The Division of Risk Management was organized in 1980 to implement a self-insurance program for the state. The division provides liability, property, and auto physical damage coverage to all state agencies and school districts, many charter schools, and all state-owned colleges and universities. The division had an Owner Controlled Insurance Program (OCIP) to provide optional insurance on construction projects; however, due to the lack of interest and funding concerns, the division is phasing out this program. The division also acts as an agent in purchasing aircraft insurance for various state entities that have airplanes or flight instruction programs, but does not provide medical malpractice coverage at the University of Utah.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $43,753,800 from all sources for ISF - Risk Management. This is a 0.6 percent increase from Fiscal Year 2015 revised estimated amounts from all sources.

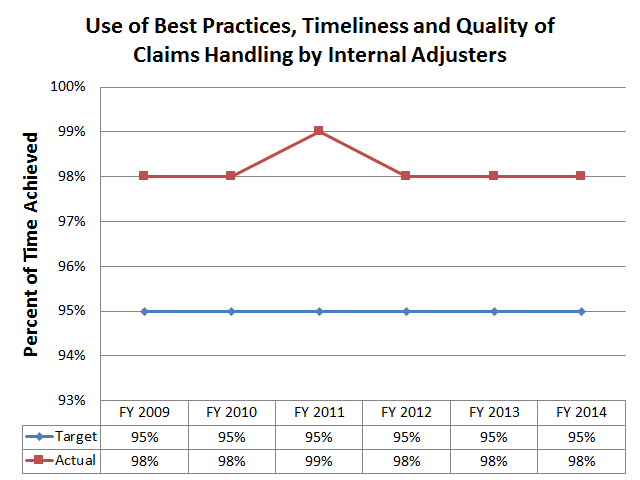

Internal Adjusters Ratings

The division contracts with an insurance consulting firm to audit adjustors' work to see if they are meeting standards in documentation, timeliness, fairness to both sides, compliance with regulations, etc. The contractor uses a rating scale to assign a score and considers 95 percent or above a "Superior Rating."

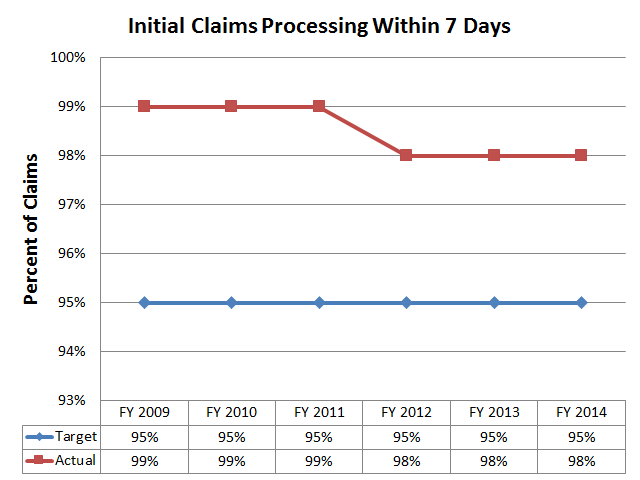

Risk Management resolves liability claims against the state. While these claims may take months to years to resolve, the program endeavors to process initial claims within seven days of receiving them.

UCA 63A-4 outlines the duties and powers of the division. Duties include:

- Acquire and administer all property, casualty insurance, and workers' compensation insurance purchased by the state

- Make rules setting forth reasonable underwriting and risk control standards, risks that will be covered by the Risk Management Fund, eligibility for payments from the fund, procedures for making claims, and procedures for settling disputes

- Implement a risk management and loss prevention program for state agencies

- Work with state agencies that manage and protect state property, such as the state fire marshal or DFCM

- Maintain necessary records

- Manage the Risk Management Fund according to economically and actuarially sound principles

- Purchase insurance or reinsurance as necessary

- Submit rates and fees to the Rate Committee and Legislature for approval

The division may:

- Enter into contracts

- Purchase insurance

- Adjust, settle, and pay claims

- Pay expenses and costs

- Study the risks of all state agencies and properties

- Issue certificates of coverage to state agencies

- Make recommendations to state agencies

- Prescribe insurance and liability provisions to be included in all state contracts

- Review building plans and make recommendations

- Spend monies from the Risk Management Fund (created under UCA 63A-4-201

UCA 63A-4-204 through 205.5 allow state agencies, institution of higher education, school districts, charter schools, and independent entities to participate in the Risk Management Fund.

The following table summarizes funding for the two programs in this line item. Restricted Revenue represents collections of Workers' Compensation premiums.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.