Mission: to regulate the exploration and development of coal, oil and gas, and other minerals in a manner which:

- encourages responsible reclamation and development;

- protects correlative rights;

- prevents waste; and

- protects human health and safety, the environment, and the interests of the state and its citizens.

The Division of Oil, Gas and Mining (OGM) regulates exploration for and development of Utah's oil, gas, coal and other mineral resources. When exploration and developmental activities are completed, the division ensures that oil and gas wells are properly abandoned and mining sites are satisfactorily reclaimed. OGM also accounts for and protects the rights of all surface property and mineral owners in oil and gas operations. Staff inspects each well site to assure that proper conservation practices are followed and that minimum ecological damage results from the location, operation, and reclamation of each site.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $14,187,300 from all sources for Oil, Gas and Mining. This is a 2.9 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $1,594,000 from the General/Education Funds, a reduction of 0.1 percent from revised Fiscal Year 2015 estimates.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

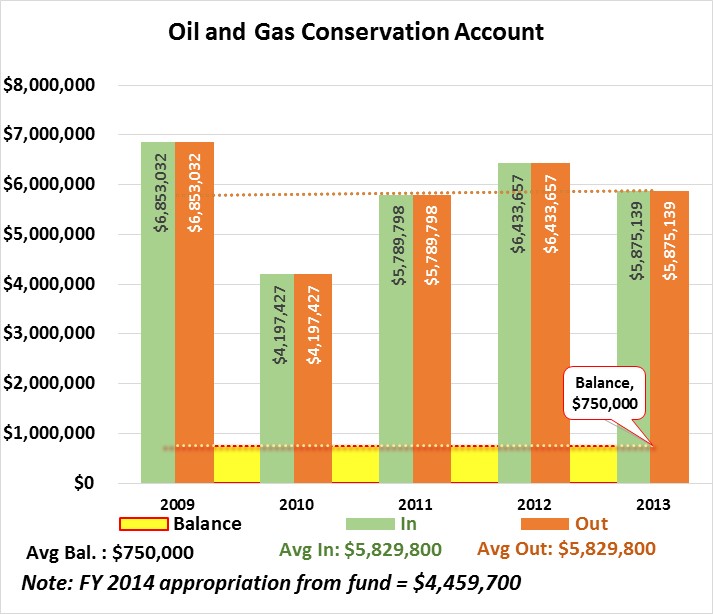

The Oil and Gas Conservation Restricted Account is the major restricted fund used by the division.

Legal Authorization: UCA 40-6-14.5

The revenues is generated from fee levied on oil and gas (.002 of the value at the well of oil and gas), penalties, and interest. The account balance has a cap of $750,000 with the excess going to the General Fund.

The division's current focus is on the following issues:

- Continuous process improvement

- Timeliness improvement

- Education and outreach

- Collaboration and coordination improvements

The following are the top measures chosen by division management to gauge the success of its programs.

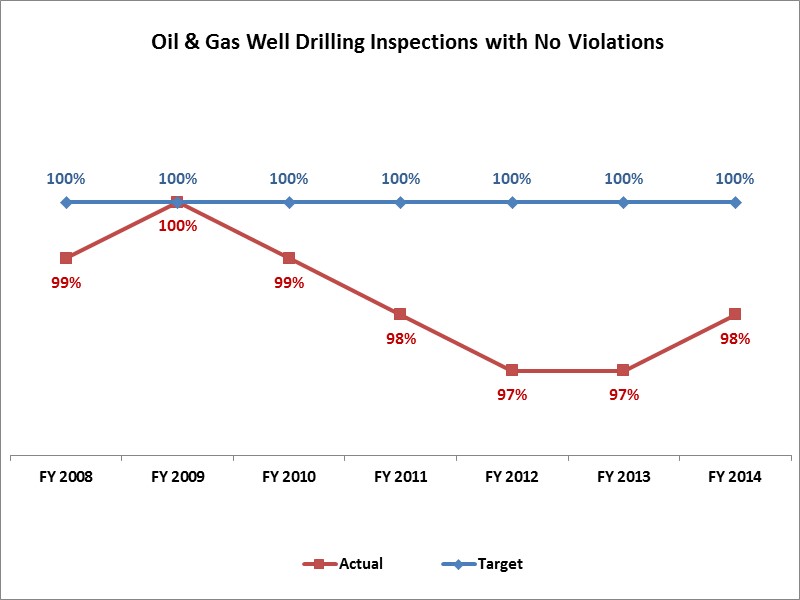

Oil & Gas Well Drilling Inspections with No Violations

Well Drilling with No Violations: The third measure reflects the percentage of time that an inspection during oil or gas well drilling results in no violations issued. The measure reflects the rate of compliance by the oil & gas industry during drilling. Drilling inspections are necessary to insure industry compliance in order to protect the public.

