Fiscal Highlights - June 2016

|

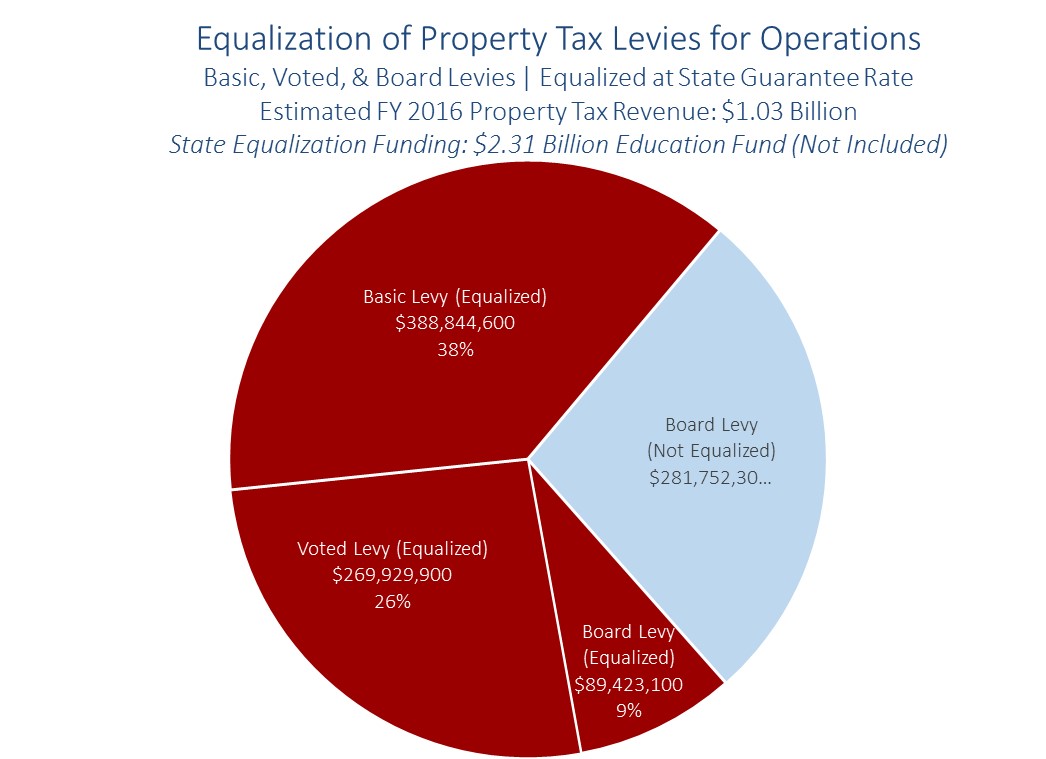

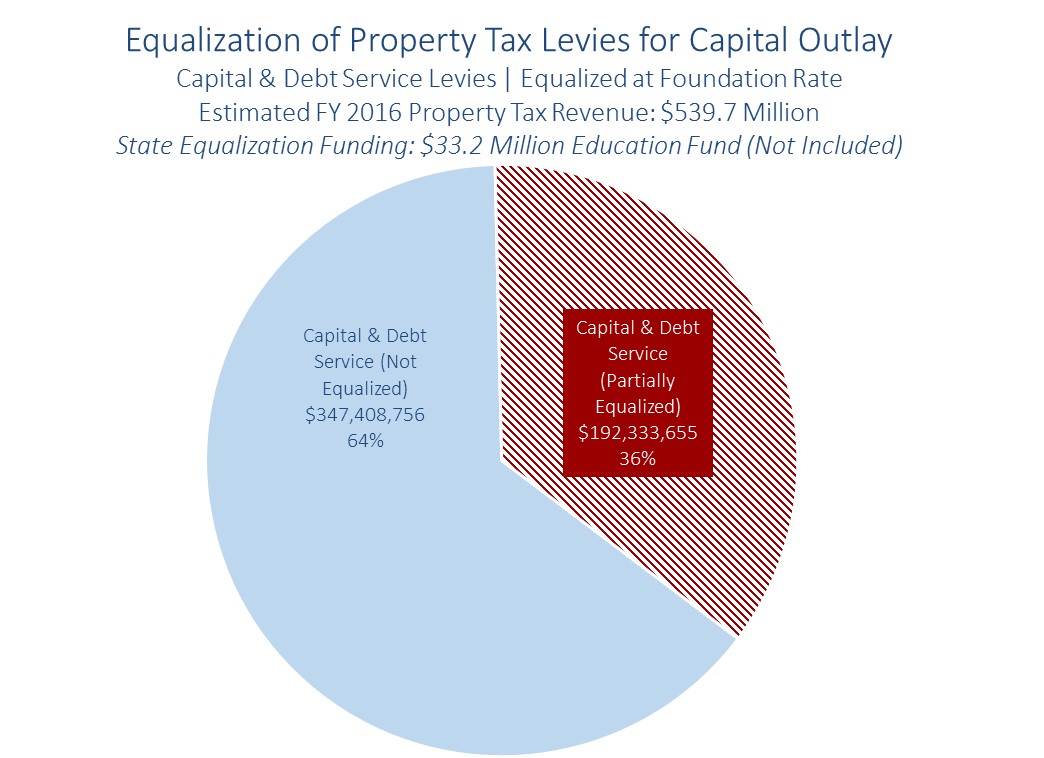

School Funding Equalization -

Ben Leishman ( Utah is continually ranked as one of the most equalized states in the nation when it comes to funding education. It is also one of only a few states that has not experienced an equity lawsuit. One of the primary reasons for these equity outcomes is the unique way state Education Fund revenues are allocated to equalize local property tax revenues generated by local school districts. Over the next several months, articles in this newsletter will explain various components of the State's equalization system. As an introduction, this article focuses on the types of local property tax levies and the extent to which equalization occurs within these levies. Subsequent articles will discuss the mechanics of how equalization works for each of the property tax levies. The extent to which equalization occurs depends on the type of property tax revenue generated. State funds are used to equalize local property tax collections in two different categories. First, and the most extensive as far as equalization, are property tax revenues used to support the operation of public schools. Property tax levies that support school operations include the Basic School Levy, the Voted Local Levy, and the Board Local Levy. Second, and less robust when it comes to equalization, are property tax revenues used for capital outlay (construction and renovation and debt service). Property tax levies that support capital include the Capital Local Levy and the Debt Service Levy. The following pie charts show the estimated amount of local property tax revenue generated by each tax levy in FY 2016. The charts are divided between tax levies for Operations and Capital. Property Tax Levies for Operations In FY 2016, school districts generated approximately $1.03 billion in local property tax revenue to support the operation of public schools. Approximately 73 percent of this property tax revenue is equalized with state Education Fund allocations to school districts based on their participation in state programs, namely, the Basic School Program and the Voted & Board State Guarantee Programs. Equalization of the Board Local Levy is not as comprehensive as the Basic Levy and the Voted Local Levy. Approximately 27 percent of Board Local Levy revenue is not equalized and does not qualify for state guarantee funding based on statute. The State uses approximately $2.31 billion in Education Fund appropriations to equalize operations revenues.  