Statewide Overview -

Jonathan Ball ( PDF) PDF)

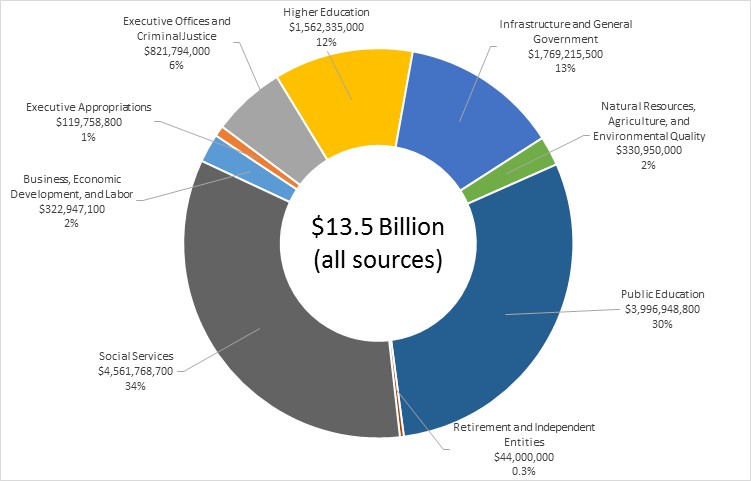

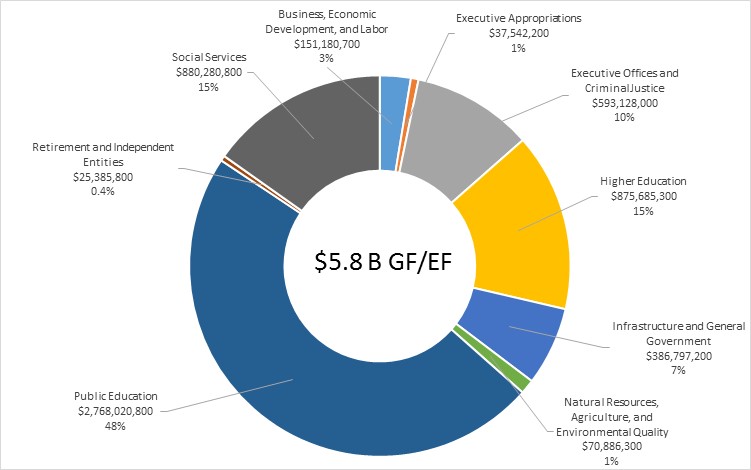

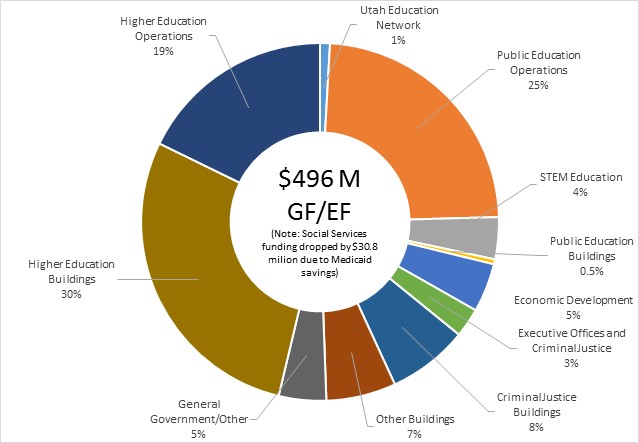

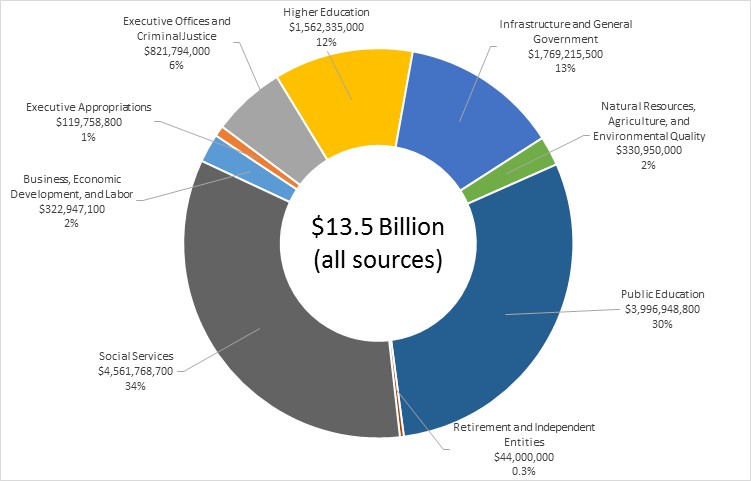

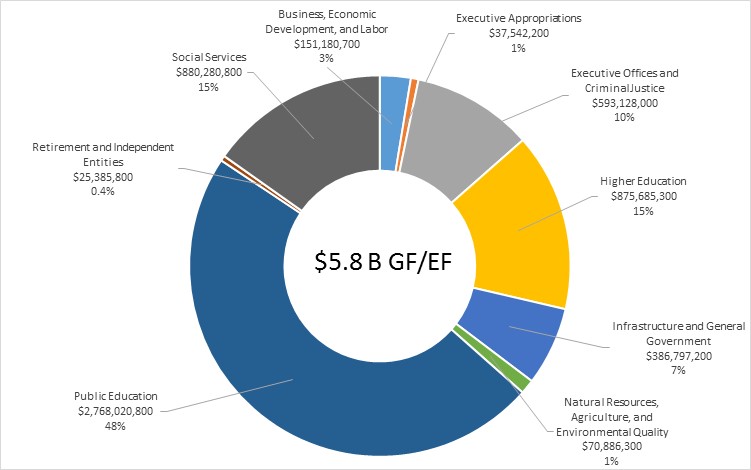

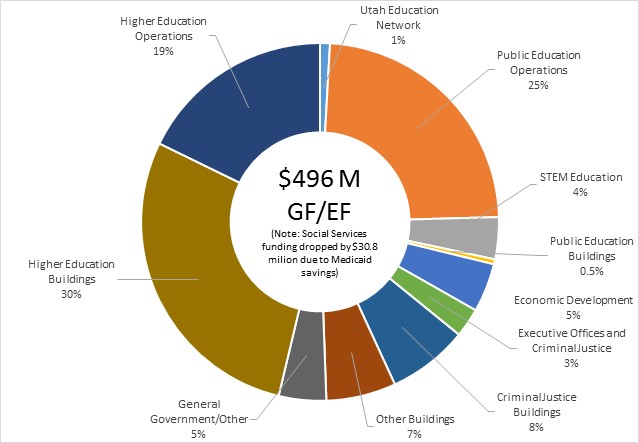

Statewide OverviewUtah's budget for fiscal year 2015 is $13.5 billion (+4.7% vs FY 14 original) from all sources. The figure below represents that total FY 15 state budget by appropriations subcommittee. The Infrastructure and General Government (IGG) subcommittee funded $106.5 million in building construction on higher education campuses and $55.5 million in higher education capital improvements; the Retirement and Independent Entities (RIE) subcommittee funded $41 million for the Utah Education Network; and the Business, Economic Development and Labor (BEDL) subcommittee funded another $22 million for USTAR. Those amounts added to the Higher Education Appropriations Subcommittee bring total appropriations for colleges and universities to $1.8 billion or 13%. The Legislature provided $21.5 million for STEM education in the BEDL subcommittee, which, when added to the Public Education subcommittee, brings total Public Education appropriations to more than $4 billion (30%). Figure 1: Share of Appropriations from All Sources by Subcommittee Of the total amount, $5.8 billion (+5.9% vs. FY 14 original) comes from the discretionary General Fund and Education Fund. As with the all-sources budget above, adding higher education related appropriations made in other subcommittees to those in the Higher Education subcommittee brings higher ed's share of the General