Fiscal Highlights - October 2016

|

Revenue Update - October 2016 -

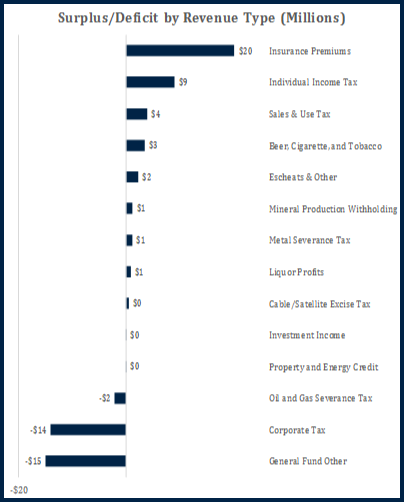

Andrea Wilko ( Utah closed FY 2016 with a $7.4 million General and Education Fund revenue surplus. The Education Fund ended FY 2016 $6.2 million below the May target, while General Fund revenue closed the year in a revenue surplus of $13.6 million. The revenue surplus was due to better-than-expected insurance premiums deposits into the General Fund, individual income tax, sales tax, tobacco taxes, escheats, mineral production withholding, metal severance tax, and liquor profits. Dragging down what otherwise would have been a stronger revenue surplus were weaker than expected performances from miscellaneous revenue to the General Fund, corporate income tax, and oil and gas severance tax. A complete reporting of the revenue surplus/deficit picture by contributing revenue category is shown below. After accounting for expenditure side adjustments, a transfer to the General Fund Budget Reserve Account, and other statutorily required transfers, the budget surplus is $5.0 million in combined General Fund/Education Fund revenue.  Looking toward FY 2017, we anticipate revenue to the General Fund/Education Fund will be in a range of $125.0 million below to $115.0 million above the adopted FY 2017 estimate. The upside potential stems from income tax, in particular a quite strong withholding picture. Insurance premiums will also provide some upside potential for the General Fund. The downside risk includes moderating sales tax performance, very weak severance taxes, potentially peaking corporate income tax, and a potential decline in gross final payments stemming from a possible decline in capital gains and other non-wage sources of income. We often follow the revenue picture in other states in an effort to gauge how Utah compares. The most recent figures, released by the Census Bureau on September 20th for the first two quarters of 2016, suggest revenue growth in Utah remains strong, and in the upper portion of the 50 state revenue collections. For the period from the third quarter of 2015 through the second quarter of 2016 (i.e. FY 2016), Utah's revenue growth ranked 15th among all states at 4.0 percent, coming in just behind Nevada and just above Alabama. In FY 2015, the state of Utah revenue picture was marginally lower at 22nd with year-over-year revenue growth of 6.0 percent. Part of the relatively steady ranking of the state's revenue performance is due to a resilient, diversified economy, where businesses operating in such diverse industries as biotechnology, information technology, and mining compete on a global basis. Other factors contributing to the State's performance include a nationally-known stable business and policy environment, a very cost effective workforce, and continued strong demographic growth less dependent on external in-migration. Tax changes, such as the recent gas tax increase here in Utah, also play a role. |

An Update on Sales Tax Revenue Set-Asides and the Gas Tax - Thomas E. Young On October 18th, the Executive Appropriations Committee heard an update on sales tax revenue set-as...Division of Fleet Operations General Fund Borrowing Follow-up - Brian Wikle Since its inception in FY 1997, the Division of Fleet Operations has been in debt to the General Fu...EOCJ Meeting Summary: October 20, 2016 - Gary R. Syphus The Executive Offices and Criminal Justice (EOCJ) Appropriations Subcommittee met on October 20th a...FY 2018 Education Budget Process Begins - Ben Leishman October is an important month when it comes to developing next year's public education budget. This...Higher Education Appropriations Subcommittee Meets - Spencer C. Pratt The Higher Education Appropriations Subcommittee met on October 20, 2016 at the Capitol.Several bil...Justice Efforts for the 2017 General Session - Alexander R. Wilson With the 2017 General Session just around the corner, the Utah Commission on Criminal and Juvenile ...Revenue Update - October 2016 - Andrea Wilko Utah closed FY 2016 with a $7.4 million General and Education Fund revenue surplus. The Education F...Utah College of Applied Technology Custom Fit, FY 2011 - FY 2015 - Jill L.Curry The Custom Fit program funds training for Utah employees that is tailored to meet specific employer...What Happened in the October 20, 2016 Social Services Appropriations Meeting? - Russell T. Frandsen Call to Order /Approval of Minutes - Approved the minutes from the September 22nd meeting.Highlight...Where did the FY 2016 General Fund Revenue Surplus Go? - Steven M. Allred Fiscal Year 2016 ended with a General Fund revenue surplus of $13.6 million. What happened to that ...Why Do Restricted Fund Types Matter? - Clare Tobin Lence Most state agencies receive revenue from multiple funding sources. These sources include "state fun... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692