Fiscal Highlights - November 2016

|

As the Holidays Begin, Let's Discuss Debt Affordability -

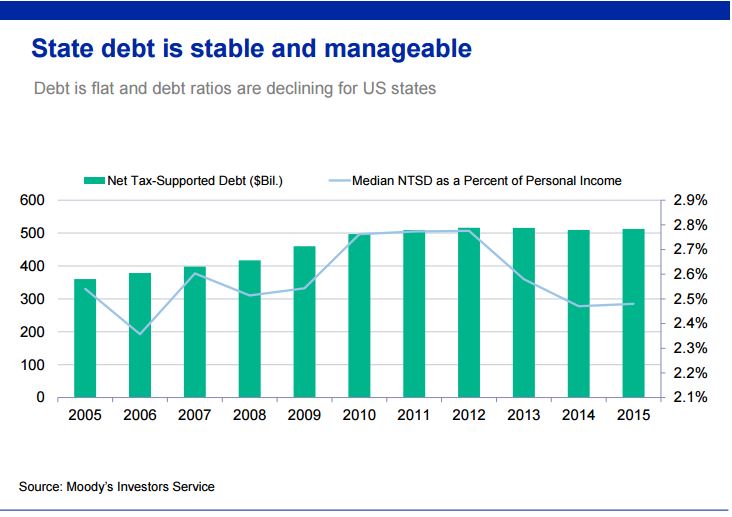

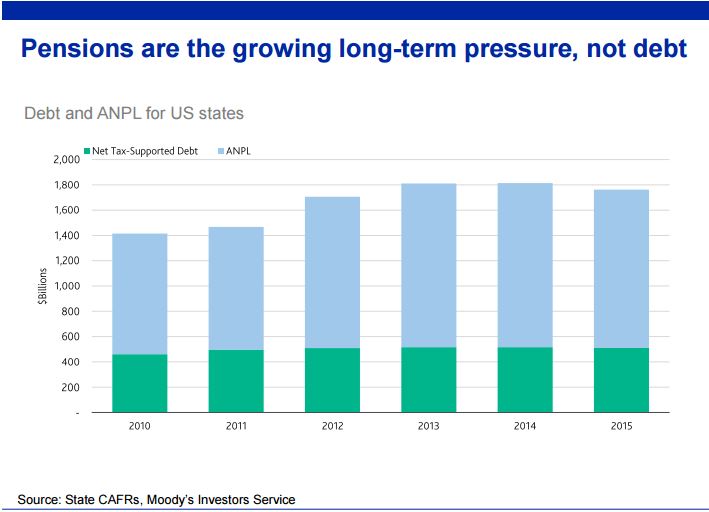

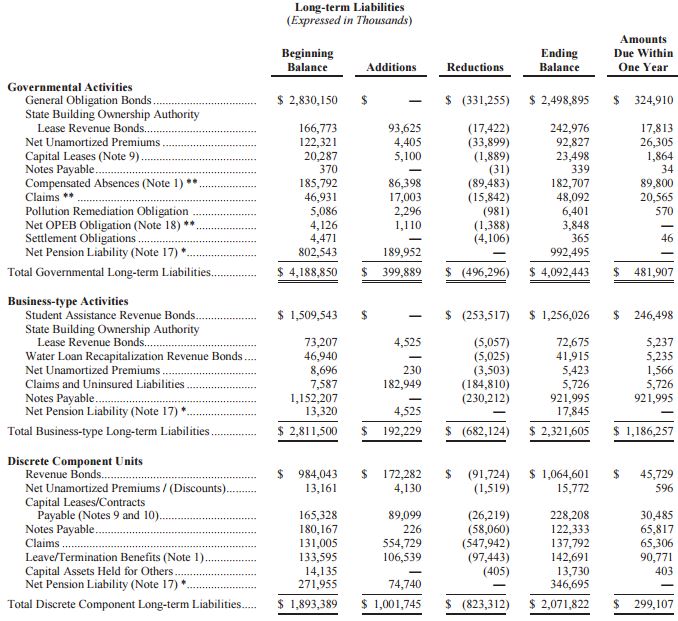

Steven M. Allred ( I recently had the opportunity to attend a National Conference of State Legislatures fiscal seminar for legislators and staff from across the country. I found the presentations to be interesting and informative. On several occasions Utah was recognized as being a fiscally well-managed state. One presenter, from UBS Financial Services, congratulated our state on having the best credit of any state in the nation. Another presenter, from Moody's Investor Service, reviewed states' debt and factors states should consider when analyzing debt affordability. I will highlight her presentation here. A good debt affordability review should include more than just a state's current debt. It should also include all long-term liabilities (in particular pension and other post-employment benefit liabilities), current commitments (for example, Medicaid), and revenue projections. As shown in the chart below, on a national level state debt has stabilized in dollar value since 2010 and has declined as a percent of personal income since 2012.  Nationally in the past fifteen years we're spending less as a percentage of Gross Domestic Product (GDP) on infrastructure than in the previous thirty years. States have become averse to debt due to painful memories of the Great Recession and other commitments being incurred. During the last four years municipal bond rates have been historically low, yet states have not been borrowing to what Moody's believes is the need to maintain infrastructure. While the presenter didn't say this, it is also possible that well-managed states are using pay-as-you-go rather than borrowing in recent years. Average net pension liability (not debt) is the largest pressure point on states' long-term liabilities:  Interestingly, Utah's net pension liability is lower than our net tax-supported debt. The Division of Finance recently provided the Executive Appropriations Committee with our FY 2016 long-term liabilities from the soon-to-be-released Comprehensive Annual Financial Report (CAFR). A copy of the table is shown below. Across three categories of state government activities, General Obligation Bond debt was $2.5 billion and net pension liability was $1.4 billion. Lease/revenue and revenue bond debt was $2.7 billion ($1.3 billion of which was student assistance revenue bonds), and total long-term liability summed to $8.5 billion.  |

