The Child Nutrition Program line item is made up of federal assistance programs that have the purpose of offering high quality, nutritionally well-balanced meals and the development of nutrition awareness among students. The programs offer low cost or free meals to children in public and non-profit private schools, non-profit residential child care institutions, public, non-profit and for-profit child care centers, and family day care homes. The state contributes to the nutrition programs in schools with revenue generated through the tax on wine and distilled liquor.

Child Nutrition Program staff provide technical assistance as requested by participants; develop an annual financial and staffing plan; provide free and reduced price meal policy; interpret state and federal regulations; and perform administrative and nutritional reviews to assure compliance with state and federal regulations.

The following are the primary programs administered by the Child Nutrition Section at USOE, in accordance with USDA regulations:

National School Lunch Program: Four funding sources contribute to the National School Lunch Program, namely, Federal Funds, State Funds, USDA Foods (Commodities) and Local Revenue. USDA Foods include items such as meat, vegetables, cheese, and staples such as flour, oils, etc. This program serves a dual need--support for the agriculture industry and helping the nutritional needs of children. School districts may also participate in the After-School Snack Program, Seamless Summer Program and may also qualify to offer the Fresh Fruit & Vegetable Program.

Meals provided in the schools must meet the nutritional requirements of the "Dietary Guidelines for Americans," published by the USDA and U.S. Department of Health and Human Services. Guidelines indicate that lunches should provide for one-third of a child's daily nutritional requirements. Free or Reduced-price lunches are available for children who meet the eligibility requirements detailed in "Free and Reduced Price Lunch Guidelines" below. Additional funds are available to "severe need" schools where a high percentage of students attending the school qualify for free or reduced-price meals.

National School Breakfast Program: Schools have the option of participating in the School Breakfast Program. The same eligibility requirements used in determining the need for free or reduced-price lunch are used for the breakfast program (see "Free and Reduced Price Lunch Guidelines" below). Severe need schools receive a higher rate of reimbursement.

Special Milk Program: Children who do not participate in the other nutrition programs, for example, children attending kindergarten, may participate in the Special Milk Program. The federal government provides a reimbursement for each half-pint of milk. Children are charged the difference between the reimbursement and the actual cost. Children not able to pay the difference may receive milk free of charge, in which case the federal reimbursement covers the full cost of the milk.

Summer Food Service Program: The Summer Food Service Program provides meals on a regular basis when school is not in session. To be eligible, the school must show that 50 percent or more of their students were served free or reduced price meals. Once the need has been demonstrated, then all children who attend the school are eligible to participate in the program. The Summer Food Service Program is entirely federally funded.

Child and Adult Care Food Program: The Child and Adult Care Food Program provides for meals in child care centers, Head Start programs, emergency and homeless shelters, at-risk after school programs, and family day care homes. To be eligible, the center must be private, non-profit or public, or provide services for low-income children. In Family Day Care Homes, the cost of meals are reimbursed to sponsors, who then distribute the funds to the day care providers. Providers are reimbursed at a higher rate if they serve meals to low-income children. Centers providing services to older or disabled adults can also receive reimbursement for meals served to those clients.

Food Distribution Program: The USDA distributes food to institutions and programs that provide nutritional services to eligible persons. These programs include the National School Lunch Program, the Child and Adult Care Food Program and the Summer Food Service Program.

Emergency Food Assistance Program: The Emergency Food Assistance Program provides food and federal cash assistance to food banks, pantries and emergency shelters. Foods are distributed through local pantries to individuals in economic distress and for meal services at shelters. The cash assistance helps food banks defray the expense of administration of the program and to defray the expense of the storage and distribution of the food. The state Education Fund appropriation supports state level administrative expenses, including warehouse receipt and some distribution to shelters.

Free and Reduced Price Lunch Guidelines: Children whose household income is at or below 130 percent of federal poverty guidelines may receive school meals at no charge. Children are entitled to pay a reduced price if their household income is above 130 percent but at or below 185 percent of these guidelines. Children are automatically eligible for free school meals if their household receives food stamps, benefits under the Food Distribution Program on Indian Reservations or benefits under the Temporary Assistance for Needy Families (TANF) program. Children who don't qualify for free or reduced-price meals receive meals at the 'paid' rate. The cost of "paid" meals to the student is determined by the school or district.

All income actually received by the household is counted in determining eligibility for free and reduced price meals. This includes salary, public assistance benefits, social security payments, pensions, unemployment compensation, etc. The only exceptions are benefits under Federal programs which, by law, are excluded from consideration. These can include: in-kind benefits, such as military on-base housing; certain kinds of assistance for students; and irregular income from occasional small jobs such as baby-sitting or lawn mowing.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $161,602,300 from all sources for Child Nutrition. This is a 10.6 percent reduction from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $143,200 from the General/Education Funds, an increase of 0.4 percent from revised Fiscal Year 2015 estimates.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

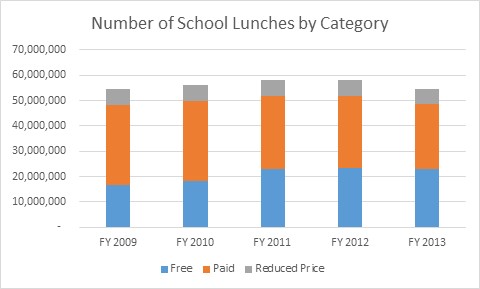

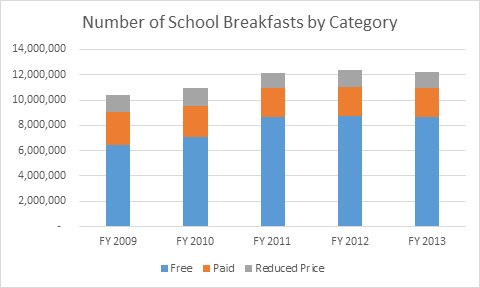

The Child Nutrition Program considers the number of school meals, child care center meals, and home day care meals and the number of sponsors and sites in each program as indicators of its performance. The number of school meals has decreased 5.75% from 2012-2013 due to the adoption of new meal patterns introduced in 2012-13. The number of meals in other programs has increased and the number of sponsors and sites has increased in most of the other programs.

Number of School Lunches by Category

Number of School Breakfasts by Category

The federal Child Nutrition Programs were authorized under the National School Lunch Act of 1946, the Child Nutrition Act of 1966, and the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 and the Healthy, Hunger-Free Kids Act of 2010. The programs strive to improve the nutritional well-being of children, enabling them to reach their full potential.

As shown in the following table, the majority of Child Nutrition revenue comes from the federal government. The State supports the school lunch programs by assessing a tax on liquor and wine. This tax, shown in the table as dedicated credits revenue, provides for approximately 19 percent of the Child Nutrition Program.

Approximately 98 percent of the total revenue generated for the program is passed to program sponsors for program operation. The remaining two percent supports the Child Nutrition division at the State Office of Education.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.