Fiscal Highlights - June 2013

|

Impact of Recent Federal Tax Changes on Utah Residents and Government -

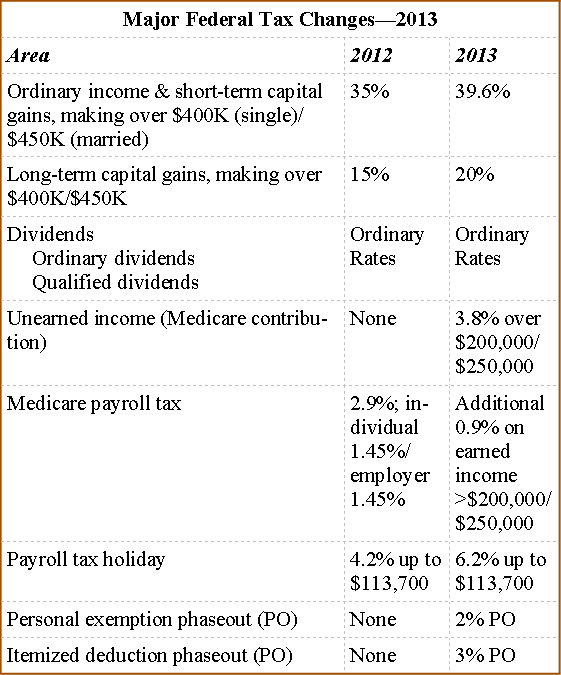

Thomas E. Young ( By how much will the recent federal tax increases reduce disposable income to residents of the state? When adding up the tax-rate changes to single and married individuals making over $400,000/$450,000 in certain instances, and $200,000/$250,000 in other instances, as well as the reinstatement of the payroll tax holiday, residents will likely see a decrease in personal income of about $2.5 billion in 2013. The major tax changes that came in 2013 include:

The largest portion of the tax increase stems from the expiration of the payroll tax holiday at about $1.2 billion. In terms of state revenue, a $2.5 billion reduction in personal income equates to about a $125 million reduction in General/Education Fund revenue, with most of that being individual income tax and sales tax. |

$119 m in Future Buildings "Phase" Funded - Mark Bleazard A new law improves financial management for state buildings by recognizing the full cost of a ...$2.6 Million Spent on Carp Removal So Far, What Are The Results? - Ivan D. Djambov The carp is identified as the greatest obstacle for recovering the endangered June Sucker in Utah L...AGRC Delivers Cadastral Grant Contracts/Funding to Locals - Gary K. Ricks The Automated Geographic Reference Center (AGRC) is a division within the Department of Technology ...Division of Juvenile Justice Services Proposes $11million Multi-use Facility - Zackery N. King The Board of Juvenile Justice Services most recently met on Thursday, May 30, 2013. Among ot...Employment and Wage Growth - Andrea Wilko Overall Utah's economy is improving. Businesses in Utah continue to create jobs at more than ...Federal FY 2013 Budget Deficit Estimate Has Dropped to $642 Billion - Steven M. Allred The non-partisan Congressional Budget Office (CBO) has revised its FY 2013 federal deficit estimate...Higher Education Enrollment Dips - Spencer C. Pratt Enrollment in the Utah System of Higher Education dropped for the spring semester. The Spring...Impact of Recent Federal Tax Changes on Utah Residents and Government - Thomas E. Young By how much will the recent federal tax increases reduce disposable income to residents of the stat...Medicaid Used 23% of all the State's General Fund in FY 2012 - Russell T. Frandsen In FY 2012, the Medicaid program in Utah spent $484,499,800 General Fund and $5,322,300 Education F...New Fiscal Note System - Stan Eckersley The Legislature has a new fiscal note system that it will use in the next general session. There we...Per Pupil Expenditures: National Comparisons Show Utah Spends Between $6,064 and $8,122 per Pupil - Ben Leishman A state's per pupil expenditure (PPE) has become one of the most common data points used to compare...Revenue Forecast - June 2013 - Andrea Wilko A consensus range forecast for June 2013 indicates that revenues will be between $135 million to $1...Special Administrative Expense Account $5.0 Million Less Than Stated - Stephen C. Jardine In the 2013 General Session, the Legislature appropriated $6.7 million from the Special Administrat...Tooele ATC New Building - Angela J. Oh On June 5th, 2013, Tooele Applied Technology College (TATC) had a ribbon cutting ceremony and open ... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692