Fiscal Highlights - November 2016

|

Unclaimed Property: A Pleasant Surprise -

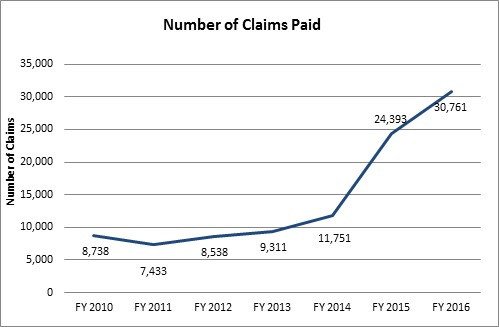

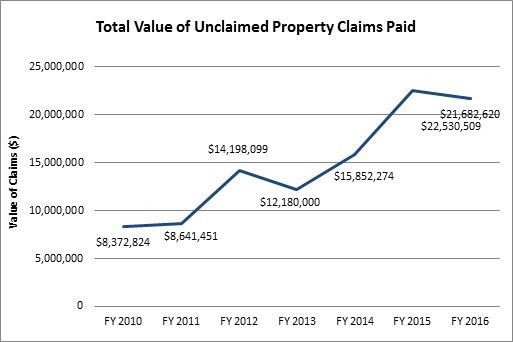

Alexander R. Wilson ( The Utah State Office of the Treasurer has made significant progress over the last three years in redistributing funds from the Unclaimed Property Program. In fact, the number of claims paid since 2014 has nearly tripled. The following graph shows that before 2014 the number of claims paid has hovered around 10,000. However, in FY 2015 that number skyrocketed and has increased even more through FY 2016.  Interestingly, the value of the claims paid has also increased, but not as dramatically. The 12,000 claims in FY 2014 amounted to about $16 million, while the 31,000 claims in FY 2016 amounted to $22 million. In other terms, a 162% increase in claims only resulted in a 37% increase in value of claims. These results could be due to a number of reasons. One explanation is that the efforts of the Treasurer have reached many individuals with low value unclaimed property. Another explanation is that in previous years there could have been fluke extremely high value claims. This was to some degree confirmed by the Treasurer's Office when I was told that a few years ago there was a claim for $4 million and also one for $600,000.  The Office of the Treasurer attributes this success to many of their recent efforts. When I contacted the Office, I was informed about the paperwork intensive nature of this effort. Simply using modern imaging technology has increased the efficiency of the process resulting in more claims. After fixing the process efficiency, the Office has focused on rebranding the unclaimed property efforts. They created a new website and embarked on an education and outreach campaign. This outreach has utilized all forms of media. Specifically, the State Treasurer has appeared on various radio talk shows to explain unclaimed property. Also, there has been a strong focus on digital marketing and social media. Another effort is that of the Fast Track system. This system uses identifying information connected with the property to streamline the claim process. Finally, the Office has even coordinated with some local officials and legislators to communicate with individual constituents and return unclaimed property. The Unclaimed Property Division is an aspect of State Government that should be understood by not only the citizens of Utah, but also those working for the state. Unclaimed property can be found at https://mycash.utah.gov/UP_Start.asp. It is easy to use and a very tangible means the state can use to give back to the citizens. As a final note, after I learned of the division, I searched my name and the names of my immediate family. Our family had a little over $200 in unclaimed property. I guess it should matter that we had earned the money, but since it was so long ago, it felt free. I, like most citizens, was used to giving money to the government; getting something back was a pleasant surprise. |

Access to High Quality Schools - Hector R. Zumaeta Santiago During the 2016 General Session, the Utah State Legislature appropriated $11 Million for 3 years (t...An Evaluation of Tax Exceptions and Inducements - Andrea Wilko Utah offers more than 170 exceptions to tax code and inducements to behavior change. They can be r...An Update on Internal Service Fund Rates - Sean C. Faherty On November 15th, the Executive Appropriations Committee heard an update on internal service funds....As the Holidays Begin, Let's Discuss Debt Affordability - Steven M. Allred I recently had the opportunity to attend a National Conference of State Legislatures fiscal seminar...B&C Roads Funding May Reach $175 Million in 2017 - Thomas E. Young The 4th Special Session of the 2016 Legislature addressed B and C Roads funding. Among the formula ...Comprehensive Study of Career and Technical Education in Utah - Jill L.Curry House Bill 337, Career and Technical Education Comprehensive Study (2015 General Session), created ...FY 2018 Capital Development Rankings - Brian Wikle As defined by UCA 63A-5-104, "capital development" means 1) a remodeling, site, or utility project ...Justice Reinvestment Initiative (JRI): Status Report - Gary R. Syphus During the 2015 General Session, the Legislature passed House Bill 348 commonly referred to as th...Managing the $173 Million DCFS Budget - Clare Tobin Lence At the October 2016 meeting of the Social Services Appropriations Subcommittee, LFA staff present...Student Enrollment Continues to Grow - Ben Leishman A total of 644,476 students enrolled in Utah public schools this fall. This is an increase of 10,58...Unclaimed Property: A Pleasant Surprise - Alexander R. Wilson The Utah State Office of the Treasurer has made significant progress over the last three years in r...Updated Full Medicaid Expansion Cost Estimates - Russell T. Frandsen Staff was asked to update full Medicaid expansion cost scenarios. This resulted in five changes to ...USHE Data Available, More to Come - Spencer C. Pratt The Utah System of Higher Education collects and organizes a significant amount of data from each o... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692