Fiscal Highlights - May 2014

|

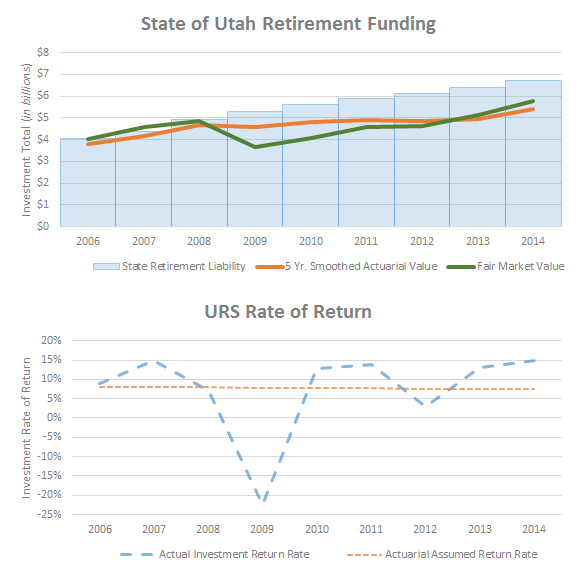

The Billion Dollar Retirement Gap -

Brian D. Fay ( In 2008, the Utah Retirement System (URS) experienced investment losses of nearly 25 percent, leaving a $7 billion unfunded liability. As the single largest member of URS, these loses resulted in an unfunded retirement liability for the State of Utah of just over $1.6 billion. In January 2009, the State began a 25 year amortization of this funding gap and as of January 2014, the unfunded retirement liability for the State was just under $942 million. Actuarial Value vs. Fair Market ValueThe fair market value (FMV) of investments fluctuates sharply in response to the market. To protect the state budget from these sharp fluctuations, URS utilizes a 5-year smoothed expected rate of return for determining the actuarial required contribution (ARC). |

$107 Million of Excess Federal TANF Spending Authority - Stephen C. Jardine The Department of Workforce Services (DWS) administers the federal Temporary Assistance for Needy F...Division of Air Quality: New Appropriations Update - Angela J. Oh Air quality was a priority during the 2014 General Session. Lawmakers passed legislation to cut emi...DJJS - Receiving Centers and Youth Services - Zackery N. King What is the next step for receiving centers and youth services? Receiving centers and youth s...Economic Development Incentives - Andrea Wilko Financial incentives are provided through the Utah Governor's Office of Economic Development and th...Higher Education Tuition Increases for 2014-2015 - Spencer C. Pratt Following the 2014 General Session, the State Board of Regents met and approved a 4.0% first-tier t...How Will Quagga Mussel Impact Utah Financially? - Ivan D. Djambov Now that the invasive quagga mussels are established in Lake Powell, how long before they get to ot...Is there a Relationship between Educational Attainment and Employment Growth? - Thomas E. Young The Education Interim Committee heard presentations on long-term planning for educational attainmen...Jail Reimbursement Program and Appropriations - Fiscal Years 2011-15 - Gary K. Ricks The Jail Reimbursement Program provides reimbursement to Utah counties for days spent in county jai...Medicaid and CHIP Enrollment Trends Since the Beginning of Mandatory Medicaid Expansion - Russell T. Frandsen Since the beginning of the Medicaid mandatory expansion as part of federal health care reform in Ja...Sequestration Update - Steven M. Allred In December 2013, Congress passed the Bipartisan Budget Act of 2013 (BBA), providing states some ce...The Billion Dollar Retirement Gap - Brian D. Fay In 2008, the Utah Retirement System (URS) experienced investment losses of nearly 25 percent, leavi... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692