Property Tax Levies for Capital School districts generated an additional $539.7 million in FY 2016 to support capital outlay and debt service. The equalization of property tax revenues for capital is much less robust than for operations, with approximately 36 percent partially equalized. The remaining 64 percent is not equalized. The state uses approximately $33.2 million in Education Fund appropriations to provide partial equalization of capital property tax revenues through the School Building Program.  Subsequent newsletter articles will explain how equalization works by highlighting each state equalization program, beginning with the Basic School Program. |

Cost to Transfer UACD Employees to Agriculture - Ivan D. Djambov The purpose of this article is to provide background information about the Department of Agricult...Department of Environmental Quality Fees - Brian Wikle UCA 63J-1-504 requires that each fee assessed by an agency be "reasonable, fair, and reflect the co...Equipment Funding Allocations for the Utah College of Applied Technology - Jill L.Curry The Utah College of Applied Technology (UCAT) receives funding for equipment at its eight colleges...Funding for Utah's Veterans' Nursing Homes - Steven M. Allred The State operates four veterans nursing homes located in Salt Lake City, Ogden, Payson, and Ivins....FY 2017 Capital Improvement Allocations - Angela J. Oh The State of Utah has a statutory requirement to fund capital improvements and it is one of the f...Market-Based Billing for State Audits - Clare Tobin Lence During the 2014 General Session, the Legislature passed intent language supporting the State Audi...Revenue Update - Fiscal Highlights - June 2016 - Andrea Wilko Utah's revenue is expected to grow by 3.0 percent between FY 2015 and FY 2016. We anticipate collec...School Funding Equalization - Ben Leishman Utah is continually ranked as one of the most equalized states in the nation when it comes to fun...The Price of Gas: More Driving and an Industry Recession - Thomas E. Young One of the more transparent price movements in recent years is the drop in the price of gasoline. T...USHE Enrollment Projections - Spencer C. Pratt The Utah State Board of Regents recently adopted enrollment projections for the eight colleges and ...What Happened at the June 16, 2016 Meeting of the Social Services Appropriations Subcommittee? - Russell T. Frandsen Morning AgendaCall to Order /Approval of MinutesSubcommittee Questions from the 2016 General Sessio... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692