Fiscal Highlights - June 2013

|

Revenue Forecast - June 2013 -

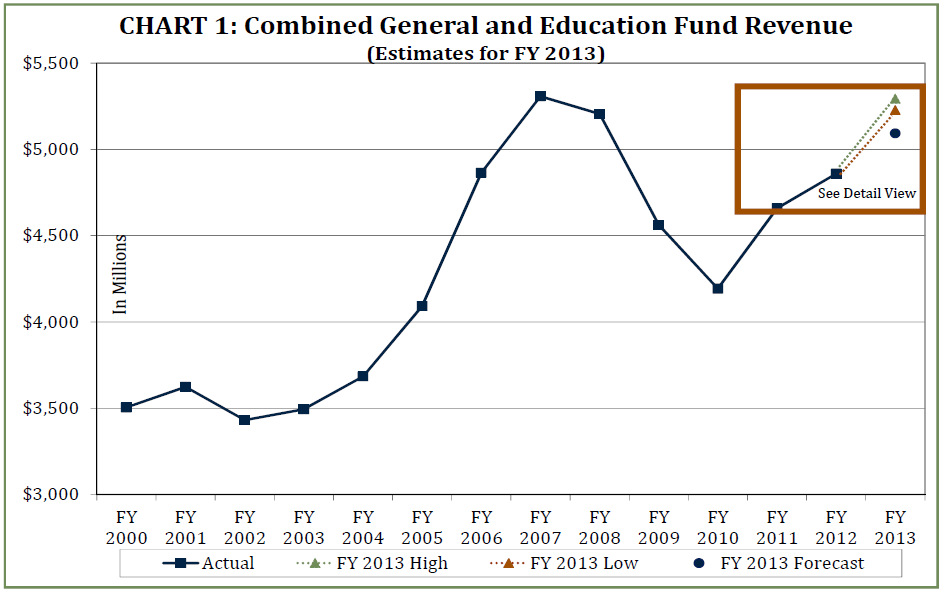

Andrea Wilko ( A consensus range forecast for June 2013 indicates that revenues will be between $135 million to $195 million above our May projection for FY 2013. Transportation Fund revenue is expected to be plus or minus $5 million of the May target.

Income tax collections have been particularly strong in FY 2013 due largely to federal tax changes which caused taxpayers to shift gains into tax year 2012. Revenue resulting from this shift should be treated as one-time in the budgeting process. Overall we have seen improvements in the housing market, consumer confidence and spending, business spending and equity markets. As a result we expect revenues to remain strong throughout the remainder of the fiscal year and into FY 2014. See the full text of our report here.

|

$119 m in Future Buildings "Phase" Funded - Mark Bleazard A new law improves financial management for state buildings by recognizing the full cost of a ...$2.6 Million Spent on Carp Removal So Far, What Are The Results? - Ivan D. Djambov The carp is identified as the greatest obstacle for recovering the endangered June Sucker in Utah L...AGRC Delivers Cadastral Grant Contracts/Funding to Locals - Gary K. Ricks The Automated Geographic Reference Center (AGRC) is a division within the Department of Technology ...Division of Juvenile Justice Services Proposes $11million Multi-use Facility - Zackery N. King The Board of Juvenile Justice Services most recently met on Thursday, May 30, 2013. Among ot...Employment and Wage Growth - Andrea Wilko Overall Utah's economy is improving. Businesses in Utah continue to create jobs at more than ...Federal FY 2013 Budget Deficit Estimate Has Dropped to $642 Billion - Steven M. Allred The non-partisan Congressional Budget Office (CBO) has revised its FY 2013 federal deficit estimate...Higher Education Enrollment Dips - Spencer C. Pratt Enrollment in the Utah System of Higher Education dropped for the spring semester. The Spring...Impact of Recent Federal Tax Changes on Utah Residents and Government - Thomas E. Young By how much will the recent federal tax increases reduce disposable income to residents of the stat...Medicaid Used 23% of all the State's General Fund in FY 2012 - Russell T. Frandsen In FY 2012, the Medicaid program in Utah spent $484,499,800 General Fund and $5,322,300 Education F...New Fiscal Note System - Stan Eckersley The Legislature has a new fiscal note system that it will use in the next general session. There we...Per Pupil Expenditures: National Comparisons Show Utah Spends Between $6,064 and $8,122 per Pupil - Ben Leishman A state's per pupil expenditure (PPE) has become one of the most common data points used to compare...Revenue Forecast - June 2013 - Andrea Wilko A consensus range forecast for June 2013 indicates that revenues will be between $135 million to $1...Special Administrative Expense Account $5.0 Million Less Than Stated - Stephen C. Jardine In the 2013 General Session, the Legislature appropriated $6.7 million from the Special Administrat...Tooele ATC New Building - Angela J. Oh On June 5th, 2013, Tooele Applied Technology College (TATC) had a ribbon cutting ceremony and open ... |

Reports/Archive | Budget Process | Office Background | Who's Who | Organization Chart

Office of the Legislative

Fiscal Analyst

House Building, Suite W310

Salt Lake City, UT 84114

Phone (801) 538-1034 Fax (801) 538-1692