Financial Institutions has two programs: 1) Administration, which includes all department programs and activities; and 2) Building Operations and Maintenance, which tracks rent separately from everyday operations.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $7,250,900 from all sources for Financial Institutions Administration. This is a 2.3 percent increase from Fiscal Year 2015 revised estimated amounts from all sources.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

Two primary goals of the department are:

- To complete the number of examinations required to maintain the health of the State-chartered banking and credit union systems in Utah, and

- To remain accredited by state regulatory peers in an interstate banking environment.

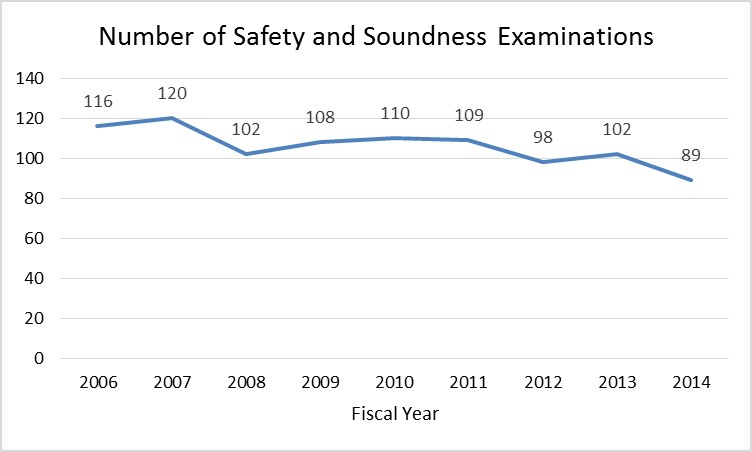

Number of Safety and Soundness Examinations

Examinations. Each depository institution, deferred deposit lender, check cashers, and title lender is examined at least once every 12 to 15 months. The optimum number of examinations required each fiscal year is based upon the number of institutions under the department's jurisdiction. The financial condition of the institutions and the industry also influences the number of examinations. The department performed 810 total examinations in FY 2014.

Safety and Soundness.These are regularly scheduled examinations of each Utah-state chartered depository institution, where assessments are made as to the institution's capital adequacy, asset quality, management performance, earnings potential, liquidity position, and sensitivity to risk.

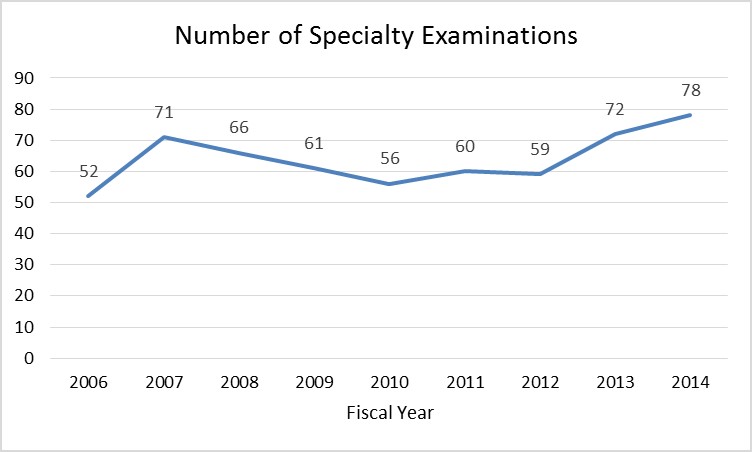

Number of Specialty Examinations

Examinations. Each depository institution, deferred deposit lender, check cashers, and title lender is examined at least once every 12 to 15 months. The optimum number of examinations required each fiscal year is based upon the number of institutions under the department's jurisdiction. The financial condition of the institutions and the industry also influences the number of examinations. The department performed 810 total examinations in FY 2014.

Specialty.These are examinations at Utah state-chartered depository institutions that evaluate specific programs or functions not examined during the safety and soundness examinations. These examinations are performed by experienced examiners who have received advanced training in the specialty area being evaluated. The examination can be performed independent of or concurrent with a safety and soundness examination.

Areas where specialty examinations are performed include information systems, consumer protection compliance, bank trust departments, holding companies, and capital market activity. Specialty examinations also include examinations of independent trust companies, independent escrow companies, money transmitters, mortgage servicing companies, and credit union service centers.

