The Multi-State Tax Compact (MTC) is a group of state governments working together to help make state tax systems fair, effective, and efficient for interstate and international commerce. It is also an effort to protect state tax sovereignty.

The Compact's two primary projects are the Joint Audit Program and the National Nexus Program.

Joint Audit Program. Reviews a business' sales and corporate income tax filings for several states at the same time. Accordingly, the audit program encourages compliance with state tax laws, generates tax revenues for states, contributes to uniformity in taxpayer treatment, and helps states learn about new industry conditions and circumstances.

National Nexus Program. Encourages voluntary disclosure and discovers businesses that are not filing returns with states. The Nexus program facilitates an exchange of information between states to identify business reporting or filing inconsistencies among these states.

During the 2015 General Session, the Legislature appropriated for Fiscal Year 2016, $252,200 from all sources for Multi-State Tax Compact. This is a 0 percent change from Fiscal Year 2015 revised estimated amounts from all sources. The total includes $205,400 from the General/Education Funds, a change of 0 percent from revised Fiscal Year 2015 estimates.

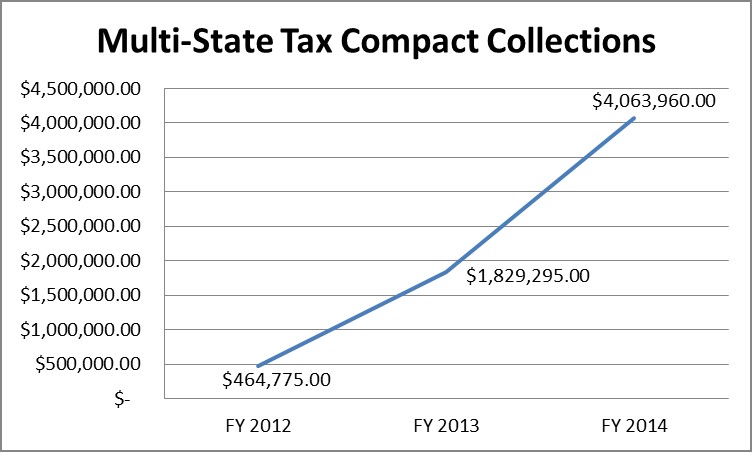

Multi-State Tax Compact Collections

The Tax Commission utilizes the work of the Multi-State Tax Compact (MTC). Referrals from audits conducted by the MTC result in the collections reflected in this graph.

Although the State is not required to be a member of the MTC, in Utah Annotated Code Title 59, Chapter 1, Section 801 the Legislature enacted into law Utah's participation in this compact.

Funding for the Multi-State Tax Compact is from the General Fund, the Education Fund, and the Tax Commission Administrative Charge Restricted Account. Annual expenditures represent membership dues to the Multi-State Tax Compact and multi-state audit services that are provided by that organization.

COBI contains unaudited data as presented to the Legislature by state agencies at the time of publication. For audited financial data see the State of Utah's Comprehensive Annual Financial Reports.