Satisfaction Level of the Division''s Customers

Customer Satisfaction: The second measure reflects the satisfaction of the division's customers via an annual survey sent through Survey Monkey to permittees, environmental groups, the Board, etc., and a link on the division's website. The purpose for this measure is to quantify the level of satisfaction from the division's customers. The customers' satisfaction is measured on a scale of 1 to 5 (1 poor, 5 excellent) on: timely services, accurate information, helpfulness of employees, employee expertise, and availability of information.

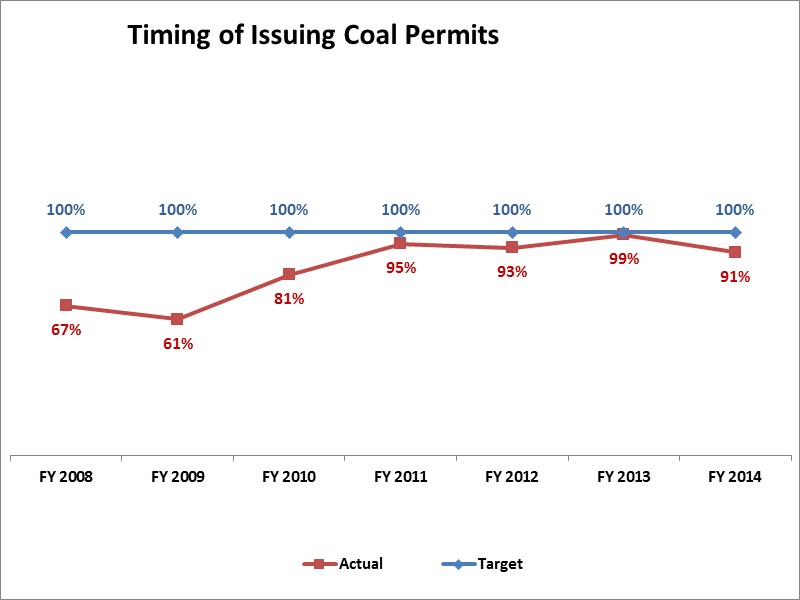

Timing of Issuing Coal Permits

Coal Permits: This measure reflects the timeliness of issuing permits by the Coal Program staff. Timeliness when it comes to new permit applications, permit amendments, five-year renewals, mid-term reviews, initial completeness reviews, and water monitoring report reviews is important to coal mining operators.

The following laws govern operation of the division:

- UCA 40-6-4 creates the Board of Oil, Gas and Mining.

- UCA 40-6-10 requires the board and division to comply with the Administrative Procedures Act in their adjudicative proceedings.

- UCA 40-6-14 levies a fee of .002 of the value of oil and gas produced and sold. Proceeds are deposited in the restricted Oil and Gas Conservation Account created in UCA 40-6-14.5. The balance at the end of the fiscal year is capped at $750,000.

- UCA 40-6-16 enumerates the division's duties, which include:

- Develop and implement an inspection program.

- Publish a monthly production report.

- Publish a monthly gas processing plant report.

- Review evidence submitted to the board.

- Require adequate assurance of approved water rights.

- Notify the county executive where drilling will take place.

- UCA 40-6-19 creates the Bond and Surety Forfeiture Trust Fund and requires monies collected by the division as a result of bond or surety failures to be deposited in the fund. The division must use the fund to accomplish the purposes for which the surety was established.

- UCA 40-8-7 gives the board and division broad authority to regulate all non-coal mining operations in the state.

- UCA 40-8-14 requires the division to determine a surety amount and receive the surety payment prior to allowing mining operations.

- UCA 40-10-6 establishes the authority for the board and division to specifically regulate coal mining and reclamation.

- UCA 40-10-25.1 creates the restricted special revenue fund known as the "Abandoned Mine Reclamation Fund" and allows the division to expend monies from the fund to accomplish the purposes of the program. Funds must be appropriated except in emergency situations.

Utah has primacy from the U.S. Department of the Interior for regulation of coal mining operations and reclamation of abandoned mine sites. The Coal Reclamation program is a reimbursable grant program with the Department of the Interior. Utah also has primacy from the U.S. Environmental Protection Agency (EPA) for regulation of Class II injection wells used for oilfield waste disposal and enhanced oil recovery projects. The Oil and Gas program receives this grant money for its Underground Injection Control (UIC) responsibilities, with the EPA providing the federal funds that amount to less than 3% of the program's budget.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.