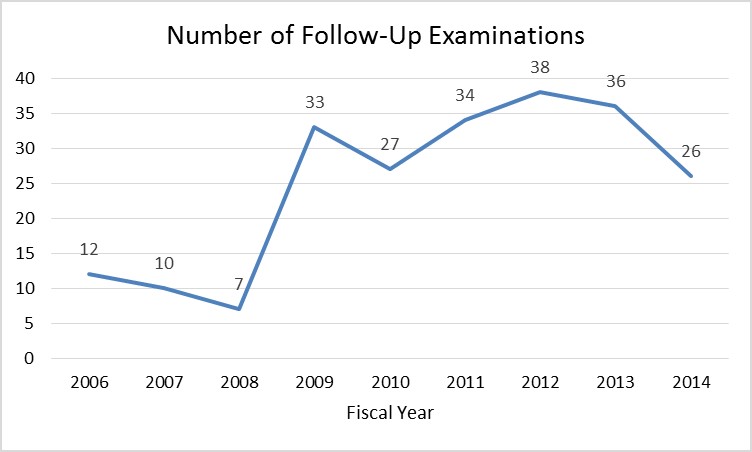

Number of Follow-Up Examinations

Examinations. Each depository institution, deferred deposit lender, check cashers, and title lender is examined at least once every 12 to 15 months. The optimum number of examinations required each fiscal year is based upon the number of institutions under the department's jurisdiction. The financial condition of the institutions and the industry also influences the number of examinations. The department performed 810 total examinations in FY 2014.

Follow-up.These are interim reviews performed between each safety and soundness examination at Utah state-chartered depository institutions that are on the Department's "Watched Institutions" list. These are not full-scope examinations, but targeted reviews, focusing on and assessing progress made on weaknesses and findings noted during the previous safety and soundness examination. Follow-up examinations are generally performed once or twice between each safety and soundness examination.

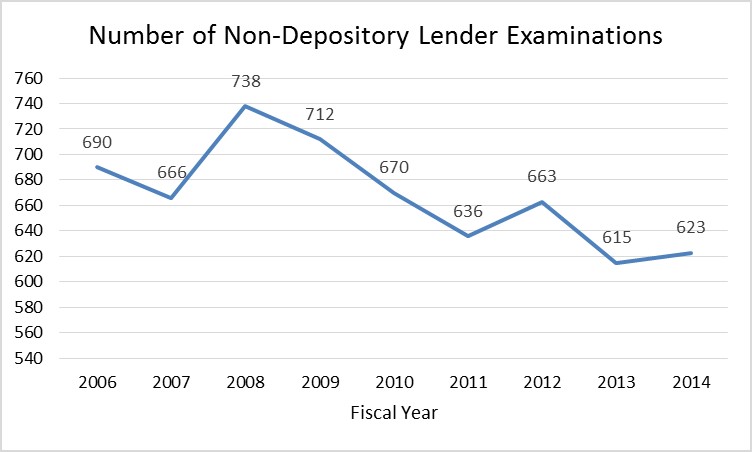

Number of Non-Depository Lender Examinations

Examinations. Each depository institution, deferred deposit lender, check cashers, and title lender is examined at least once every 12 to 15 months. The optimum number of examinations required each fiscal year is based upon the number of institutions under the department's jurisdiction. The financial condition of the institutions and the industry also influences the number of examinations. The department performed 810 total examinations in FY 2014.

Non-depository lender. These are annual examinations performed at each physical location in Utah of every check casher, deferred deposit lender, and title lender. It also includes the examination of every entity that extends deferred deposit and title loans over the internet to Utah residents. All deferred deposit lenders are considered non-depository lenders, but non-depository lenders are not exclusively deferred deposit lenders. Non-depository lenders include anyone outside of depository institutions (entities that have authority to take deposits from customers/members in addition to making loans) who extend credit to consumers (consumer lenders, mortgage lenders, deferred deposit lenders and title lenders).

All of the examinations included on graph are non-depository lender examinations. Many lenders have check cashing and title lending operations in the same location as their deferred deposit operations. The Department will examine all three operations at the same time and count it as one examination. The FY 2014 number in the graph is the total number of examinations the Department performed at the 599 deferred deposit, check casher, and title lender locations.

Accreditation Organizations Ratings

Accreditation. The Conference of State Bank Supervisors (CSBS) and the National Association of State Credit Union Supervisors (NASCUS) are two organizations that oversee accreditation requirements and standards nationwide. In order to maintain their accreditation, departments must maintain a 80% rating with each of these organizations.

The department is rated every five years according to the following criteria:

Department Ratings:

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.