The mission of the Office of the Legislative Fiscal Analyst is to "affect good government through objective, accurate, relevant budget advice and documentation." LFA helps legislators balance the budget by projecting revenue, staffing appropriations committees, recommending budgets, and drafting appropriations bills. The office also estimates costs and savings for each piece of legislation via fiscal notes. Finally, it performs studies aimed at improving government efficiency and management.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $3,328,300 from all sources for Legislative Fiscal Analyst. This is a 5.4 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $3,328,300 from the General/Education Funds, an increase of 5.4 percent from revised Fiscal Year 2015 estimates.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

The Legislative Fiscal Analyst measures and reports to the Subcommittee on Oversight factors that directly relate to its stated mission of objectivity, accuracy, and relevance as determined by timeliness. These measures include:

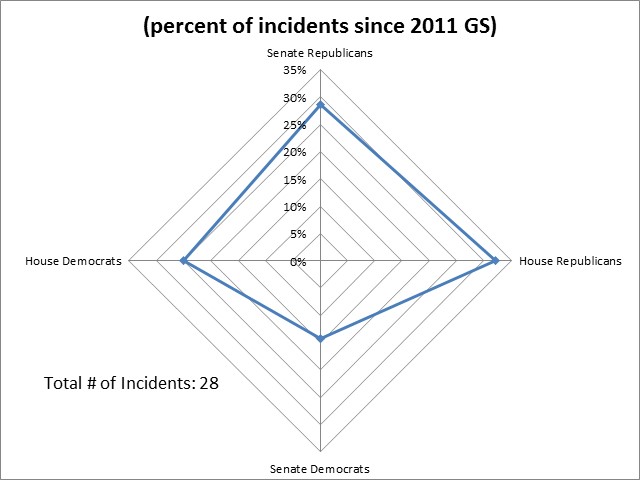

- distribution of feedback among chambers and parties;

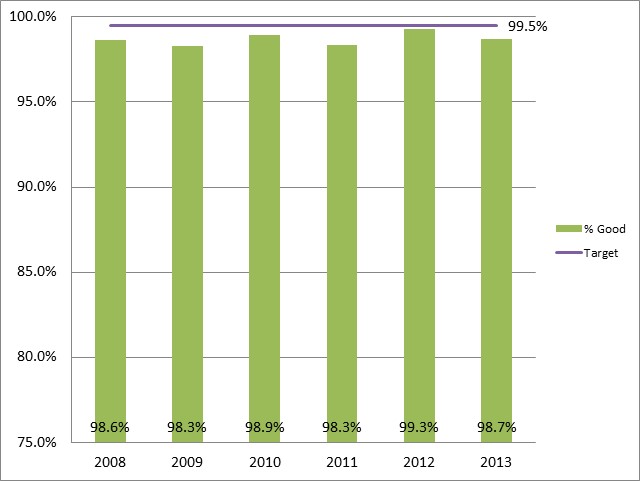

- accuracy of initial and final revenue estimates;

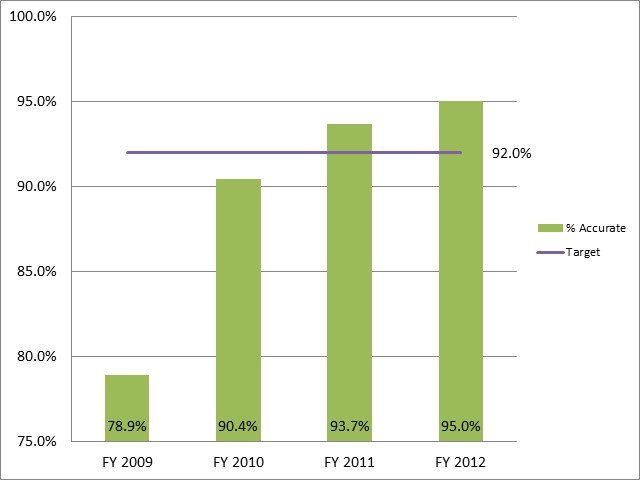

- accuracy of initial fiscal notes;