Access to High Quality Schools - Hector R. Zumaeta Santiago During the 2016 General Session, the Utah State Legislature appropriated $11 Million for 3 years (t...An Evaluation of Tax Exceptions and Inducements - Andrea Wilko Utah offers more than 170 exceptions to tax code and inducements to behavior change. They can be r...An Update on Internal Service Fund Rates - Sean C. Faherty On November 15th, the Executive Appropriations Committee heard an update on internal service funds....As the Holidays Begin, Let's Discuss Debt Affordability - Steven M. Allred I recently had the opportunity to attend a National Conference of State Legislatures fiscal seminar...B&C Roads Funding May Reach $175 Million in 2017 - Thomas E. Young The 4th Special Session of the 2016 Legislature addressed B and C Roads funding. Among the formula ...Comprehensive Study of Career and Technical Education in Utah - Jill L.Curry House Bill 337, Career and Technical Education Comprehensive Study (2015 General Session), created ...FY 2018 Capital Development Rankings - Brian Wikle As defined by UCA 63A-5-104, "capital development" means 1) a remodeling, site, or utility project ...Justice Reinvestment Initiative (JRI): Status Report - Gary R. Syphus During the 2015 General Session, the Legislature passed House Bill 348 commonly referred to as th...Managing the $173 Million DCFS Budget - Clare Tobin Lence At the October 2016 meeting of the Social Services Appropriations Subcommittee, LFA staff present...Student Enrollment Continues to Grow - Ben Leishman A total of 644,476 students enrolled in Utah public schools this fall. This is an increase of 10,58...Unclaimed Property: A Pleasant Surprise - Alexander R. Wilson The Utah State Office of the Treasurer has made significant progress over the last three years in r...Updated Full Medicaid Expansion Cost Estimates - Russell T. Frandsen Staff was asked to update full Medicaid expansion cost scenarios. This resulted in five changes to ...USHE Data Available, More to Come - Spencer C. Pratt The Utah System of Higher Education collects and organizes a significant amount of data from each o... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692