and Education Fund budget to $1.1 billion or 19%. Combined, then, General and Education Fund appropriations for higher and public education total $3.9 billion and constitute 66% of the General/Education Fund budget. Figure 2: Share of General and Education Fund Appropriations by Subcommittee Utah's steadily growing economy delivered $253 million in new ongoing revenue in addition to $144 million in one-time surpluses. Appropriators added to that nearly $100 million in transfers from one-time sources like nonlapsing balances, fund balances, and revenue set-asides. Legislators made public and higher education their highest priority in the 2014 General Session. As shown below, Education garnered 80% of new sources. Figure 3: Share of New General and Education Funds by Area Appropriators undertook a new approach to budgeting called Base Budget Week. They held a series of back-to-back budget meetings in which they scrutinized base budgets before turning to budget increases. Base Budget Week produced nearly $70 million in savings that could be reallocated to higher priority uses. Utah continued it's prudent fiscal management by paying cash for buildings and continuing to pay down debt. Legislators went a step further, passing three budget policy changes aimed at smoothing revenue volatility by recognizing above trend growth, considering it in rainy day deposit rules, and treating such windfalls as one-time revenue. Funding Initiatives- Weighted Pupil Unit: Among the largest budget increases was the state's per student spending - amount known as the Weighted Pupil Unit (WPU). Policymakers allocated more than $60 million to support a 2.5% increase in the WPU.

