The Auditing Division attempts to increase voluntary and involuntary taxpayer compliance through selective examination of taxpayer returns and supporting records. The division audits all taxes except property tax (local level), and conducts audits in-house and at taxpayers' places of business. The division emphasizes compliance audits for accurate tax return reporting, and review for possible investigation of suspected fraud and tax evasion. Through educational outreach and customer service, the division works to help taxpayers report future taxes properly.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $11,789,200 from all sources for Auditing Division. This is a 3.7 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $7,919,200 from the General/Education Funds, an increase of 4.1 percent from revised Fiscal Year 2015 estimates.

The coverage areas for the Auditing division include approximately 1.2 million income tax returns and another 800,000 business returns.

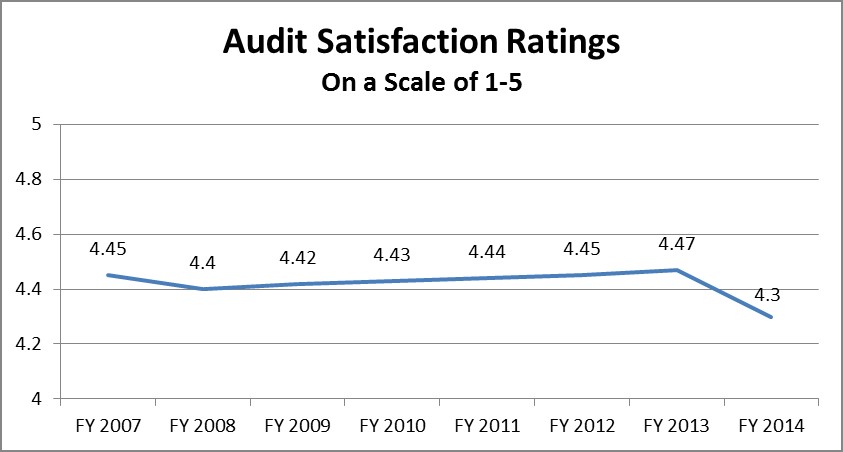

Audit Satisfaction Ratings

The division aims to ensure that those being audited believe they are treated fairly in the audit process. Surveys are provided at the end of every audit, allowing taxpayers to provide input to the quality of the audit process. Input can be provided anonymously or taxpayers can identify themselves when providing feedback. Taxpayers rate their response to the statement, "overall, I was satisfied with the manner in which the audit was conducted," on a scale of one to five. A rating of five indicates the taxpayer "strongly agrees" with the statement and a rating of one indicates the taxpayer "strongly disagrees" with the statement. The graph depicts the average of all responses for that fiscal year.

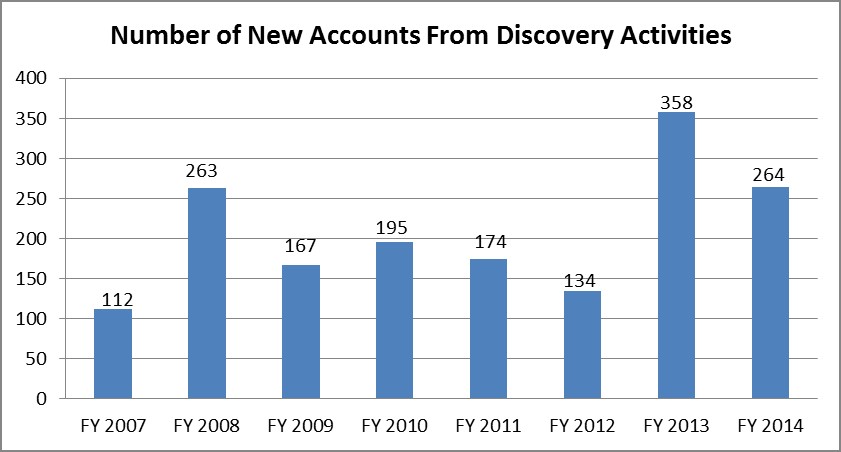

Number of New Accounts From Discovery Activities

The Auditing Division also considers indicative of its success the number of new accounts discovered (sales and corporate) from auditing activities. Efforts are taken to identify taxpayers that are not in compliance with state filing requirements. This measurement shows the results of those activities from year to year.

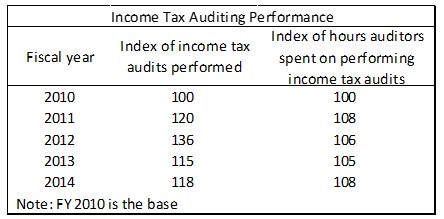

Income Tax Auditing Performance

A measurement of performance success is whether the number of income tax audits performed per year is increasing. The Auditing division sets goals for each section at the beginning of the year. The table represents indexes of the number of income tax audits performed and the hours spent on income tax audits.

The Auditing Division is funded mostly from the General Fund, the Education Fund, and the Tax Commission Administrative Charge Restricted Account.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.