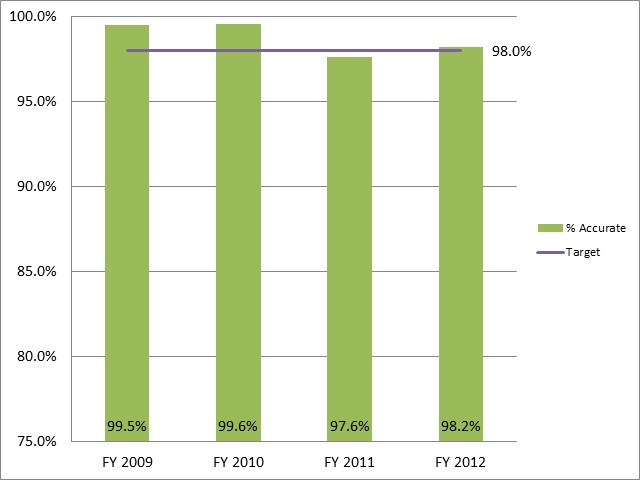

- accuracy of introduced appropriations bills; and

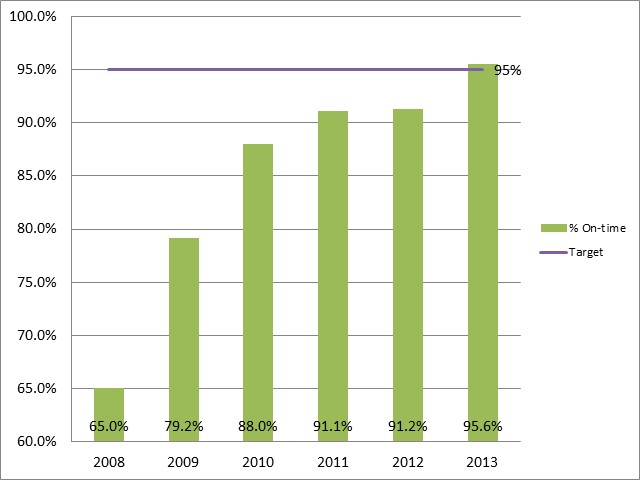

- on-time delivery of fiscal notes.

Distribution of Feedback from Legislators

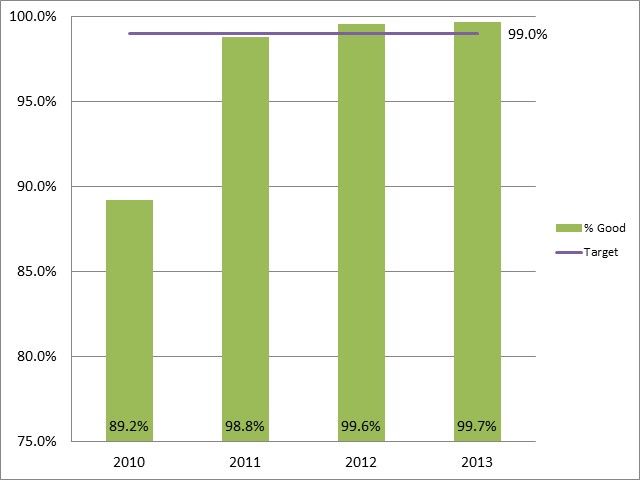

Accuracy of Initial Fiscal Notes

Accuracy of Initial Revenue Estimates

Accuracy of Final Revenue Estimates

Accuracy of Introduced Appropriations Bills

On-time Delivery of Fiscal Notes

LFA is created and authorized in Utah Code Annotated 36-12-13. Its functions are further defined in Legislaive Rule.

- Joint Rule 3-2-401 outlines LFA's responsibilities as they relate to budgeting.

- Joint Rule 4-2-403 delineates LFA's responsibilities as they relate to fiscal notes.

- Joint Rule 4-2-404 covers performance notes.

Appropriations to the Legislature, including the Legislative Fiscal Analyst, are nonlapsing via 63J-1-602.1.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.