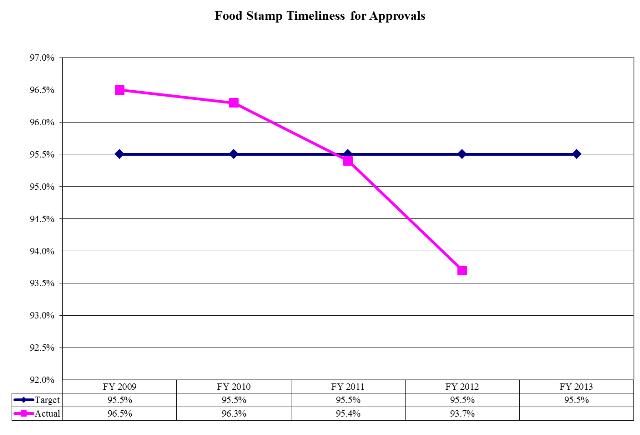

Subcommittee Table of ContentsProgram: Nutrition Assistance Function The Food Stamp Program/SNAP is authorized by the Food and Nutrition Act of 2008 (previously the Food Stamp Act of 1977). The program is governed by 7 CFR 271, 272, 273, 274 and 275. As stated in 7 CFR 271.1, the purpose of the program is: "designed to promote the general welfare and to safeguard the health and well being of the Nation's population by raising the levels of nutrition among low-income households". The Food Stamp Program provides benefits to low-income people that they can use to buy food to improve their diets. Food stamp recipients spend their benefits (in the form of electronic benefits on debit cards) to buy eligible food in authorized retail food stores. Most grocery stores accept them. Food Stamps cannot buy tobacco, alcoholic beverages, items that cannot be eaten, or already-prepared foods. Food Stamps can buy vegetable seeds and plants. Items purchased with Food Stamps are not subject to sales tax. Benefits for SNAP are provided to a household. The minimum benefit for a household is $10 per month. The maximum amount depends on the household size as shown in the examples below. Food Stamp administration is funded with federal funds at a 50/50 match rate. Benefits are 100 percent federally funded. Performance    Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $4,800 | $1,235,900 | $0 | $0 | $479,000 | | Federal Funds | $215,106,900 | $351,735,300 | $391,994,500 | $410,226,900 | $393,200,500 | | Total | $215,111,700 | $352,971,200 | $391,994,500 | $410,226,900 | $393,679,500 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Other Charges/Pass Thru | $215,111,700 | $352,971,200 | $391,994,500 | $410,226,900 | $393,679,500 | | Total | $215,111,700 | $352,971,200 | $391,994,500 | $410,226,900 | $393,679,500 |

|---|

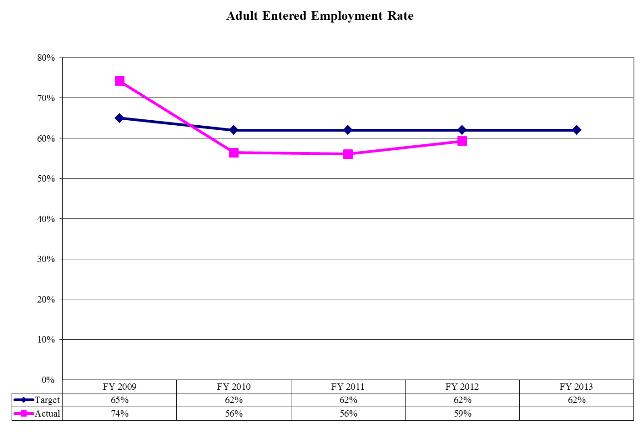

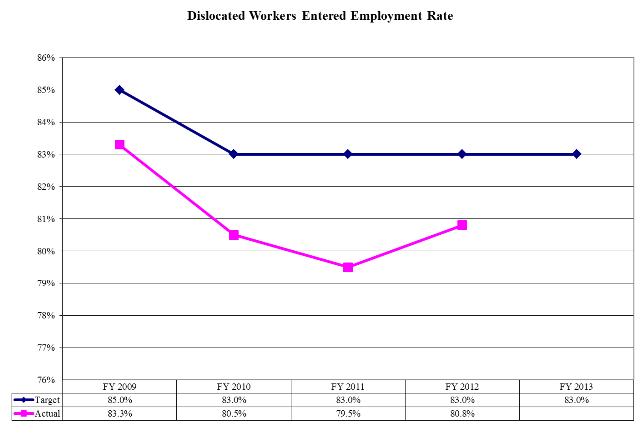

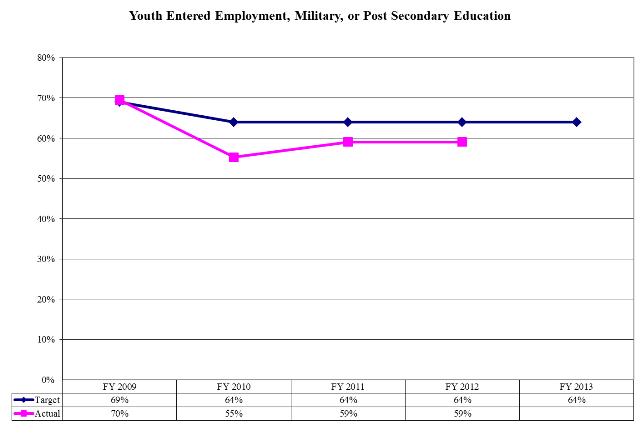

Subcommittee Table of ContentsProgram: Workforce Investment Act Assistance Function This federally funded program prepares low-income youth, adults

