The Property Tax Division appraises and audits complex natural resource extraction and transportation related properties in the state, as well as properties that cross county or state lines. Such properties include those owned by airlines, motor carriers, railroads, and utilities.

The division works with local officials to assure equitable and accurate assessment and taxation under local property tax systems. It also administers the Truth-In-Taxation law.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $5,096,000 from all sources for Property Tax Division. This is a 3.2 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $4,959,300 from the General/Education Funds, an increase of 3.3 percent from revised Fiscal Year 2015 estimates.

The top three performance measures the Property Tax Division considers as indicative of its success are, 1) Timely Completion of Valuation of Centrally Assessed Companies, 2) the Percent of Counties NOT Received Correction Action Orders, and 3) Personal Property Audits per Auditor per Year.

Percent of Centrally Assessed Company Valuations Completed On Time

This measurement shows what percentage of centrally assessed company valuations were completed on time. Counties and local entities rely on assessments to establish their budgets. Centrally assessed company valuations are considered on time when completed by May 31.

FY 2014 Centrally Assessed Valuations:

- Businesses - 561

- Land Assessments - 1,134

Percent of Counties Not Recieved Correction Action Orders

All 29 counties must be in compliance with statutory requirements concerning assessment level and statistical variance. If a county is not in compliance it means that taxpayers in that individual county are not paying their fair share of the uniform school fund. If the counties are not in compliance, the Tax Commission must issue orders to bring them into compliance.

The Property Tax Division approaches its oversight function first through education, assistance and cooperation. The intent of this measure is to test the success of that approach. The Property Tax Division performs what is called an April Sales/Ratio study. This study tests actual property sales against the assessed value for the sale property that the assessor had already determined. The outcome is communicated to the assessors to explain where and how much values will have to change in the county to avoid a factor order. After the assessment roll closes on May 22, the division does the final sales/ratio study to ensure that the counties have made the necessary changes to avoid an order.

The assessment study is a year-round process that involves reviewing all sold property data in the state. It is completed in cooperation with the county assessor's office, and both the April study and the final study are cooperatively analyzed by the state and the county. Even when a county is in statutory compliance, advisory communications are made to inform the county of potential areas of concern for the next year's assessment.

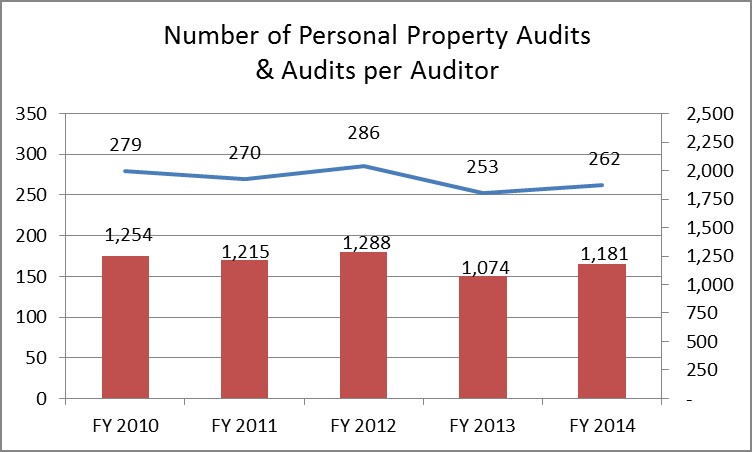

Number of Personal Property Audits and Audits per Auditor

The Personal Property Tax section performs audits for counties. This measurement is used to monitor the workload of that section's staff.

The Utah Constitution, Article XIII, Section 6, Paragraph 3 provides authority for the State Tax Commission to assess, adjust, and equalize property values and to revise local property tax levies when necessary. The Property Tax Division also draws authority from the Property Tax statute contained in Utah Annotated Code Title 59, Chapter 2.

The Property Tax Division's financing comes mainly from the Education Fund. A portion of funding comes from a dedicated credit property assessment fee authorized by UCA 59-2-703 and 59-2-705.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.