Fiscal Highlights 2014

|

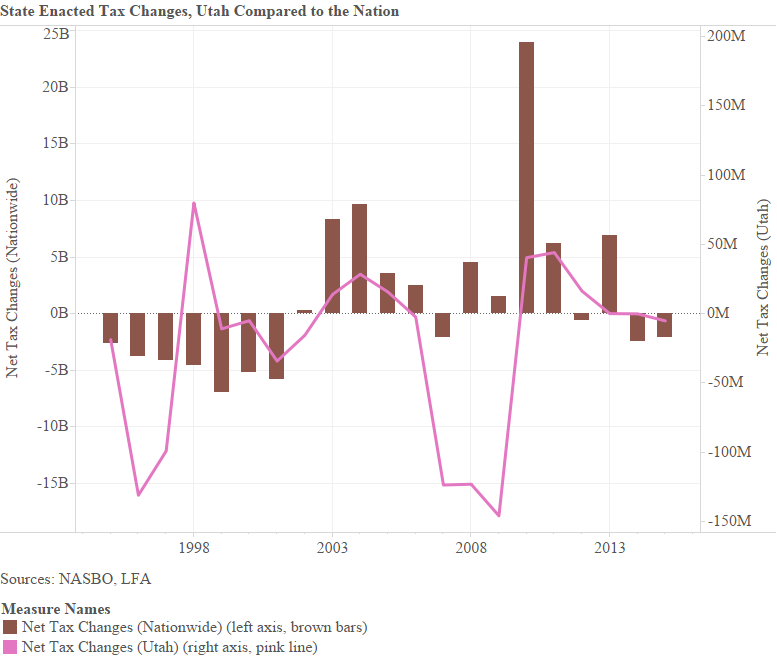

How Have Tax Changes in Utah Compared to the Nation? -

Thomas E. Young ( Every spring and winter, the National Association of State Budget Officers (NASBO) releases numbers on what states have done with budgeted revenue, known as their Fiscal Survey of the States. How do tax changes in Utah compare to the nation as a whole? The pink line in the figure below corresponds with the right axis and represents tax changes enacted by Utah. The brown bars correspond with the left axis and represent net tax changes across the 50 states, as reported by NASBO. Overall, Utah tax policy somewhat follows the national trend and the business cycle. Prior to the NASDAQ bust, the general trend was for states to reduce tax liability, and, with the exception of 1998, Utah followed that general trend. Following the NASDAQ correction, on the net, states increased the tax burden. Utah followed that trend until 2007. From 2007 to 2011, the states flipped from implementing net tax reductions to net tax increases, peaking at $24 billion in 2010. Utah was somewhat aligned, reducing the tax burden from 2007 to 2009, after which, net tax increases were the story until 2013. The two most recent years - 2014 and 2015 - have seen, for the first time since 2001, two consecutive years of net tax burden reductions for both Utah and the nation.  Overall, state tax changes somewhat follow the national trend and business cycle. |

Coyote Removal Program - Ivan D. Djambov The Division of Wildlife Resources (DWR) has been working to improve the mule deer numbers in Utah ...DAS and DTS Reports - Gary K. Ricks In the last few months, the Departments Technology Services and Administrative Services and ha...How Close Did We Come to the Cap on Sales Tax Earmarks for Transportation in FY 2014? - Steven M. Allred Since 2005, the Legislature has earmarked portions of the sales tax for highway construction projec...How Have Tax Changes in Utah Compared to the Nation? - Thomas E. Young Every spring and winter, the National Association of State Budget Officers (NASBO) releases numbers...Income Tax Appropriations to Public and Higher Education - Ben Leishman In November 1996, Utah voters amended the Utah Constitution to formally authorize the pra...Pew Final Key Findings - Gary R. Syphus After several months of research, the Pew Charitable Trusts' Public Safety Performance Project ...Snow College Concurrent Enrollment Update - Spencer C. Pratt During the 2014 General Session, the Legislature passed S.B. 38, "Snow College C...The Changing Demographics of Expected Income - Angela J. Oh The two recent recessions and subsequent recoveries continue to affect expected lifetime income by ...Utah's Credit Rating and Debt Measures - Brian Wikle Did you know the State of Utah has a credit score? Although the stat...Utah's Revenue Continues to Grow - Andrea Wilko Utah ended FY 2014 with a $166 million General and Education Fund revenue surplus. The revenu... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692