The Uninsured Employers Fund (UEF) was established in 1984 to provide benefits to injured workers whose employers, (1) did not maintain the statutorily required workers compensation insurance, or (2) cannot pay because of insolvency.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $4,801,800 from all sources for Uninsured Employers Fund. This is a 6.9 percent increase from Fiscal Year 2015 revised estimated amounts from all sources.

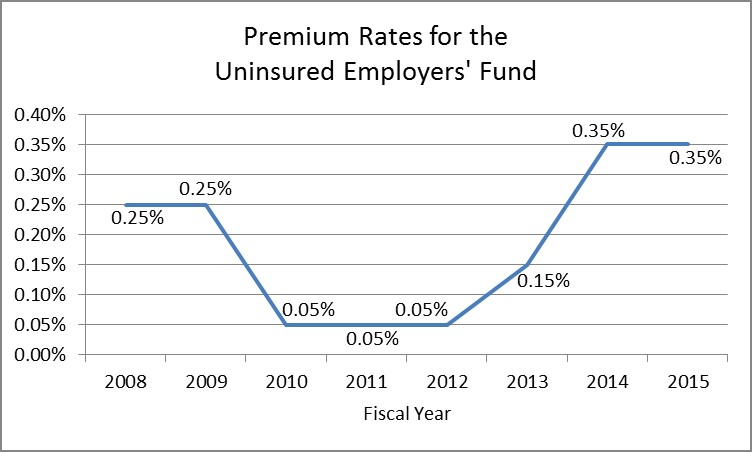

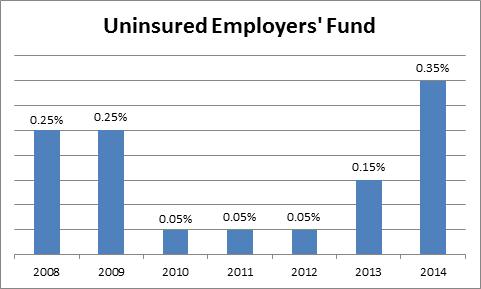

Premium Rates for the Uninsured Employers' Fund

Premium rates for the Uninsured Employers' Fund, which was established in 1984 to provide benefits to injured workers whose employers, (1) did not maintain the statutorily required workers compensation insurance, or (2) cannot pay because of insolvency.

The Legislature appropriated funds from the UEF to the Labor Commission to pay for expenses related to the UEF and to contribute to the operational expenses for the Industrial Accidents Division until FY 2011. At that time, appropriations to the Labor Commission from the UEF ended and the Industrial Accidents Restricted Account was established to assist in funding the operational activities of the Adjudication and Industrial Accidents Division.

Revenues come from (1) a surcharge on Workers' Compensation premium assessments collected by the State Tax Commission, (2) an assessment to employers that are self-insured for workers compensation, (3) penalties imposed against employers who fail to maintain workers compensation insurance, and (4) money collected is invested with the State Treasurer where interest is earned.

The Labor Commission works closely with actuaries and the Workers Compensation Advisory Council, made up equally of employer and employee representatives, to establish the assessment rate for the UEF. This surcharge is administered by calendar year.

For CY 2014 the Council recommended a 0.2 percent increase to the rate, from 0.15 to 0.35 percent. This recommendation represents a 133 percent change from CY 2013. Additionally, this recommendation increases the total surcharge on workers' compensation insurance premiums from 3.8 percent to 4 percent and represents a 5.3 percent change from CY 2013.

For CY 2015 the Council recommended that the rate continue at the same level - 0.35 percent. This was the amount recommended by the actuary this year.

The increased assessment in CY 2014 was due to the consistently low interest rates resulting from a slow economy. The lower interest rates return a lower dollar amount in assessments and it was not expected that interest rates would remain at their current levels for a long period of time. As a result, interest earnings can no longer be expected to significantly reduce the deficit fund balance, and increase in collections from the surcharge are required.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.