This line item accounts for a portion of revenue generated by the beer tax, collected by the Tax Commission and distributed to local governments. The Alcoholic Beverage Enforcement and Treatment Restricted Account houses the funds collected.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $5,391,900 from all sources for Liquor Profit Distribution. This is a 0.1 percent increase from Fiscal Year 2015 revised estimated amounts from all sources.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

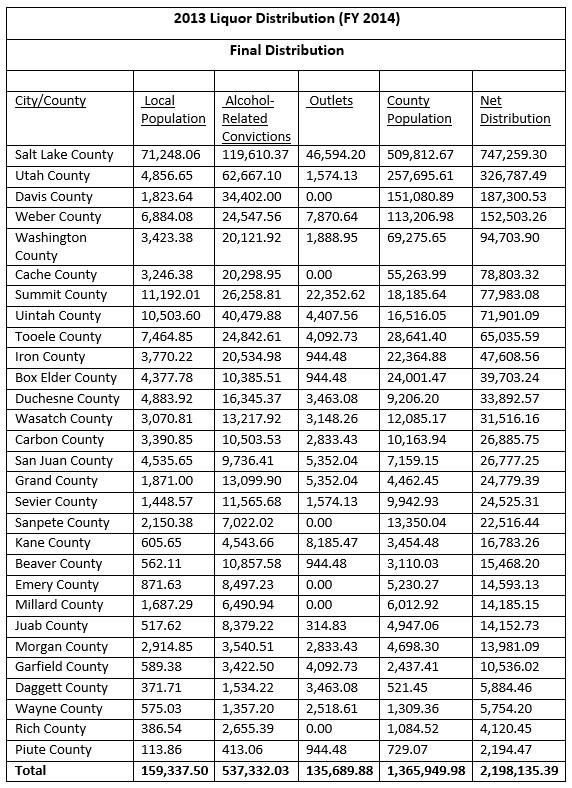

The total distribution from the Alcoholic Beverage Enforcement and Treatment Resticted Account to counties and cities was $5,463,800 in calendar year 2013.

County Distribution from the Alcoholic Beverage Enforcement & Treatment Restricted Account

The following table shows the amount of funds received by counties from the Alcoholic Beverage Enforcement and Treatment Restricted Account in 2013:

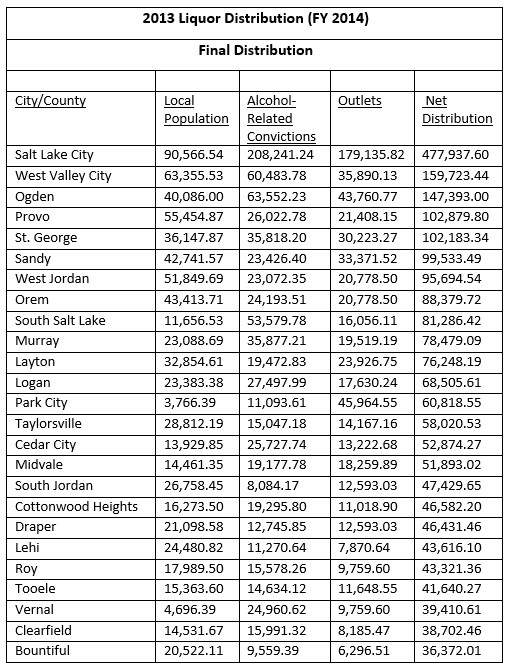

City Distribution from the Alcoholic Beverage Enforcement & Treatment Restricted Account

The following table shows the amount of funds received by the top 25 cities from the Alcoholic Beverage Enforcement and Treatment Restricted Account in 2013:

Utah Code 32B-2-404 specifies the distribution formula for municipalities and counties as follows:

- 25 percent based on population;

- 30 percent based on alcohol related convictions;

- 20 percent based on the number state liquor stores, package agencies, retail licensees, and off-premise beer retailers; and

- 25 percent for confinement and treatment purposes, and authorized on the basis of population

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.