The Tax Processing Division designs and produces both on-line and paper tax forms, instructions, and publications for taxpayer use. It collects and records tax payments and taxpayer information, processes paper and electronic tax documents, and maintains archival records. This division is using updated technologies provided by new systems to image documents. Copies of returns, payments, and correspondence can now be accessed in real time, as compared to the prior microfilm and manual retrieval process.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $7,270,300 from all sources for Tax Processing Division. This is a 4.8 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $5,183,900 from the General/Education Funds, an increase of 6.2 percent from revised Fiscal Year 2015 estimates.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

The Processing Division deals with approximately 3 million paper and electronic returns and payments, which includes review of electronic submissions and processing, entering data, scanning documents, and archiving of paper documents.

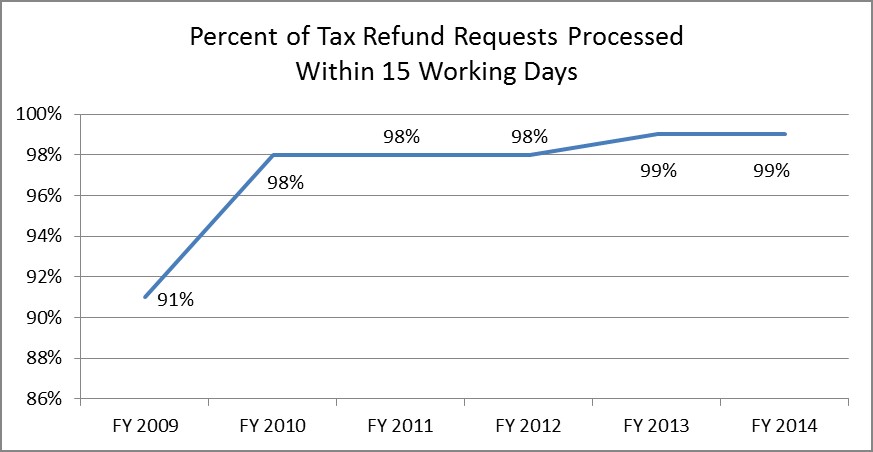

Percent of Tax Refund Requests Processed Within 15 Working Days

A measure of efficiency for the division is the percent of income tax refund requests processed within 15 working days. Once taxpayers file their returns, if they are due a refund, they would like it in a timely manner. This measurement shows the percent of returns that were processed within 15 working days. An exception to the target is any tax return that requires further research or follow-up with the taxpayer.

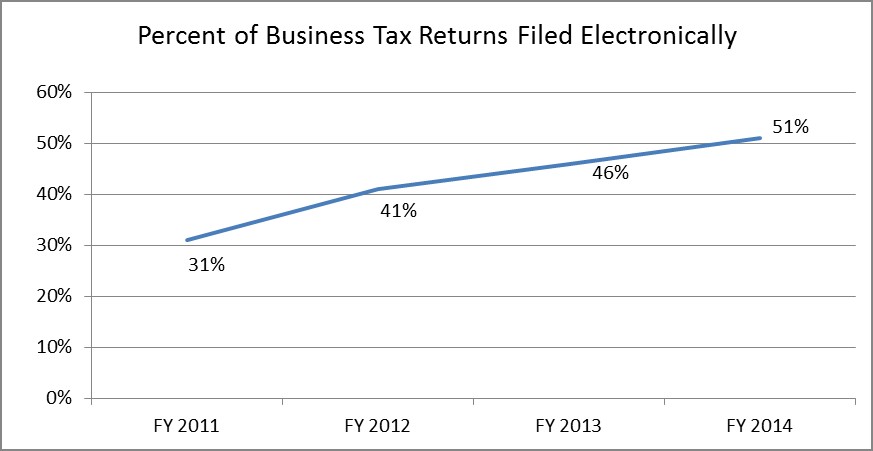

Percent of Business Tax Returns Filed Electronically

An online tax return application is available for all businesses using a Taxpayer Access Portal (TAP). The TAP requires fewer resources to process paper returns. Increased efficiency and reduced costs are realized with a high percentage of electronic tax filings.

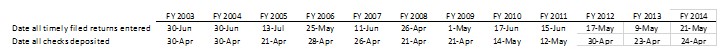

Timeliness of Recording and Depositing of Income Tax Returns

Indicative of the Processing Division's accountability are the dates by which all timely-filed income tax returns are entered and checks deposited. The goal is to record and deposit these funds as quickly as possible to keep account information current.

If the processing time for any timely-filed return exceeds 45 days from the date of filing, the Tax Commission must include an interest payment on the balance of the return of 2 percent.

The Processing Division is funded by the General Fund, Education Fund, Transportation Fund, and the Tax Commission Administrative Charge Restricted Account.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.