The Administration Division includes the Commissioners' and the Executive Director's Offices. Both offices provide direction and management to the department.

The Commissioners' Office:

- Develops tax policy and rules;

- Provides an appeals process with most appeals heard by administrative law judges;

- Assures agency operations are in compliance with the law;

- Keeps the public informed with tax bulletins and news releases;

- Forecasts state revenues and provides economic and statistical analyses from Tax Commission data; and

- Supervises and administers tax law of the state.

The Executive Director's section:

- Directs and coordinates day-to-day department operations;

- Provides oversight of employee recruitment, supervision, and training;

- Provides direction and oversight of the budget, training, goal setting and performance measurement;

- Drafts legislation, rules, and bulletins, and coordinates legislative issues;

- Develops policy and monitors compliance of data security policies to ensure that taxpayer information is protected;

- Oversees the State's revenue collections and reporting, including distribution of revenues to local governments;

- Manages the department's internal accounting processes;

- Investigates criminal tax evasion cases;

- Manages disclosure and IRS liaison functions; and

- Provides help desk support and training to agency staff and citizens using the commission's new online computer systems.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $11,045,400 from all sources for Administration Division. This is a 1.5 percent increase from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $6,193,300 from the General/Education Funds, a reduction of 2.2 percent from revised Fiscal Year 2015 estimates.

In addition to statewide compensation and internal service fund cost increases, the following appropriation adjustments were made during the 2015 General Session:

The three top measures the Administration division cites as evidence of its success are, 1) successful oversight of the tax system implementation process, 2) timely distribution of revenue, and 3) number of tax appeal cases closed by fiscal year.

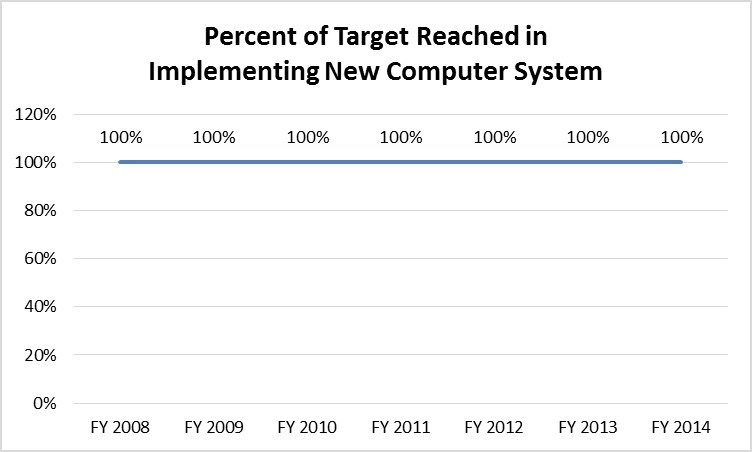

Percent of Target Reached in Implementing New Computer System

The Tax Commission has been directing nonlapsing balances towards automating its processes since FY 2006. Successful oversight and implementation of the new computer systems has been a top priority of the Administration division since inception of the project. 'The percentage of target completed each month' is an indicator of success because the replacement of computer systems is key to the agency's improvement and efficiency efforts. The Administration division reports 100% of the target completed each month since FY 2008.

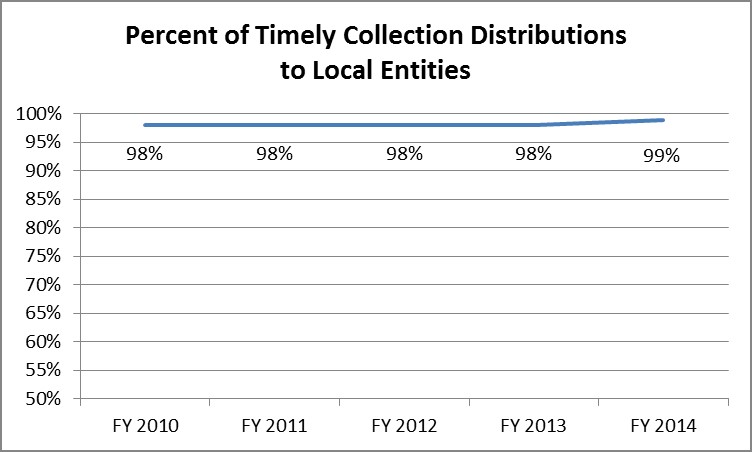

Percent of Timely Collection Distributions to Local Entities

This graph shows the role of the Tax Commission in collecting local sales taxes and distributing those taxes to the proper municipalities or counties. Local entities rely on sales tax collections for operating cash flow and program funding. The Tax Commission has set a goal of achieving a timely distribution for 95% of collections-defined as remittance of collections to local entities during the month received-for the largest accounts.

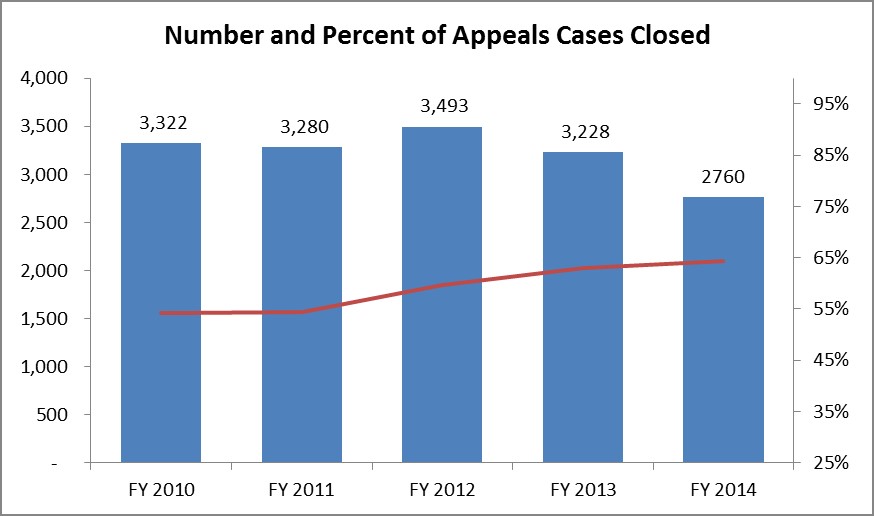

Number and Percent of Appeals Cases Closed

Taxpayers have a right to appeal to the Tax Commission their state tax assessments, and local property tax appeals that the county has denied. This measurement monitors appeals activity and the percent of cases that are closed each year.

The Administration Division is funded primarily from General Fund and Education Fund. It also has nonlapsing funds for the long-term project of modernizing the agency's tax and motor vehicle systems.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.