and dislocated workers, and persons with other barriers for employment. The program makes funding available to eligible job seekers for vocational training, education, job search assistance, and other support services. Performance    Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | Federal Funds | $7,594,700 | $5,438,300 | $6,447,300 | $7,570,500 | $12,591,200 | | American Recovery and Reinvestment Act | $866,700 | $6,353,200 | $1,774,000 | $0 | $0 | | Total | $8,461,400 | $11,791,500 | $8,221,300 | $7,570,500 | $12,591,200 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Current Expense | $1,770,100 | $2,500,100 | $1,722,700 | $0 | $1,722,700 | | Other Charges/Pass Thru | $6,691,300 | $9,291,400 | $6,498,600 | $7,570,500 | $10,868,500 | | Total | $8,461,400 | $11,791,500 | $8,221,300 | $7,570,500 | $12,591,200 |

|---|

Subcommittee Table of ContentsProgram: Other Assistance Function Other assistance programs are those that do not fall into the other specific categories. These include federal grant awards, Special Administrative Expense Account activities, Medical assistance payments and repayment of disallowed costs. Federal grant awards include State Energy Sector Partnership grant, Wagner Peyser, Health Coverage Tax Credit Bridge Program (HCTC), and Education Training Voucher (ETV) programs. Special Administrative Expense Account allows the department to provide labor exchange and employment and training services to customers that may not qualify for other funding sources. Repayment of Disallowed Costs utilizes State funding to repay federal partners when a cost has been determined not appropriate under a federal funding source. Education Training Voucher (ETV) provides post-secondary funding for eligible youth who have been involved in the foster care system for 12 months after age 14, provides career assessment, education and employment planning, and resources to help obtain post-secondary educational credentials and become self-sufficient. The Health Coverage Tax Credit Bridge Program allows a job seeker to have continuity of health insurance coverage while they look for new employment. This eliminates a potential barrier for that job seeker to obtain or retain employment. This is in line with the Mission of DWS to "strengthen Utah's economy by supporting the economic stability and quality of our workforce." Wagner Peyser services and activities serve to improve the marketability of workers toward the development of a higher quality workforce capable of competing in the labor force on a state and national level. It also provides the opportunity for employers, through job match of highly skilled and qualified workers, to thrive in today's highly competitive market place. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $5,851,700 | $0 | $1,136,900 | $264,900 | $229,100 | | Federal Funds | $4,885,600 | $1,547,100 | $4,089,200 | $3,246,300 | $96,600 | | American Recovery and Reinvestment Act | $0 | $0 | $392,500 | $1,543,400 | $2,735,000 | | GFR - Special Administrative Expense | $0 | $3,779,600 | $226,500 | $366,600 | $0 | | Transfers - Medicaid | $369,200 | $75,700 | $111,100 | $17,600 | $129,100 | | Beginning Nonlapsing | $0 | $2,596,600 | $0 | $1,419,200 | $0 | | Closing Nonlapsing | ($2,596,600) | ($46,500) | ($1,419,200) | ($3,455,600) | $0 | | Lapsing Balance | $0 | ($7,419,000) | $0 | ($268,100) | $0 | | Total | $8,509,900 | $533,500 | $4,537,000 | $3,134,300 | $3,189,800 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Current Expense | $0 | $0 | $2,688,000 | $0 | $61,600 | | DP Current Expense | $0 | $0 | $0 | $500 | $0 | | Other Charges/Pass Thru | $8,509,900 | $533,500 | $1,849,000 | $3,133,800 | $3,128,200 | | Total | $8,509,900 | $533,500 | $4,537,000 | $3,134,300 | $3,189,800 |

|---|

Subcommittee Table of ContentsProgram: Information Technology Function This is the part of the department's budget used to pay for its costs for services provided by the Department of Technology Services. The Department of Technology Services was created to consolidate all IT resources and services for the State of Utah into one department. Funding Detail Sources of Finance

(click linked fund name for more info) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp | | General Fund | $11,286,900 | $9,895,600 | $7,772,200 | $6,549,000 | $7,734,100 | | Federal Funds | $15,720,600 | $14,878,700 | $14,755,300 | $15,002,700 | $16,214,400 | | American Recovery and Reinvestment Act | $0 | $407,200 | $0 | $0 | $48,600 | | Dedicated Credits Revenue | $197,600 | $555,200 | $1,847,600 | $1,313,900 | $1,021,200 | | GFR - Special Administrative Expense | $0 | $224,000 | $0 | $0 | $0 | | Transfers - Medicaid | $6,742,900 | $5,064,500 | $3,899,900 | $3,015,700 | $3,693,700 | | Total | $33,948,000 | $31,025,200 | $28,275,000 | $25,881,300 | $28,712,000 |

|---|

| | | | | | Categories of Expenditure

(mouse-over category name for definition) | 2009

Actual | 2010

Actual | 2011

Actual | 2012

Actual | 2013

Approp |

|---|

| Personnel Services | $1,170,900 | $0 | $0 | $0 | $0 | | In-state Travel | $17,700 | $0 | $0 | $0 | $0 | | Out-of-state Travel | $1,600 | $13,700 | $28,600 | $24,800 | $36,000 | | Current Expense | $899,100 | $630,800 | $285,100 | $313,000 | $449,200 | | DP Current Expense | $31,169,800 | $23,421,600 | $22,939,700 | $21,137,100 | $21,421,800 | | DP Capital Outlay | $688,900 | $6,959,100 | $5,021,600 | $3,200,500 | $6,805,000 | | Capital Outlay | $0 | $0 | $0 | $1,205,900 | $0 | | Total | $33,948,000 | $31,025,200 | $28,275,000 | $25,881,300 | $28,712,000 |

|---|

Subcommittee Table of Contents |