Fiscal Highlights - October 2014

|

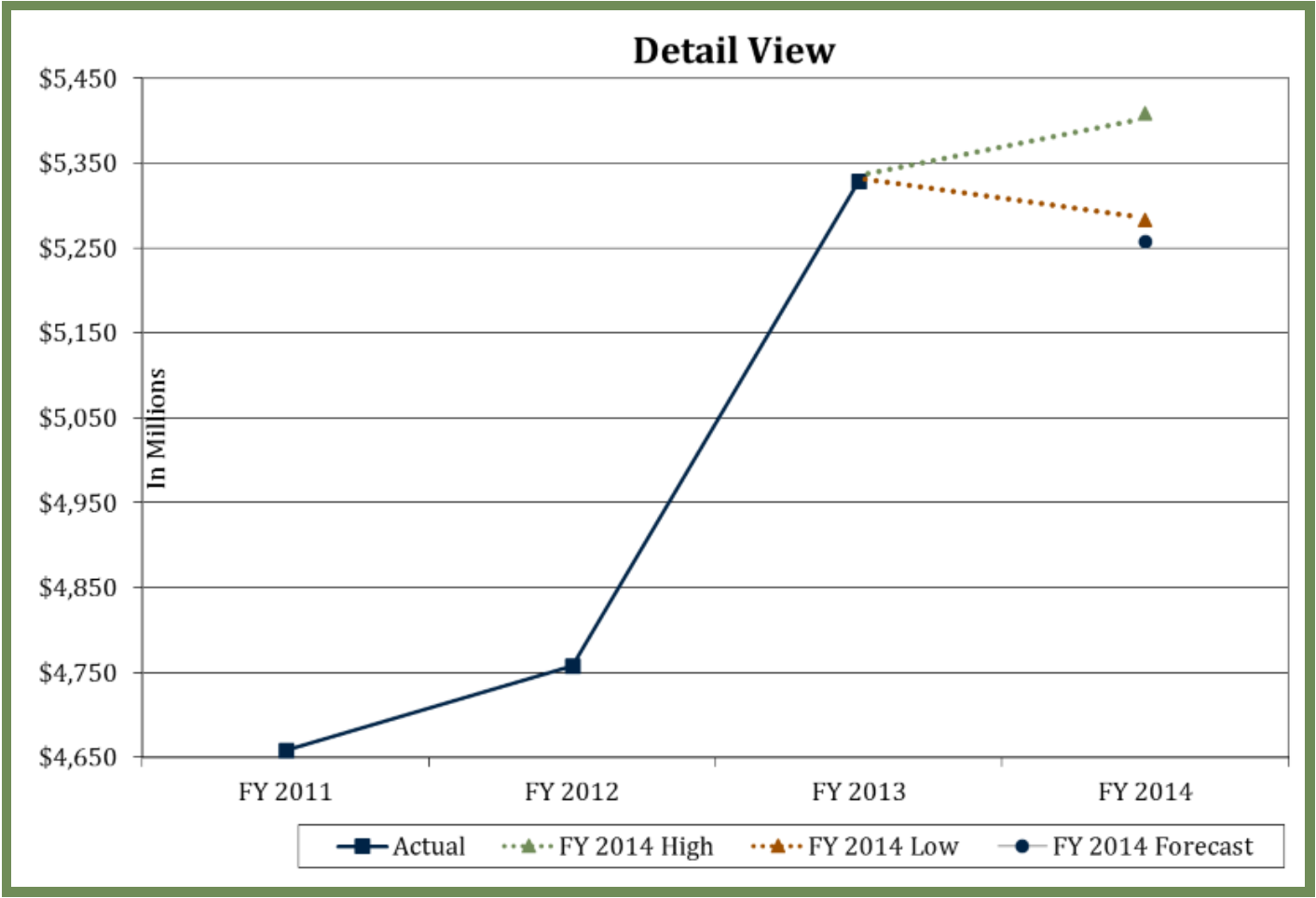

Utah's Revenue Continues to Grow -

Andrea Wilko ( Utah ended FY 2014 with a $166 million General and Education Fund revenue surplus. The revenue surplus was due to better-than-expected growth in the Education Fund from above-target gross final payments and stronger-than-expected corporate balance sheets. General Fund came in above targets because of stronger-than-anticipated sales tax and severance taxes. After expenditure adjustments and transfers to the General and Education Rainy Day Funds, the Disaster Recovery Fund, the Medicaid Rainy Day Fund, and the Industrial Assistance Fund, the FY 2014 budget surplus is $112 million, $7 million in General Fund and $105 million in Education Fund. Given consensus economic indicators developed by the Revenue Assumptions Working Group, we anticipate FY 2015 General and Education Fund revenues will be in the range of $70 million to $200 million above May 2014 Executive Appropriations Committee targets. We expect the Transportation Fund will be between $10 million below to $10 million above May targets. Our current forecast for the Utah economy assumes that it will continue to move forward at a moderate pace; improving in key areas, such as labor and housing markets. There is upside potential in a couple of areas.

However, there are risks that could disrupt growth.

We remain optimistic that the Utah and U.S. economy will continue to grow modestly over the next 12 to 18 months. In particular, we expect Utah to remain a growth leader nationally.

|

Coyote Removal Program - Ivan D. Djambov The Division of Wildlife Resources (DWR) has been working to improve the mule deer numbers in Utah ...DAS and DTS Reports - Gary K. Ricks In the last few months, the Departments Technology Services and Administrative Services and ha...How Close Did We Come to the Cap on Sales Tax Earmarks for Transportation in FY 2014? - Steven M. Allred Since 2005, the Legislature has earmarked portions of the sales tax for highway construction projec...How Have Tax Changes in Utah Compared to the Nation? - Thomas E. Young Every spring and winter, the National Association of State Budget Officers (NASBO) releases numbers...Income Tax Appropriations to Public and Higher Education - Ben Leishman In November 1996, Utah voters amended the Utah Constitution to formally authorize the pra...Pew Final Key Findings - Gary R. Syphus After several months of research, the Pew Charitable Trusts' Public Safety Performance Project ...Snow College Concurrent Enrollment Update - Spencer C. Pratt During the 2014 General Session, the Legislature passed S.B. 38, "Snow College C...The Changing Demographics of Expected Income - Angela J. Oh The two recent recessions and subsequent recoveries continue to affect expected lifetime income by ...Utah's Credit Rating and Debt Measures - Brian Wikle Did you know the State of Utah has a credit score? Although the stat...Utah's Revenue Continues to Grow - Andrea Wilko Utah ended FY 2014 with a $166 million General and Education Fund revenue surplus. The revenu... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692