- Salary: Legislators appropriated funds equivalent to a 1.25% cost of living allowance for state and higher education employees. Administrators will have discretion in how such raises are implemented.

- Retirement: Appropriators provided funds sufficient to pay the annual retired contribution amount on the state's retirement plan. Increased costs amounted to approximately 8 percent.

- Health Insurance: Policymakers allocated money to cover the current year increase in rates for state and higher education health insurance plans. Plan managers anticipate a 2.2% increase in costs from FY 2014 to FY 2015.

- Internal Service Fund Rates: Elected officials funded $4 million for the impact of increased rates charged by internal service fund agencies that provide support services to other state entities. The highest cost increases are expected in the Department of Technology Services, Division of Facilities Construction Management, and Division of Risk Management.

- Budget Increases and Decreases: Detailed lists of budget changes, including references to bill and item numbers, can be found here:

- Budget Changes (Salmon List), Executive Appropriations Committee, March 10, 2014

- Index of Approved Funding Items, March 10, 2014

- Additional Sources and Uses (Purple List), Executive Appropriations Committee, March 12, 2014

- Index of Items in the Bill of Bills, March 13, 2014

Revenue Impacts- House Bill 74, Energy Efficient Vehicle Tax Credits: Lawmakers passed H.B. 74 extending tax credits for electric, natural gas, and other alternative fuel vehicles resulting in a $1.3 million one-time annual revenue loss.

- House Bill 140, Tax Credit Amendments: Policymakers enacted a new credit for businesses that employ homeless individuals. Such businesses can receive a refundable tax credit of up to $2,000 under this three-year pilot project. Estimated revenue loss from this change is estimated at $100,000 per year.

- Senate Bill 65, Sales and Use Tax Exemption Modifications: Elected officials reduced the tax liability of manufacturers and related businesses by $347,000 for purchases of certain parts, repairs, and products used in specific manufacturing processes and related activities.

- Senate Bill 224, Renewable Energy Tax Credit Amendments: Legislators prospectively extended a tax credit for power, heating, and cooling systems based on renewable energy. The credit may forgo an estimated tax liability of about $637,000 per year beginning in fiscal year 2016.

- Revenue Transfers and Additional Sources: Legislators approved sources of finance in addition to revenue estimates as indicated here:

Significant Legislative ActionsUtah's unique appropriations process allows all legislators to serve on an appropriations committee or subcommittee. Each legislator has an influence on the budget resulting in a richer and more informed exchange of information and ideas. Utah's eight appropriations subcommittees and it's Executive Appropriations Committee undertook myriad budget initiatives in the 2014 General Session. Those initiatives are detailed on each subcommittee's page of this Appropriations Summary. Links to each subcommittee summary are provided in the call-out box on the right hand side of this page.

|

March 2026 Content

( PDF) PDF)

No current documents found.

|