Fiscal Highlights - October 2016

|

An Update on Sales Tax Revenue Set-Asides and the Gas Tax -

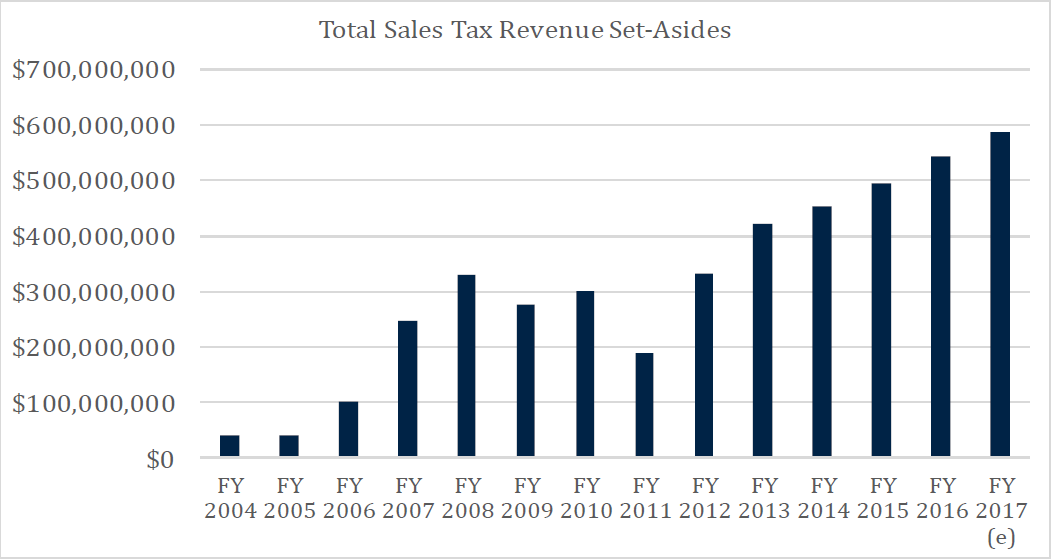

Thomas E. Young ( On October 18th, the Executive Appropriations Committee heard an update on sales tax revenue set-asides (earmarks) and the gas tax. The report is available here. Overall, in FY 2016, sales tax revenue set-asides for transportation, water, and other purposes combined came in about $3 million above the adopted target during the legislative session of $540 million. Revenue growth to the Transportation Fund from the gas tax increase contained in H.B. 362 of the 2015 General Session came in about $1.5 million above the original $24.6 million fiscal note estimate. On sales tax revenue set-asides, the total amount of sales tax revenue set-asides in FY 2017 are estimated to amount to about 21.4% of all potential sales tax revenue. Between 2012 and 2017 growth in set-asides accelerated under S.B. 229 of the 2011 Session. That legislation set an upper limit on two Centennial Highway/Transportation Investment Fund set-asides (the 8.3% and 30% new growth) equal to 17% of total state sales tax collections. The cap is expected to be hit in FY 2018. Sales tax growth to the General Fund should pick up after that. A history of sales tax revenue set-asides is given below.  On revenue from the gas tax, the most recent policy change was the gas tax increase contained in H.B. 362 of the 2015 General Session. That bill indexed future gas tax rates to the rack price of gasoline by multiplying the average rack price for an entire year by 12% and converting this amount to a tax per gallon. The minimum tax rate is the floor rack price of $2.45 multiplied by 12% (or 29.4 cents per gallon). Current estimates do not anticipate further gas tax increases due to indexing in FY 2017 or FY 2018. |

An Update on Sales Tax Revenue Set-Asides and the Gas Tax - Thomas E. Young On October 18th, the Executive Appropriations Committee heard an update on sales tax revenue set-as...Division of Fleet Operations General Fund Borrowing Follow-up - Brian Wikle Since its inception in FY 1997, the Division of Fleet Operations has been in debt to the General Fu...EOCJ Meeting Summary: October 20, 2016 - Gary R. Syphus The Executive Offices and Criminal Justice (EOCJ) Appropriations Subcommittee met on October 20th a...FY 2018 Education Budget Process Begins - Ben Leishman October is an important month when it comes to developing next year's public education budget. This...Higher Education Appropriations Subcommittee Meets - Spencer C. Pratt The Higher Education Appropriations Subcommittee met on October 20, 2016 at the Capitol.Several bil...Justice Efforts for the 2017 General Session - Alexander R. Wilson With the 2017 General Session just around the corner, the Utah Commission on Criminal and Juvenile ...Revenue Update - October 2016 - Andrea Wilko Utah closed FY 2016 with a $7.4 million General and Education Fund revenue surplus. The Education F...Utah College of Applied Technology Custom Fit, FY 2011 - FY 2015 - Jill L.Curry The Custom Fit program funds training for Utah employees that is tailored to meet specific employer...What Happened in the October 20, 2016 Social Services Appropriations Meeting? - Russell T. Frandsen Call to Order /Approval of Minutes - Approved the minutes from the September 22nd meeting.Highlight...Where did the FY 2016 General Fund Revenue Surplus Go? - Steven M. Allred Fiscal Year 2016 ended with a General Fund revenue surplus of $13.6 million. What happened to that ...Why Do Restricted Fund Types Matter? - Clare Tobin Lence Most state agencies receive revenue from multiple funding sources. These sources include "state fun... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692