Fiscal Highlights 2014

|

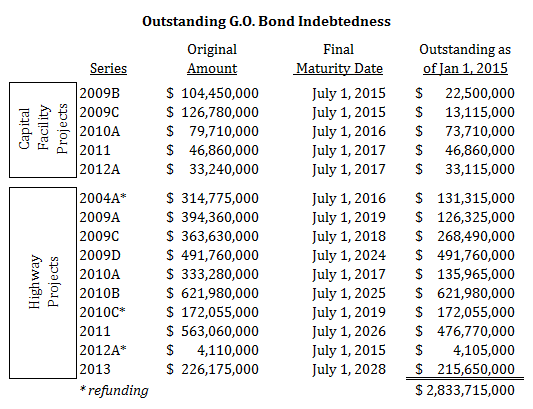

General Obligation Debt of the State of Utah -

Brian Wikle ( The State of Utah often uses general obligation (G.O.) bonds to finance large capital expenditures, including new facility construction, major remodeling, and highway projects. In practice, the state uses General Fund revenues that may be derived from various sources to service the debt. However, because G.O. bonds are secured by the full faith and credit of the state, the state must levy taxes on the property and income of residents sufficient to make principal and interest payments in the event that debt service funds fall short. As lawmakers consider funding options for prison relocation, transportation, and other infrastructure projects, it is important to understand the state's existing indebtedness and payoff schedule, as well as constitutional and statutory debt limitations. Utah currently has $2.95 billion in outstanding G.O. bond debt. Of this amount, $2.83 billion is debt principal, and the remainder includes certain costs of debt issuance that were financed along with the principal. As a general rule, principal payments for each bond series occur annually on January 1 and interest payments are made on January 1 and July 1. The table below shows the state's outstanding G.O. debt principal. Under the current schedule, Utah will pay off three bonds on July 1, 2015 (Series 2009B, the capital facility projects portion of Series 2009C, and the highway projects portion of Series 2012A). If no new G.O. debt is issued, 36% of the outstanding debt will be paid off within five years, and the debt will be fully retired in 2028. Article XIV, Section 1 of the Utah Constitution limits total general obligation debt to 1.5 percent of the value of the state's taxable property. Currently, the constitutional debt limit stands at $4.24 billion, allowing additional debt capacity of $1.29 billion. Debt is also capped statutorily by the State Appropriations and Tax Limitation Act, though most highway bonds are exempt from this cap. Under the Act, the state may incur another $1.17 billion in general obligation debt. |

Coyote Removal Program - Ivan D. Djambov The Division of Wildlife Resources (DWR) has been working to improve the mule deer numbers in Utah ...DAS and DTS Reports - Gary K. Ricks In the last few months, the Departments Technology Services and Administrative Services and ha...How Close Did We Come to the Cap on Sales Tax Earmarks for Transportation in FY 2014? - Steven M. Allred Since 2005, the Legislature has earmarked portions of the sales tax for highway construction projec...How Have Tax Changes in Utah Compared to the Nation? - Thomas E. Young Every spring and winter, the National Association of State Budget Officers (NASBO) releases numbers...Income Tax Appropriations to Public and Higher Education - Ben Leishman In November 1996, Utah voters amended the Utah Constitution to formally authorize the pra...Pew Final Key Findings - Gary R. Syphus After several months of research, the Pew Charitable Trusts' Public Safety Performance Project ...Snow College Concurrent Enrollment Update - Spencer C. Pratt During the 2014 General Session, the Legislature passed S.B. 38, "Snow College C...The Changing Demographics of Expected Income - Angela J. Oh The two recent recessions and subsequent recoveries continue to affect expected lifetime income by ...Utah's Credit Rating and Debt Measures - Brian Wikle Did you know the State of Utah has a credit score? Although the stat...Utah's Revenue Continues to Grow - Andrea Wilko Utah ended FY 2014 with a $166 million General and Education Fund revenue surplus. The revenu... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692